Windpower Faces A Tempest

At the end of August Orsted, a Danish developer of wind turbines, announced they’d be delaying their first planned installation off the New Jersey coast until 2026. They blamed supply chain issues, interest rates and insufficient US Federal tax credits. The Federal government had only recently approved the project.

New Jersey Democrat governor Phil Murphy and the Democrat-controlled legislature are big proponents of the garden state switching to windpower. New Jersey has regrettably moved to the left in recent years, partly because Republican voters are leaving for southern states such as Florida.

But even though New Jersey is a solidly blue state, there is plenty of opposition to windpower along the Jersey shore, which tends to be more conservative. Cape May county, opposite which the wind turbines are planned, is both especially conservative and opposed. Turbines already in place are blamed for a jump in whale deaths although this is disputed. It’s also feared that they will spoil the view. Protect Our Coast NJ is adopting some tactics from the environmental extremists’ playbook in using court challenges to impose costly delays. Treasurer Frank Coyne said, “The objective is to hold them up and make the cost so overwhelming that they’ll go home.”

The cost of installing windpower is going up. Orsted said it may take a $2.3BN writedown on its US projects. New Jersey Democrats even passed legislation redirecting Federal tax credits from residents to Orsted in order to make the economics more appealing. The delay until 2026 means the project won’t be completed before Phil Murphy leaves office, casting further doubt over its ultimate viability. Orsted has said it considered abandoning the project but for now intends to proceed, which is likely to encourage opponents to keep up the pressure. So far they’ve invested $4BN in US offshore wind projects including Montauk point at the tip of Long Island, and Rhode Island. They plan to make a final investment decision on all three by early next year.

Orsted is not alone. Spain’s Iberdrola canceled a planned wind farm off the coast of Massachusetts. Sweden’s Vattenfall backed out of a project off the coast of Britain, citing cost inflation. Siemens is expected to lose up to $5BN in its wind turbine manufacturing unit.

It’s tough to make money in renewables.

Then there’s NextEra Energy (NEE) and its MLP NextEra Energy Partners (NEP). NEE is “an industry-leading clean energy company” and is building its renewables capability as fast as it can. Four years ago we wondered if rapid depreciation in its asset base would ultimately hurt earnings (see Is NextEra Running in Place?). At the time the company was depreciating 5.5% of its Property, Plant and Equipment (PP&E), higher than other utility companies and suggesting a useful life of under twenty years.

Rapidly improving costs for renewables power generation cause older equipment to depreciate more quickly. And solar always faces the challenge that if a region is sunny enough a utility might find its customers investing in their own solar panels and batteries, disconnecting from the distribution network which means the fixed cost of transmission lines is spread across fewer users. It still doesn’t look like an appealing business to us.

