The World Of Natural Gas

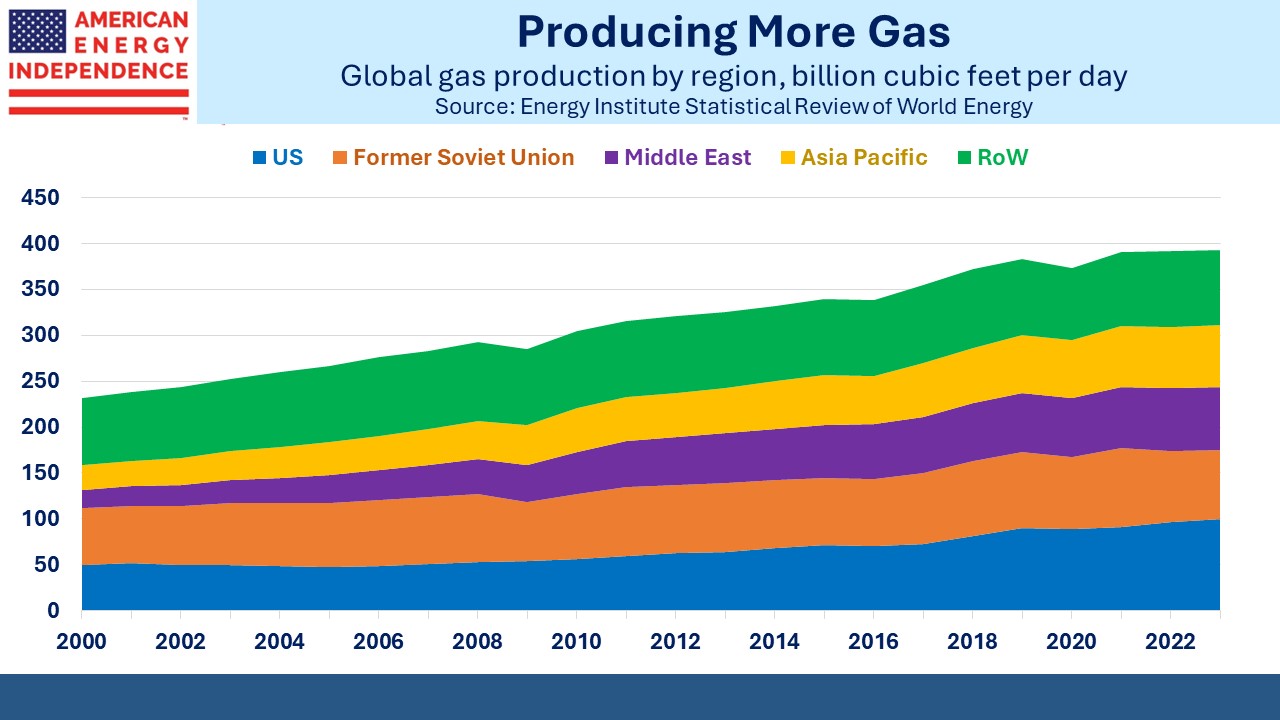

It’s hard to overstate the global success of US natural gas production. Over the past decade we’ve grown output by 37 Billion Cubic Feet per Day (BCF/D), accounting for half the global increase. We now produce over a quarter of the world’s gas. And it’s cheap.

The development of fracking happened in America not elsewhere for many reasons. The geology, water availability, access to capital, technology and a culture of entrepreneurship. Least appreciated is the concept of privately owned mineral rights, which has enabled thousands of landowners to partner with drillers, earning royalties subject to state regulation and taxation.

All over the world except in the US, governments own mineral rights.

Several years ago, a Spanish E&P company found out how hard it is to drill when you’re not welcome. In the north of England, the British government granted Cuadrilla rights to extract natural gas using fracking. The local population was strongly opposed. Britain surely needs natural gas, but the residents living above the reserves saw no financial benefit while enduring all the noise and disruption. It quickly became a political issue and the government backed down (see British Shale Revolution Crushed: America’s Unique Ownership of Oil and Gas).

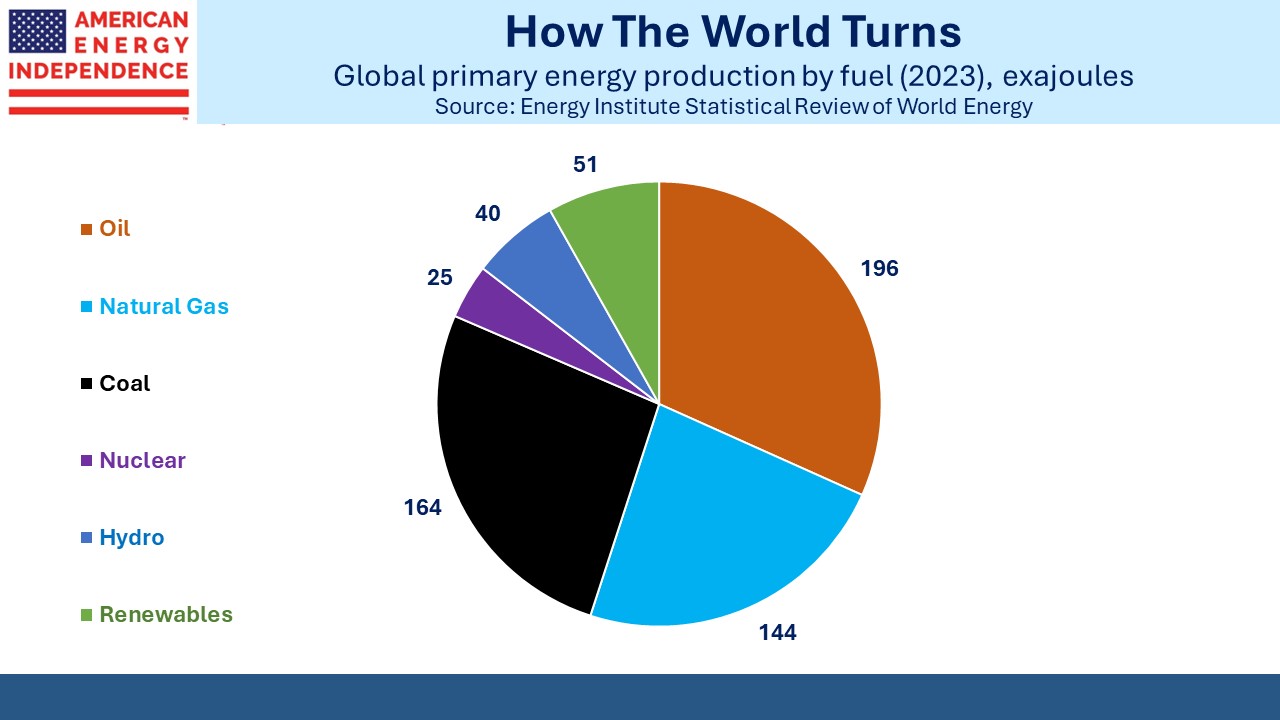

The Energy Institute’s 2024 Statistical Review of World Energy provides informative detail on natural gas, which provides 24% of the world’s primary energy, up from 22% at the start of the century. It’s 23% of the world’s electricity. In the US it provides 43% of our power. Even the International Energy Agency, which has transformed from an objective observer of energy markets to a renewables champion, concedes that last year “Coal-to-gas switching was the largest driver behind emissions reduction in the US electricity sector.”

The US Energy Information Administration (EIA), credits coal to gas switching for 61% of the power sector’s emissions reductions since 2005.

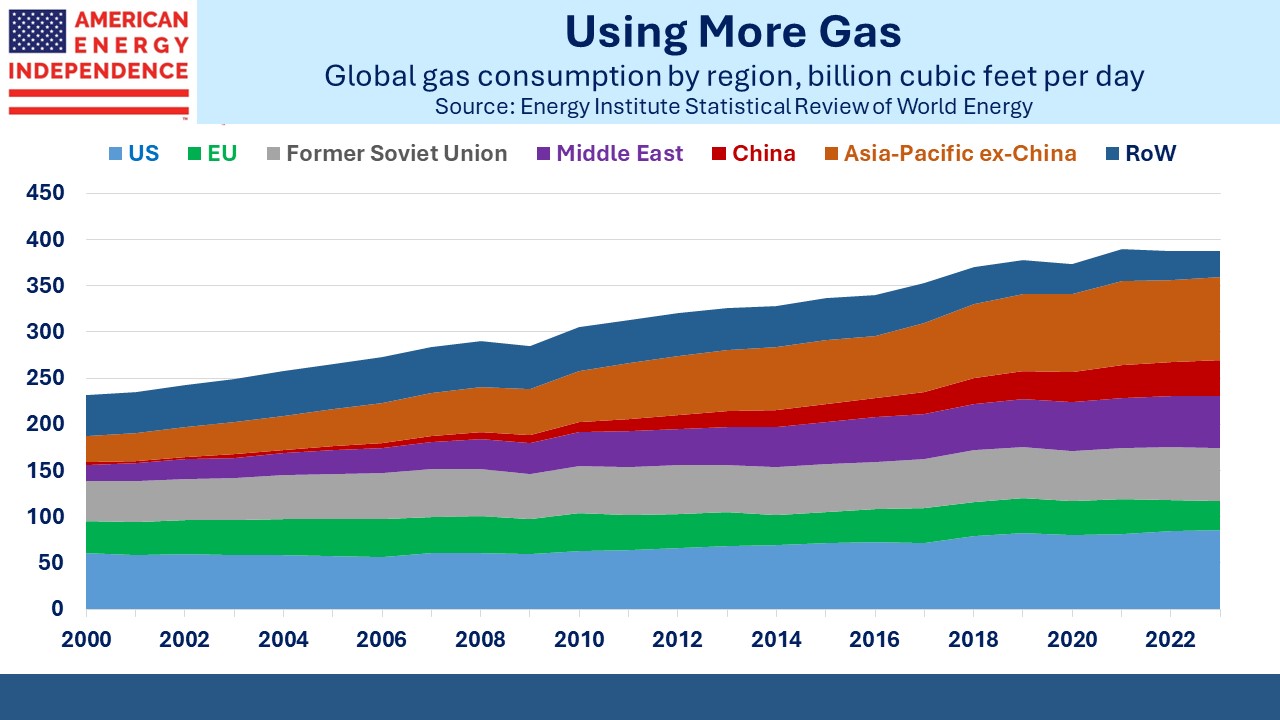

Global consumption has grown broadly, with the notable exception of the EU. Their strategic blunder of reliance on Russian piped gas along with ruinous climate policies have constrained GDP growth (see Natural Gas Demand Keeps Growing). German emissions are falling because they’ve made energy too expensive. They are de-industrializing, to the benefit of the US (see Gains From Energy).

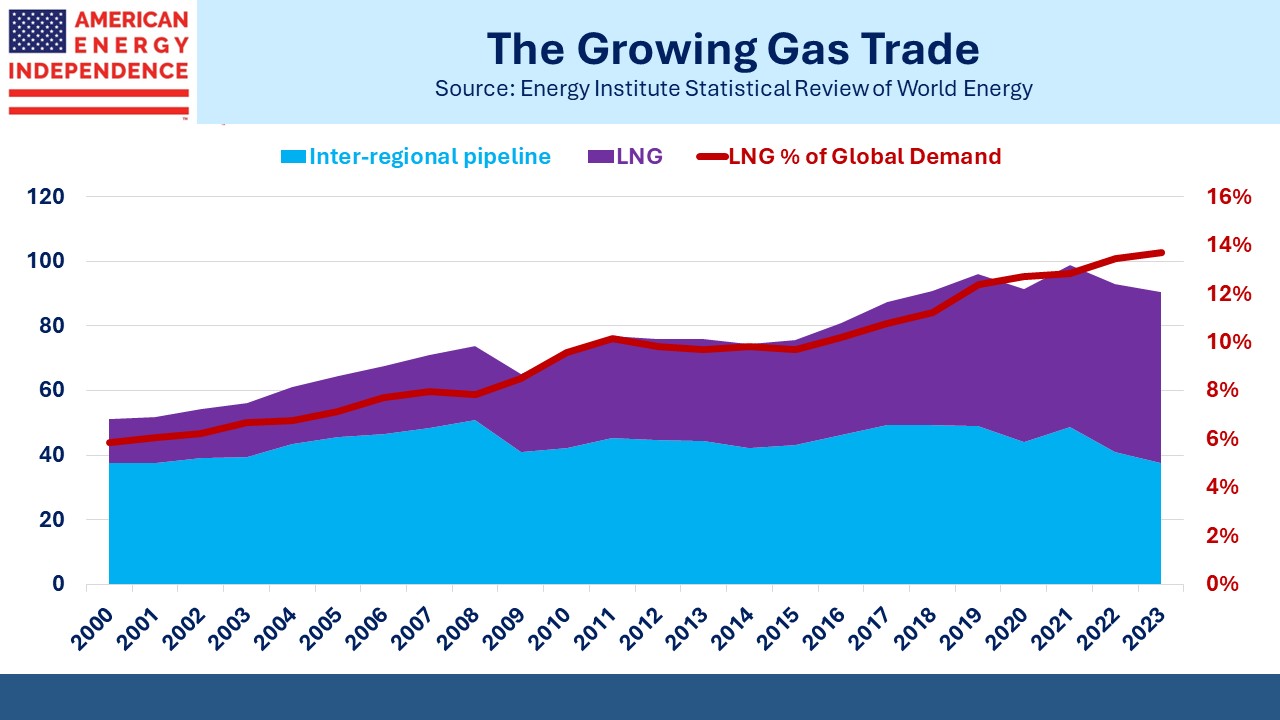

Gas is much harder to transport than oil, so only moves via pipelines or LNG tanker. Transportation costs are a much bigger percentage of the value of the commodity than for oil. Shipping costs from the US to Europe via LNG tanker are $1.50-$2 per Million BTUs (MMBTUs), but liquefaction can add another $2-$3.50. With US spot gas prices at $2, that still leaves a profit margin vs Europe’s TTF benchmark at around $10, but this shows why large regional price differences persist.

Shipping crude oil over the same route is around $2-$4 per barrel, so a much smaller percentage of the value of the commodity.

Nonetheless, global trade in LNG is growing, even while intra-regional pipeline trade has shrunk with the loss of Russian shipments to the EU. Almost 14% of natural gas was shipped as LNG last year, up from only 6% in 2000. Pipelines represented another 10%.

LNG provides both buyer and seller optionality in a world more prone to geopolitical trade disruption. Pipelines linking neighboring countries require extremely stable relationships (think US/Canada, or UK/Norway). Nordstream 2 had its gas supply cut before it flooded with seawater after a sabotage. Pipelines reduce flexibility for both parties. It’s why the China-Russia negotiations over Power of Siberia 2 continue to drag on.

By contrast, the global oil trade was 68 million barrels per day last year, around two thirds of consumption. Oil and gas reserves are unevenly distributed. Coal trade was only 21% of consumption. It’s easy to move, but reserves are widely distributed. It’s why developing countries use so much of it – because it’s easily accessible.

Natural gas consumption will continue to grow, to meet the developing world’s relentless demand for more energy. Policymakers may even acknowledge that renewables are hopelessly inadequate to replace fossil fuels and instead emulate the US success by prioritizing coal-to-gas switching.

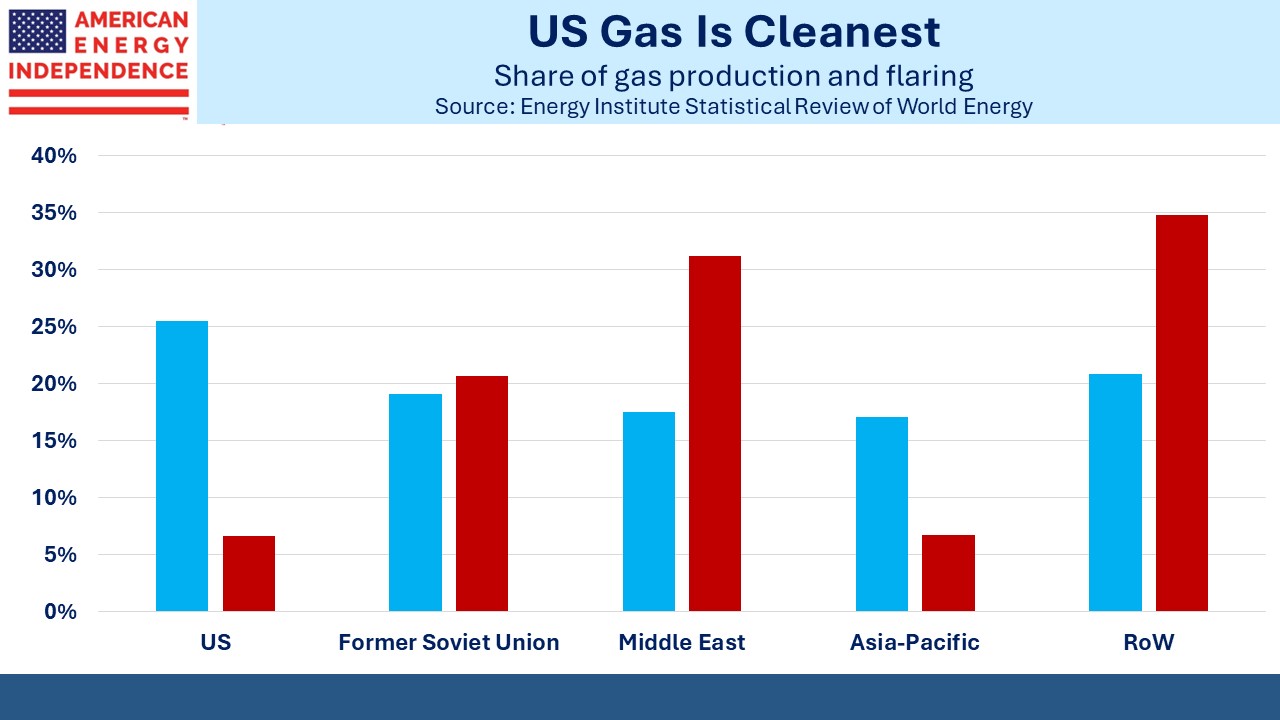

Gas generates around half the CO2 of coal when burned for power, and also generates far less local pollution. Critics argue that flaring and methane leaks offset this advantage. However, the US is far stricter on flaring than other big producing regions such as Russia or the Middle East. We produce 26% of the world’s supply but only 7% of the flaring.

This all highlights the huge opportunity of US natural gas. Our supplies can help poorer countries meet their growing energy needs, while displacing more damaging coal. And because our environmental standards are higher than in Russia or Iran, our natural gas is a more climate-friendly product.

The simpletons at the Sierra Club and the knuckle draggers at Extinction Rebellion who hurl paint in art galleries will never embrace this. But increased US exports of natural gas are the most effective way to reduce CO2 emissions. In our opinion it offers continued attractive returns, and by delivering what is expected rather than unmet promises, it is the most ethical investment in the energy sector.

We have three have funds that seek to profit from this environment: