Pipeline Dividends Are Heading Up

For investors who seek despondent sellers, look no further than energy infrastructure in late 2018. The Alerian MLP Index made its all-time high way back in August 2014. It currently sits 43% lower (including dividends). Barring a strong recovery in the last days of December, returns for three of the past four years are negative. Not coincidentally, MLP distributions are down for their fourth straight year. The Alerian MLP ETF (AMLP) has cut payouts by 34%, with its most recent one last month. Investors don’t want dividend cuts, they want dividend hikes – and in 2019 they will see them.

The shift of MLP Distributable Cash Flow (DCF) from distributions to funding growth projects has been well documented (see Will MLP Distribution Cuts Pay Off?). Growth capex (i.e. where that money went) dipped in 2016 but has been robust since then. Valuations continue to be more reflective of Free Cash Flow (FCF), which is after capex, whereas we think DCF (before capex) is more relevant (see Valuing Pipelines Like Real Estate). But investors are skeptical that cash formerly paid out is being well spent, and resentful of the dozens of cuts. Rising payouts should help.

Pipeline company earnings calls are full of positive reports with optimistic guidance. Business has rarely been this good. In August, Energy Transfer (ET) CEO Kelcy Warren memorably said, “A monkey could make money in this business right now.” (see Running Pipelines is Easy). Business conditions have only improved since then. In November, ET reported another strong quarter, beating Street estimates of EBITDA by 11%. Yet ET’s stock slumped, and is down 33% from its late July “business is easy” level, even though that description seems accurate.

No other metric explains sector performance as well as the path of dividends (or distributions for MLPs).

It’s rare for an industry to cut dividends when profits are growing, but that’s exactly what this sector has done. Falling dividends are so often associated with poor operating performance that investors reasonably equate the two – especially yield investors. Pipeline management teams consistently report on terrific business conditions and lament their stock’s low valuation. Part of the reason is that management teams too often invest in new projects rather than buying back stock. Buybacks with DCF yields of 14% and higher must surely be more compelling (and less risky) than all but the most attractive new investments. It’s no wonder investors question their judgement. Williams Companies (WMB) CEO Alan Armstrong recently said, “I don’t recall a time in my years in executive management when the business has been this healthy but the equity markets so poorly reflecting that.”

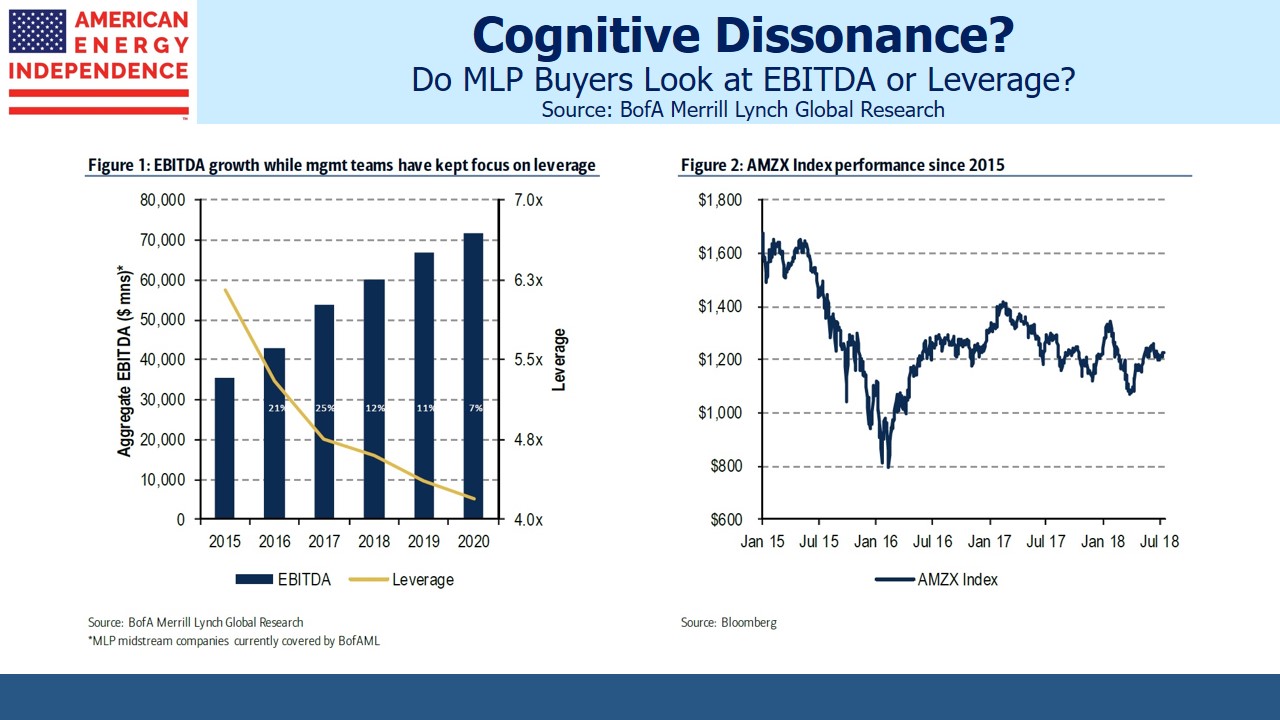

While business is booming and valuations are very attractive, Alan Armstrong and others still fail to appreciate (or at least don’t acknowledge) the crushing effect dividend cuts have had on investor appetite for their stocks. No other explanation fits the facts as well. Some blamed crude oil for the 2014-16 collapse, but MLPs only modestly participated in the subsequent crude rally. Recently we read an analysis that attributed stock weakness to rising leverage, but leverage peaked in 2016 at around 5.5X Debt/EBITDA and is comfortably heading lower. We estimate that our portfolio companies’ will exit next year at 4.1X, comfortably within the range that prevailed before the 2014 MLP market peak.

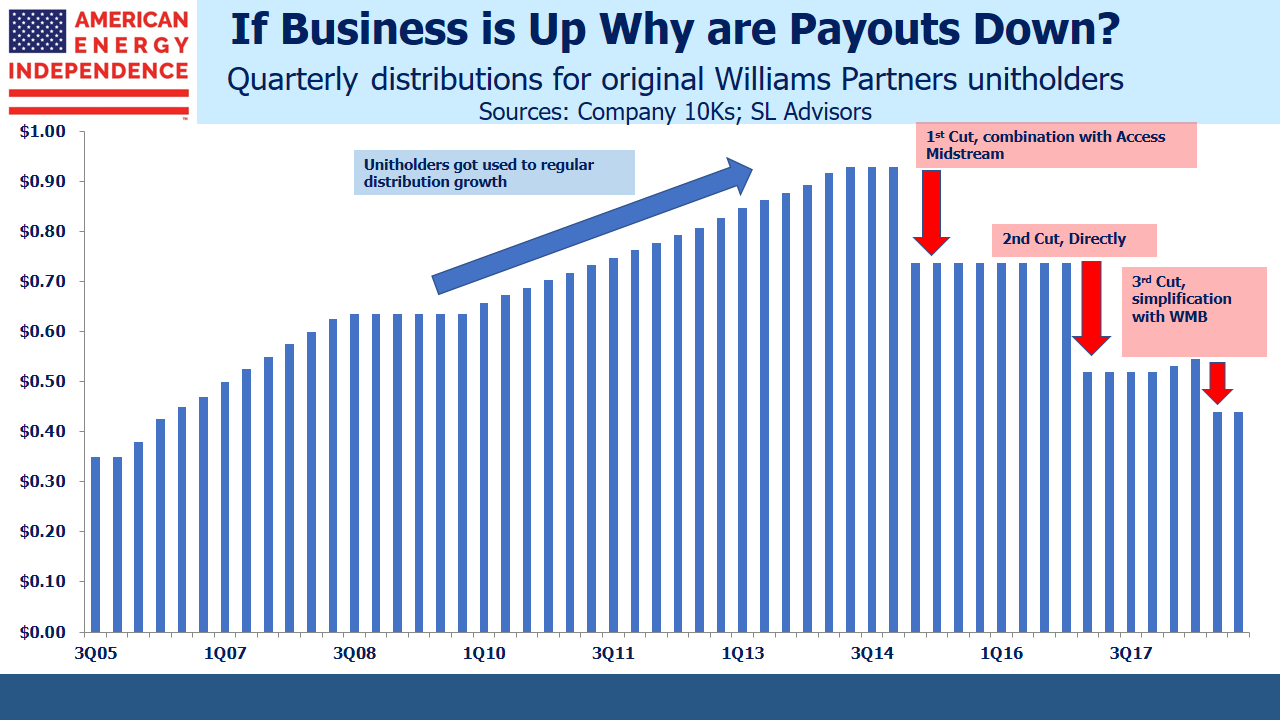

For almost a decade, Williams Partners (WPZ) investors were trained to expect gently rising distributions that came with a tax deferral and a K-1. This happy arrangement was abandoned when Shale Revolution growth opportunities presented themselves. The first cut came when WPZ combined with Access Midstream (ACMP), formerly Chesapeake’s midstream business before it was spun out. WPZ adopted the lower, ACMP payout which resulted in an effective cut for legacy WPZ holders. Two years later, partly due to concerns about leverage, WPZ imposed a second outright cut. The final one came when WPZ was folded into Williams Companies (WMB), in a “simplification”. WMB’s lower payout was applied to WPZ holders, along with a tax bill on recaptured income.

Long-time WPZ investors have endured a 53% cut in their payouts, which are back to the levels of 2006. Having been taught to focus on distributions and ignore market gyrations, they must find Alan Armstrong’s upbeat comments incongruous if not insulting.

Nonetheless, Alan Armstrong is right that business is good. It’s just that he and his peers have so mistreated their investors that his enthusiasm is less infectious than he might like.

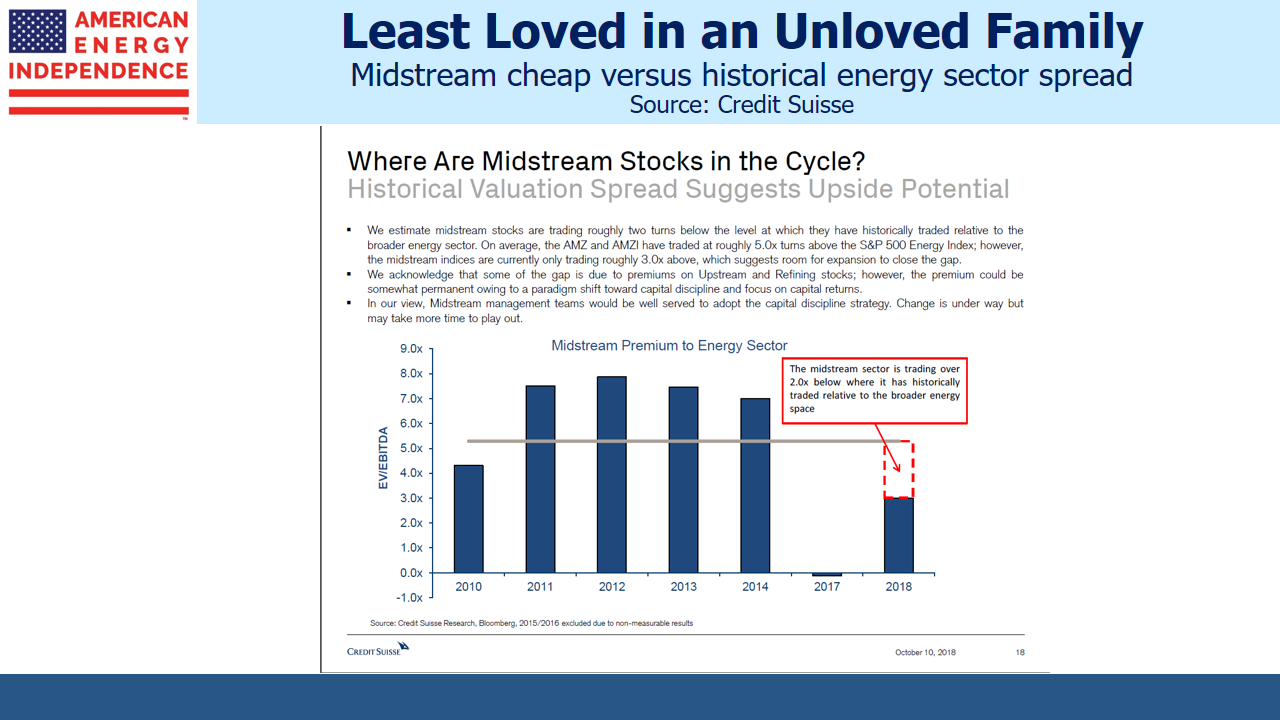

A useful perspective on valuations is to compare pipeline companies’ current EV/EBITDA premium to the energy sector versus its long term average. Even by the unloved standards of the energy sector, midstream infrastructure is historically undervalued.

The American Energy Independence Index (AEITR) includes North America’s biggest pipeline companies, and is 20% weighted to MLPs. Dividends paid by corporations have been more reliable than MLPs; 2018 dividends on the index are up 7%, following a 3% increase last year. By contrast, dividends on the Alerian MLP and Infrastructure Index, as represented by its index fund AMLP, are down 6% following a 16% drop in 2017. Since MLP payouts are a bigger portion of their available cash flow, they had farther to fall. But the limited investor base (largely U.S. individual investors) has inhibited their flexibility in managing cash.

As a result, many large MLPs have converted to corporations, so an MLP-only view of energy infrastructure (as with the Alerian MLP Index for example), fails to fully represent the sector. Moreover, MLP investors invest for income, which has made them an unreliable source of capital when their income is being cut.

In 2019 we expect AEITR dividends to grow high single digits. MLP distributions should also begin growing for the first time since 2014, although not by as much. Corporations generally offer faster, more reliable growth.

We wish all of our readers a Happy Christmas and holiday season. Enjoy the time with family, and we’ll all look forward to a rebound in 2019.

We are invested in ET and WMB. We are short AMLP.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).