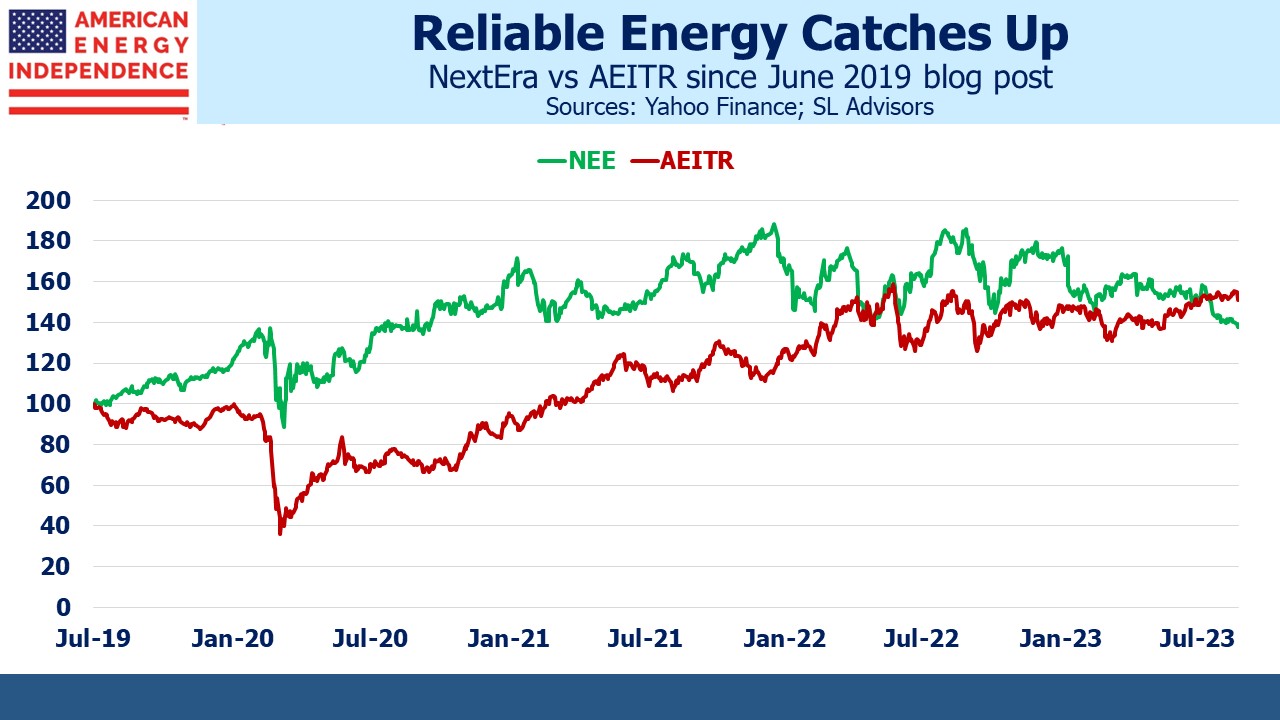

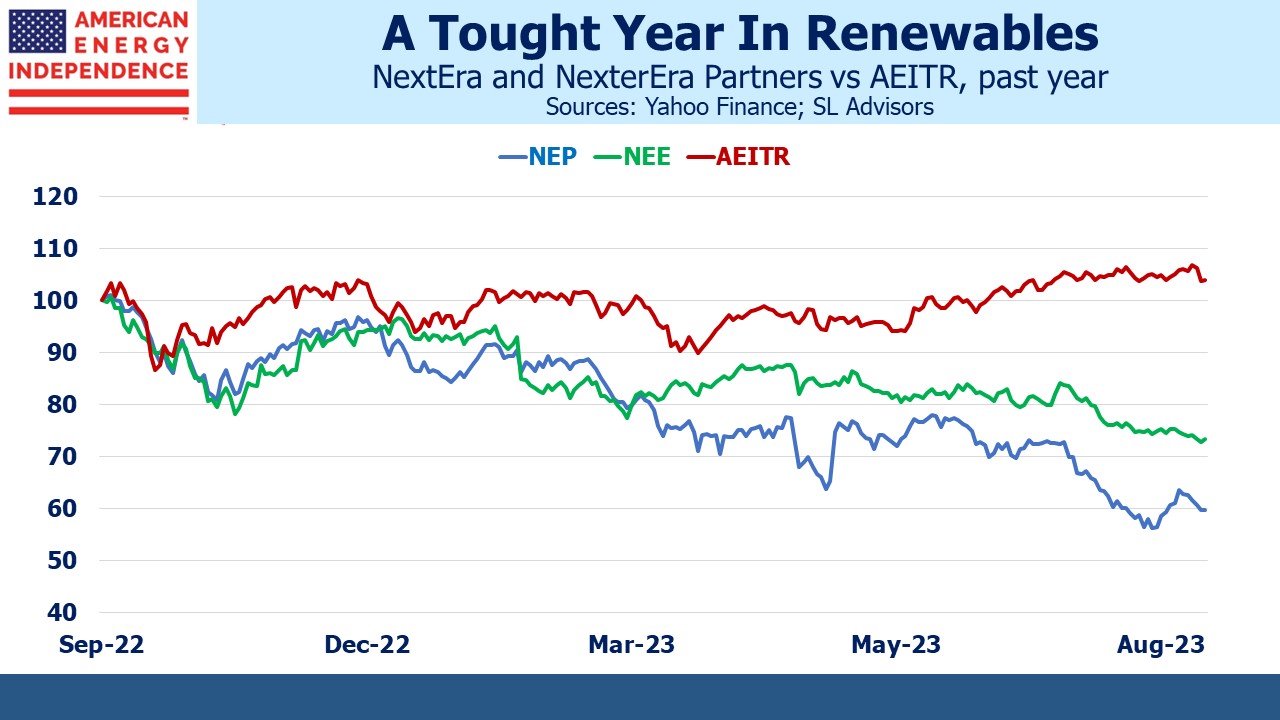

NEE pulled ahead of the American Energy Independence Index (AEITR) for the next three years following our 2019 blog post, and its depreciation as a % of PP&E fell back to its peer group. In recent weeks it’s lagged and is now behind the AEITR over that time period. Over the past year NEE and NEP have substantially underperformed the AEITR.

An investor asked me last week what I thought of NEP. It is an old-fashioned MLP, with a controlling General Partner (GP) that can drop down assets. Midstream energy infrastructure, still known colloquially as the MLP sector, used to have many similar structures. The GP, in this case NEE, has a similar position to a hedge fund manager with respect to her hedge fund, in this case NEP.

When MLPs were controlled by a GP, we always favored the GP, just as you’d rather be the hedge fund manager rather than a hedge fund client. In 2012 I published The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True which revealed how investors had in aggregate done poorly in spite of hedge funds being wildly profitable, because fees had siphoned those returns over to the manager.

We recognized the analogy with MLPs and their GPs. NEE is NEP’s GP. They retain the old model but are in new energy. So we would avoid NEP and favor NEE because we always prefer the GP.

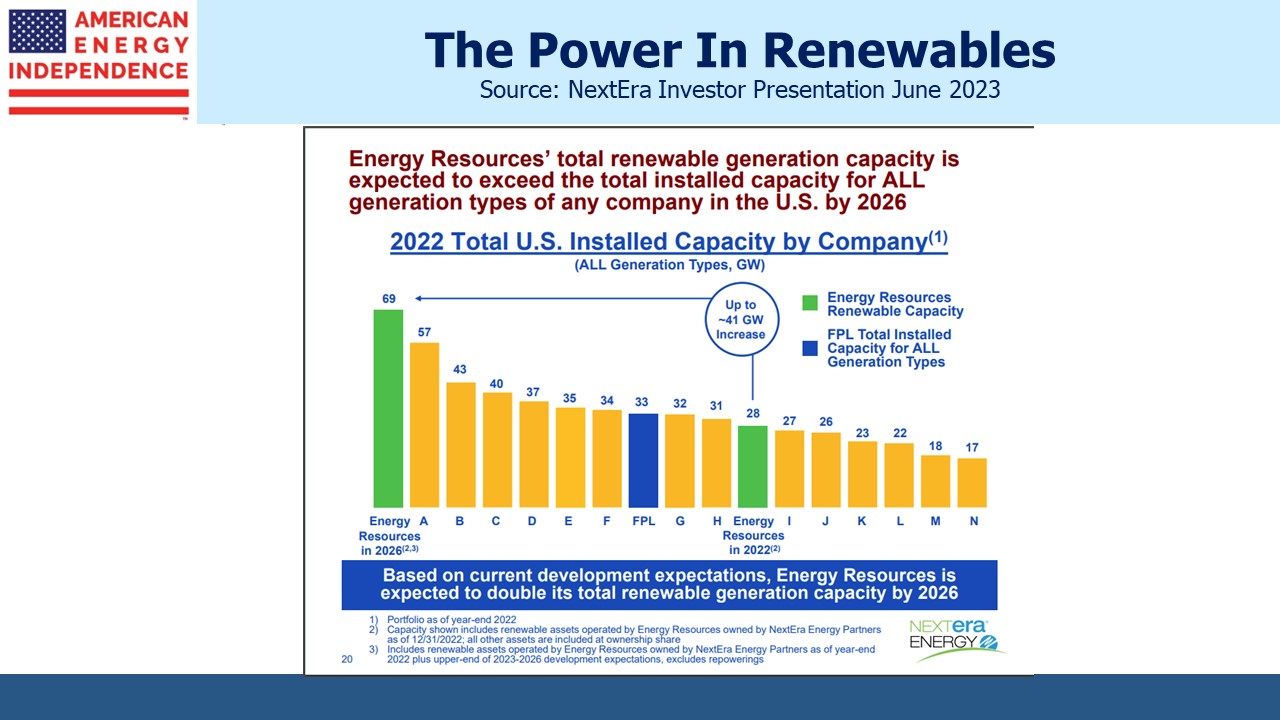

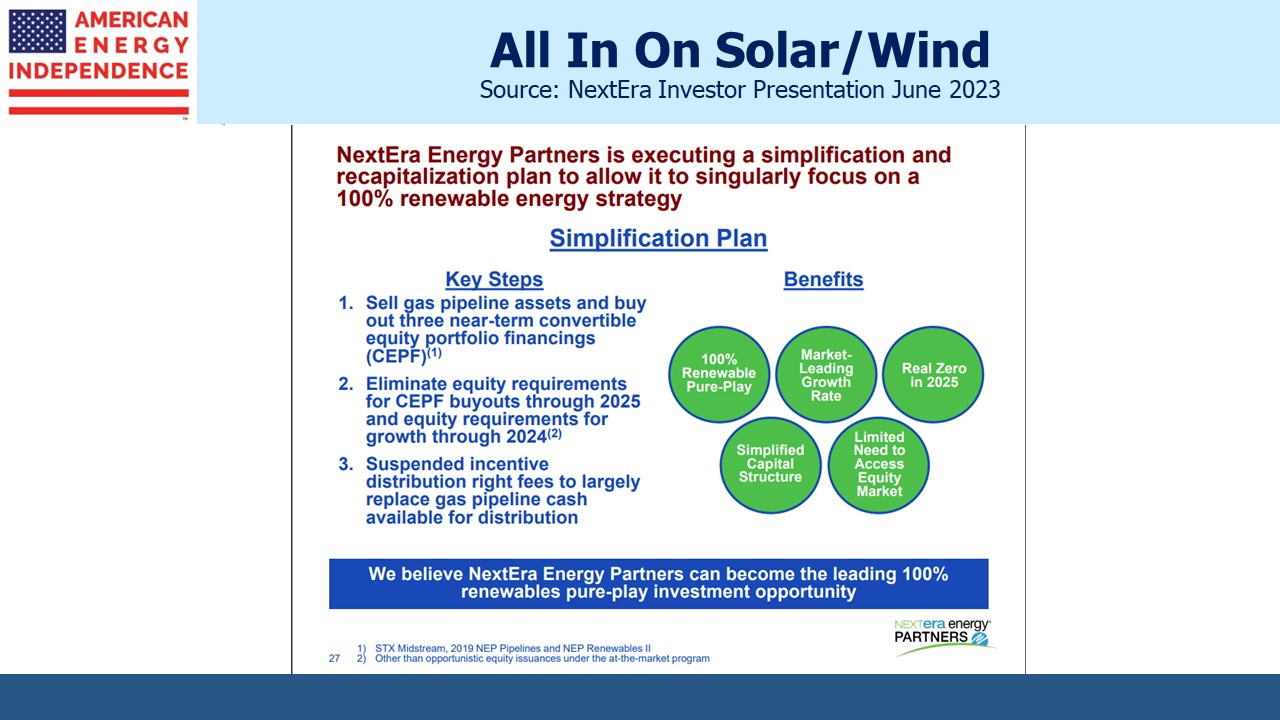

Nonetheless, it’s easy to see why both stocks look attractive especially if you want exposure to solar and wind. Within three years NEE is planning to have more renewable generation capacity than total installed capacity for any other US company. NEP is planning to sell its natural gas pipeline business and be 100% renewables.

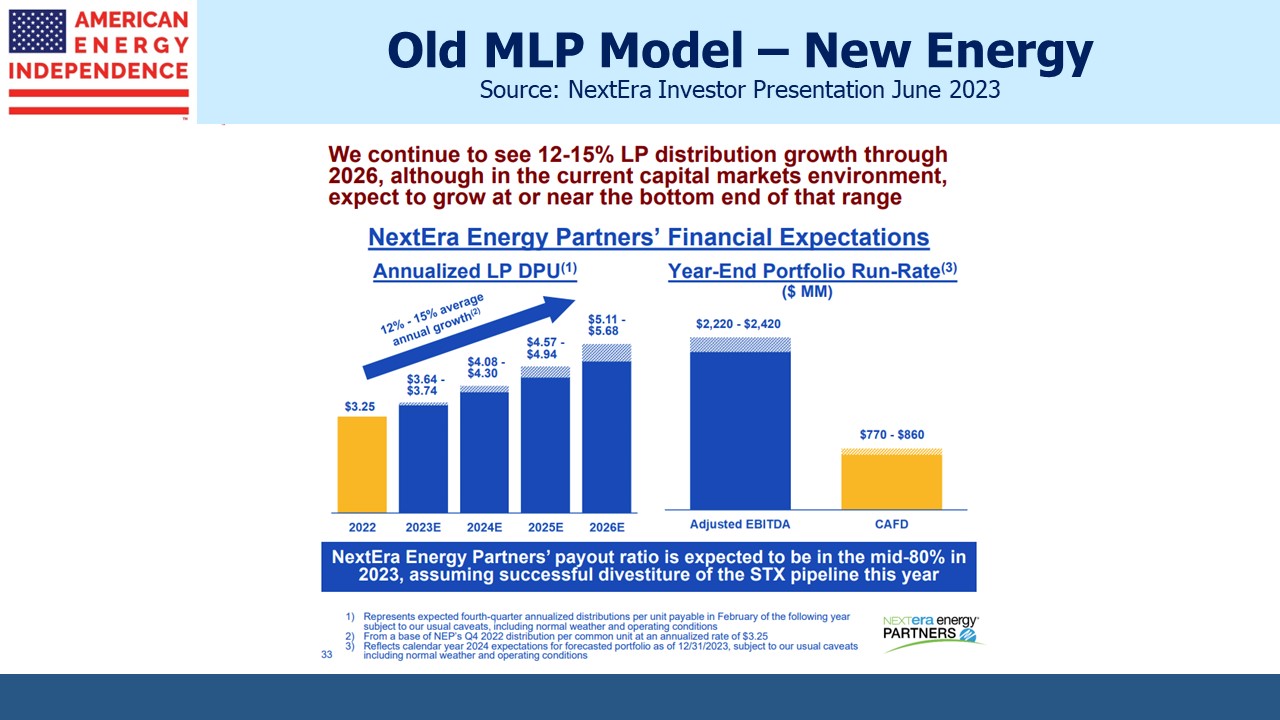

NEP yields 7.6% and is guiding for 12% annual distribution growth. Its one year total return is –40%, probably dragged down by the challenges faced by Orsted and others.

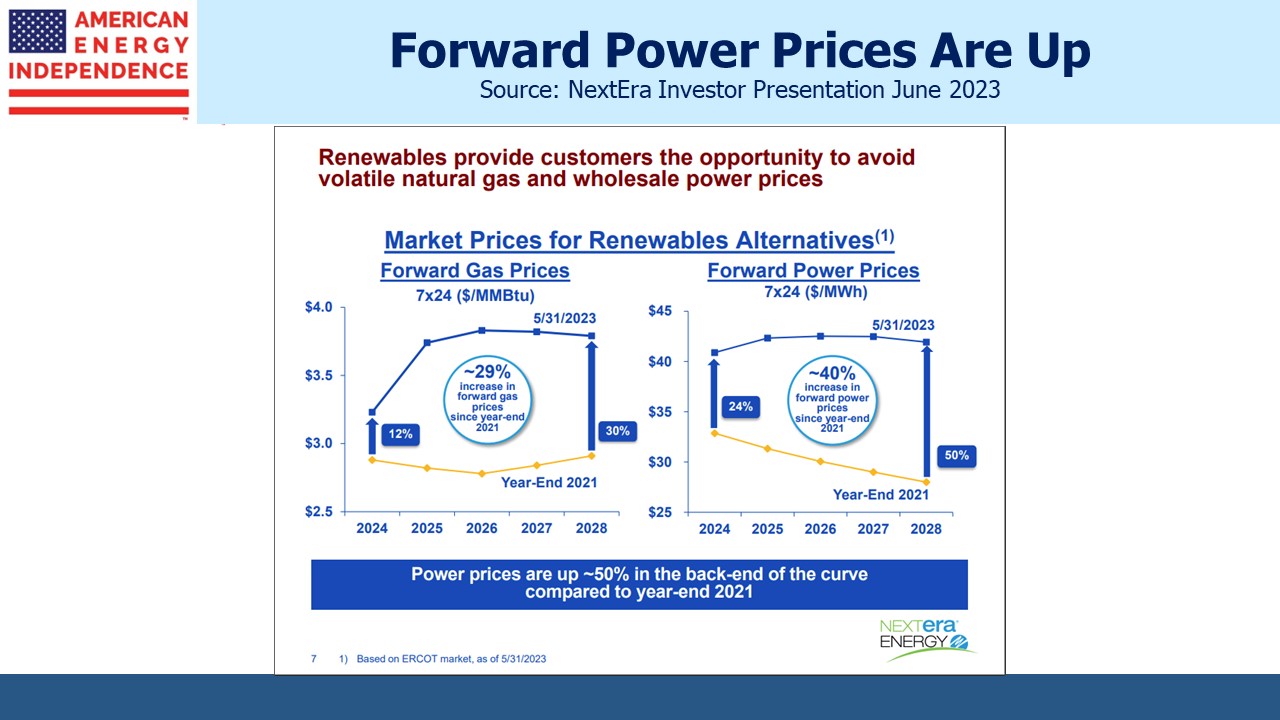

NextEra’s wildly bullish outlook on renewables runs counter to the experience of the windpower manufacturers. They are a pureplay bet on renewables profitability, contrasting with writedowns being taken elsewhere in the industry.

It’ll be fascinating to see how this plays out.

We three have funds that seek to profit from this environment: