The Costs Of Bad Energy Policy

European policymakers are being forced to reassess energy policy. Premature reliance on intermittent renewables came up short last Fall (see Europe Follows California Into Renewables Oblivion). More recently, the EU’s reliance on Russia for 40% of its natural gas imports is being exposed as especially unwise with Russian troops poised to invade Ukraine.

Britain has moved steadily to use wind power, and when the normally windy North Sea was inconveniently calm they turned to imports of Liquified Natural Gas (LNG) because they have been phasing out natural gas storage.

Horizontal fracturing (“fracking”) is mostly limited to the US. In 2018 we chronicled Cuadrilla’s ill-fated attempt to drill for natural gas in Lancashire, northwest England (see British Shale Revolution Crushed: America’s Unique Ownership of Oil and Gas). With British households bracing for a 50% hike in power bills because of high natural gas prices (see Learning From EU Mistakes On Energy Policy), being more self-reliant for natural gas looks smart.

Hence the right wing Daily Telegraph is making the case that fracking would have shielded Britons from the worst effects of the energy crisis. Members of Britain’s ruling Conservative party are pressing PM Boris Johnson to relax rules against fracking. The country’s unrealistic aspirations to give up reliable energy are facing a reality check.

Meanwhile Germany is considering legislation to force increased storage of natural gas by utilities in time for next winter. Germany has rated reducing emissions ahead of energy security, a prioritization that looks poorly considered.

European leaders have embraced renewables faster than many American states. Reducing emissions is a laudable goal, but many of these policies betray little serious thought about the consequences for reliability or cost.

New Jersey’s Democrat legislature passed the Global Warming Response Act (GWRA) in 2007, and updated the law in 2019. It requires an 80% reduction in annual CO2 equivalent emissions (i.e. converting other greenhouse gases such as methane into CO2 equivalents based on their warming impact and rate of degradation) below the 2006 total by 2050 (dubbed “80X50”). This requires a reduction by then of 96.5 million tonnes per year.

China plans to increase emissions until 2030, and only then start reducing them to zero by 2060. New Jersey’s population is around 0.6% of China’s, and the reduction under the GWRA is approximately 1% of China’s current emissions.

Maybe liberals are poor negotiators. The government officials that negotiate climate change agreements are probably more worried than average about the planet – that must be why western countries have agreed to continue reducing emissions while the biggest emitters like China are still increasing theirs. Shouldn’t we all be reducing CO2 at the same time, rather than creating capacity for others to keep generating more?

The people implementing NJ climate change regulations are playing fast and loose with the data. A recent proposal that buildings replacing fossil-fuel fired boilers would have to install electric ones instead estimated “the operational costs for an electric boiler may be between 4.2 and 4.9 percent higher.”

A subsequent correction quietly conceded, “The Department’s analysis indicated that operational costs for an electric boiler would result in a 4.2 to 4.9 times increase (rather than 4.2 to 4.9 percent increase).”

It’s a trivial typo, except that the proposed regulation must be uneconomic following the correction. This reflects the same absence of cost-benefit analysis that has led the EU to depend so heavily on renewables and Russian natural gas for energy. The Europeans are reassessing the energy transition and pragmatic changes will follow.

It’s in nobody’s interests for energy policy to be run such that everything is examined through the single lens of its impact on emissions.

The good news for investors is that when idealistic plans collide with realism, natural gas is often the winner. An example is Europeans buying more LNG from the US, reducing their vulnerability to Russia’s capricious supply decisions and intermittent renewables.

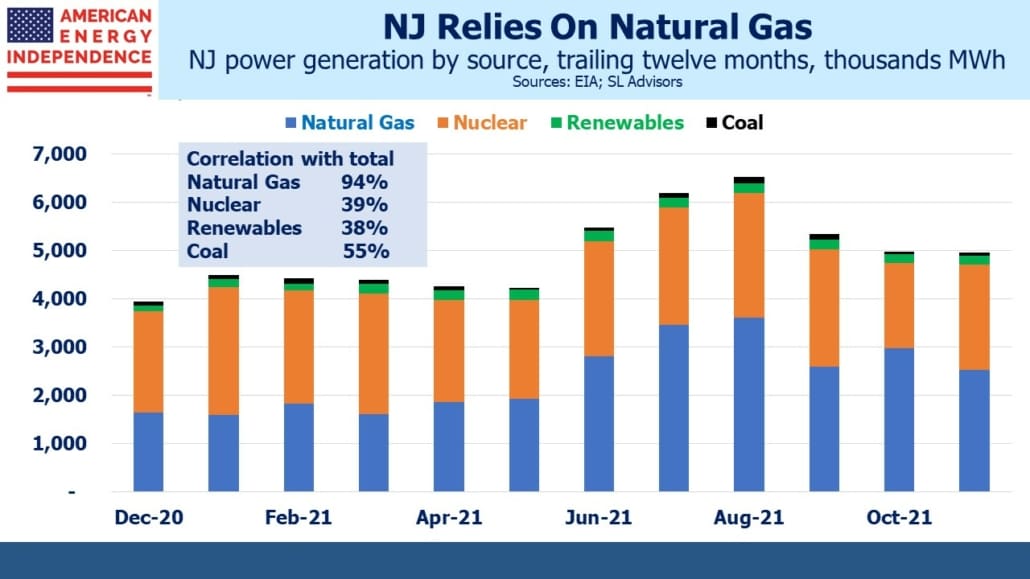

Natural gas power generation is most flexible in reacting to shifting demand. NJ offers an informative example. During the summer when power demand goes up because of air-conditioning, natural gas responds. Natural gas based power production is 94% correlated with the total. Renewables at a 4% share aren’t relevant but have a similar low correlation to nuclear – neither is able to change output when customers need them to.

The energy transition means electrification. Natural gas, which is reliably 40% of US power production, will continue to benefit from this shift in NJ and elsewhere – as long as the bureaucrats don’t follow New England where new pipelines are blocked with LNG regularly imported rather than transported by pipeline from Pennsylvania (see Why Staying Warm In Boston Will Cost You).

We’ll be watching carefully.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.