US Oil And Gas Production Growing

The US Energy Information Administration (EIA) published their Short Term Energy Outlook last week. The EIA produces an enormous amount of data and is apolitical. For energy investors it’s really all good news.

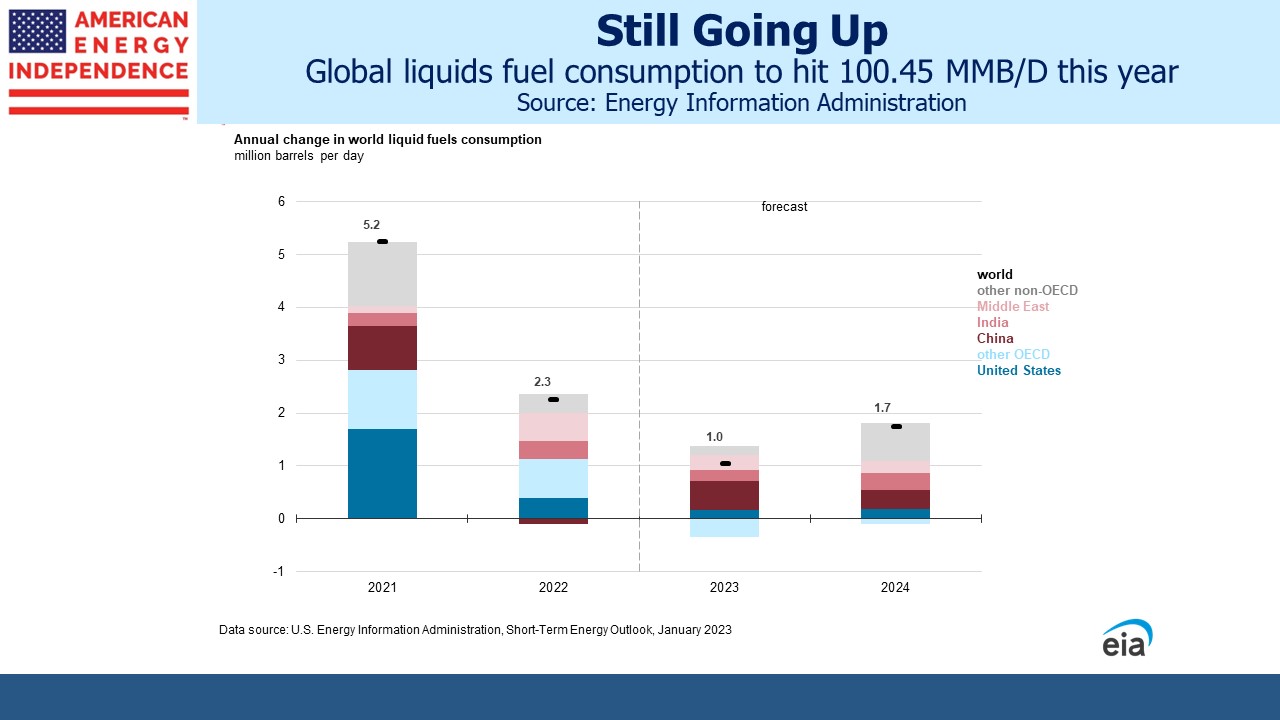

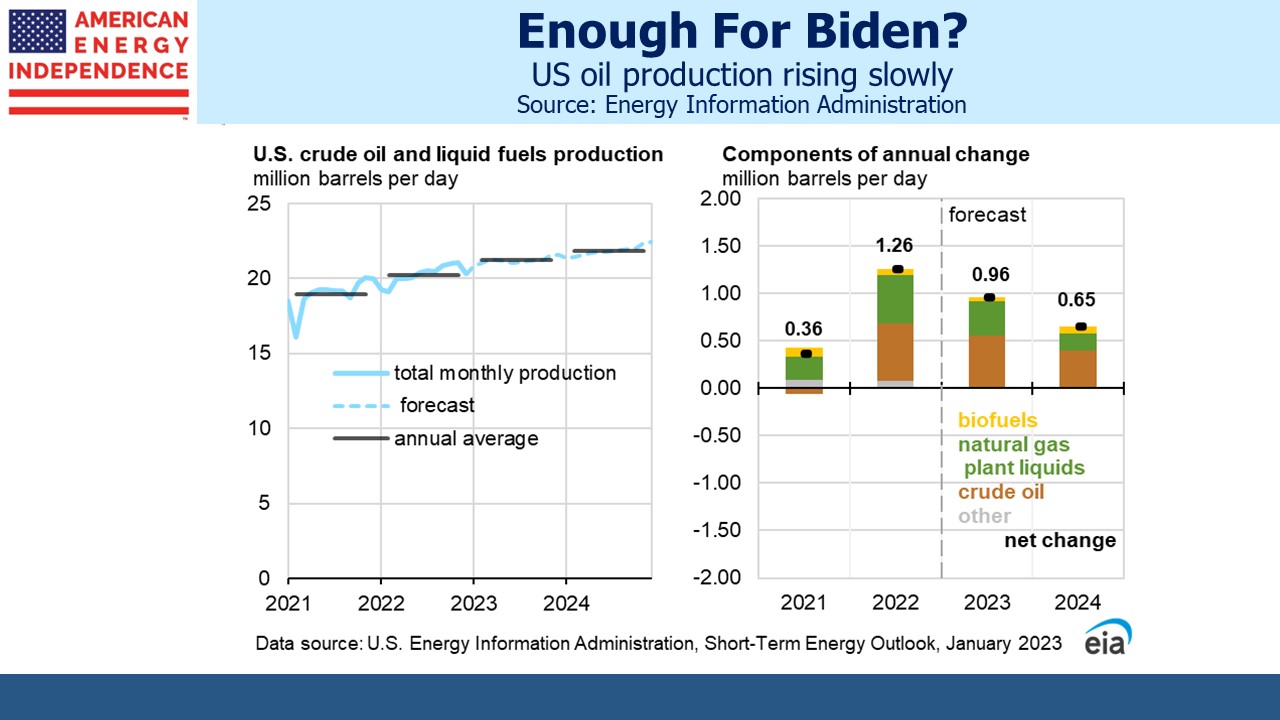

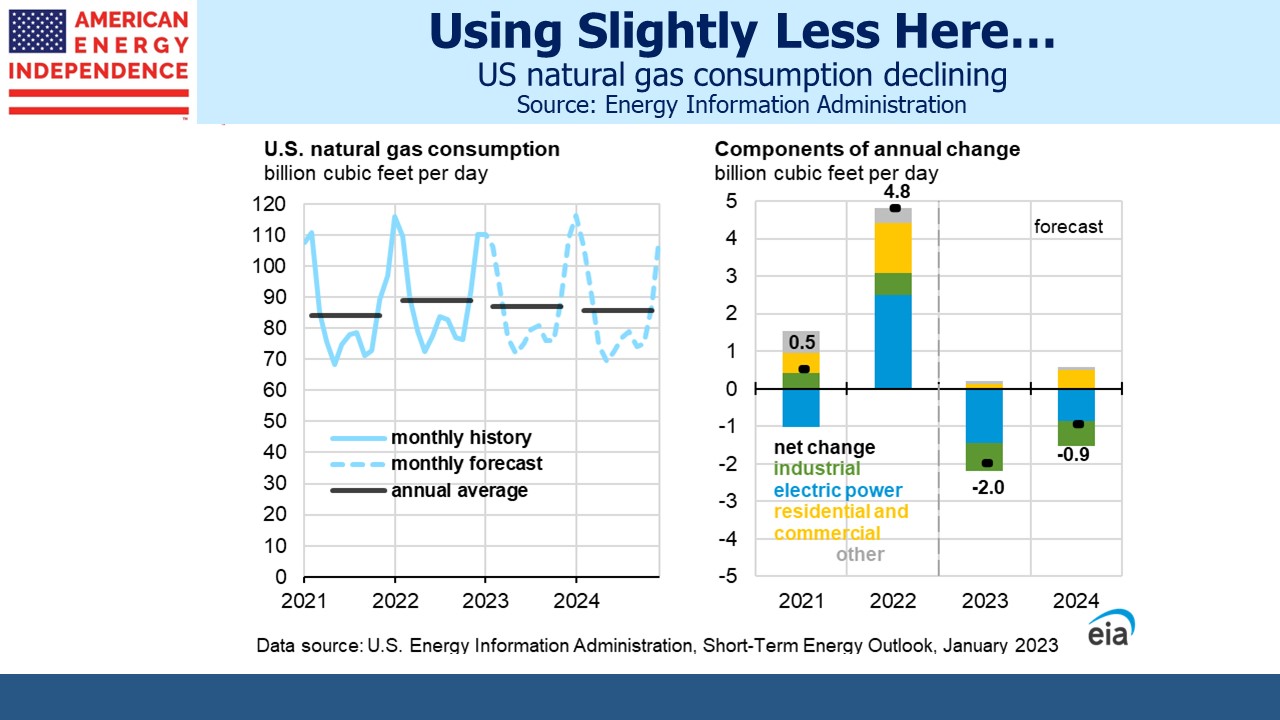

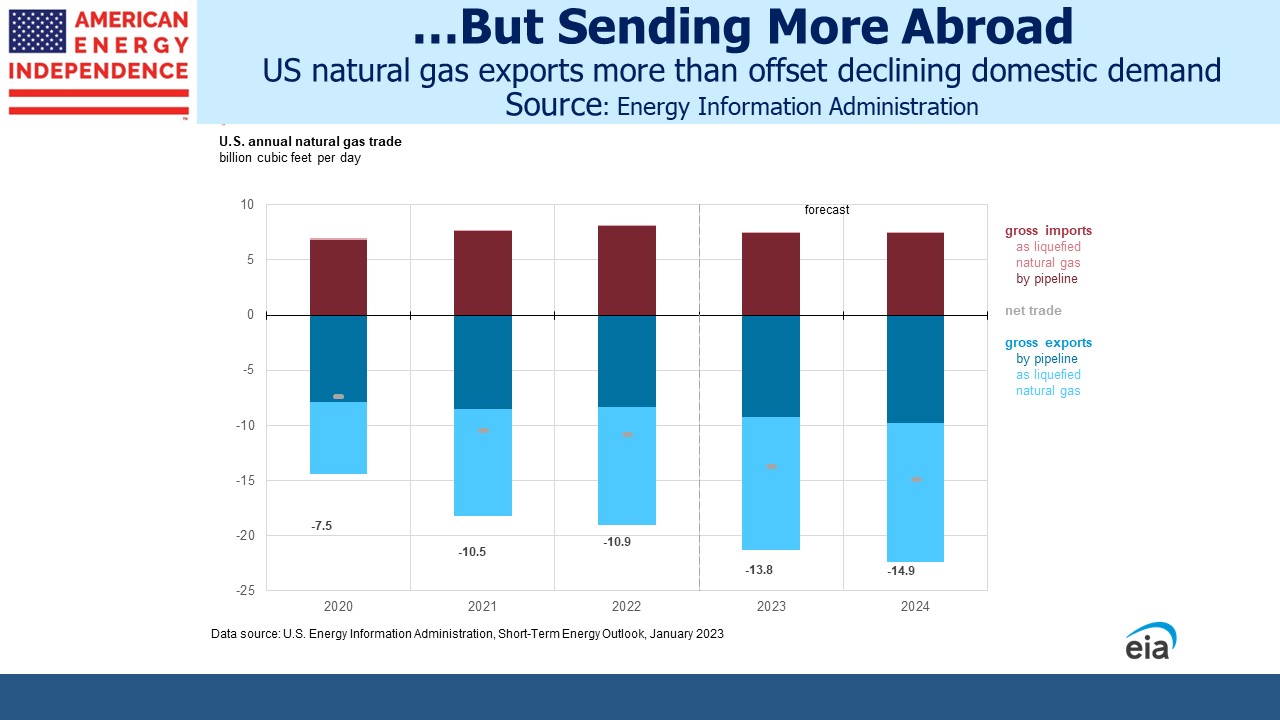

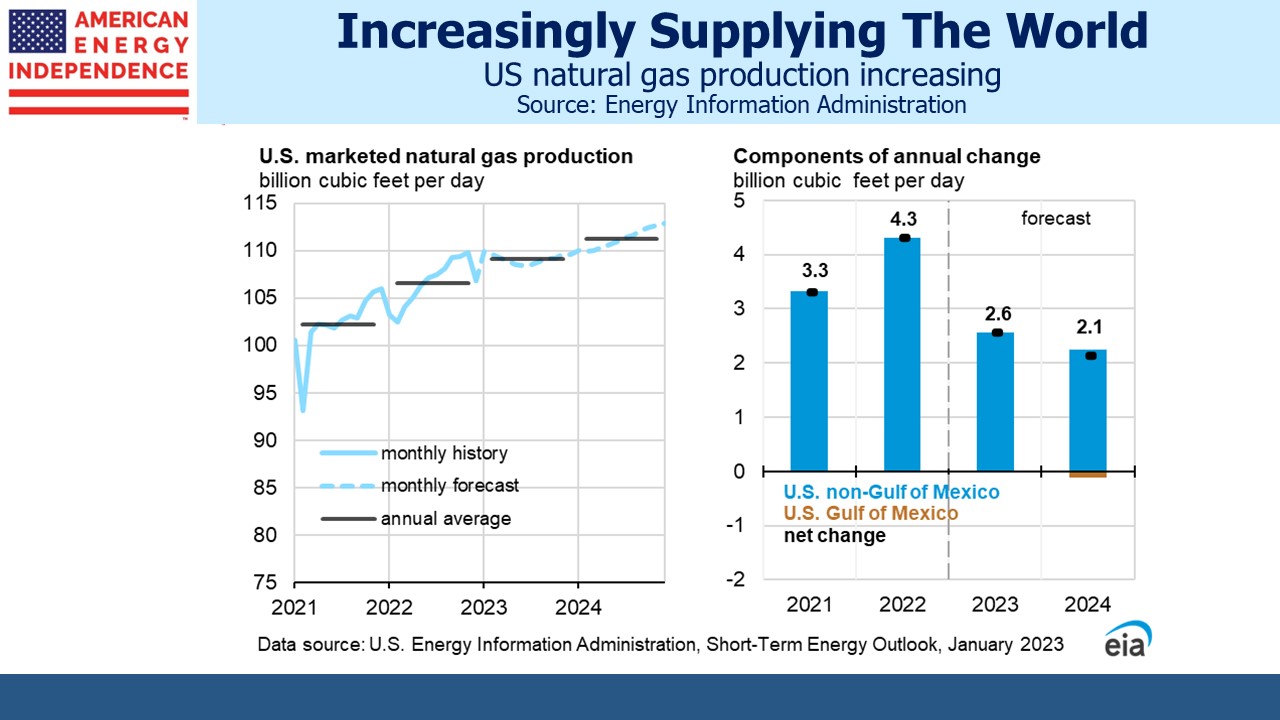

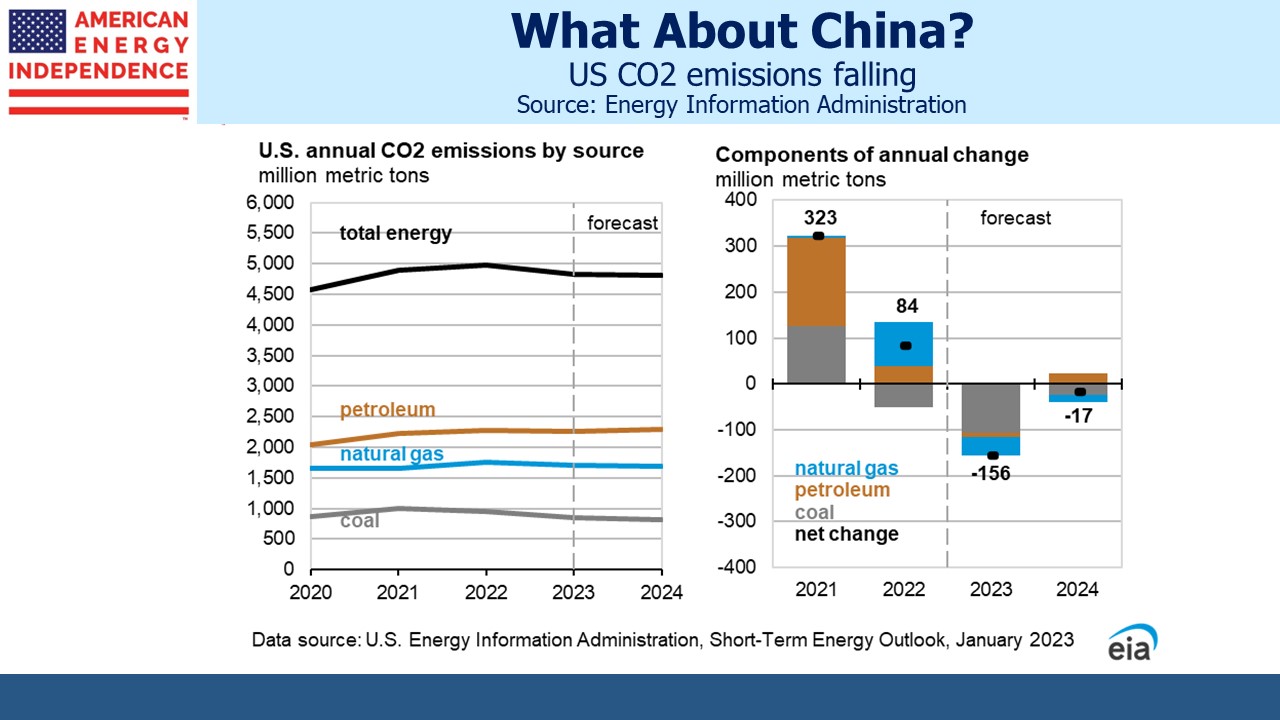

US crude production is expected to grow, but slowly. Natural gas production will increase at a faster pace with export growth more than offsetting a modest drop in domestic consumption. US CO2 emissions will continue to fall, accommodating growth in China and other emerging economies where higher living standards are their priority.

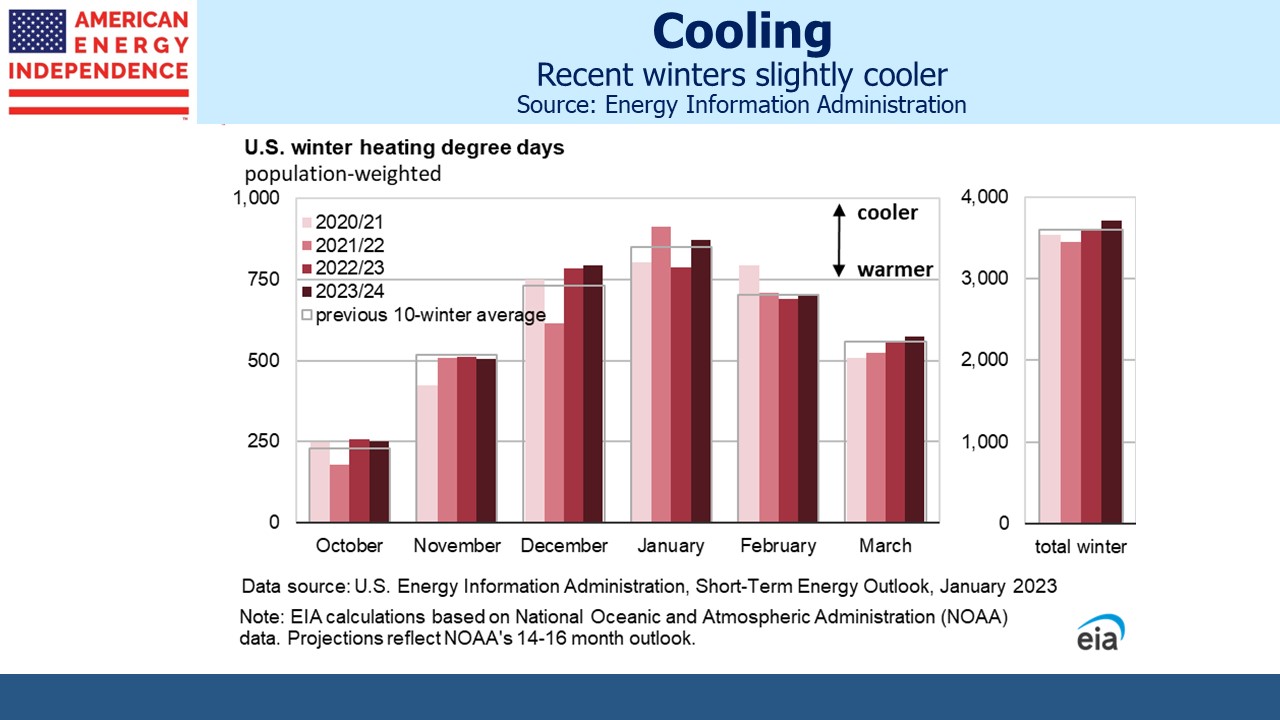

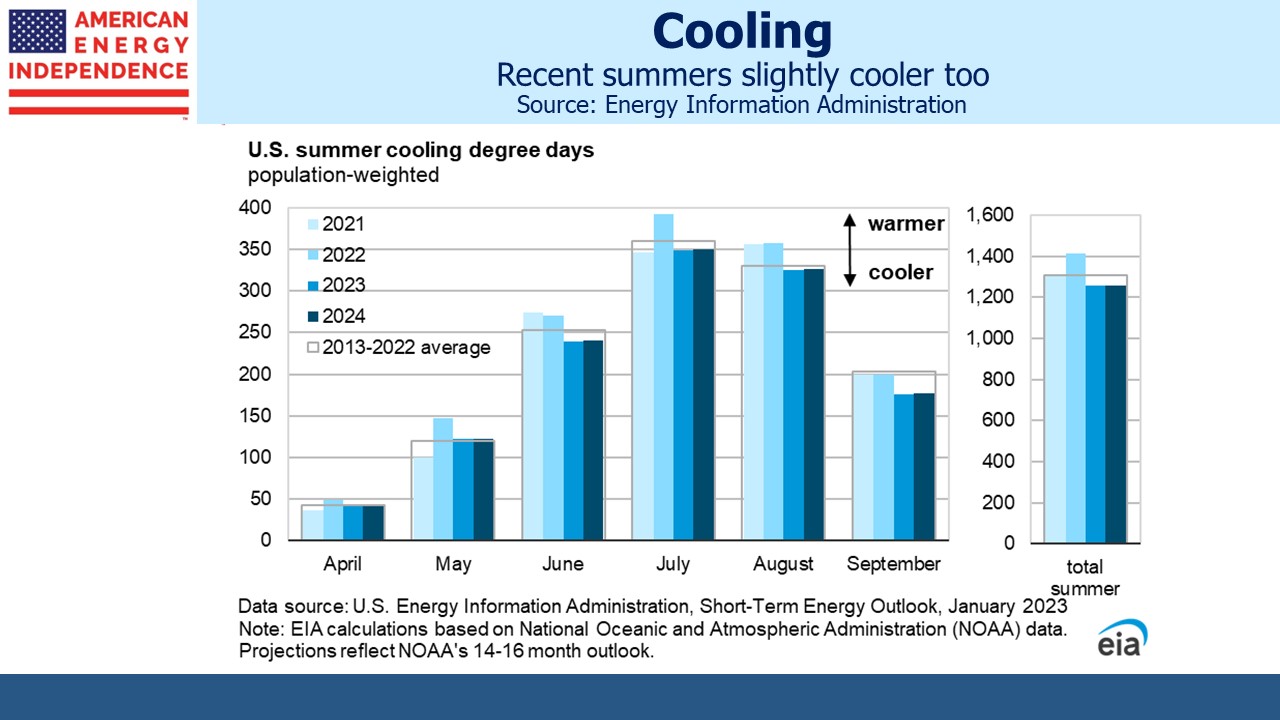

The charts tell their own story. You’ll note that Residential and Commercial consumption of natural gas is expected to rise in spite of the musings of the Consumer Product Safety Commission about eliminating gas stoves. And the last four years have shown slightly cooler weather in the US, although not enough to form a trend.

Climate Action Tracker, a website that assesses countries’ commitments to reduce emissions, rates China “Highly Insufficient”. No country is compatible with the UN’s “Zero By 50” goal which requires eliminating CO2 emissions by that date in order to limit global warming to 1.5°C above 1850. Britain and Norway are among those rated “Almost Sufficient”. The US is “Insufficient” while China, India and most of Asia ex-Japan are rated “Highly Insufficient”.

China’s emissions are expected to grow through 2030, at which time the government says they’ll start falling and reach zero by 2060. Western negotiators at the UN who are dominated by liberal politicians too readily accept China’s word. They haven’t been forthcoming about Covid or much else, so it’s unclear why climate change would be different. Rich world countries, where climate concern is greatest, will push ahead with emissions-reducing policies that are more than offset by developing Asia. This gets too little media coverage.

Last week in a significant development, Climeworks announced that they had pulled CO2 from the air and stored it underground at a meaningful scale, verified by an independent third party. Direct Air Capture (DAC) is not easy – there’s around 412 parts per million of CO2 in ambient air, although it has been trending up. Much higher concentrations can be found in the emissions of power plants or petrochemical facilities. Although cheaper to capture at the source, the CO2 then needs to be moved by pipeline to permanent storage underground. Climeworks equipment can be built on or near the porous rock formations appropriate for permanent storage.

This development is another step towards proof of concept. Microsoft, e-commerce company Shopify Inc. and payments firm Stripe Inc have each agreed to pay hundreds of dollars per Metric Tonne (MT) for credits which they can use to offset their own emissions. Because the CO2 is permanently stored and independently verified, this is a more robust and honest way for companies to demonstrate reduced emissions.

The Inflation Reduction Act provides for 45Q tax credits as high as $180 per MT for DAC, a level that is generating interest among several US energy companies. We’ve been following carbon capture developments for some time (see Clean Energy Isn’t Just About Renewables). Occidental is developing the world’s biggest DAC facility driven in part by the 45Q credits (see How Occidental Invests In Lower Taxes).

Concrete maker Lehigh Hanson, plans to capture CO2 from its operations. Start-up CarbonCapture expects to remove 5 million MTs per annum by 2030, and UK-based DRAX 12 million MTs. The 45Q tax credits aren’t capped. The Congressional Budget Office estimated they’ll cost $3BN over the next decade. Credit Suisse thinks $52BN. Forecasts are that around 200 million MTs, representing 4% of US energy-related CO2 emissions, will be captured by 2030.

It’s also possible for carbon atoms to make a virtuous roundtrip. They first leave a natural gas formation as methane (CH4) to be used by a petrochemical facility before being emitted and returned as CO2 for sequestration back in a geological formation similar to the one they left (see Putting Carbon Back In The Ground).

It’s appealing to think that DAC could ultimately solve the problem of climate change. If the technology works, the world only needs to identify enough sites to deploy the Climeworks equipment for permanent CO2 sequestration. It’s much more appealing than relying on vast, intermittent solar and wind farms with requisite battery backup.

But Climeworks understands their market, and their website sensibly positions the company as complimenting other efforts to reduce emissions: “To mitigate climate change, we need all solutions to be working together. One measure alone is not enough.”

When the EIA’s outlook is combined with the positive fundamentals outlined in Wednesday’s blog post (see Bearishness Is Holding Back Energy), there are plenty of reasons for pipeline investors to remain optimistic.

We have three funds that seek to profit from this environment: