2018 Lessons From The Pipeline Sector

Blog pageviews and comments help us gauge how relevant our topics are. Writing is more enjoyable when readers engage. This blog gets reposted across many websites, including Seeking Alpha and Forbes.com. The feedback from subscribers often leads to a useful dialog and informs later choice of topics. Below are the themes that resonated in 2018.

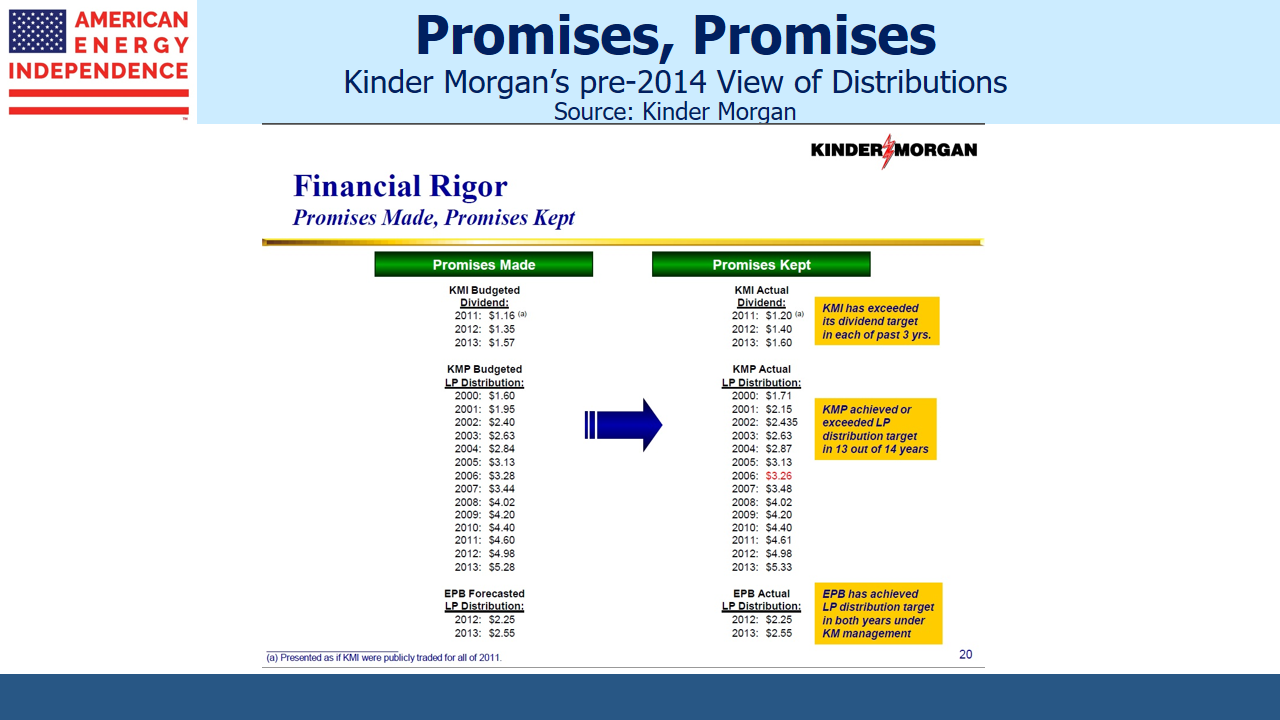

The name Rich Kinder strikes a raw nerve with many. Kinder Morgan: Still Paying For Broken Promises revealed the depth of feeling among many investors. This is because Kinder Morgan (KMI) began the trend towards “simplification”, which came to mean distribution cuts and an adverse tax outcome. To get a sense of the betrayal felt by some, peruse the comments on the blog post on Seeking Alpha where readers can let rip in a mostly un-moderated forum. It becomes clear that cutting payouts has severely damaged appetite for the sector, something we realized through this type of feedback.

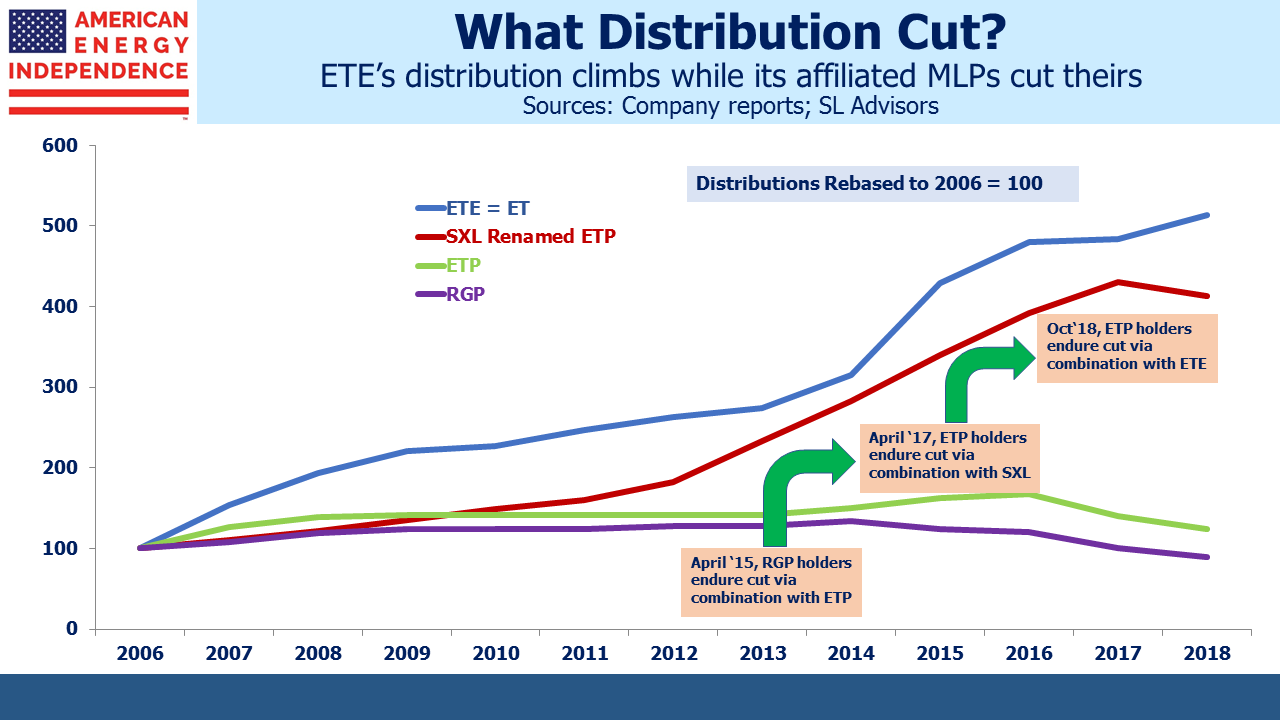

A similar post examined how Energy Transfer (ET) had lowered payouts for certain classes of investor, (see Energy Transfer: Cutting Your Payout Not Mine) and drew an even bigger response (272 comments). ET CEO Kelcy Warren is a controversial figure. Our post showed that while original Energy Transfer Equity investors had avoided distribution cuts, holders of Energy Transfer Partners, Sunoco Logistics and Regency Partners hadn’t fared so well.

Kelcy Warren inspired our most colorful graphic in August, when he said, “A monkey could make money in this business right now.” (see Running Pipelines Is Easy). ET’s stock has lost a quarter of its value since then, even though their financial performance has justified his comments.

Last year was a testing one for those convinced the Shale Revolution should generate investment profits. In Valuing MLPs Privately; Enterprise Products Partners we laid out how a private equity investor might value the biggest publicly traded MLP. It wasn’t controversial, but many readers communicated their appreciation at this type of analysis.

The problem for the sector has always been balancing high cash distributions with financing growth projects. We think current valuations focus too much on Free Cash Flow (FCF) without giving credit to Distributable Cash Flow (DCF). FCF is after growth capex, while DCF is before. We illustrated this with a short video (see Valuing Pipelines Like Real Estate).

Early in the year we wrote several blog posts highlighting the tax drag faced by most MLP-dedicated funds. Because they pay Federal corporate taxes on investment profits, 2018’s bear market didn’t expose their flawed structure the way a bull market will. We won’t repeat the argument here, but it’s laid out in MLP Funds Made for Uncle Sam.

A related topic we covered several times was the conundrum facing MLP-only funds, given that many big MLPs have converted to regular corporations. MLP-only funds can no longer claim to provide broad sector exposure, since they omit most of the biggest North American pipeline companies. But the funds themselves can’t easily broaden their holdings beyond MLPs, which creates some uncertainty for their investors. We explained why in Are MLPs Going Away? and The Alerian Problem.

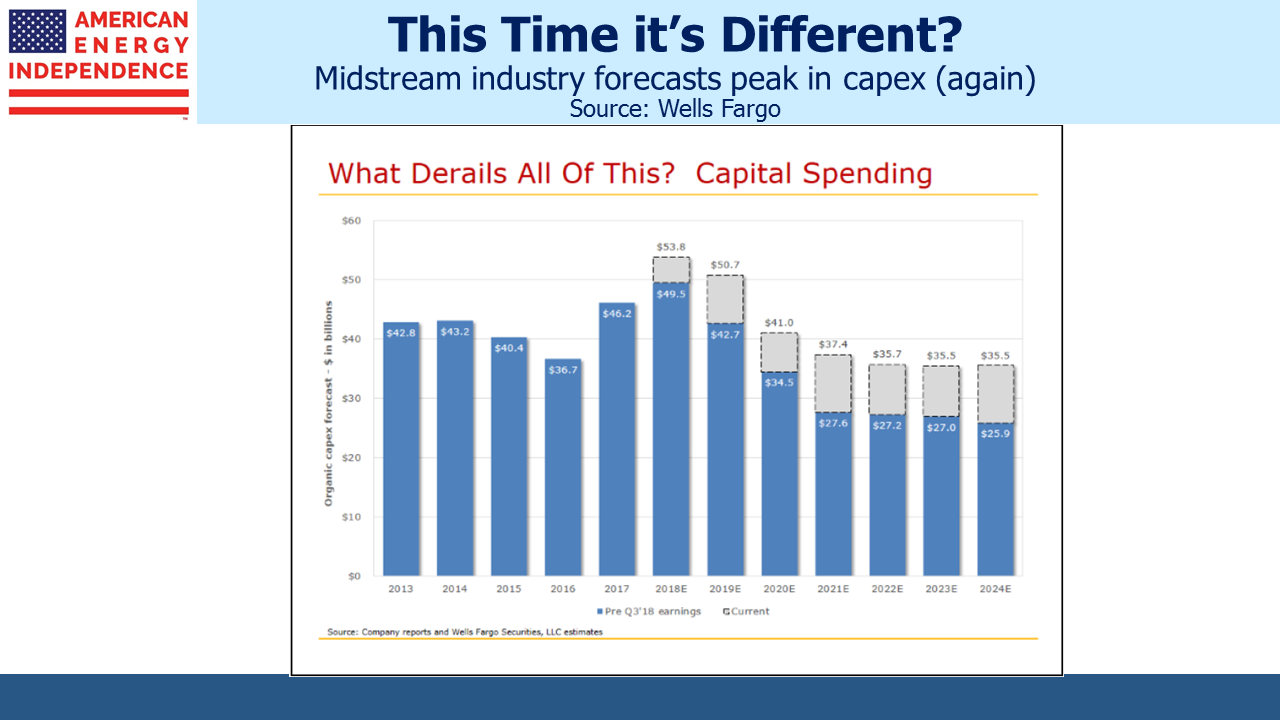

We returned to the tension between using cash for growth versus distributions in Buybacks: Why Pipeline Companies Should Invest in Themselves. The industry continues to reinvest more cash in new infrastructure than is justified by stock prices. In many cases, share repurchases offer a better and more certain return than a new pipeline. Trade journals are full of breathless commentary on the need for more export facilities, more pipelines, more everything. It’s not pleasant reading for an investor, but this is the world inhabited by industry executives. More mention of IRR would be welcome. Pipeline investors are hoping that the Wells Fargo chart showing lower capex in the future will, finally, be accurate.

Fortunately, there are signs of better financial discipline. Leverage continues to drop and dividend coverage is improving, which will support a 6-8% increase in dividends on the American Energy Independence Index in 2019. As the year unfolds, we expect investors to cheer a long overdue improvement in returns.

We are invested in ET and KMI.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).