Trade Deals Boost LNG Stocks

European Commission president Ursula von der Leyen described the US-EU trade agreement as “huge”, demonstrating a helpful grasp of President’s Trump’s lexicon. The imposition of tariffs and the threat of punitive ones has gone remarkably smoothly. That may not always be so, but for now markets are buoyant and inflation only modestly higher.

The White House is linking trade with defense, at least implicitly. Reports suggested that von der Leyen had to consider the continued security umbrella via NATO that the US provides as well as ongoing support of Ukraine. With a trade surplus of almost €200BN in goods last year, she conceded that, “We have to rebalance it.”

Weakness in the Euro FX rate, down 2% in the subsequent two days, confirmed the view of many observers that the EU got the worse end of the deal.

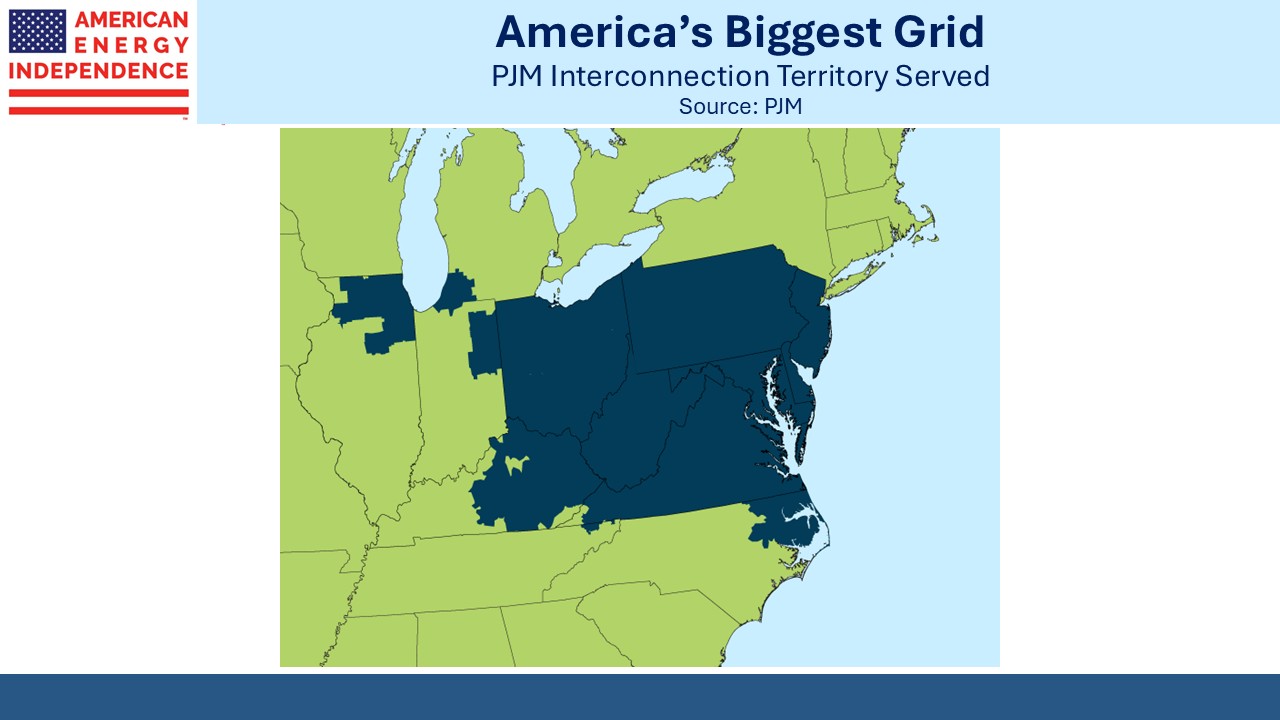

Analysts were quick to point out that the EU will struggle to buy $750BN of US energy exports (mostly oil and gas) over the next three years, even though that is part of the agreement. US total exports of oil and LNG are around $150BN, with about half of that going to the EU, so we will also find it challenging to provide that much. But we can expect US-EU trade to expand in that direction. This will pressure Europeans to source less gas from Russia, which is surely in their best interests as well as ours.

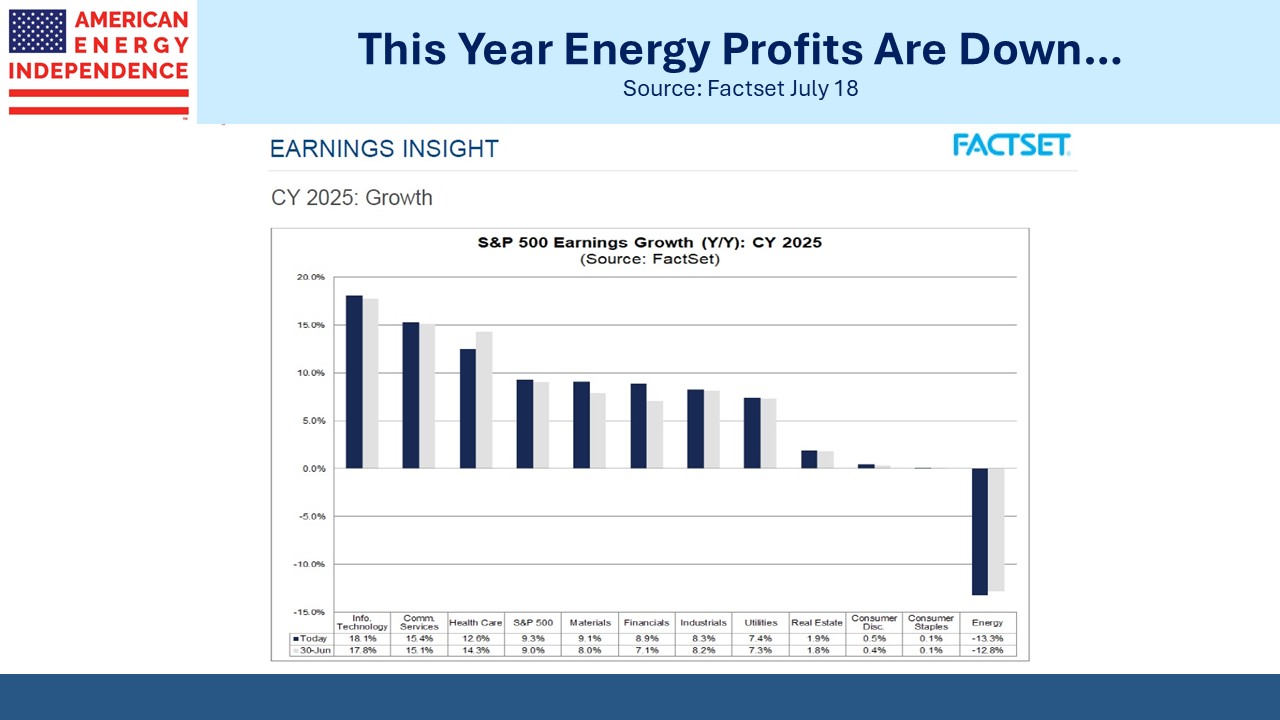

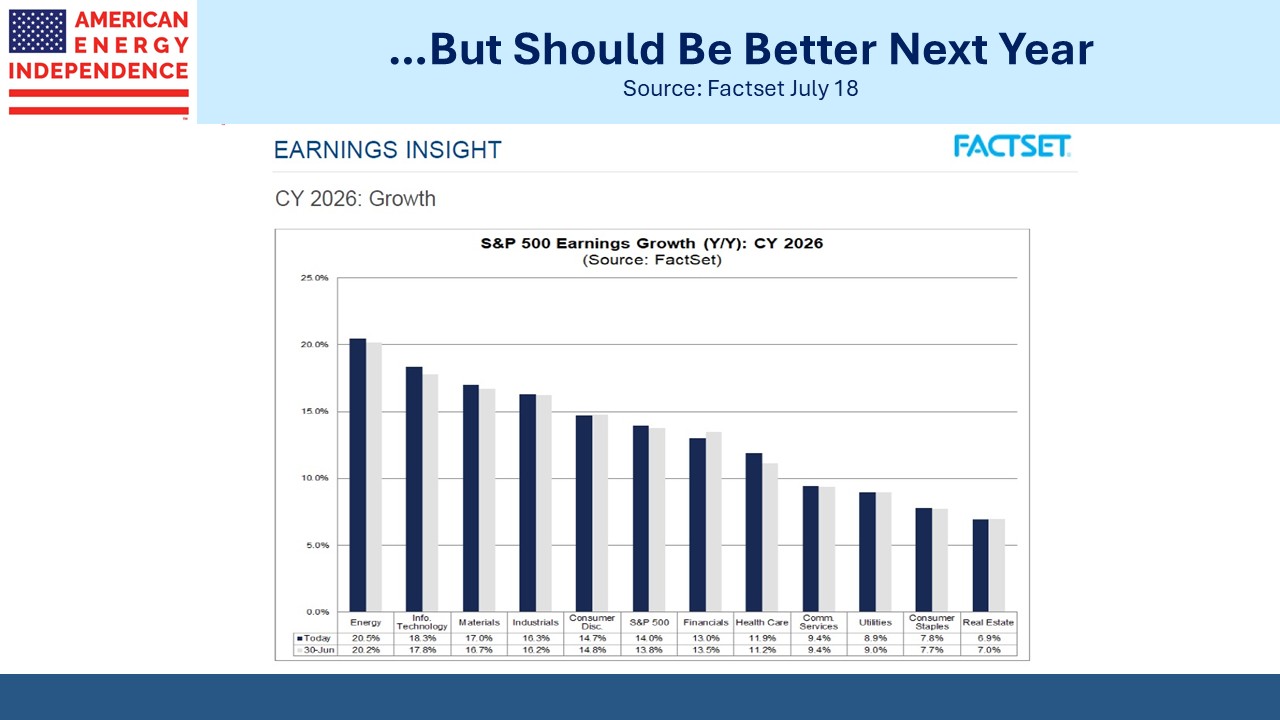

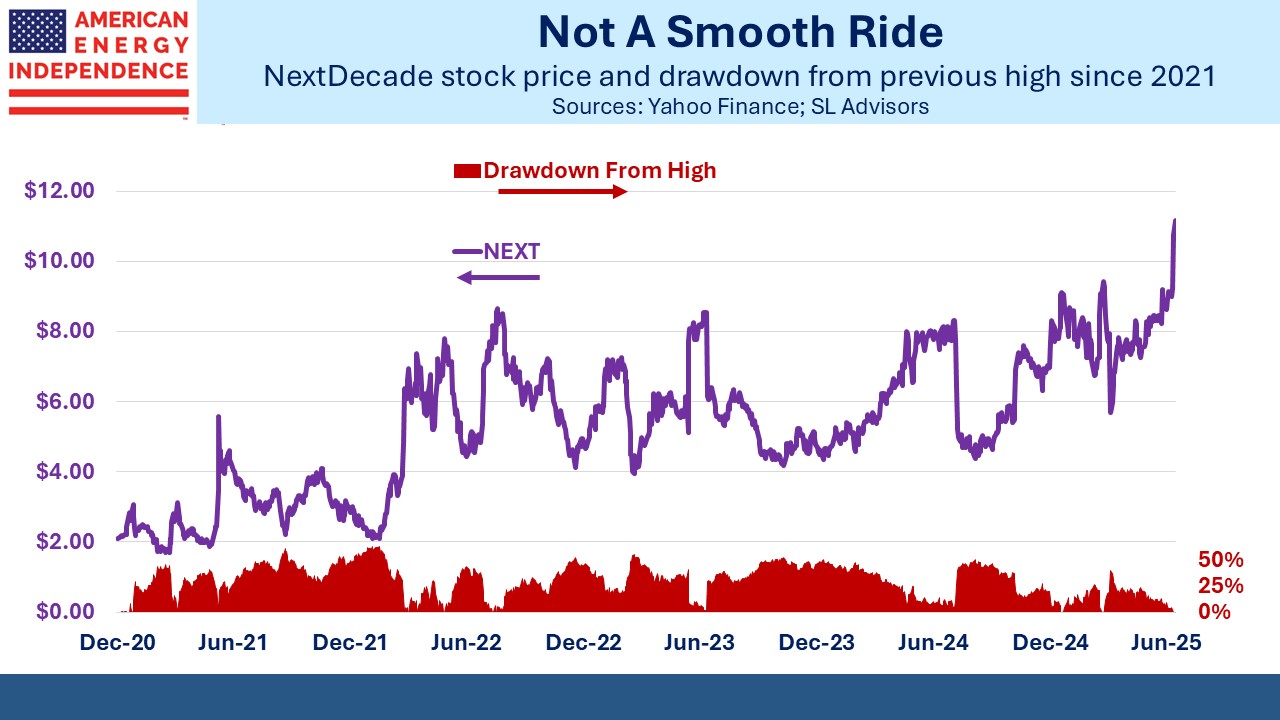

LNG stocks initially reacted strongly to the trade news but then slipped as traders contemplated that the path to increased gas exports is pretty much set for the next few years based on projects already under construction. Price differentials are already sufficient to induce flows from the US to Asia and Europe.

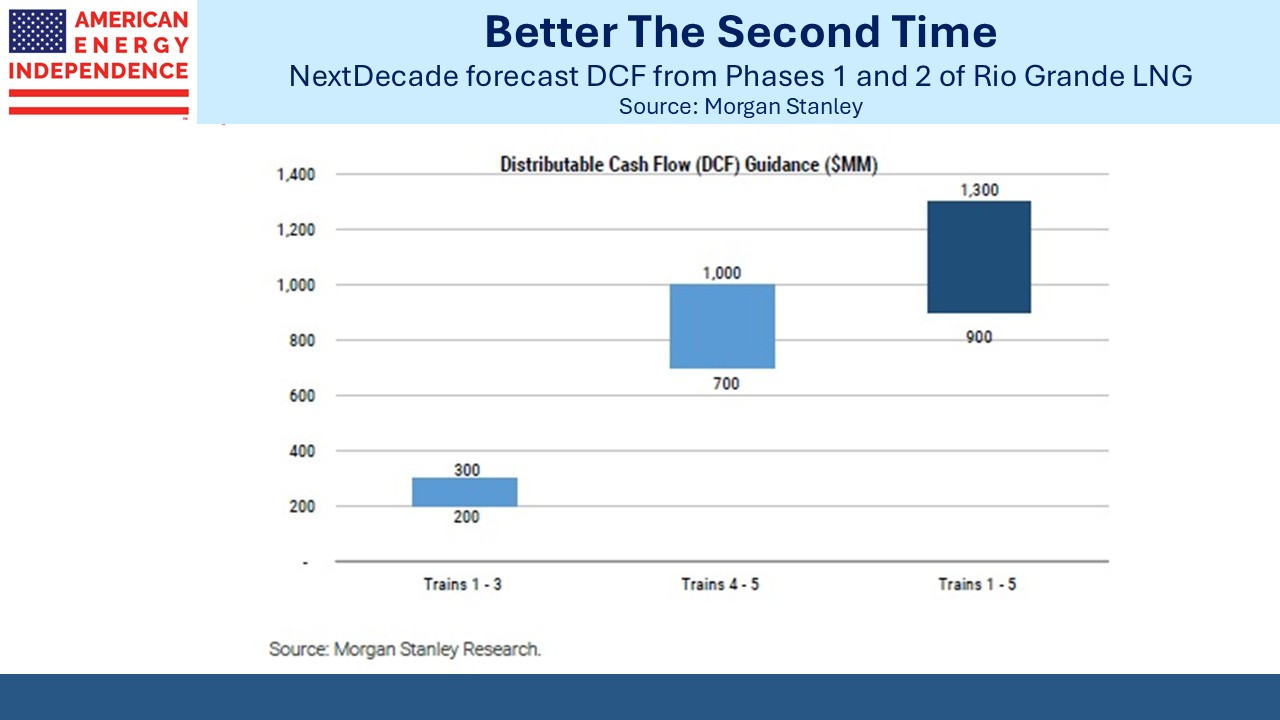

Venture Global (VG) announced Final Investment Decision (FID) on Phase 1 of CP2 LNG. They estimate the project will cost $15.1BN to complete and will make them the #1 LNG exporter in the US. VG has developed a reputation for relatively fast construction of LNG terminals, aided by their modular design. Along with Cheniere they dominate LNG exports, with each leapfrogging the other to be the biggest as they announce new projects.

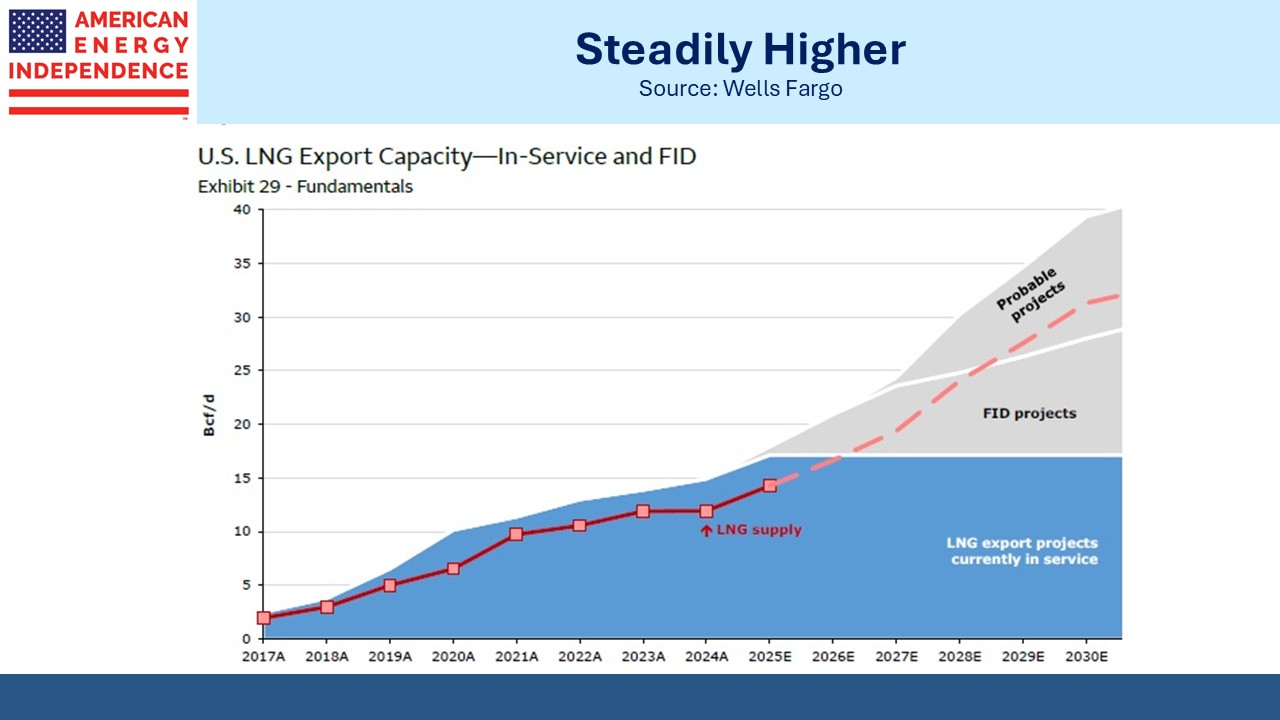

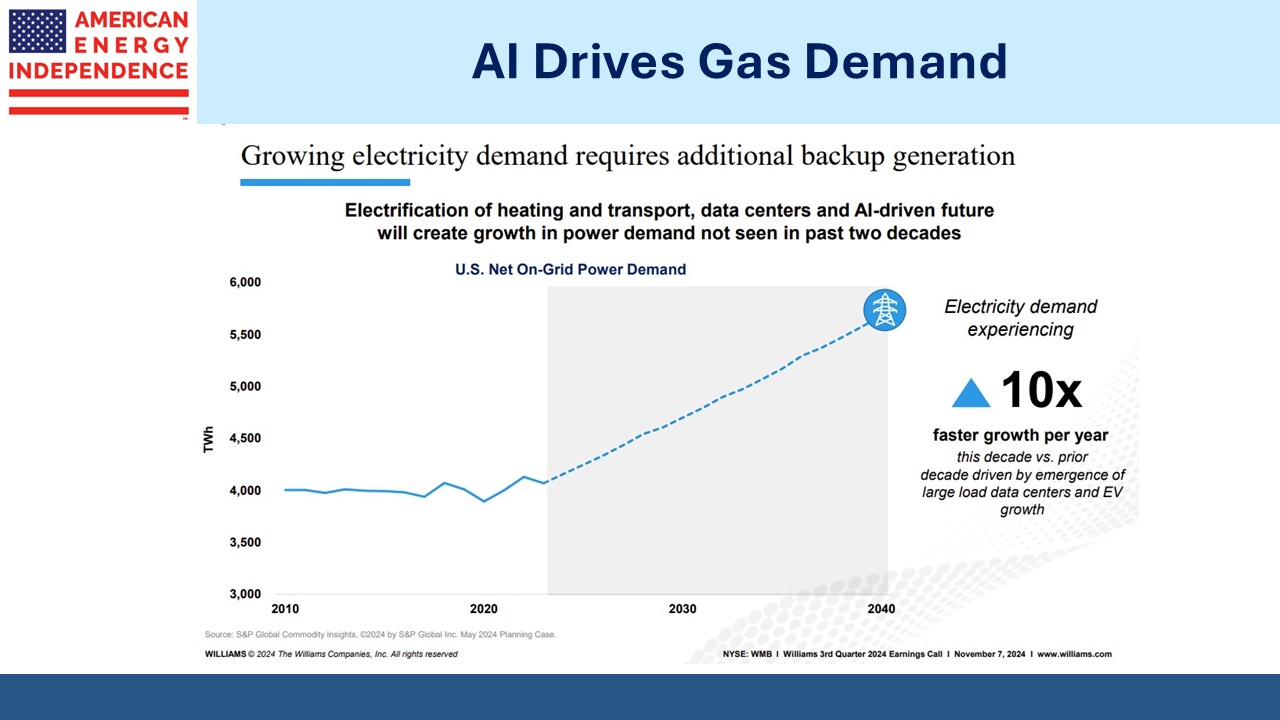

The prospects for export volumes to double within five years are good, and it’s possible they could increase further still. Export terminals take several years to build, so we have good visibility over that time frame.

The continued promotion of oil and gas exports as a way for foreign countries to reduce their trade surpluses with us is consistent. It means we should expect ongoing regulatory support for increasing our LNG export capacity.

Growing even faster than LNG export capacity is that for Floating LNG (FLNG). Shell’s Prelude FLNG vessel off the coast of NW Australia gave the sector a bad name because of construction delays and downtime which led to enormous cost overruns.

But technology has improved, with former LNG tankers in some cases being converted into liquefaction vessels. The large spherical storage tanks they come with make the conversion relatively straightforward.

Rystad Energy estimates that global FLNG capacity will triple over the next five years.

Enterprise Products Partners (EPD) reported earnings that came in as expected. They spent $170MM repurchasing stock in 1H25 compared with a full year range of $200-300MM. They raised their dividend by 4% year-on-year. At $0.545 per quarter it yields 7%.

A couple of weeks ago I asked my accountant to estimate my tax bill if I was to sell any EPD. As an MLP, the portion of my past EPD distributions that were defined as Return Of Capital (ROC) would be “recaptured” or taxed upon sale. This large tax bill is often a painful experience for the investor.

Oneok’s (OKE) 2023 acquisition of Magellan Midstream (MMP) was treated as if MMP unitholders (which included me) had sold their units. This was one of the reasons we were unhappy about the transaction (see Oneok Does A Deal Nobody Needs). I did get a big tax bill, but OKE’s deft integration of their target has more than compensated.

The taxes owed and tax benefits of MLPs are impenetrable to all but a very few highly skilled tax experts. My friend Elliot Miller is one and he may add a comment to this post when he reads it.

I have owned EPD for close to twenty years and it’s almost tripled since my first purchase. My cost basis has gone negative due to years of the ROC portion of distributions. Nonetheless, I was surprised to learn that for each $100 of EPD I might sell, I’d owe the Federal government $16 which was less than I expected. New Jersey was more than I expected, at $10, so a 26% total tax hit.

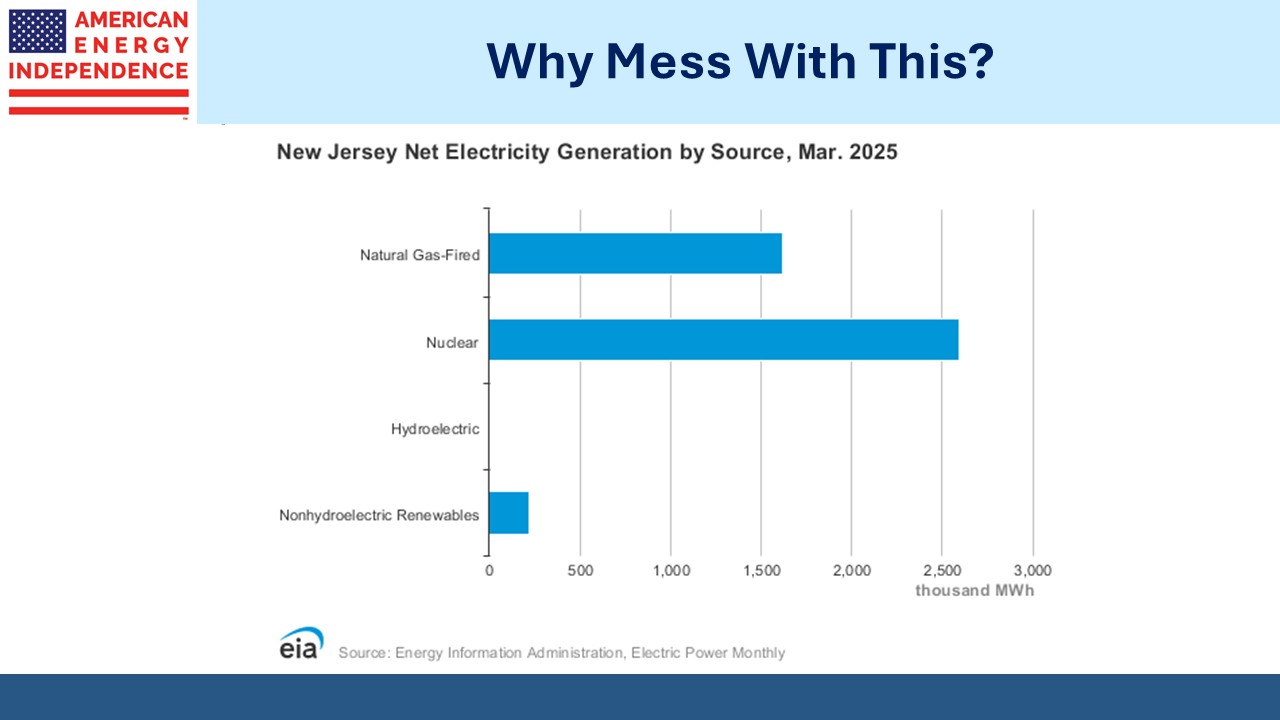

The Garden State’s tax code is ruinously high, illogical in ways that always favor the state and doesn’t allow tax-loss carryforwards which is why you should never come to NJ to start a business.

EPD’s yield of 7% is high because of the MLP discount – most investors don’t want a K-1. Even though those distributions are now taxed as ordinary income, it still looks like an attractive yield to me so why sell it?

I’m currently reading Jon Meacham’s American Lion, a Pulitzer Prize winning biography of President Andrew Jackson. His absence of links to the establishment, rejection of constitutional norms and desire for political fights which he invariably won are all reasons he’s compared with Trump, not least by the President himself.

For those who fear the country can’t survive a second four years of Trump (and among this blog readership you are few), draw some comfort from the fact that America survived Andrew Jackson’s two terms (1829-37).

We have two have funds that seek to profit from this environment: