Energy Racks Up Steady Outperformance

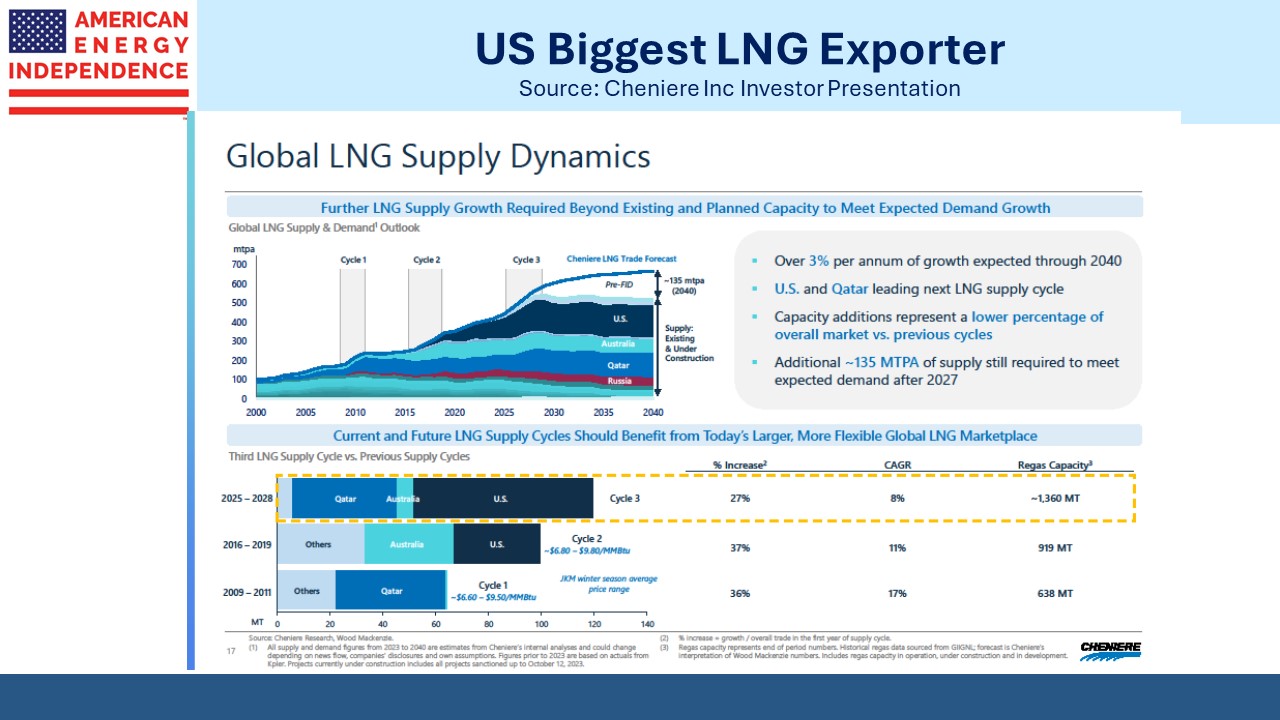

As we head into earnings season, Kinder Morgan will as usual kick off the reports from midstream energy infrastructure. The appeal of pipelines has always been their predictable earnings underpinned by long term contracts. Earnings surprises have been rare for several quarters, except for Cheniere which regularly beats to the upside.

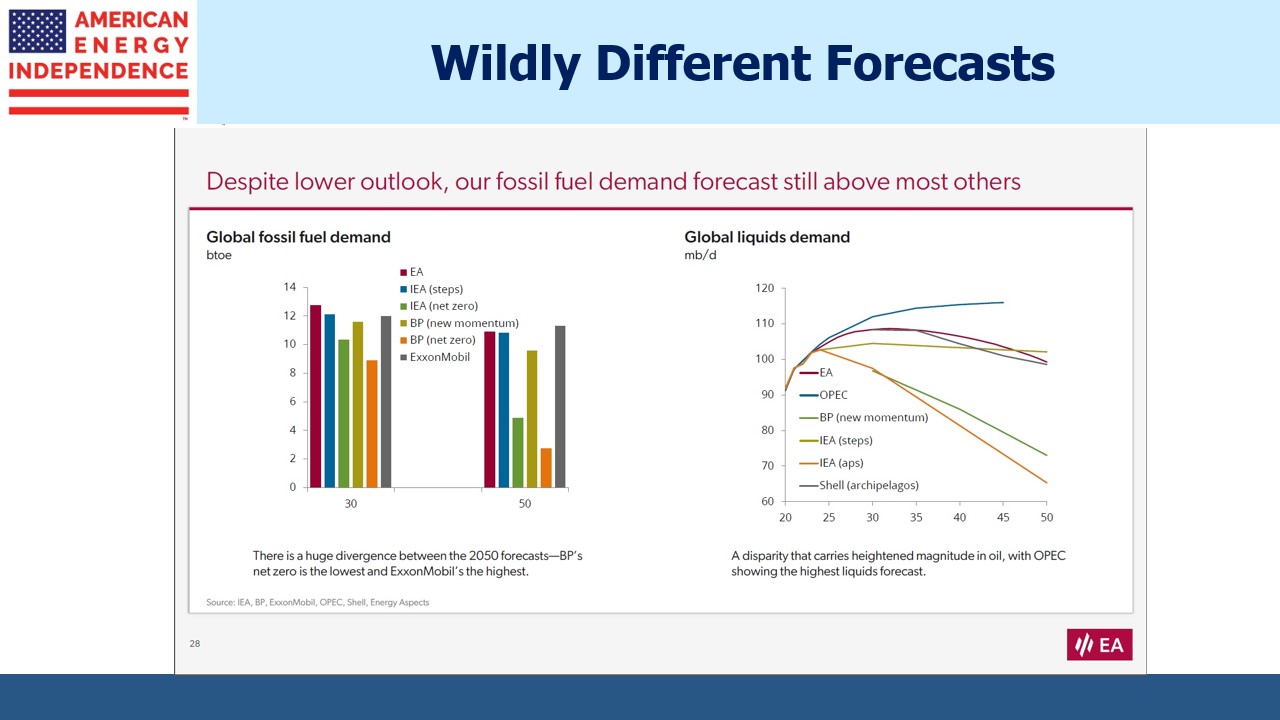

Many investors continue to regard energy with trepidation. Uncertainty over the path of the energy transition is a major reason. A period of poor returns caused by too much capex exuberance during the shale revolution and culminating in the 2020 pandemic is another.

Ben Graham once said that in the short run the market’s a voting machine but in the long run it’s a weighing machine. Sentiment is ephemeral, and financial performance long ago overwhelmed the disfavor many felt towards midstream infrastructure.

The response to covid was excessive once the data showed that most people weren’t going to die. We needed to protect older people and those with co-morbidities. The sharp but short drop in markets reflected the realization that our economic response was more damaging than the virus itself.

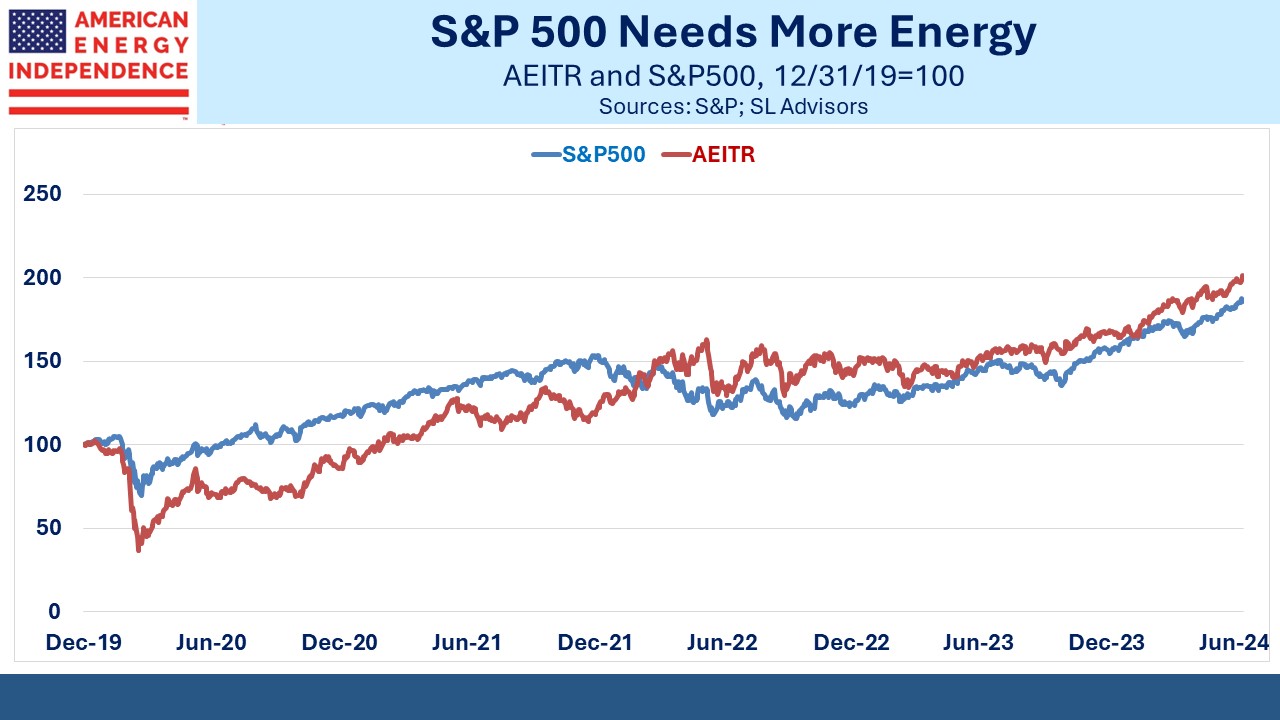

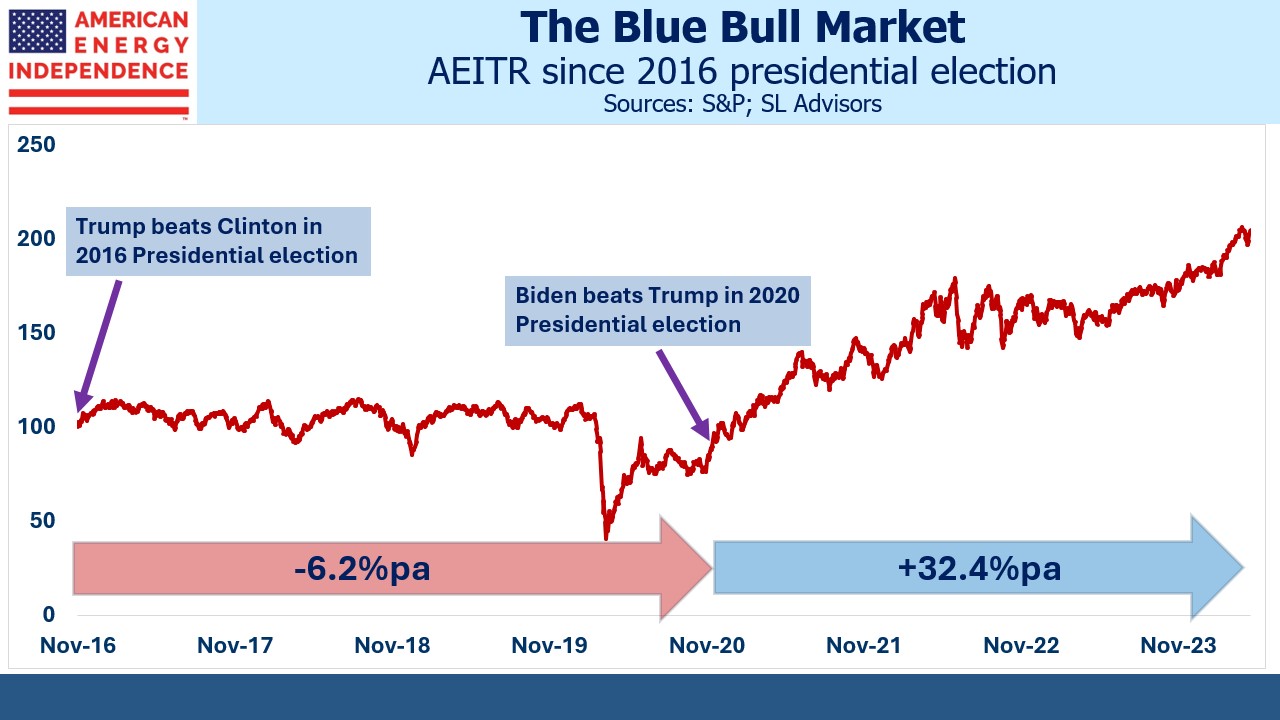

Hence the S&P500 recovered to its 2019 year-end level by June 2020. Midstream took until February 2021. But relative performance since pre-pandemic has favored the American Energy Independence Index (AEITR) over the market.

By March 2022 the AEITR had recovered so strongly that it was ahead of the S&P500 from their YE 2019 levels and it’s never looked back. Stocks have performed well over this period, and the S&P500 has been boosted by AI stocks, none of which are in the AEITR. Midstream has powered along anyway, with the added benefit of a low correlation with the market.

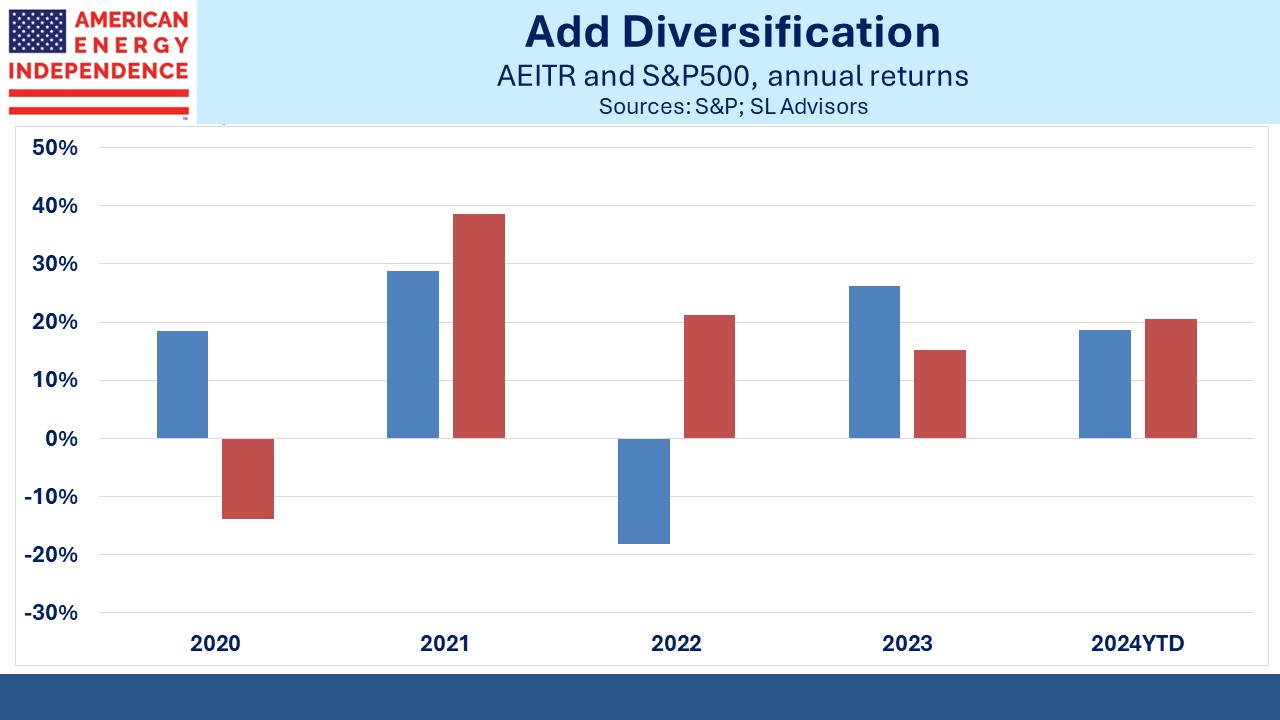

During the 2022 inflation contracts that often incorporate PPI-linked price hikes drove a 21% return, 39% ahead of the S&P500. So, if you’re worried about a resurgence of inflation or a dip in AI stocks, midstream could offer useful diversification.

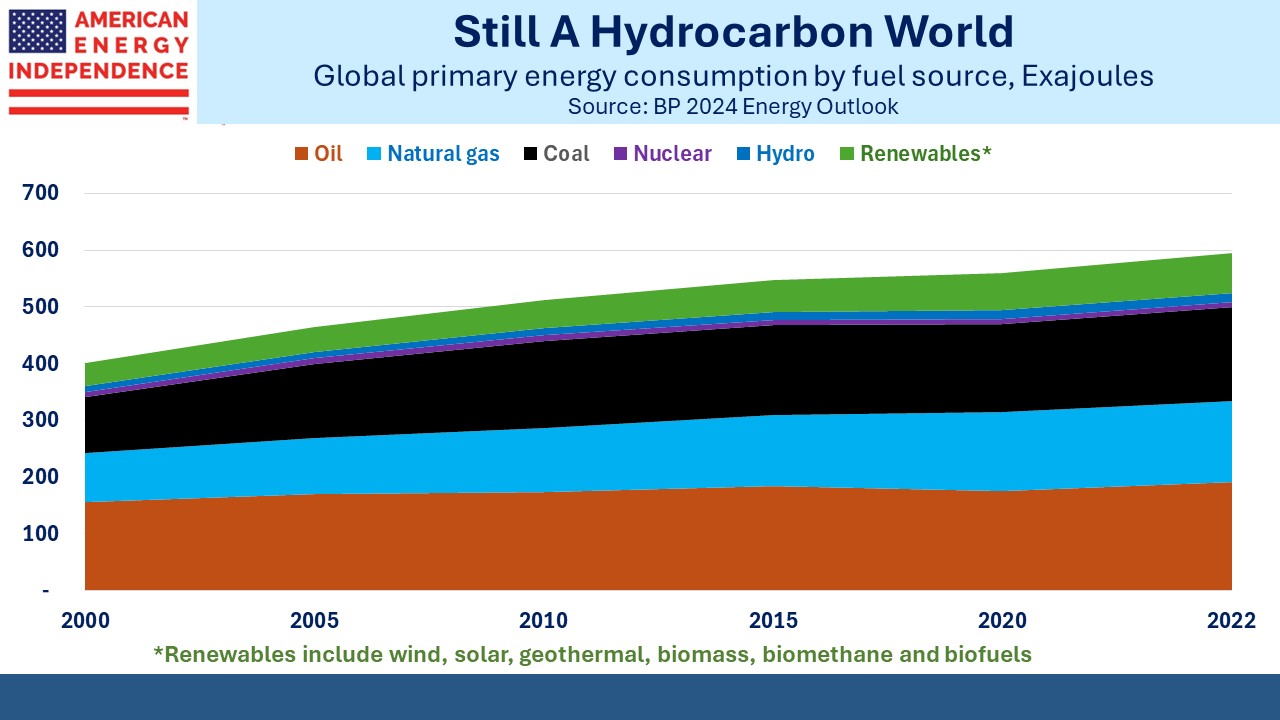

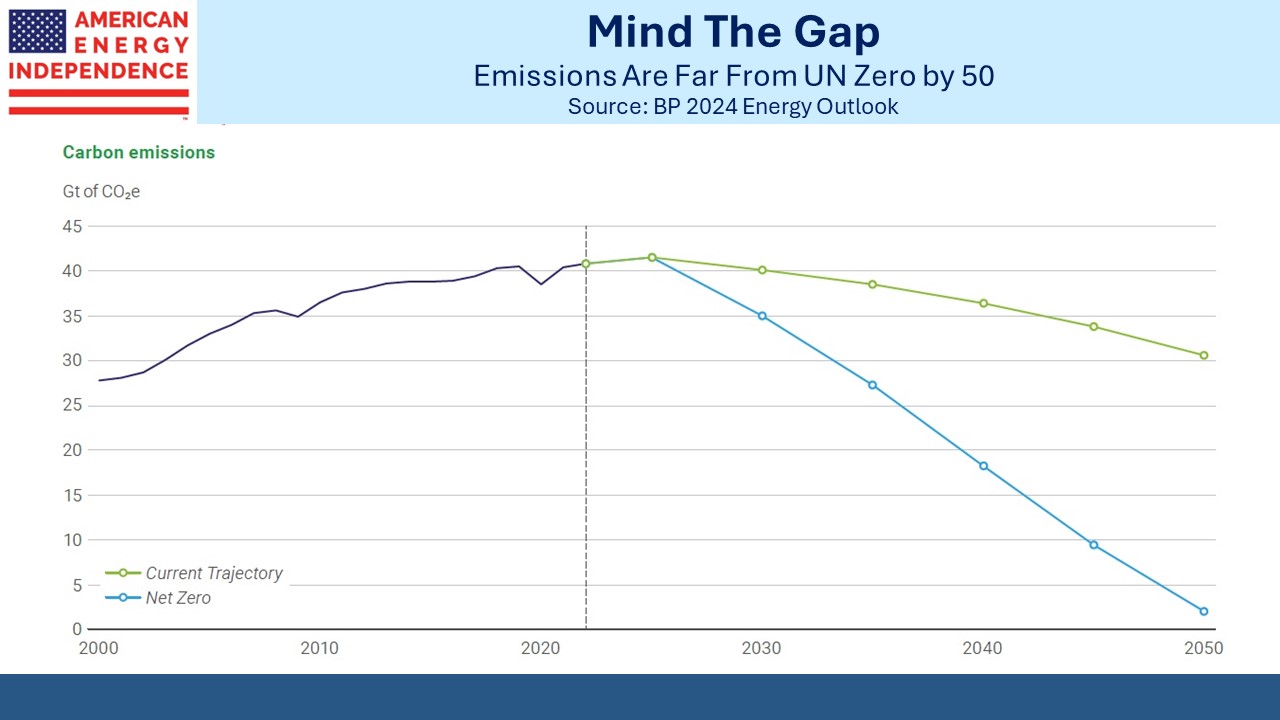

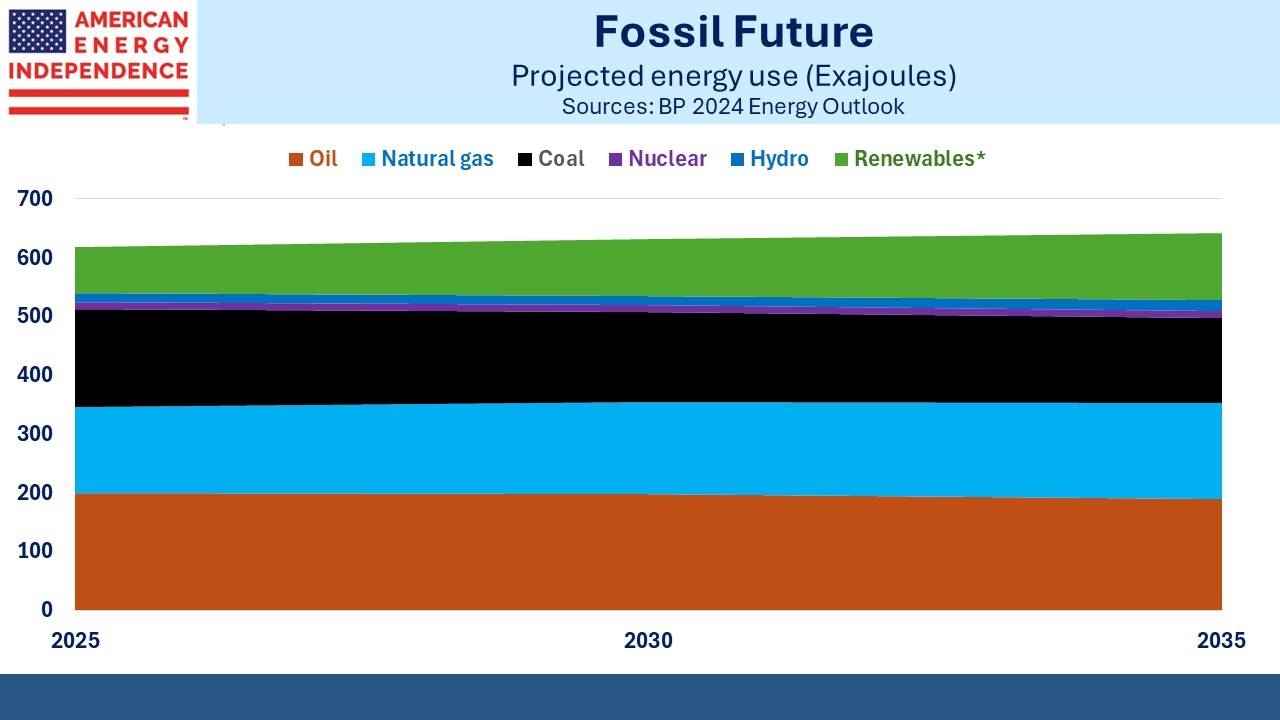

The inability of solar and wind to displace fossil fuels is apparent in the most recent BP Energy Outlook. Since 2000, primary energy derived from renewables has grown at a 2.5% annual rate, barely faster than natural gas, coal or hydro each at 2.3% pa. Given the low starting point of renewables and $TNs in subsidies, it shows how hard it is to displace reliable energy with something that’s intermittent, requires enormous space and consumes substantial minerals.

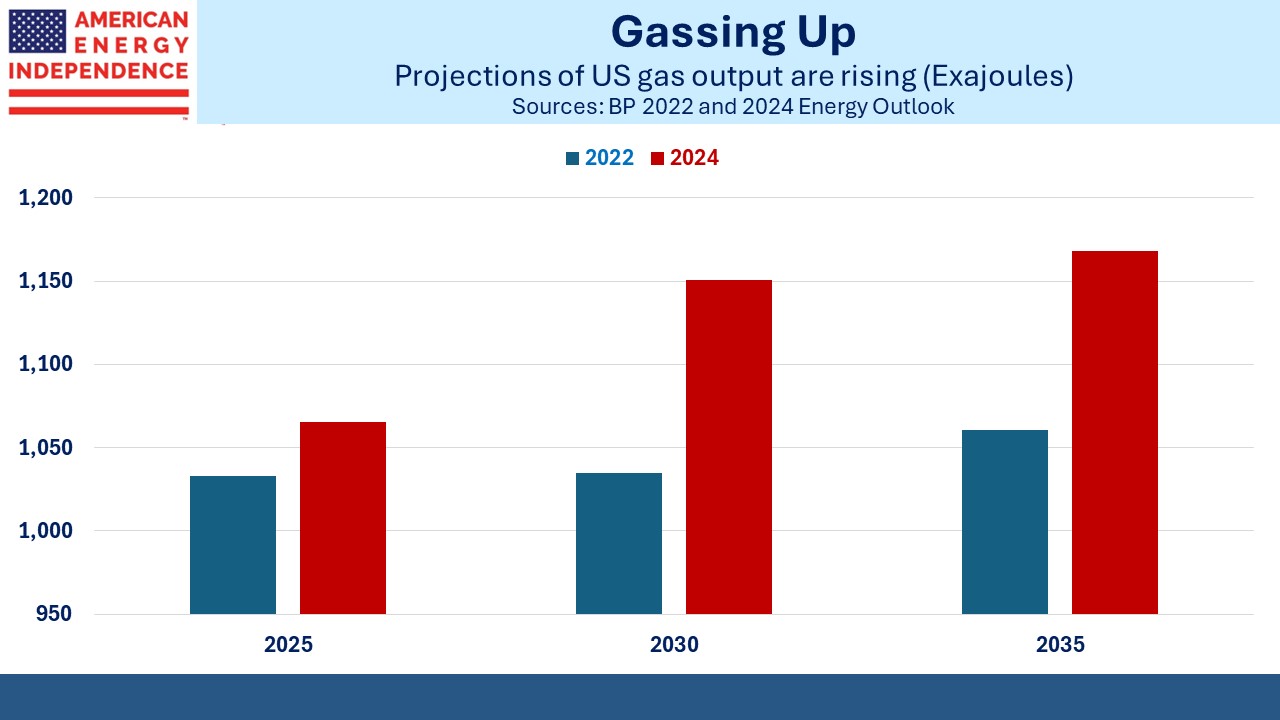

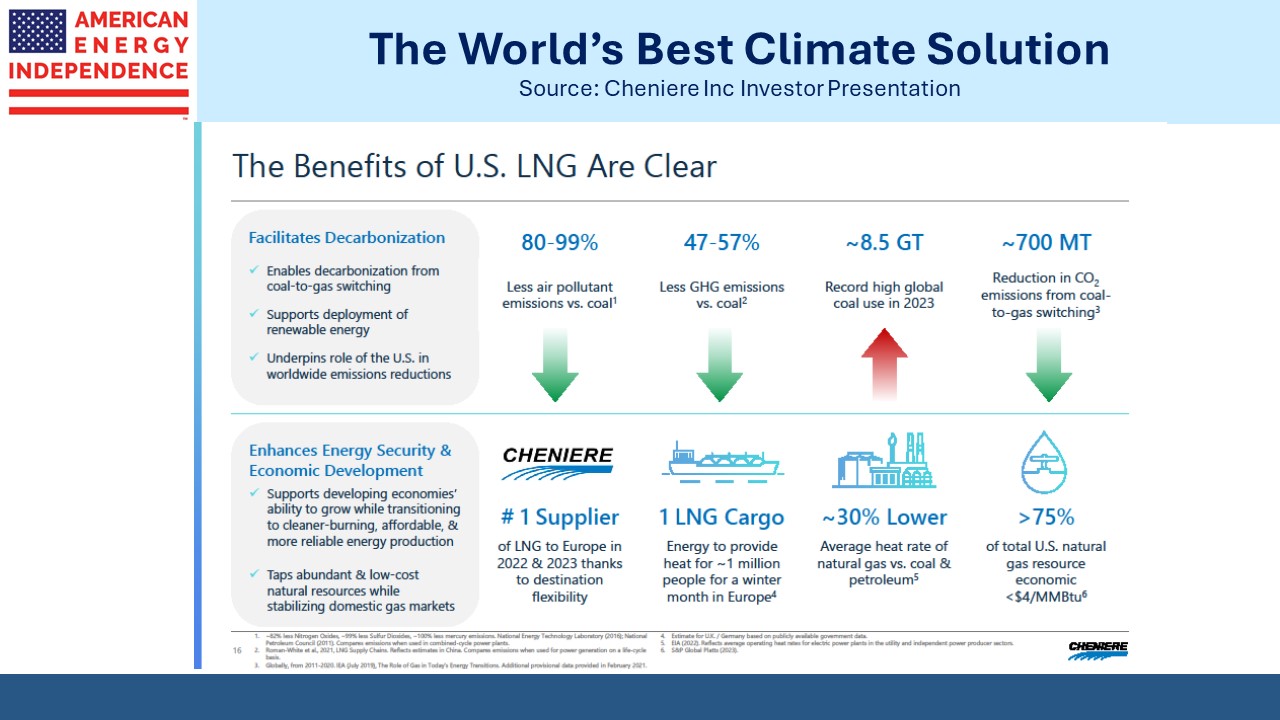

This blog is in favor of sensible measures to reduce emissions. The most positive development has been the growth in natural gas. Increased output since 2000 of 57 Exajoules (EJs) is almost twice that added by renewables at 29 EJs, which have been able to meet only 15% of the increase in global energy consumption over this time. Fossil fuels have gone from providing 85% of global primary energy to 84%.

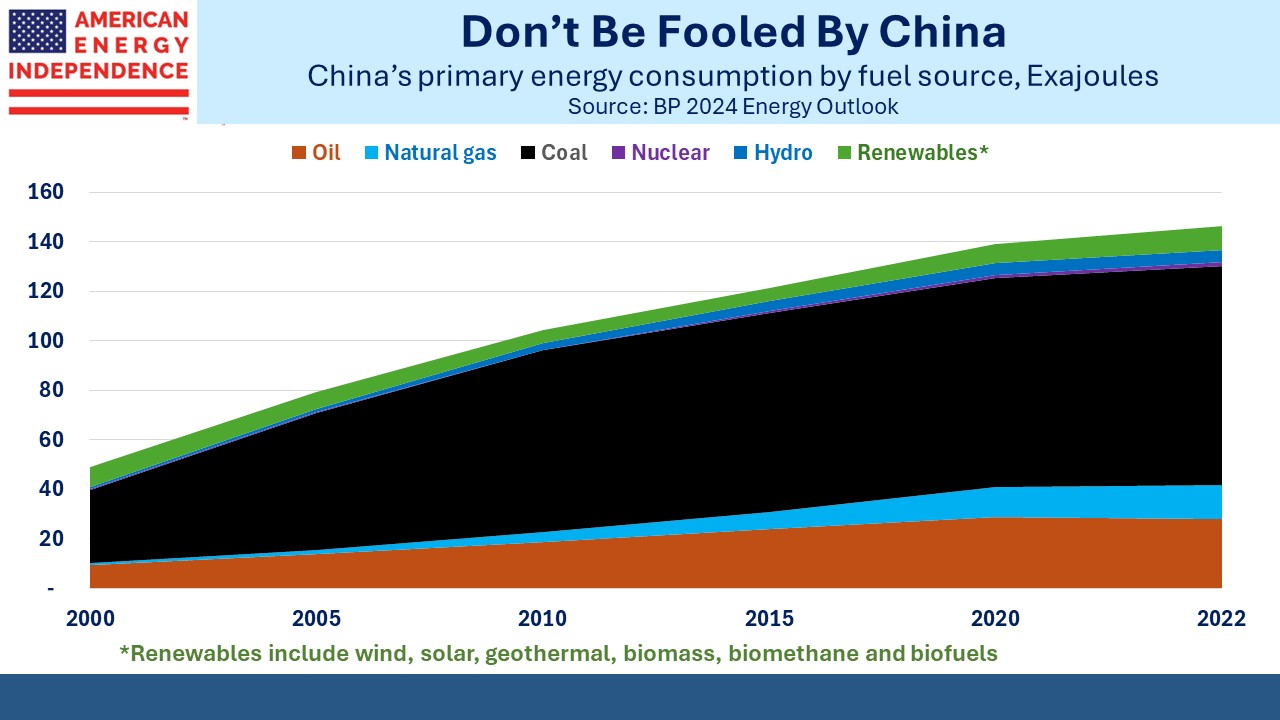

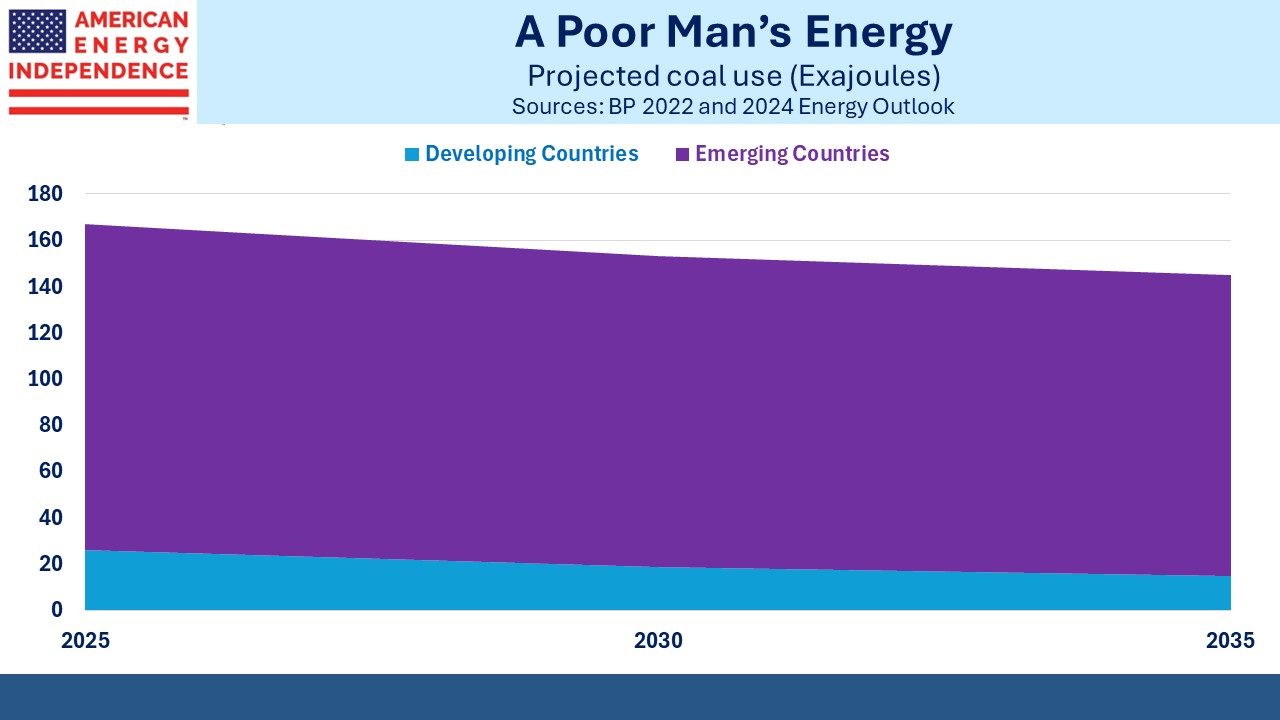

The biggest failure is the world’s inability to cut back on coal, which remains the energy of choice for developing countries. China receives misplaced praise for its investments in solar and wind but derives nearly 9X as much primary energy from coal as from renewables (89 EJs vs 10 EJs).

Blog readers often send me interesting material. Mark Mills is a senior fellow at the Texas Public Policy Foundation and often writes about energy. Here’s a link to a concise, clear video explaining the impossibility of pursuing energy policies embraced by progressives. Thanks to Dave Bachmann from Westfield, NJ for sharing.

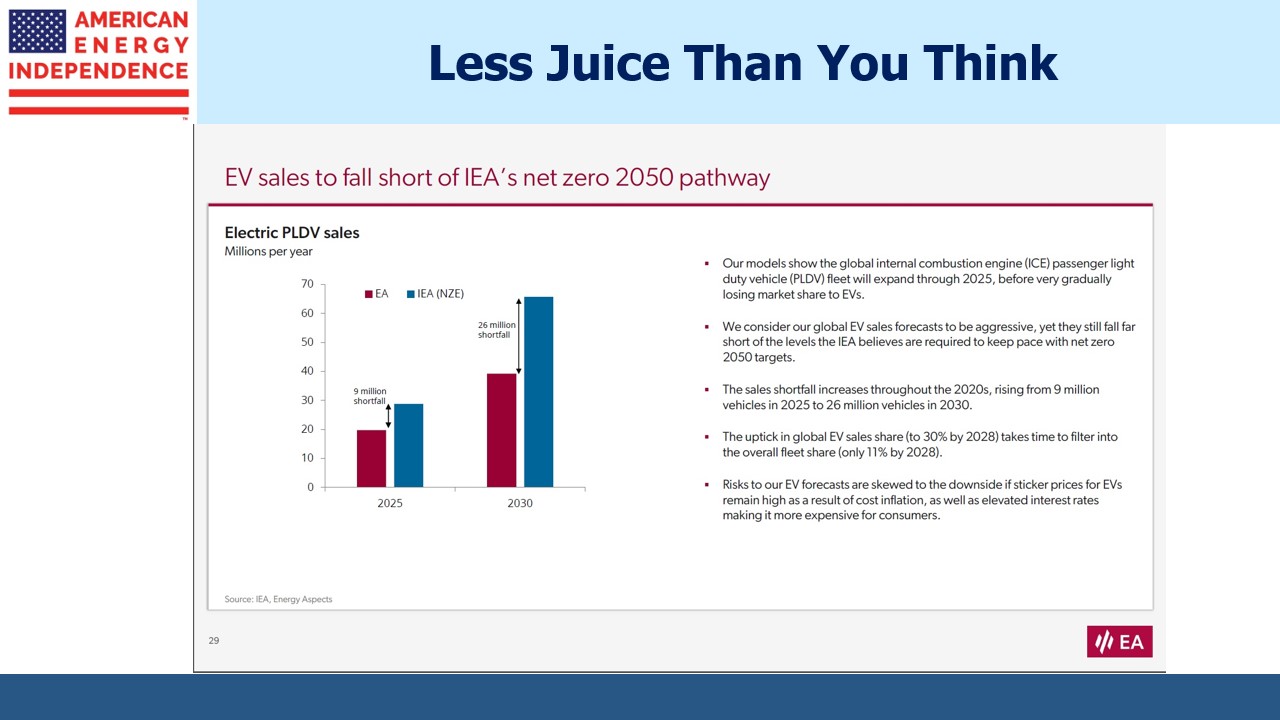

I also discovered Konstantin Kisin, a wonderfully articulate critic of wokeness and its chief concern, climate change. My thanks to Gene Muenchau of GHJ Financial Group in Oakdale, MN for bringing him to my attention. In his engaging style Kisin reminds that billions of people in emerging economies are going to prioritize energy to support the health of their children and higher living standards over reducing CO2 emissions. New York’s banning of natural gas in new buildings will create inconvenience without impact, because most of the world simply wants more energy.

Konstantin Kissin talks a lot of sense.

The widespread discrediting of wokeness, ESG and Diversity, Equity and Inclusion (DEI) are coinciding with more realism about the energy transition. The E in DEI promotes socialism by seeking equal outcomes instead of equal opportunities. The I is intended to exclude white males so as a practical matter is racist. This is not how America became the great country it is.

The rejection of progressive left-wing philosophies that demand guilt instead of fostering pride over humanity’s achievements and opportunities is a recognition of their negativity and inutility.

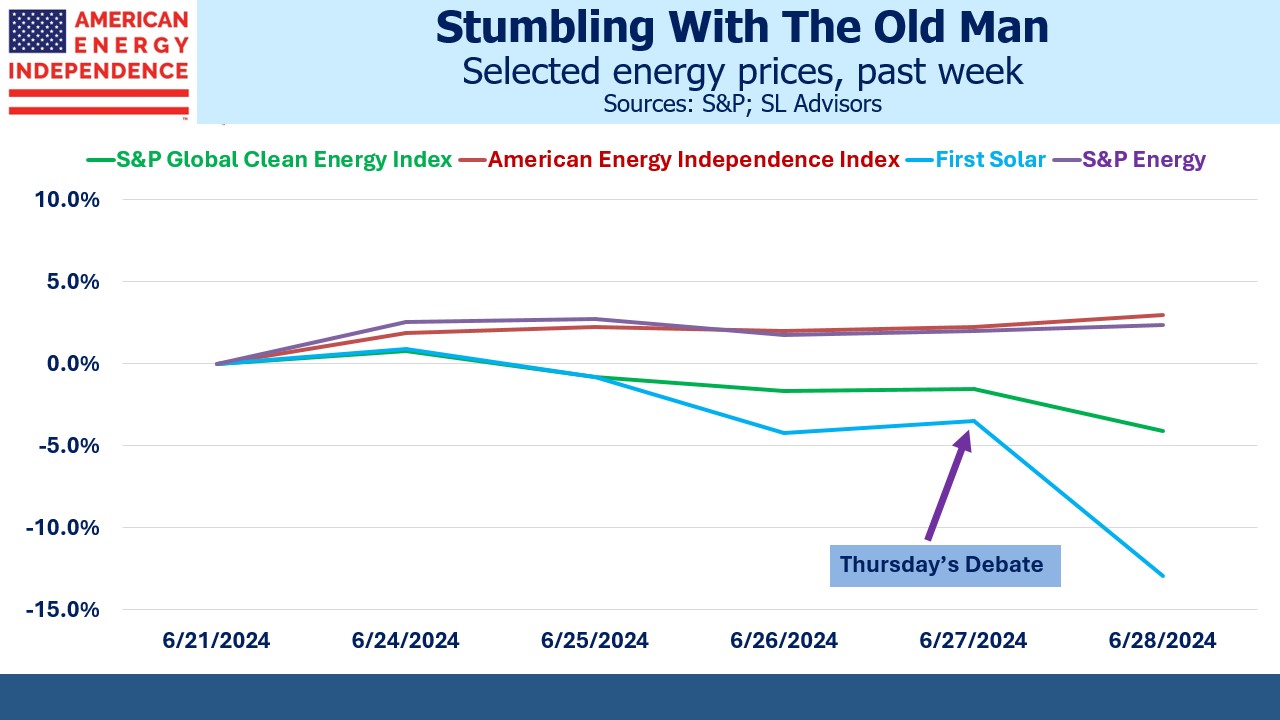

This overall shift away from the group-think of university faculties is refreshing because it is overdue. Along with the disastrous investment returns on renewable energy, it is making reliable energy and its supporting infrastructure ever more appealing to thoughtful investors.

We have three have funds that seek to profit from this environment: