The Iberian Grid Warning

It’s too early to say what caused the loss of power across Spain and parts of Portugal, but early signs are that it was linked to a disruption in solar supply. Some will soon blame it on global warming. But reducing greenhouse gas emissions (GHGs) requires increased electrification of energy systems. European governments are pushing heat pumps and EVs, all with the goal of increasing the use of electricity, more of which will come from solar and wind.

Spain gets 21% of its primary energy from renewables, significantly higher than Europe’s 15%. Red Eléctrica de España, which operates Spain’s grid, estimates that 56% of power generation was from renewables last year, significantly above the EU which was about a third.

Whether or not Spain’s heavy reliance on renewables is to blame, the bigger lesson is that increased electrification means the grid needs to work all the time. EV penetration is relatively low in Spain, but the country’s extensive public transport system runs largely on electricity. Travelers were stranded. Those pushing decarbonization will be increasingly marginalized unless they’re honest about the importance of grid reliability.

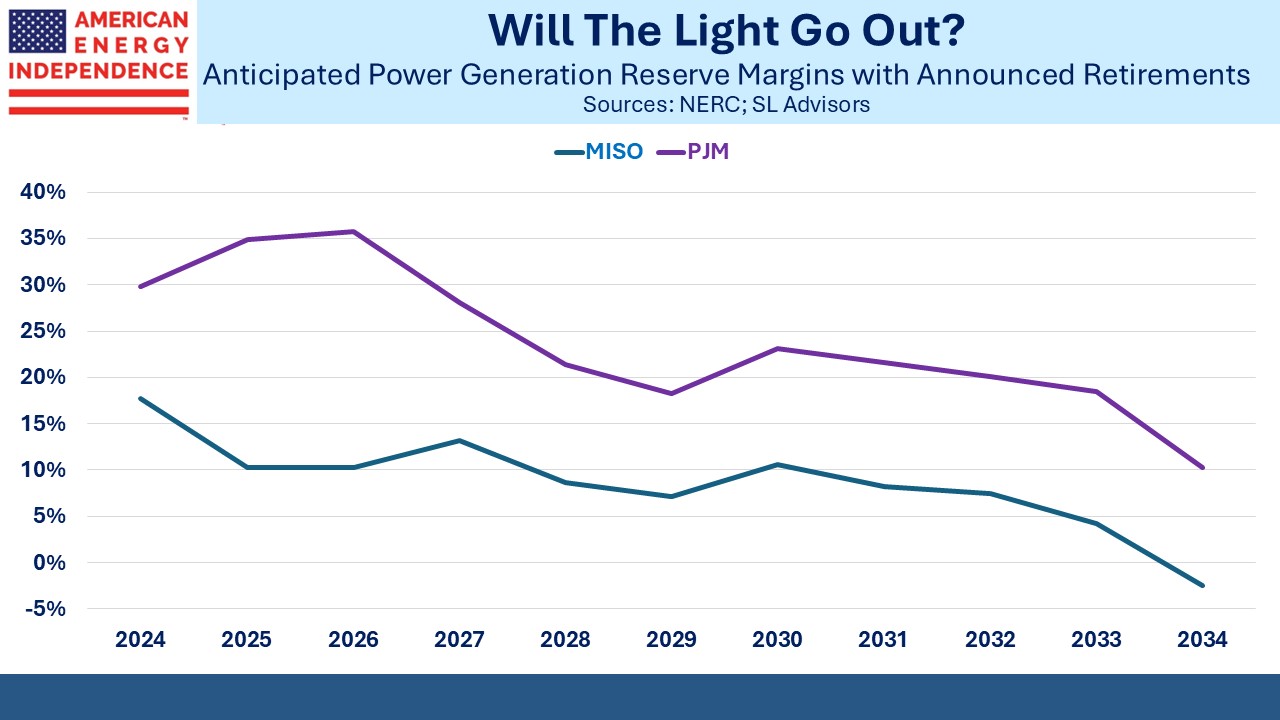

Across the US, independent system operators are warning that reserve margins are declining. This measures the amount of excess capacity that is available during peak demand, which typically occurs during hot summer days when AC units are cranked up.

The North American Electric Reliability Corporation’s (NERC) most recent Long-Term Reliability Assessment makes for grim reading. Throughout the continent, the margin for error is decreasing. The Midcontinent System Operator (MISO) is projected to have no reserve margin at all by 2034, which means that it will be unable to meet peak demand. On current trends, power outages on such days are virtually certain.

The PJM system, which includes New Jersey where your blogger resides when it’s warm enough for golf, will see its reserve margin drop from 35% to 10% by 2034. NERC warns that, “Resource additions are not keeping up with generator retirements and demand growth. Winter seasons replace summer as the higher-risk periods due to generator performance and fuel supply issues.”

We heat our home with natural gas, which is always available. A heat pump would increase our exposure to the grid, which looks increasingly ill-advised.

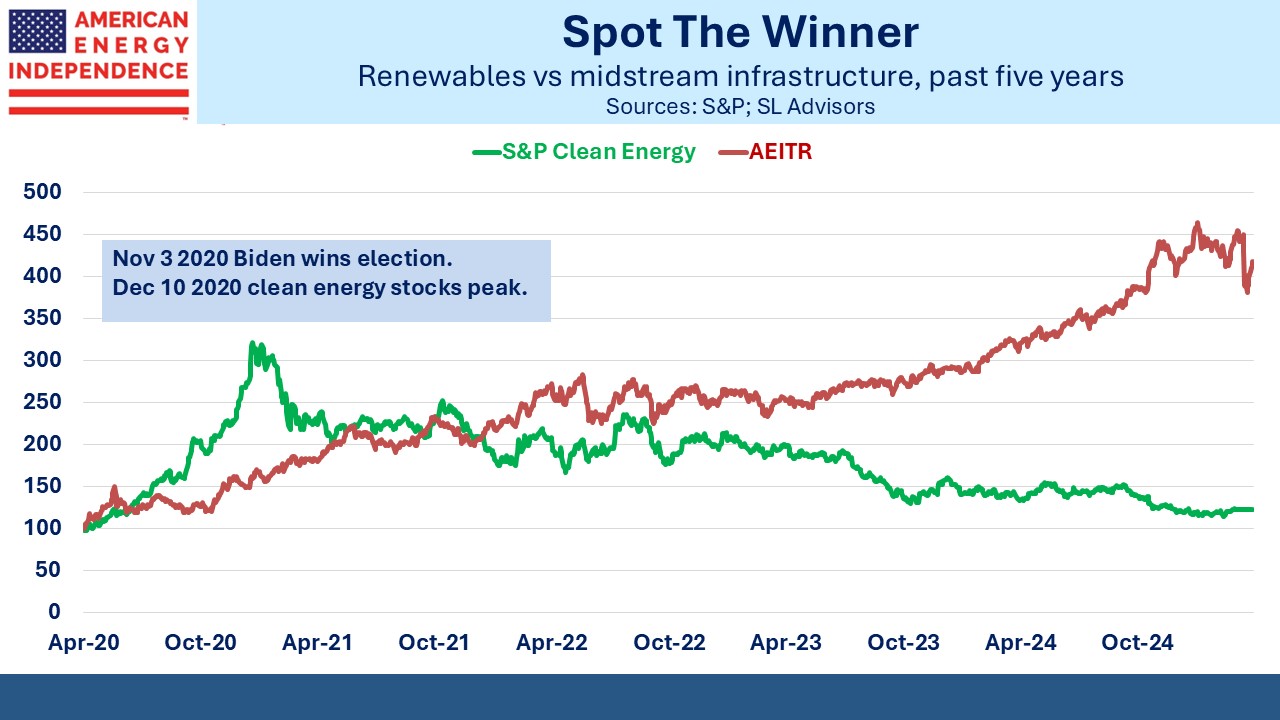

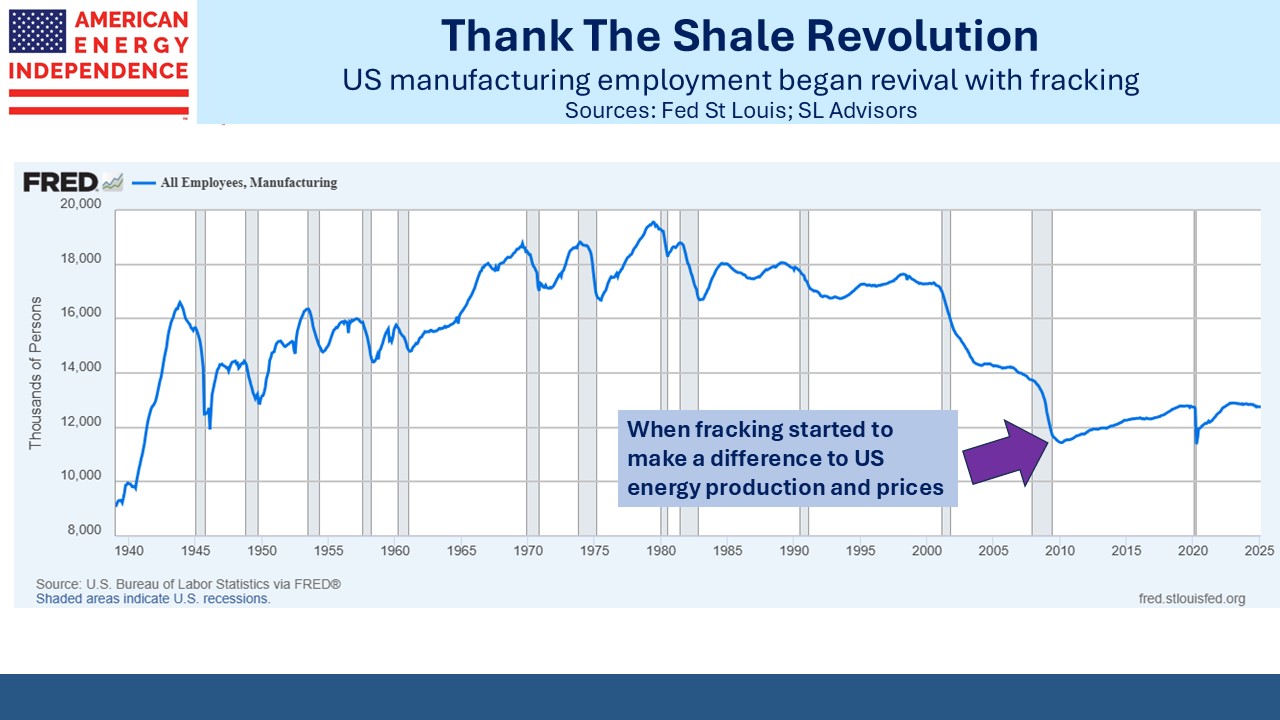

There’s no doubt that increased use of renewables is causing this. Natural gas power plants typically operate 95% of the time. Solar and wind are 20-35%. Moreover, if it’s cloudy solar output in a region can drop to zero, whereas it’s rare for gas power plants to all stop production at the same time.

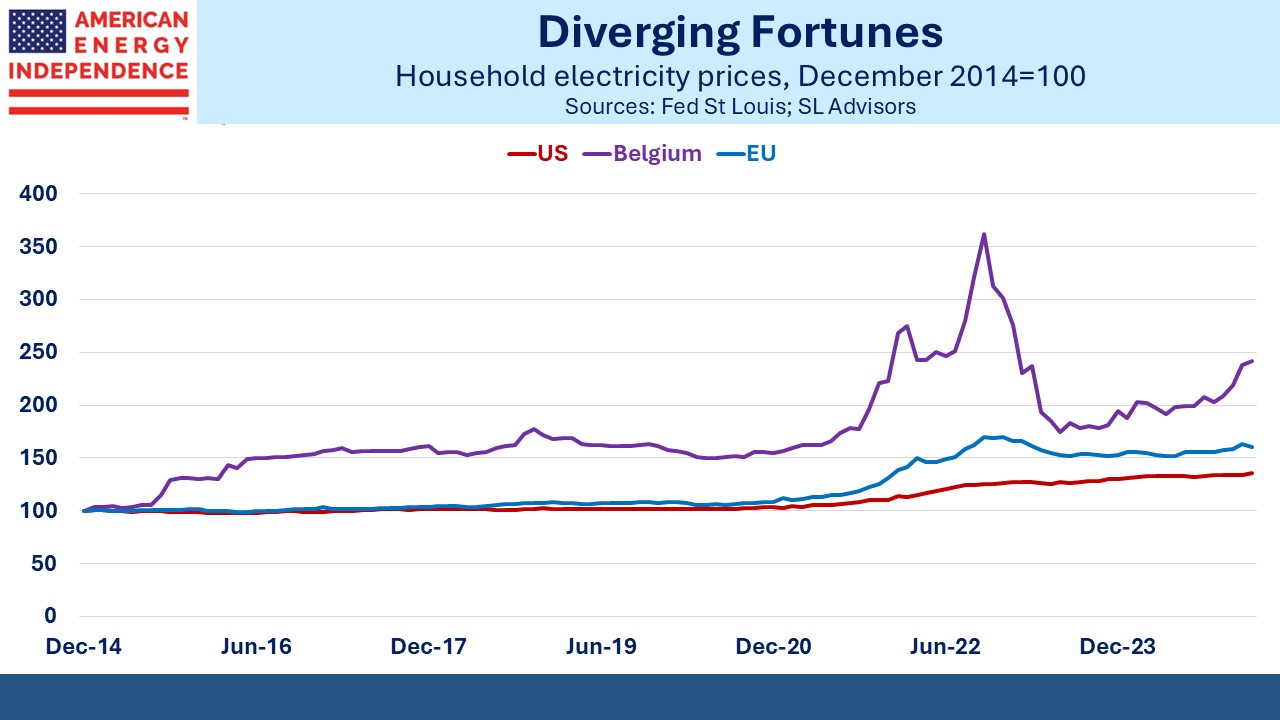

In places where renewables are a significant source of electricity, consumers are increasingly facing compromises on reliability and cost.

Electrification is leading to a concentration of risk on a single energy system. During Superstorm Sandy in 2012, the basement of a house we owned flooded because the loss of power meant the sump pump didn’t work. We now have one that relies on water pressure.

The NERC is warning that we’re likely to endure more power outages in the future. Climate change has lost its political relevance in the US for a host of reasons, and energy reliability will displace CO2 levels as a concern if it’s not there 100% of the time.

Declining grid reliability is a good reason to stick to natural gas for heating rather than heat pumps. Otherwise, a power outage in the winter assures residents of northern states burst water pipes.

After Sandy, sales of gas-powered home generators soared. Some diversification of energy sources seems sensible.

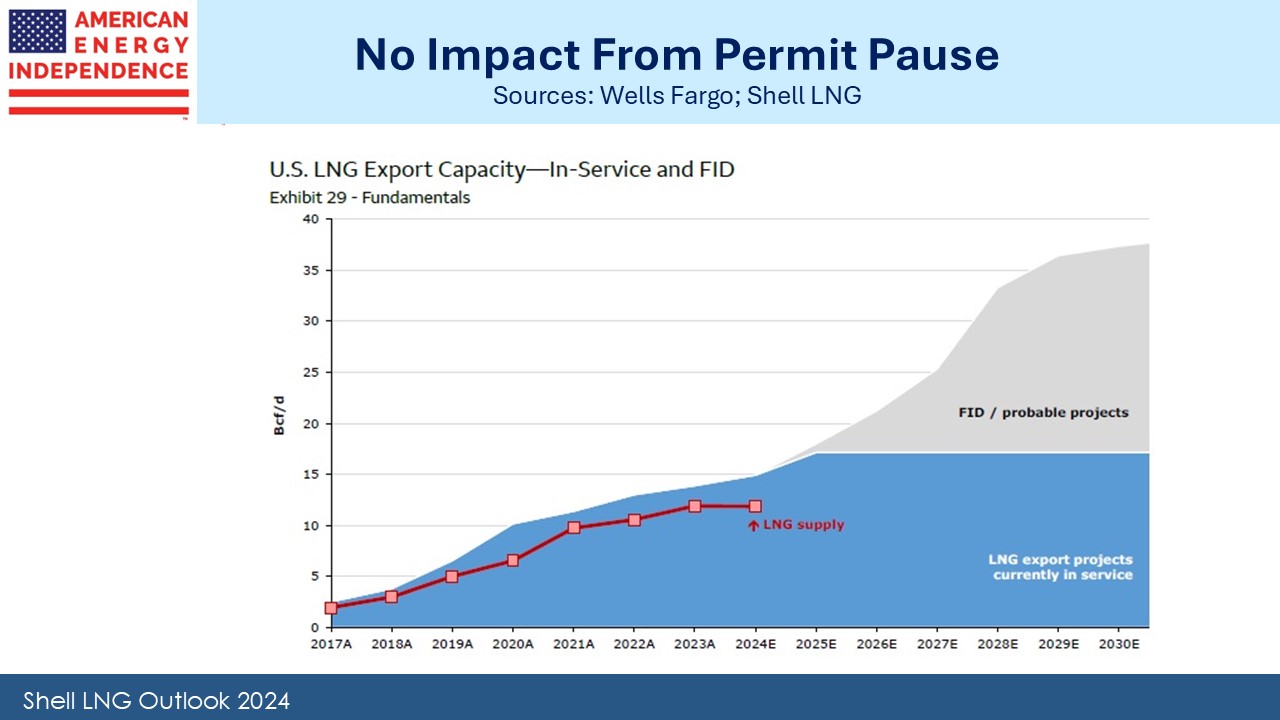

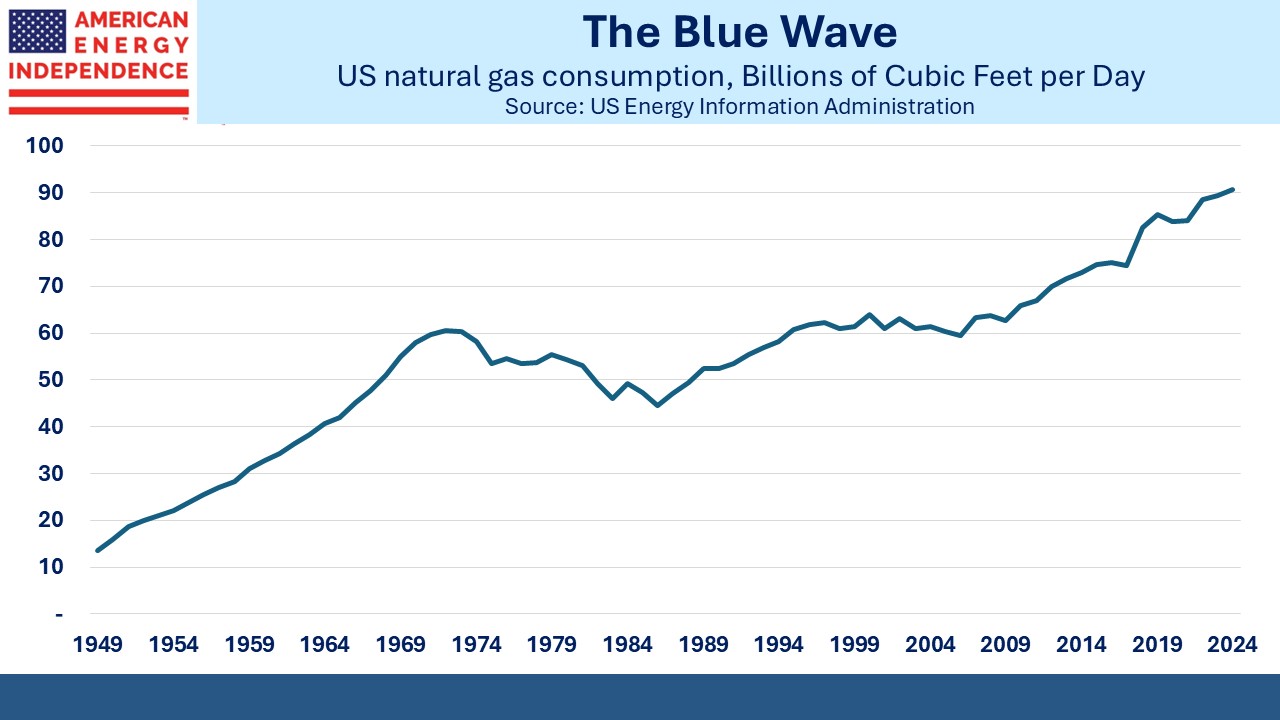

Gas production in the US continues to grow. In their Annual Energy Outlook 2025, the US Energy Information Administration (EIA) forecasts 1.6% annual growth through 2030. They expect Residential, Commercial and Industrial demand to all grow, but see declining use for power generation.

Unlike the EIA, we think power generation will use more gas, not less. It’s reliable and not weather-dependent. It’s what data centers will favor. It’s cheap, and it’s here in the US. Unlike the EU, American voters are not going to sacrifice reliability or price to accommodate China’s relentlessly increasing GHGs.

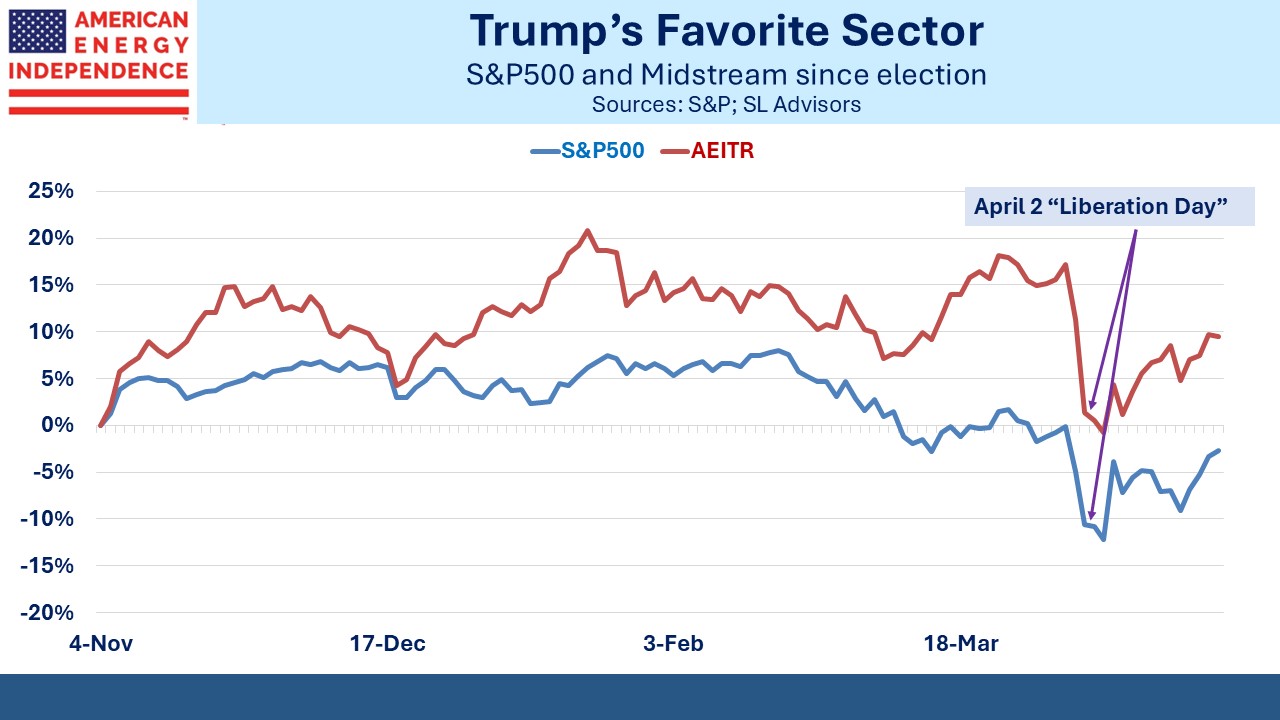

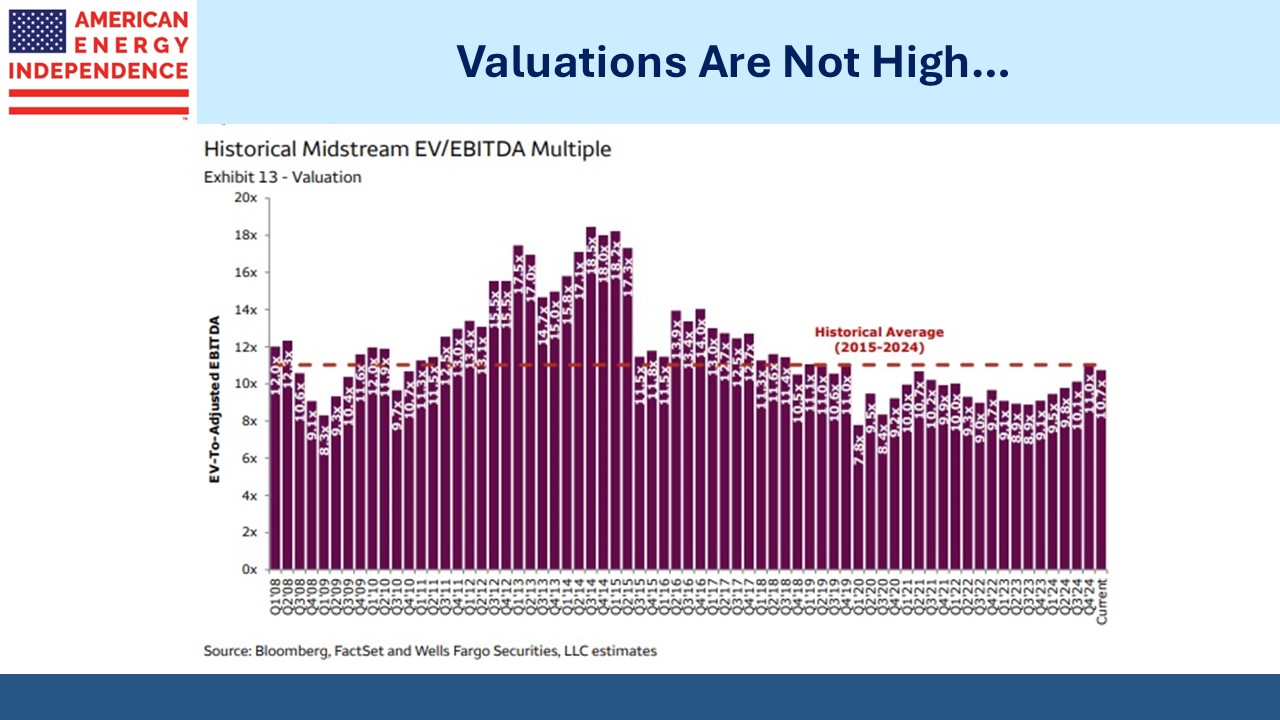

Cheniere Energy trades at 12.6X Enterprise Value/EBITDA (EV/EBITDA), marginally above the sector median but with double-digit projected growth in Distributable Cash Flow (DCF). Williams Companies is a little more expensive at 13.2X EV/EBITDA but offers DCF growth in the mid-teens. With these rates of cash flow increase, over time their valuations will normalize.

Both companies are levered to increased consumption of natural gas both in the US and via exports. This is a better bet than assuming increasing dependence on stretched power grids.

We have two have funds that seek to profit from this environment: