Old Style MLP Funds Get Left Behind

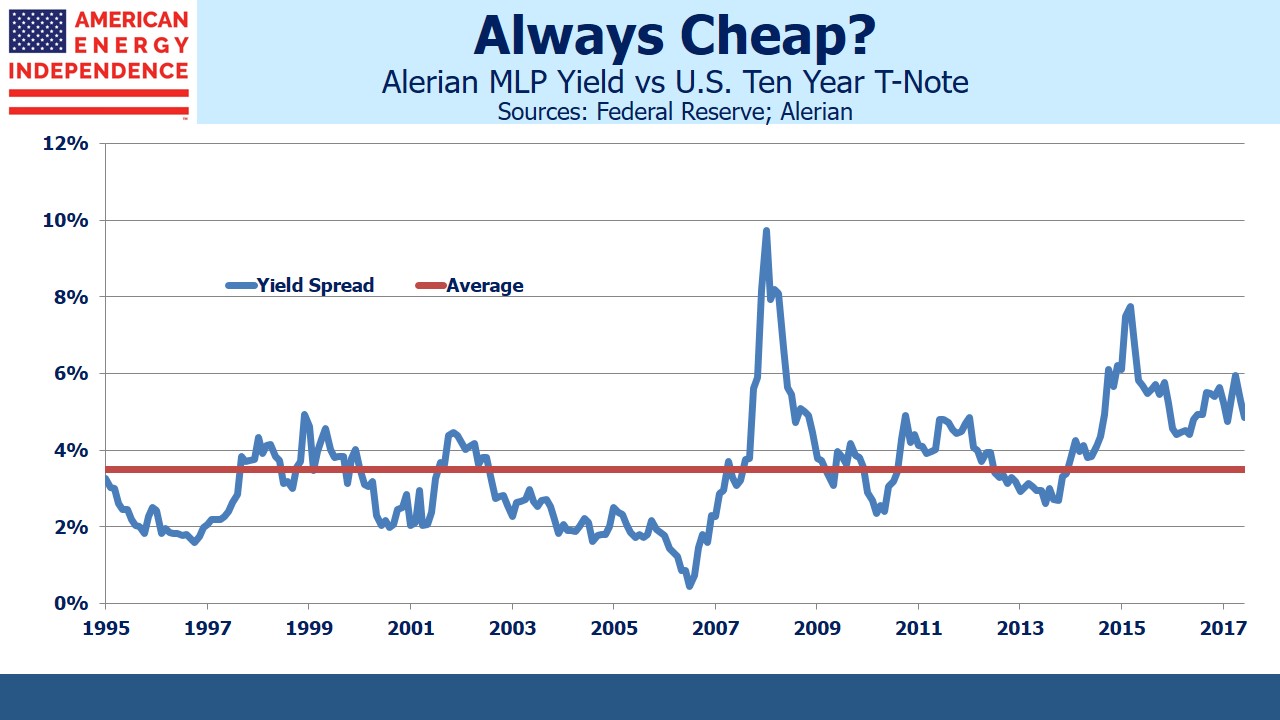

Although MLPs are cheap by historical standards, the persistence of their attractive valuation should prompt observers to think a little harder. The almost 5% yield spread between the Alerian MLP Index and ten year treasuries is 1.5% wider than the 20-year average of 3.5%. However, the MLP yield spread to treasuries has been historically wide since 2013.

What an investor regards as a cheap security is, for the issuer, an expensive source of capital. Market gyrations create opportunities, but a temporary mispricing can evolve into a permanent one. The buyers and issuers of such securities are in effect debating whether such a shift has occurred.

The list of companies concluding that a shift has occurred includes all those who have converted from the traditional MLP structure with a General Partner (GP) earning Incentive Distribution Rights (IDRs). In 2014 Kinder Morgan (KMI) became the first large MLP to decide that something fundamental had changed in the MLP investor, and converted to a corporation. As regular readers know, we believe the Shale Revolution upset the prior business model. Before hydraulic fracturing and horizontal drilling unlocked America’s enormous reserves of hydrocarbons, energy infrastructure companies had a limited need to reinvest profits. Our existing network of pipelines, processing facilities and storage was adequate to the task. Hence, MLPs distributed most of their cashflow in a tax-advantaged form, which attracted income-seeking investors.

In recent years, unconventional oil and gas extraction from previously untapped areas has required new infrastructure. Financing this disrupted the high payout model, leading to distribution cuts which alienated long-time investors (see Will MLP Distribution Cuts Pay Off?).

KMI was followed by many other large MLPs (see What Kinder Morgan Tells Us About MLPs), eventually including Targa Resources (TRGP), Oneok (OKE), Tallgrass (TEGP), Williams Companies (WMB) and Enbridge (ENB). Although there were some differences in structure, all these companies ultimately sought access to the wide pool of global equity investors. They’ve moved beyond the older, wealthy Americans who had long held MLPs for income and didn’t mind the K-1s. This narrow pool of buyers was not suited to finance growth businesses.

The MLPs that converted to corporations, including those listed above, have explicitly acknowledged this inadequacy of the traditional MLP investor. Many of those companies who remain MLPs are nonetheless mindful that the structure may not always suit them. Crestwood (CEQP) CEO Bob Phillips has said, of conversion to a corporation, that, “we won’t be the first, but we won’t be the last either.” Every MLP CFO is regularly asked about their structure.

On the other side of the Corp vs MLP debate are the managers of MLP-dedicated funds, including the Alerian MLP Fund (AMLP), and numerous other tax-burdened vehicles (see MLP Funds Made for Uncle Sam).

While the biggest MLPs are converting to corporations, it isn’t easy for these specialized funds to follow them. A taxable MLP fund that invested in a taxable corporation, delivering taxable returns to investors, would look absurd. But converting an MLP-dedicated fund to a RIC-compliant structure would require dumping 75% of their portfolio in order to comply with the 25% limit on MLPs. This would be hugely disruptive. With over $50BN in various poorly structured vehicles, they must all be hoping that none of their peers decide to become RIC-compliant, because it would depress MLP prices and lead fund investors to fear that others would follow (see The Uncertain Future of MLP-Dedicated Funds).

Faced with unpalatable choices, the managers of such funds naturally enough like their MLP-only approach.

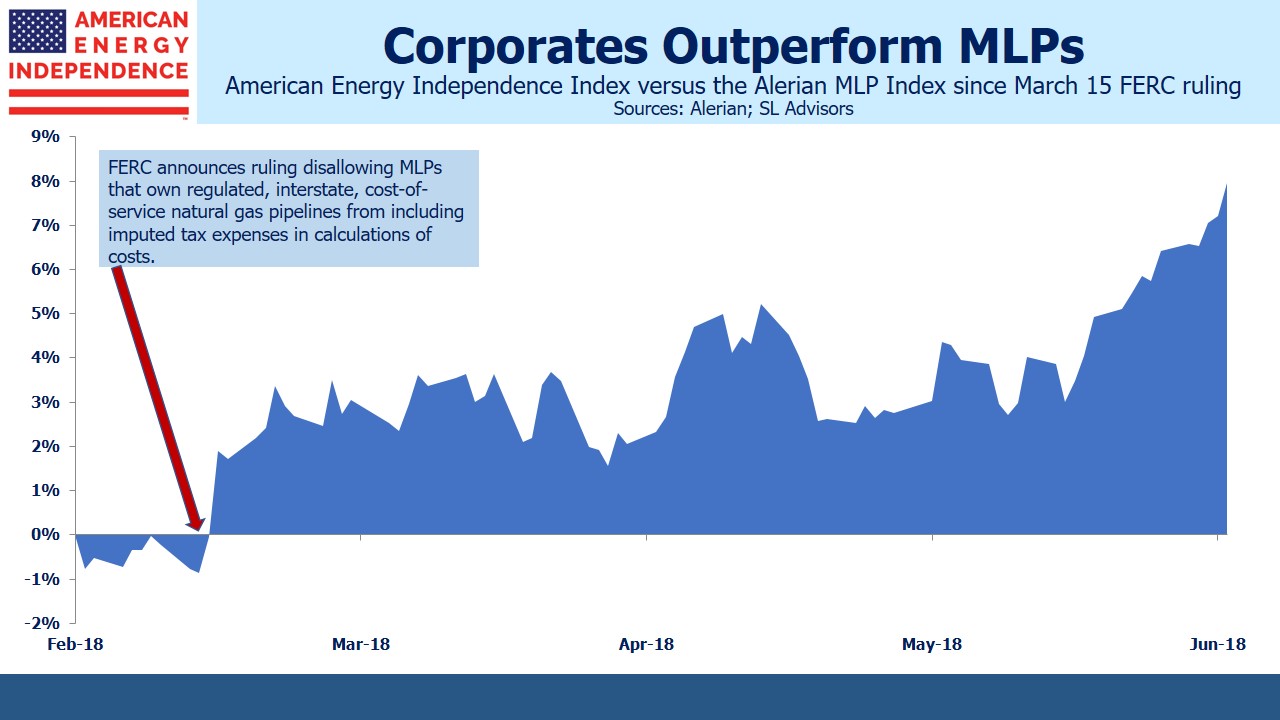

As the chart shows, since the FERC ruling in March which caused many to reconsider the MLP structure (see FERC Ruling Pushes Pipelines Out of MLPs), diversified energy infrastructure has handily beaten MLPs. The American Energy Independence Index (AEITR) consists mostly of U.S. and Canadian corporations as well as having 20% allocated to the largest MLPs. Driven by its heavy exposure to corporations, the AEITR has delivered an 8% higher return than the Alerian MLP Index. Moreover, investors in AMLP and other MLP-dedicated funds have to contend with the corporate tax drag which further impedes their return. The broader investor base available to corporations means better liquidity, which in turn attracts additional capital. Clearly, the companies that converted from MLPs can feel their choice was vindicated. Even Alerian CEO Kenny Feng concedes that the midstream sector, “…is in a bit of an identity crisis.”

The lesson here is that when a sector stays cheap for an extended period of time, perhaps something has fundamentally changed. Along with many of the largest energy infrastructure corporations, we think it has.

We are invested in CEQP, ENB, KMI, OKE, TEGP, TRGP, WMB.

We are short AMLP.