Williams Has Covid Immunity

Pipeline company earnings continue to provide reassurance about their ability to grow cash flows (see Pipeline Cash Flows Will Still Double This Year). Yesterday’s earnings call with Williams Companies (WMB) was an example.

WMB’s 2Q adjusted EBITDA came in at $1,240MM, $48MM ahead of expectations. For the full year they are guiding conservatively to the low end of their prior range ($4.95BN-$5.25BN). 2020 growth capex was reduced by another $100MM to $1BN-$1.2BN. Like other pipeline companies, WMB’s continued trimming of growth capex is boosting their cash flow generation (see Pipeline Opponents Help Free Cash Flow).

Leverage has now come down to 4.31X Debt:EBITDA. Their $1.60 annual dividend still yields 7.5%, even after yesterday’s 8% rally in the stock.

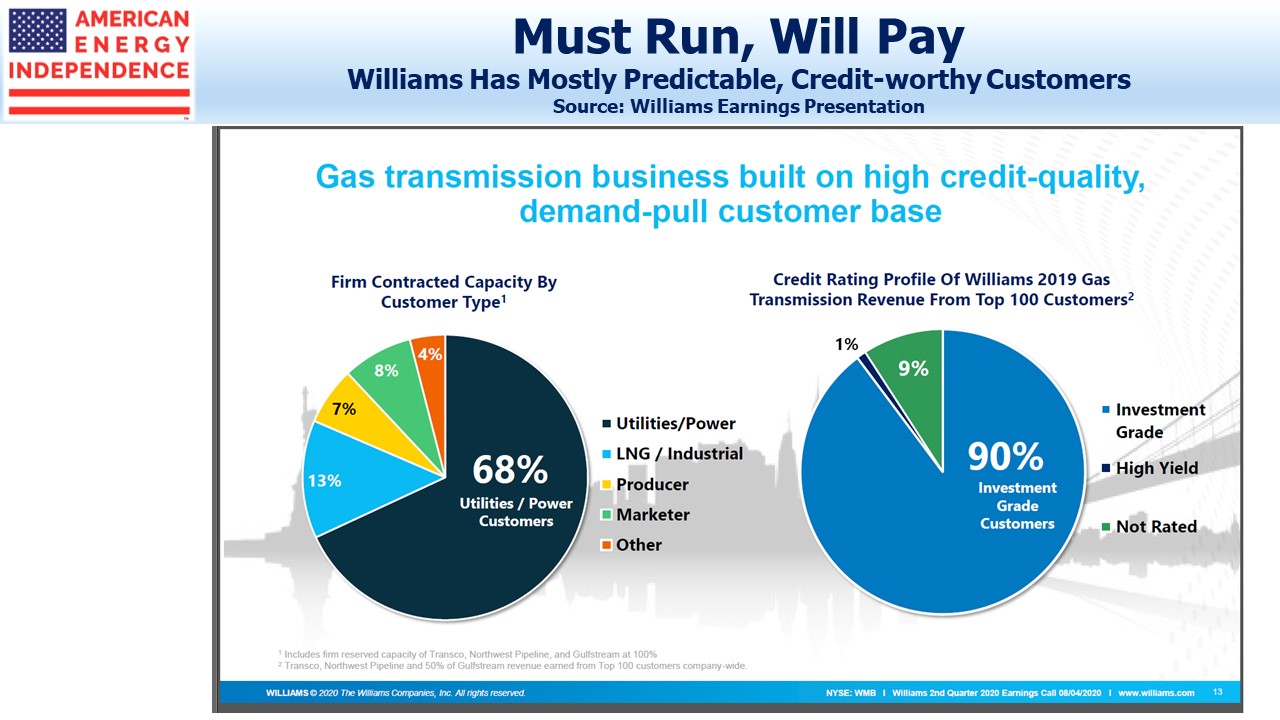

WMB is among the best positioned pipeline companies – almost 100% natural gas. Its gas transmission business, which is 44% of EBITDA, is two thirds utilities and 90% investment grade. Gathering and processing, which is the rest of the company, has picked its customers well, growing 3.6% year-on-year even while Lower-48 production is roughly flat.

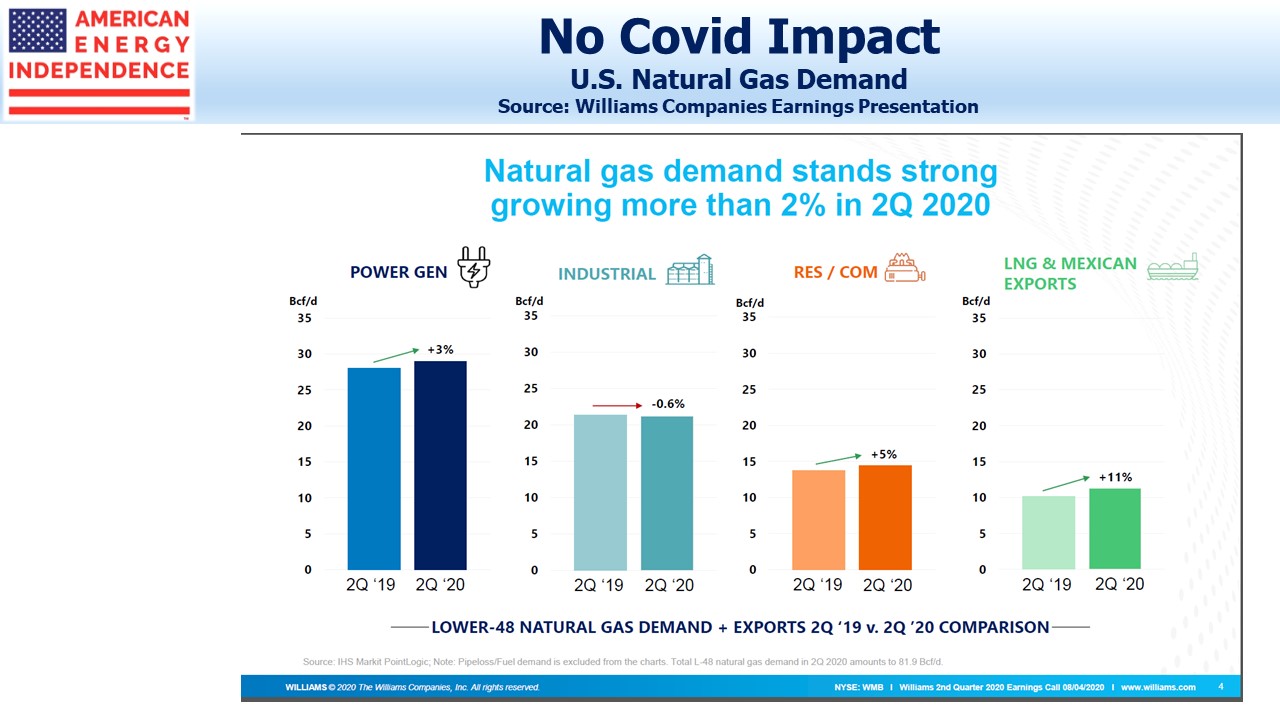

CEO Alan Armstrong noted what we’ve pointed out recently, that natural gas demand has remained strong and shows little impact from the pandemic (see Energy Demand After Covid-19). Armstrong also mentioned that canceled LNG shipments, the only area of weakness, appear to be moderating in July.

Armstrong spoke to the complimentary relationship gas-fired power generation has with solar and wind. Pairing always-available gas with intermittent renewables allows for increased use of both and lowers overall CO2 emissions. Since natural gas is crucial to any serious green initiative, WMB has a secure future (see Where America gets Its Power).

Transco, WMB’s extensive natural gas pipeline network that runs from Texas to NY, sits beneath many dense population centers. Given today’s uncertain regulatory process faced by new projects and successful opposition from environmental extremists (see Installed Pipelines Are Worth More), Armstrong feels that WMB’s extensive existing infrastructure gives them an advantage in expanding to meet growing demand. It’s much less disruptove to add on to an existing network than to embark on a new, greenfield project.

WMB’s business was neither helped nor hurt by Covid. In that respect it offers more visibility, if less excitement, than some of today’s high-fliers that are profiting from the new stay-at-home lifestyle. In effect, WMB is immune to Covid. It looks like a pretty cheap stock.

On a different topic, the owner of Jos A. Banks, Tailored Brands, recently filed for bankruptcy. I have followed Jos A. Banks with interest ever since 2008 when I saw Marc Cohodes, a short seller, explain why “Buy One Get Two Free” was not a sustainable business model for selling mens suits. I recounted this in The Hedge Fund Mirage. Cohodes had a tragically bad financial crisis for a short seller and for a time left Finance in disgust (see A Hedge Fund Manager Finds More to Like in Farming). On Jos A. Banks, Marc was early but ultimately right.

We are invested in WMB and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.