Energy Infrastructure Stability Should Encourage More Buying

Volatility is not the investor’s friend. Some will immediately take issue with this – volatility caused by falling prices can mean opportunity, and volatile rising prices are surely welcome. While true, investments that gyrate cause investor stress which often leads to poorly timed sell decisions. Although a company’s long-term profitability should be more important, the downside of liquid equity markets is that they offer a constant evaluation of your decisions.

For many years before the Shale Revolution took hold, MLPs were known for stable, attractive yields. Companies paying out 90% of their Distributable Cashflow found income-seeking investors. This idyllic relationship suffered a nasty break-up once growth opportunities led to reduced distributions. Although justified, in order to lower leverage and fund new projects (see Will MLP Distribution Cuts Pay Off?), many investors felt betrayed.

As investors recall only too well, the result was a collapse in MLP prices bigger than occurred during the 2008 Financial Crisis. Midstream infrastructure businesses responded by strengthening balance sheets and, in many cases, converting to corporations. Older, wealthy Americans attracted to stable, tax-deferred MLP distributions are a poor match for growth businesses. The narrowness of the investor base, combined with uncertainty over how FERC will implement its revised policies on cost of service pipeline contracts (see FERC Ruling Pushes Pipelines Out of MLPs), have convinced most of the biggest energy infrastructure companies to organize as corporations. This makes their stock available to a far wider set of buyers.

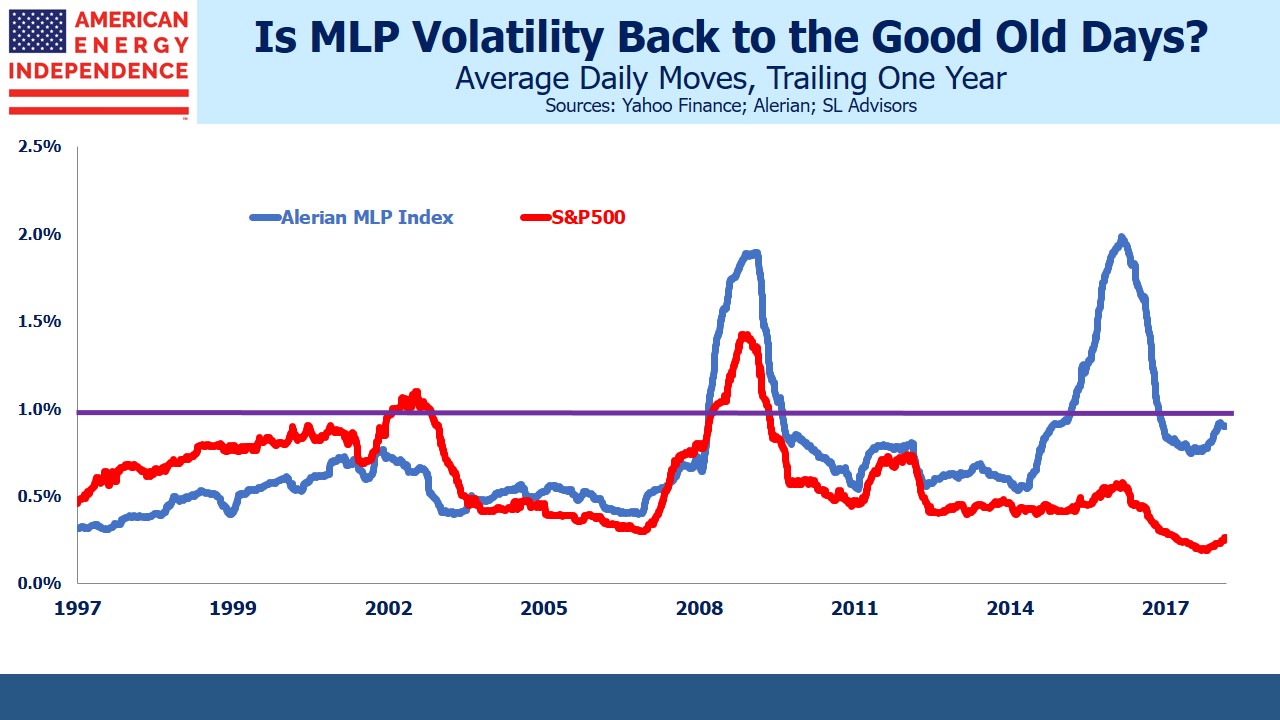

For years, MLP prices were roughly as volatile as the S&P500. This relationship broke down in 2014 when the Energy sector endured its own bear market, leading to substantial performance divergence between the two.

But there are signs that the lower volatility of the past is returning. Companies are continuing to reduce leverage. 4X Debt/EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is now preferred to 5X. Financing of growth projects is far less reliant on issuing public equity. Distribution coverage is going up, even at the near term expense of distribution growth. Enterprise Products Partners (EPD) last year told investors to expect slower distribution hikes so they could redirect cash towards attractive projects. It’s worth noting that the high volatility of 2016 (defined as average daily moves of >1% over the prior year) is historically rare, occurring only 8% of the time since 1996.

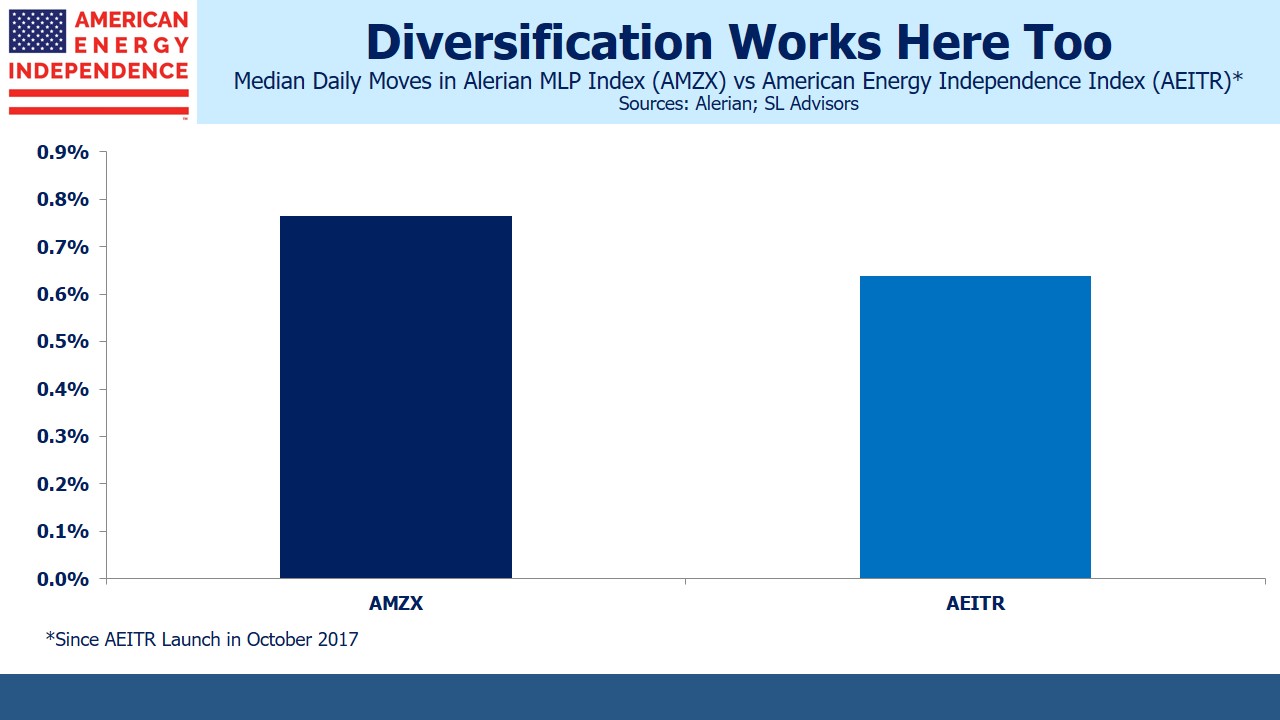

Perhaps most importantly, the shift to a corporate structure is dramatically broadening the investor base, and this added stability is further reducing the sector’s volatility. The American Energy Independence Index provides broad exposure to North American energy infrastructure, with 80% corporations and only 20% in the biggest MLPs . It has 16% less volatility than the Alerian MLP Index, a meaningful improvement.

Given the well-established trend of larger MLPs to convert to corporations, this metric is likely to continue pointing away from an MLP-focused approach to the sector. As volatility returns to the lower levels that have predominated over the past 20-odd years, it’s likely that returns will also improve.