There’s No AI in AMLP

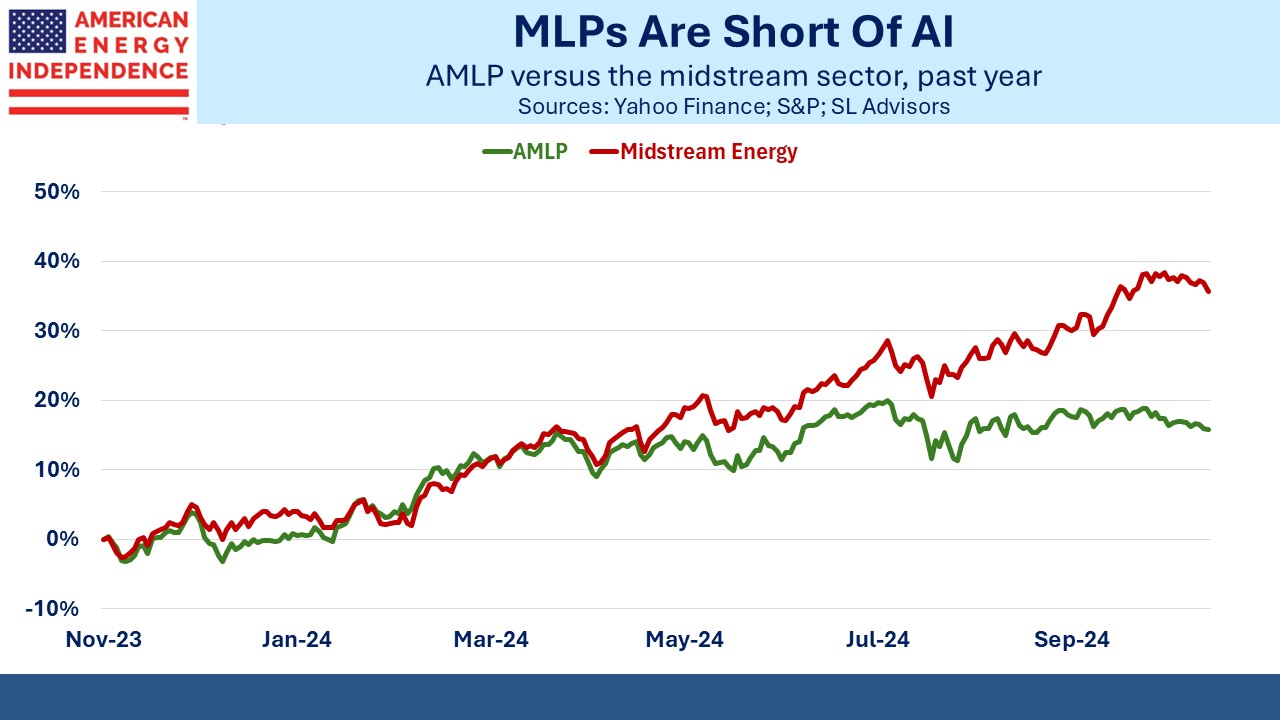

Performance in the pipeline sector remains strong – closing in on its fourth straight year beating the S&P500 and ahead overall for the past five. But for the past six months the Alerian MLP Infrastructure ETF (AMLP) has increasingly lagged the sector, as defined by the American Energy Independence Index.

AMLP is more or less tracking its index, the Alerian MLP Infrastructure Index (AMZIX), although taxes are opening up a gap here too. It’s 2.4% behind over the past year through September. Over 4% of its NAV is set aside for future taxes.

Between December 2022 and June 2023 AMLP took two NAV adjustments as their accountants revised their tax calculations (see AMLP Trips Up On Tax Complexity and AMLP Has Yet More Tax Problems).

Being a tax-paying ETF is complicated. Those two adjustments added up to over 6% of NAV.

Last year AMLP cut its distribution (see AMLP Fails Its Investors Again) even though MLPs were raising payouts.

But the problem is that the AMZIX index which AMLP tries to track represents a shrinking subset of midstream infrastructure, since it’s limited to MLPs. AMLP labors under the same burden.

The boom in data centers to support AI is driving electricity demand up. Nuclear power is enjoying a renaissance with several of the Fabulous Five announcing plans to rely on dedicated nuclear plants to provide electricity to their new data centers.

These are positive steps for everyone outside of the Sierra Club with its dystopian vision for humanity. But these new sources of nuclear power won’t be available until well into the next decade.

In many regions of the US grids are revising their ten-year demand outlook from 0-1% pa to 5% pa or more. Natural gas is the only plausible solution, since data centers need to run 24/7 not simply when it’s sunny or windy.

This realization has boosted midstream infrastructure. Williams Companies (WMB) CEO Alan Armstrong recently told investors, “… we frankly are kind of overwhelmed with the number of requests.”

WMB is up over 50% YTD as they recalibrate demand across their extensive natural gas pipeline network.

MLPs generally haven’t enjoyed the same uplift, because they tend to be more focused on liquids than gas. In recent years many MLPs converted to c-corps, the conventional corporate form for US businesses, so as to eliminate K1s in favor of 1099s. They concluded that making their stock available to all buyers of US equities and not just those willing and able to invest in partnerships was worth foregoing the tax efficiency of the MLP structure.

Natural gas MLPs have had an additional incentive to convert to corporations since 2018 when the Federal Energy Regulatory Commission (FERC) issued a ruling that impeded their ability to incorporate tax expense in their calculation of tariffs for cost of service pipelines.

Prior to 2018 natgas MLPs could include in their cost of service calculations an estimate of the taxes paid by their MLP unitholders. Of course they didn’t actually know what those taxes were, so they made a good faith estimate. Then FERC reversed the rule. Faced with a less generous rate-setting regime, most converted to c-corps.

As a result, there aren’t any pureplay natural gas pipeline MLPs although some like Energy Transfer do operate gas pipelines within their mix of businesses.

As MLPs have become less representative of the midstream sector, so has AMLP. Its relative underweight to natural gas pipelines means it has missed out on the AI-driven rally such stocks have enjoyed. Global sales of gas turbines are forecast to be up 5% this year, driven by the need to power data centers, EV sales and to compensate for intermittent solar and wind. Midstream energy is seeing the benefits of this.

In other news, FERC rejected a plan by Talen Energy’s Susquehanna Nuclear facility to provide power to Amazon data centers. The regulator felt there was some risk that rates could rise for other customers on the PJM grid. This setback is unique to the Talen plant and doesn’t affect plans announced by Microsoft and Google to rely on nuclear power for their planned data centers.

In a note on Monday Wells Fargo predicted this could shift gas demand to Texas, where unlike PJM their ERCOT grid operates outside of FERC regulatory oversight. The net result is that the demand outlook for natural gas continues to be robust.

The impact from AI is rippling unevenly across midstream, benefiting natural gas c-corps but not liquids-oriented MLPs.

We have two have funds that seek to profit from this environment: