Common Questions About The Pipeline Sector

We received a few comments from readers in response to last Sunday’s Heat Pumps Need Natural Gas. While EVs are widely criticized for the issues with charging, where heat pumps are installed, they seem to operate with little controversy. Defenders were quick to point out the benefits.

One client in California uses solar power + a battery backup to run his heat pump and has eliminated his electricity bill. He’s also not exposed to power outages from California’s creaky grid prone to wildfires. He did concede that air reaching rooms at the far end of the house from the compressor don’t get as warm, but didn’t feel that was a big problem.

Another reader knows people in upstate NY and in Maine who use heat pumps with no problems. He noted that the state capitol building in Boise, ID relies on heat from water pumped 3,000 feet below ground – technically not a heat pump although elsewhere some do operate with geothermal energy.

Nobody contacted us to say they hated their heat pump. They have their place and will likely grow over time. Perhaps one day I’ll even own one.

In conversations with clients last week, the Middle East figured prominently. Higher crude oil has provided a boost to midstream prices, although as we noted recently (see Oil And Pipelines Look Less Like Fred And Ginger) the relationship is weak.

In years past some suggested that we might include a short oil position into our portfolios as a hedge. The problem with that is the hedge ratio is unstable. The oil hedge required for $1 million of pipeline stocks depends on the period of past performance you’re examining. The slope of the regression line over two years versus five years can vary widely. It becomes an oil bet.

One firm launched such fund a few years ago and it soon failed when oil rose while pipeline stocks fell.

Pipeline executives are not altering guidance based on oil prices. But energy sector sentiment does improve with higher crude, and pipeline stocks are not immune. Goldman Sachs estimates that options pricing reflects a 5% probability of a $20 per barrel jump in prices, corresponding to a loss of 2 Million Barrels per Day (MMB/D) over six months. This is approximately equal to Iran’s exports although in recent weeks they’ve been lower.

As Israel contemplates how to respond to Iran’s largely ineffective missile attack, targeting oil infrastructure is an appealing option. The White House has counselled against this, probably fearing an oil price spike so close to the election. This could tip the balance next month to Trump, who’s more clearly pro-Israel.

Iran’s oil infrastructure is vulnerable.

We regularly get questions on how the election will affect pipelines. Energy executives will cheer a Trump victory but are unlikely to “drill baby, drill” since such exuberance didn’t work out so well eight years ago. Financial discipline will likely continue, but a more pro-energy regulatory touch could help US production at the margin. This could be offset by a tougher stance towards Iran, curtailing their exports.

Most US oil and gas production is on private land, and US presidents have little influence. Kamala Harris’ position flip on fracking may excite some voters in Pennsylvania, but her views aren’t relevant because states decide such things, not the White House.

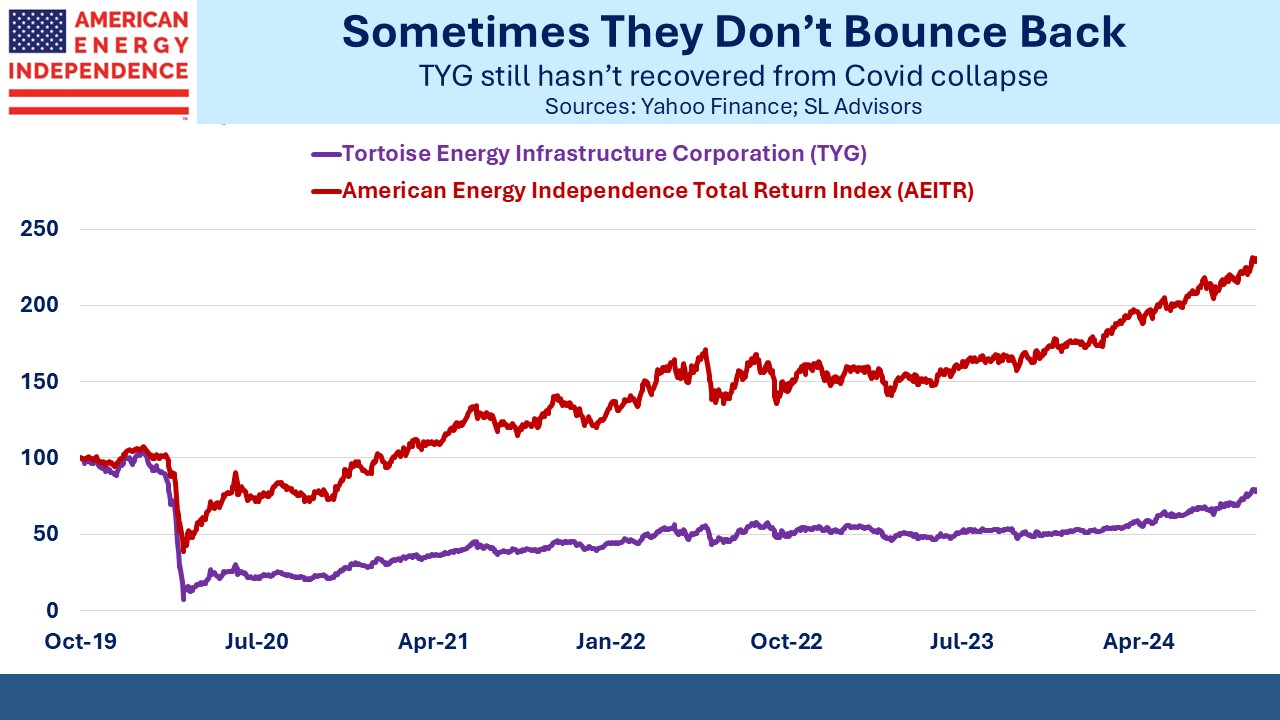

We sometimes get questions about the sharp but brief drop in prices in March 2020 as the pandemic was taking hold. Potential buyers wonder if it could happen again. An important cause was the forced deleveraging of MLP Closed End Funds (CEFs).

Equity funds that invest in a single sector with added leverage are a dumb idea.

For MLPs, 4.0X was the prevailing Debt:EBITDA range among investment grade names. The CEF PM who thinks a portfolio of such similar names needs added leverage at the fund level is ignoring the figure that pipeline CFOs and the rating agencies have collectively agreed upon. In a triumph of hubris over humility, this PM thinks he knows better – and it is always a he.

March 2020 showed what happens when an undiversified portfolio with excessive leverage falls sharply. Forced sales result in a permanent loss of capital (see MLP Closed End Funds – Masters Of Value Destruction). Goldman Sachs, Kayne Anderson and Tortoise are among the firms whose risk management failed. The Tortoise closed end fund still hasn’t recovered its losses.

The good news is that it’s unlikely to happen again, because MLP CEFs destroyed enough of their investor capital that they’re permanently smaller. Their incompetence led to their irrelevance.

We have two have funds that seek to profit from this environment: