Europe’s Liberal Energy Policies Costs More

I was in the UK recently where reducing emissions to zero by 2050 is now law. In spite of the conservative populism that drove Brexit, Britain is a politically liberal place from the eyes of this visitor who last lived there 41 years ago. Illegal immigration is a worldwide problem, and the British face African and Asian refugees crossing the English Channel from France in flimsy boats. The government estimates 45,700 such arrivals last year in the Explanatory Notes to proposed legislation (the Illegal Migration Bill).

The new law would compel deportation back home or to Rwanda which is deemed a “safe third country.” Left-wing critics contend that the country should be more welcoming. Former English footballer Gary Lineker, who now analyzes games on the BBC’s Match of the Day, was briefly taken off the air for equating government policy with Nazi Germany. The middle ground in the UK debate over illegal immigrants and refugees is left of the US. New York City is considering repurposing the Javitz Convention Center to house asylum-seekers, many of whom have been bused north from Arizona and Texas.

Wind power contributed 27% of the UK’s electricity last year. Dozens of wind turbines are visible from the windy coast of Kent in the English Channel where on a clear day you can also see France. They extend up into the North Sea and are all around the country. The UK’s 28.8 Megawatts of wind capacity generated just over 80 Gigawatt Hours of power last year, meaning they ran at about 32% of capacity. This is within the normal range for offshore wind, although a visitor to the blustery English seaside would be forgiven for assuming they generate power more or less permanently.

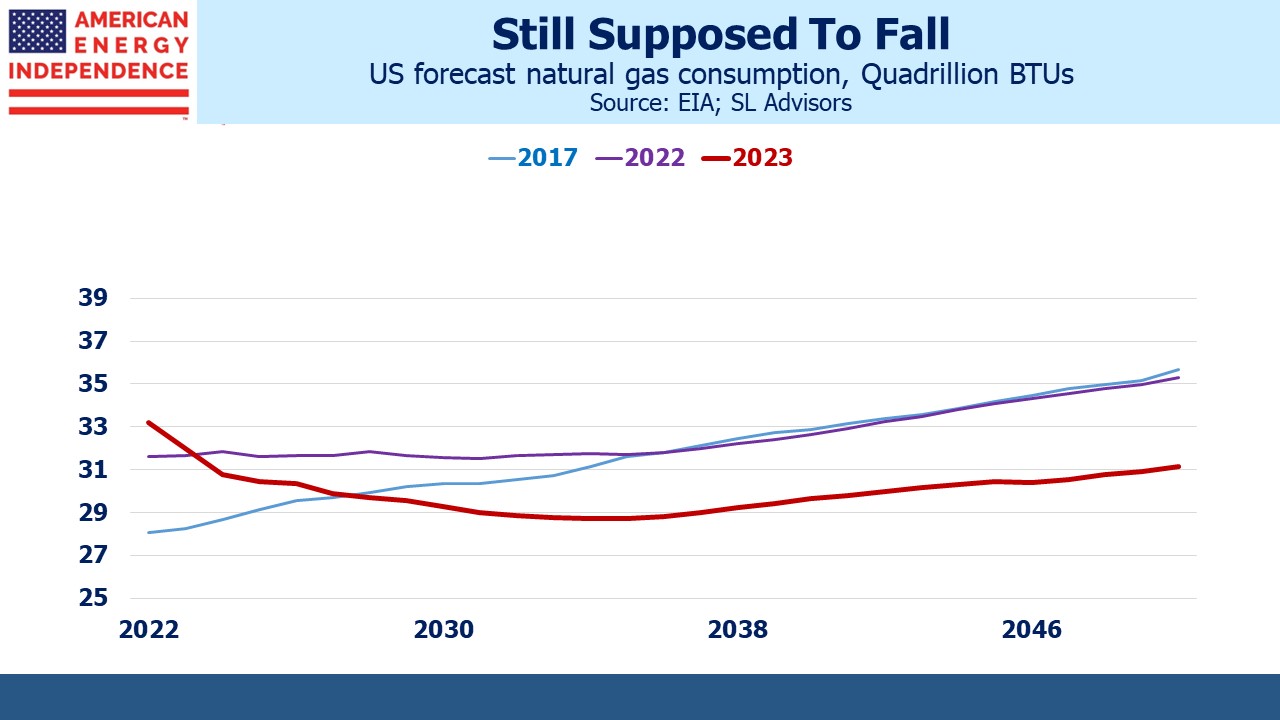

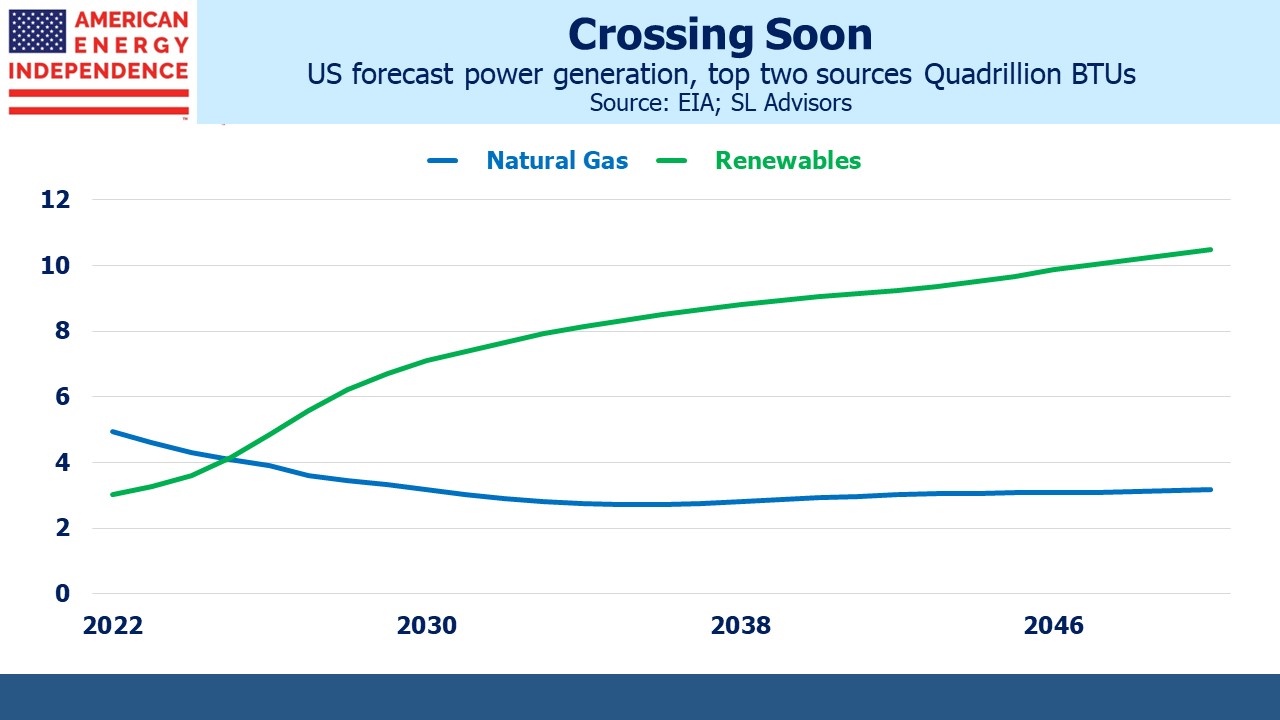

Although the high renewables share sounds good, wind only supplies 3.3% of Britain’s primary energy because there’s more to modern life than electricity. Fossil fuels provide 81%. In his recent Annual Energy Outlook, JPMorgan’s Mike Cembalest thinks of two energy transitions: (1) decarbonizing electricity generation, and (2) electrifying energy consumption. The world is doing better at (1) than (2).

Electricity is expensive in Britain, because renewables are expensive and because they have to import Liquefied Natural Gas (LNG) at prices that compete with Europe’s failed energy policies. But public opinion generally supports the energy transition.

Across the North Sea, the Netherlands relies on fossil fuels for around 80% of its total energy, about the global average. Wind is 4.9%. We recently spent a couple of days in Amsterdam, a city whose downtown is for walking. Pedestrians face greater risk from the cyclist’s silent approach than from automobiles. Bike lanes are common, although cyclists rarely pause at stop signs or crosswalks.

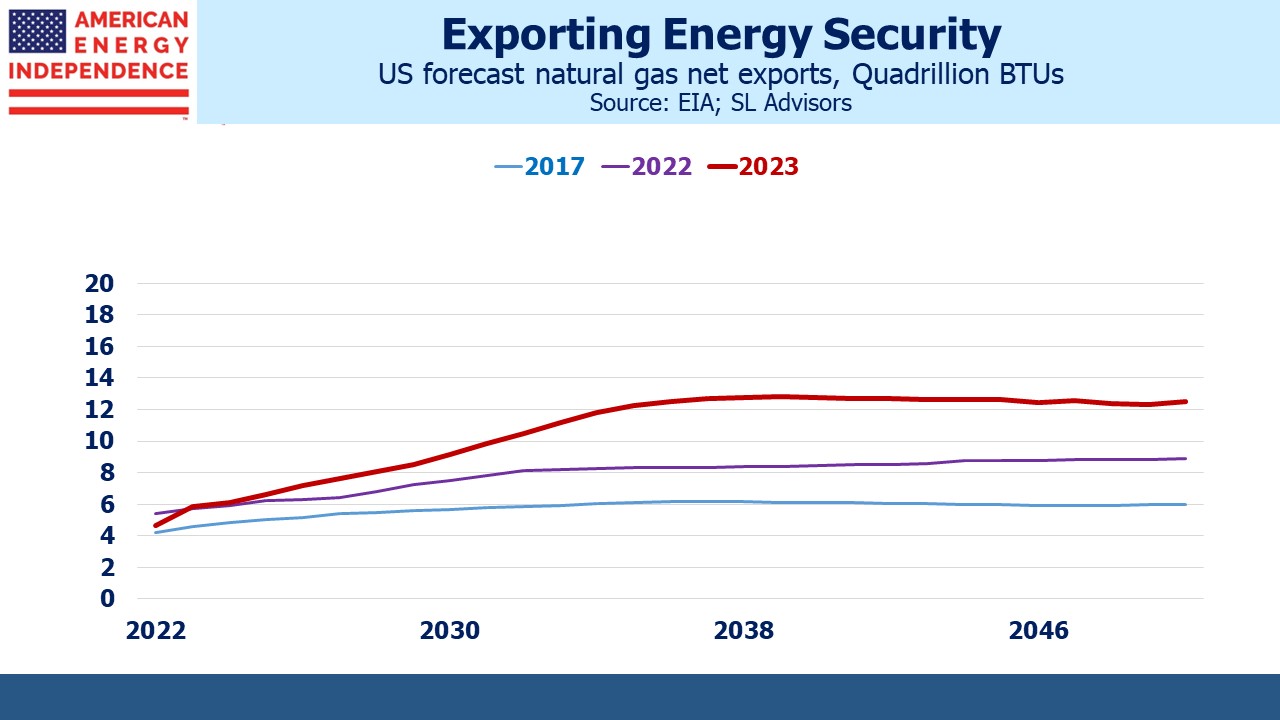

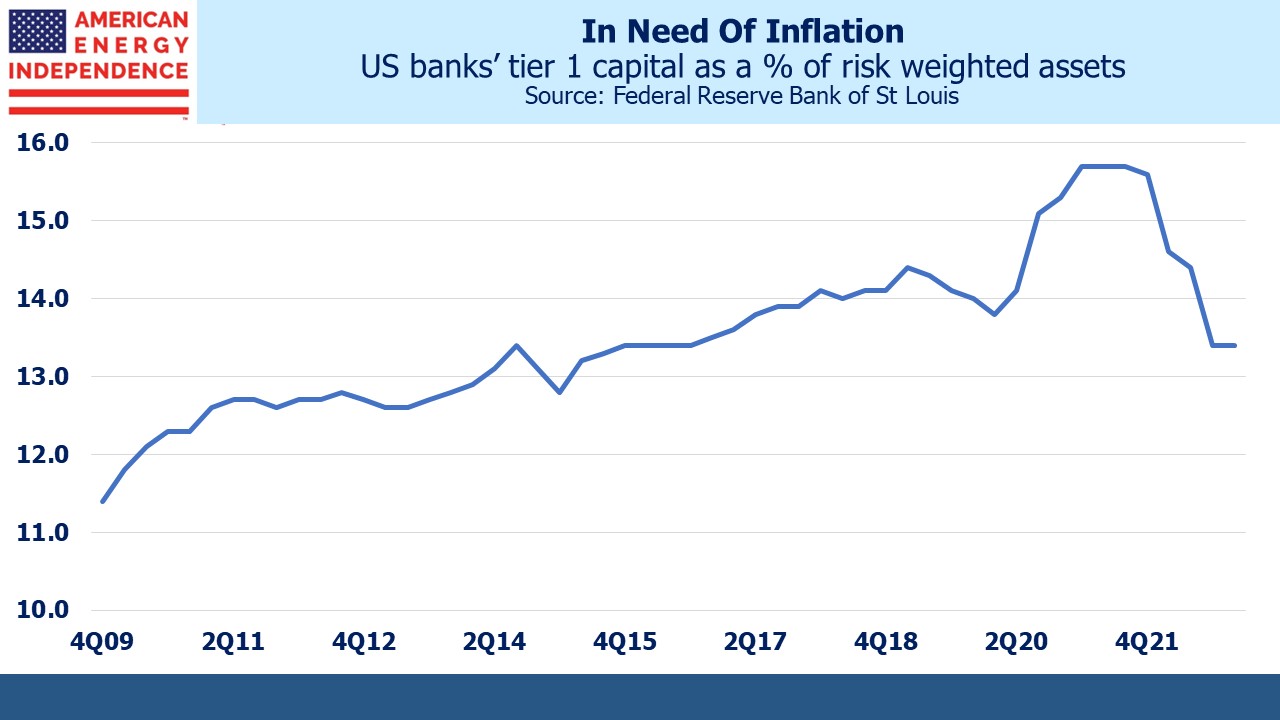

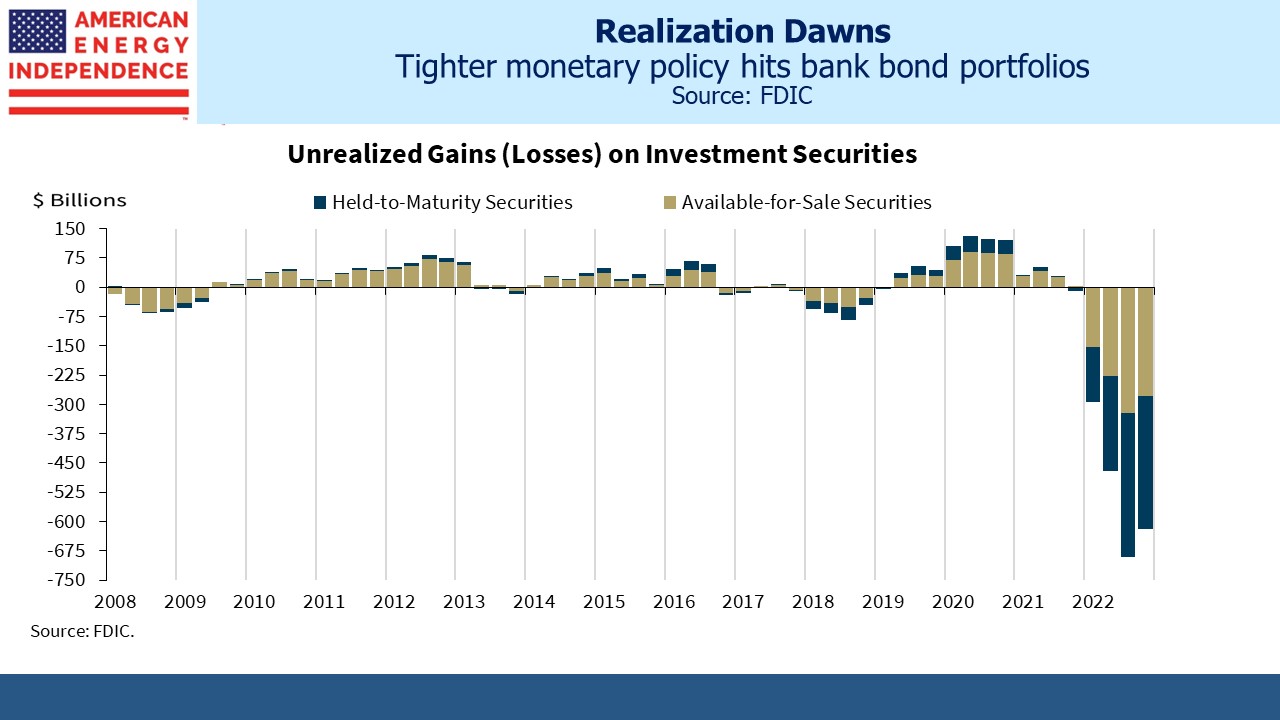

Europe’s mild winter prevented a shortage of natural gas, but next year presents a bigger problem since Russian gas will no longer boost supplies as it did in the first half of 2022. European prices have plummeted from last year’s high but remain double their pre-war level. There are signs high energy prices are causing a shift in manufacturing to other countries, including the US.

Like much of Europe, Massachusetts imports LNG which exposes them to high global prices. The Bay State has rejected pipelines that could deliver gas cheaply and safely from Pennsylvania because some climate extremists think impeding access to gas will stop its use. Others prefer the lights to stay on, so an LNG tanker recently docked in Boston from Trinidad and Tobago. In January 2022 New England households paid 22.9 cents per Kilowatt Hour (KwH) of electricity. For all of 2022 the UK averaged 18.9 pence (23.4 cents) per KwH. Higher natural gas and increasing use of renewables mean both are paying more now. UK households expect to pay 34 pence (42 cents) this year. And that’s only because of a government imposed price cap. The actual price is forecast to average 52 pence (64 cents) per KwH. New England is at 29.7 cents.

The US average is 15.5 cents. Even in liberal New Jersey we only pay 16.9 cents, although Democrat governor Phil Murphy is pursuing policies designed to push this up, such as opposing an expansion of natural gas pipeline capacity planned by Williams Companies and approved by FERC.

For cheap, reliable power natural gas is the solution. Even Texas, which produces more electricity from windpower than any other state, is planning to invest $18BN in natural gas power plants to reduce the risk of another grid failure like the one two years ago.

Florida households pay 15 cents per KWh. Florida Power and Light promotes its growing use of solar but is also reducing rates modestly because of falling natural gas prices. My family and most of my friends are in New Jersey, but you wouldn’t want to start a business there. Florida is a better run state.

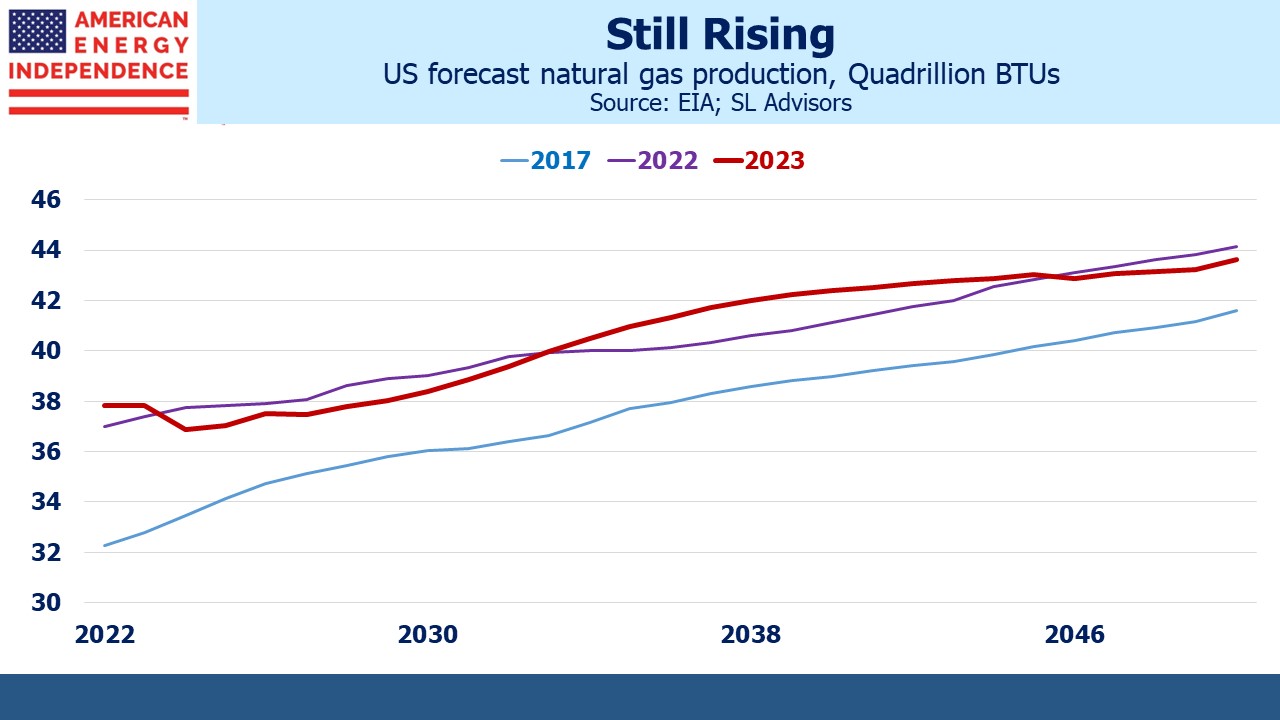

Europe’s energy policies, which impose most of the cost of the energy transition on households, explain most of this difference. The embrace of fracking, almost unique to the US as a method of oil and gas extraction, has created our abundant and cheap natural gas.

Your blogger’s recent trip to London included two English Premier League games, at Arsenal and West Ham, seeing old friends and a short visit to Amsterdam. I am now rejuvenated and back in the land of more conservative politics and (mostly) cheap energy.

We have three funds that seek to profit from this environment: