Elections Usually Boost Earnings

It’s a year until the next presidential election. The S&P500 is making new highs, reflecting the persistence of fund flows into equities. Quarterly earnings have been coming in ahead of expectations, but still down 1% year-on-year. Down less than expected counts as up for traders.

It’s also worth noting that expectations are for a 10% increase in S&P500 earnings next year, according to bottom-up estimates compiled by Factset. A year ago, we noted that equity returns are often strongest in the year following midterms – i.e., preceding presidential election years (see What the Midterms Mean for Stocks). 2019 looks as if it will confirm that pattern. The S&P500 is up 25% YTD.

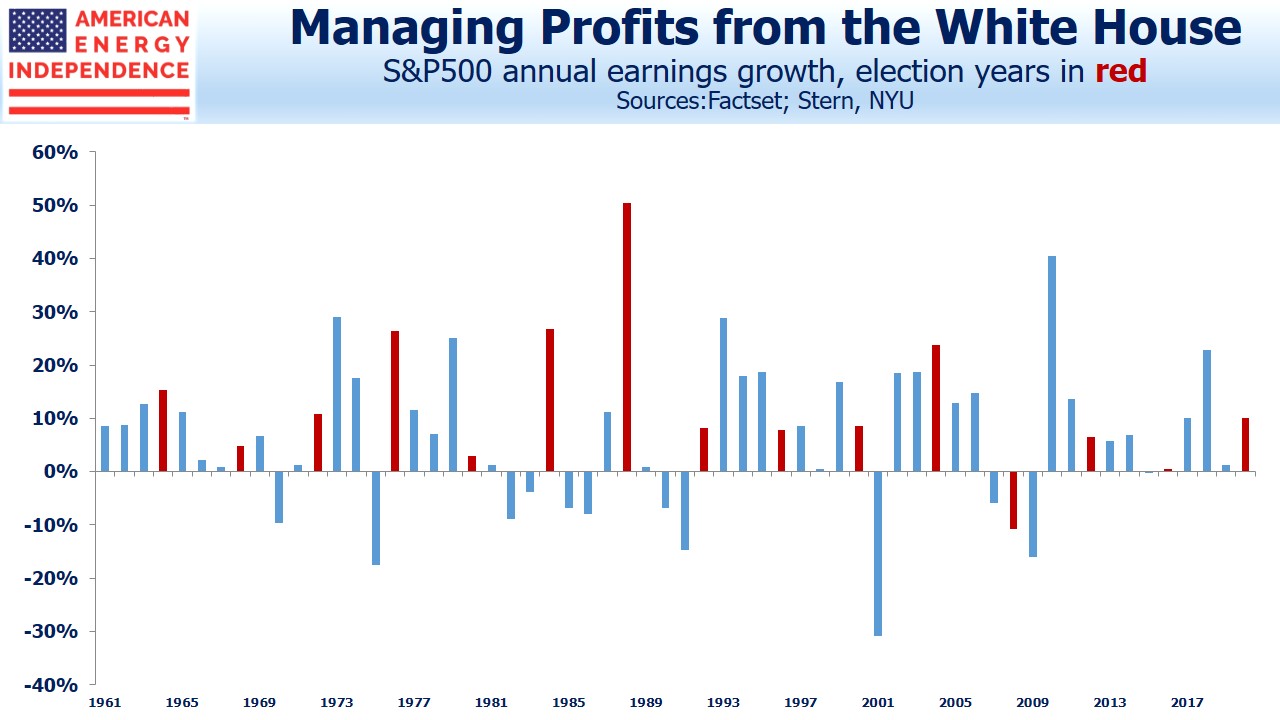

This is probably due in part to the fact that S&P500 earnings growth tends to be stronger than average in election years, and markets being forward-looking tend to anticipate that.

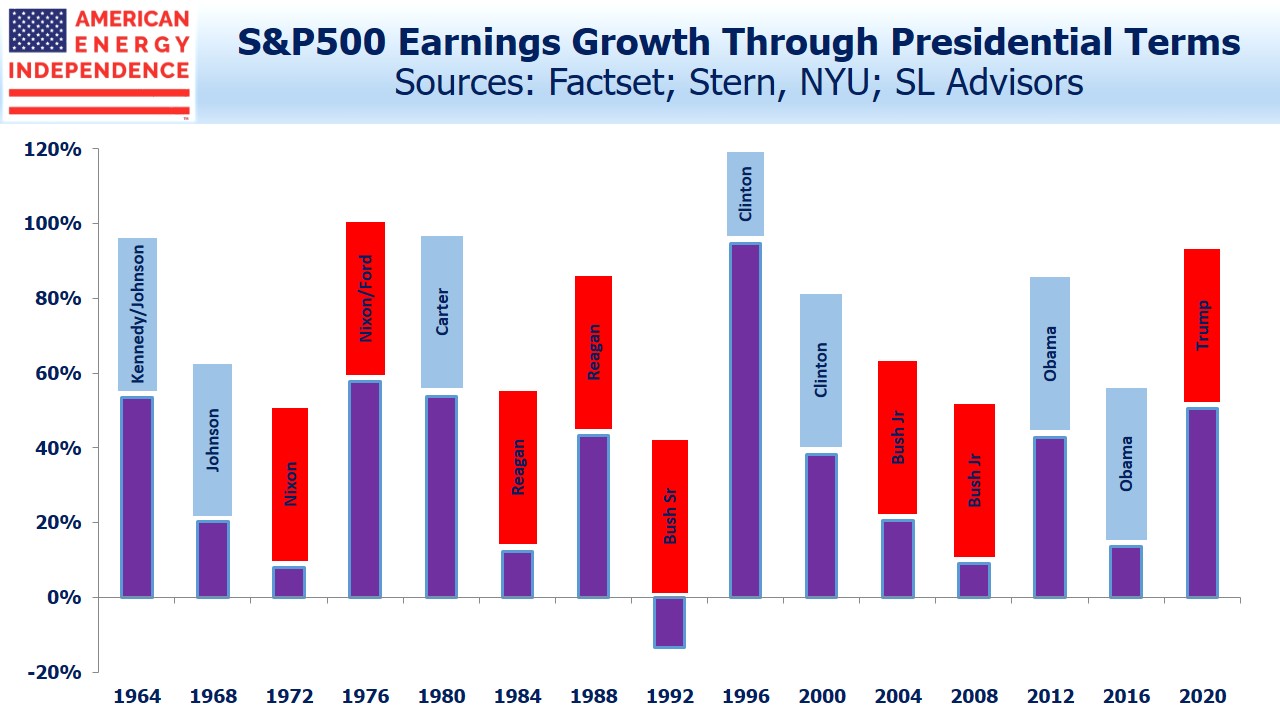

Next year’s anticipated 10% S&P500 earnings growth is above the 8% annual average since 1960, but below the 13% average for election years. The 2017 tax reform, which slashed corporate taxes, boosted 2018 corporate profits, making for tough comparisons this year. But overall S&P earnings are set to be up 50% during this four-year presidential cycle, fifth best out of 15 since 1960. Equity investors have done well.

We won’t offer an election forecast derived from stocks, nor a market return based on next year’s election; there are plenty of better qualified prognosticators. Suffice it to say that the synchronization of corporate profits with the election cycle has continued into 2020. There’s no clear pattern showing one party’s control of the white House is better for S&P500 earnings over another.

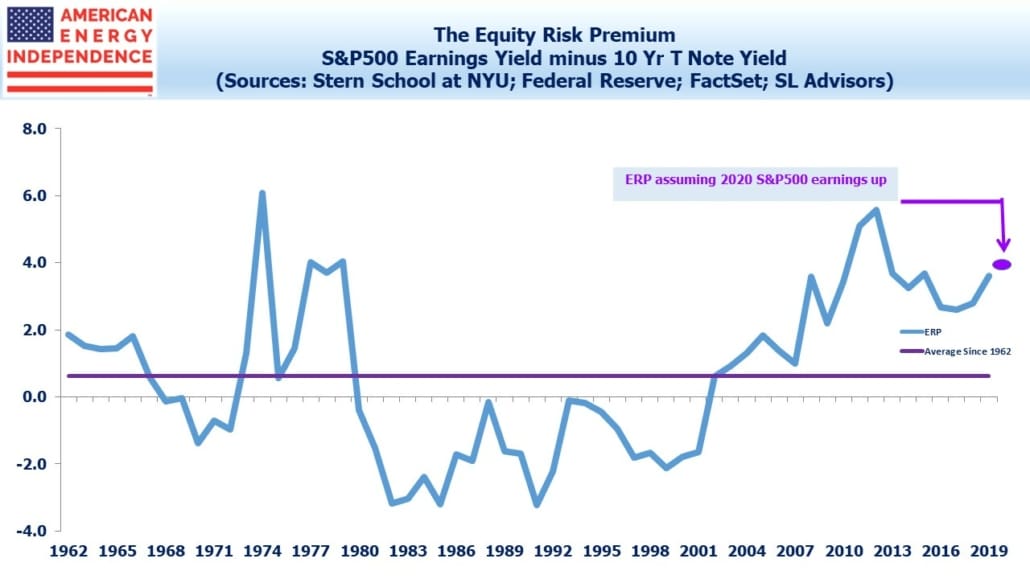

The Equity Risk Premium (S&P500 earnings yield minus the yield on ten year treasury notes) has favored stocks for several years. Low interest rates leave equities one of the few asset classes with a chance to deliver returns ahead of inflation. It remains substantially wider than the 60 year average, and 10% earnings growth next year would accentuate the appeal of stocks. The Federal Reserve has gradually accepted the reduced real rate that bond investors have long felt was appropriate (see Real Returns On Bonds Are Gone). Perhaps the biggest unanswered question for investors today is why long term rates around the world are so low, with U.S. the highest among G7 nations. Part of the explanation is inflexible investment mandates (see Pension Funds Keep Interest Rates Low). It’s the most important factor showing stocks are cheap. There are few good alternatives.