The Coming Energy Backlash

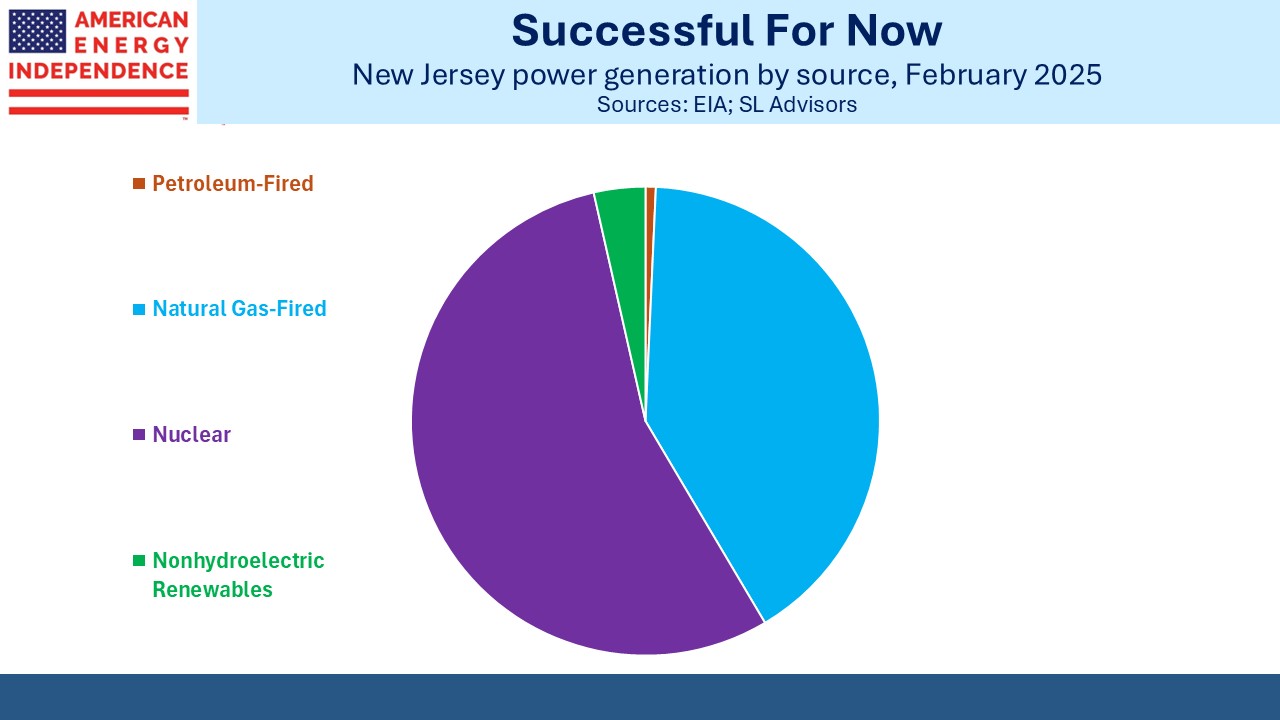

New Jersey, where your blogger resides when temperatures allow, had a good story to tell on energy until recently. Power generation relies heavily on natural gas and nuclear (38% and 56% respectively in February). Residential electricity prices are 19.7 cents per Kilowatt Hour (KwH), above the US average of 16.4 cents but well below neighboring blue New York state’s 26.2 cents.

New England, where energy masochism is an art form, averages 29.7 cents led by Connecticut at 33.3 and Massachusetts at 30.4.

However, New Jersey’s Democrat governor Phil Murphy has been leading a left-wing assault on the Garden state’s satisfactory power supply. It began with the 2019 Energy Master Plan: Pathway to 2050. Executive Order 315 issued in February 2023 went further, mandating that 100% of electricity be derived from clean energy by 2035.

Offshore windpower is supposed to be the major source. Currently, non-hydro renewables provide 3.6% of the state’s electricity. The state’s goal is to add 7,500 megawatts of offshore wind by 2035 which they say will power 3.2 million homes, out of a total of 3.8 million. So the plan is that within a decade more than four homes in five will run on windpower.

Almost all the windpower in the US is onshore (see Offshore Wind vs Onshore). Texas generates the most, and Iowa relies on it the most at 64% in 2023. Offshore wind is more expensive to install, and several projects have collapsed. Equinor is taking a big loss on New York’s Empire Wind Offshore project (see Pipelines Will Get a Lift From Gas) because the US Interior Department ordered them to stop construction.

Apparently, the previous administration’s environmental review was hasty and incomplete. Equinor has said the delay is costing them $50 million a week and they’ll pull the plug within days without a resolution.

Plans to add offshore wind in New Jersey were wildly unpopular with coastal communities who opposed a blighted view and disruption where infrastructure would bring the power onshore (see Windpower Faces A Tempest). In 2023 Orsted abandoned two large projects citing increased costs and delays.

The Garden State may be politically blue, but the Jersey shore is decidedly red.

Given Equinor’s losses and the US administration’s opposition to offshore wind, it’s hard to see any enthusiasm for new projects. There’s too much execution risk with a potential change in government every four years.

Which brings us back to New Jersey, whose stated policies make clear the government’s antipathy towards traditional energy including natural gas. Residents are about to be hit with utility bill hikes of 17%-20%. Supply constraints are part of the reason. PJM Interconnection, the grid operator whose footprint includes New Jersey, has warned of insufficient generation capacity if the summer is hotter than average. Given the state’s energy goal to move away from hydrocarbons, adding natural gas infrastructure has limited appeal.

Democrat energy policies are leading to a jump in prices even though the state hardly uses windpower. My friend Jon Bramnick is running for governor and released this short video explaining the problem. It will be to New Jersey’s great benefit if he wins the election.

Even though this may look like a polemic against left wing politicians and not an investment blog, the rest will look familiar.

Energy planners in New Jersey and New York have created a developing problem for their residents. Because of their assumption that wind power will provide a meaningful share of electricity they’ve often blocked additions of natural gas infrastructure. By planning to reduce and eventually eliminate gas they’ve made it less attractive for new investment.

Much of the intended offshore wind capacity is now unlikely to be built. Therefore, both states’ demand for natural gas will be higher than expected. It may first require a political backlash against today’s flawed and expensive policies. The looming price hikes in New Jersey will be another confirmation that progressives have disingenuously promoted solar and wind as cheap.

The pendulum has swung back against a price-insensitive pursuit of intermittent, weather-dependent electricity (see Energy Policies Are Moving Right). As former UK Prime Minister Tony Blair pointed out in The Climate Paradox: Why We Need to Reset Action on Climate Change, the current approach is failing.

This is long term bullish for natural gas demand and its related infrastructure. The failure of left wing energy policies to generate widespread public support will be a tailwind for reliable energy. The investment outlook for energy infrastructure is more constructive than reflected in market prices, because many have been wrongly persuaded that renewables will displace everything else.

We never accepted the view that the US would abandon reliable energy in favor of the intermittent, expensive alternative.

Ignoring progressives can be hard but is always worth the effort.

We have two have funds that seek to profit from this environment: