Reliable Energy Is Mainstream Again

The ending of many renewables subsidies in the One Big Beautiful Bill (OBBB) is being hailed as a win for the oil and gas industry. The WSJ wrote, The Moment the Clean-Energy Boom Ran Into ‘Drill, Baby, Drill’, suggesting that oil production will benefit.

But in reality it’s about electricity generation, and oil produced just 0.4% last year. It’s an expensive way to generate power – globally it was just 2.2%. Oil is used as a back-up in places like Boston where new natural gas pipelines have been opposed, although this may be changing (see Gas Kept Us Cool Last Week).

Saudi Arabia gets over a third of their electricity from oil, since they have it in abundance. They use natural gas for the rest.

Since renewables are all about power generation and OBBB shifted public policy support away from them, natural gas is the obvious winner. With EV sales faltering, crude oil demand may also benefit but not as much as gas.

The change in priorities reflects evolving public opinion. A majority still favors expanding solar and wind output, but according to one survey that has fallen to 60% from 79% five years ago. Unsurprisingly, red and blue respondents hold widely differing views.

The shift back towards reliable hydrocarbons isn’t limited to America. Canada’s PM Mark Carney recently said it’s, “highly likely that we will have an oil pipeline…” when asked about improving access of Alberta’s crude oil to foreign markets by adding a pipeline to Canada’s Pacific coast.

Alberta may be the only Canadian province where Trump’s disappointing references to the 51st state don’t provoke widespread anger. Carney likely believes that supporting Alberta’s energy sector will snuff out any nascent calls for secession, and the country badly needs alternative export routes for its hydrocarbons. Canadians know they’re too reliant on their southern neighbor.

Canada shipped its first tanker full of LNG last week, from Kitimat, BC. The export terminal, owned by LNG Canada, cost about C$48BN ($35BN). PM Carney said, “Canada has what the world needs.” He wants to lead “the world’s leading energy superpower.”

Until recently Canada thought of itself as a leader in reducing greenhouse gas emissions, even though their per capita emissions are among the world’s highest at 20.4 tonnes per year (the US is 17.2). They attribute this to their energy intensive industries, ironically including oil and gas extraction, and their cold climate.

The Department of Energy (DoE) just released a report evaluating grid reliability. Demand is rising at a faster rate than in the past, mainly because of data centers. The supply mix is becoming less reliable as dispatchable power from coal plants is replaced with intermittent solar and wind.

Some may find the report’s tone political, such as this sentence: The current administration has made great strides—such as deregulation, permitting reform, and other measures—to enable addition of more energy infrastructure…

But then NJ residents just saw electricity bills rise 17% which their grid operator PJM blamed on the same factors mentioned in the DoE report: data centers and insufficient new dispatchable power, which really means reliable power that’s there when needed.

The whole situation needs more natural gas power plants.

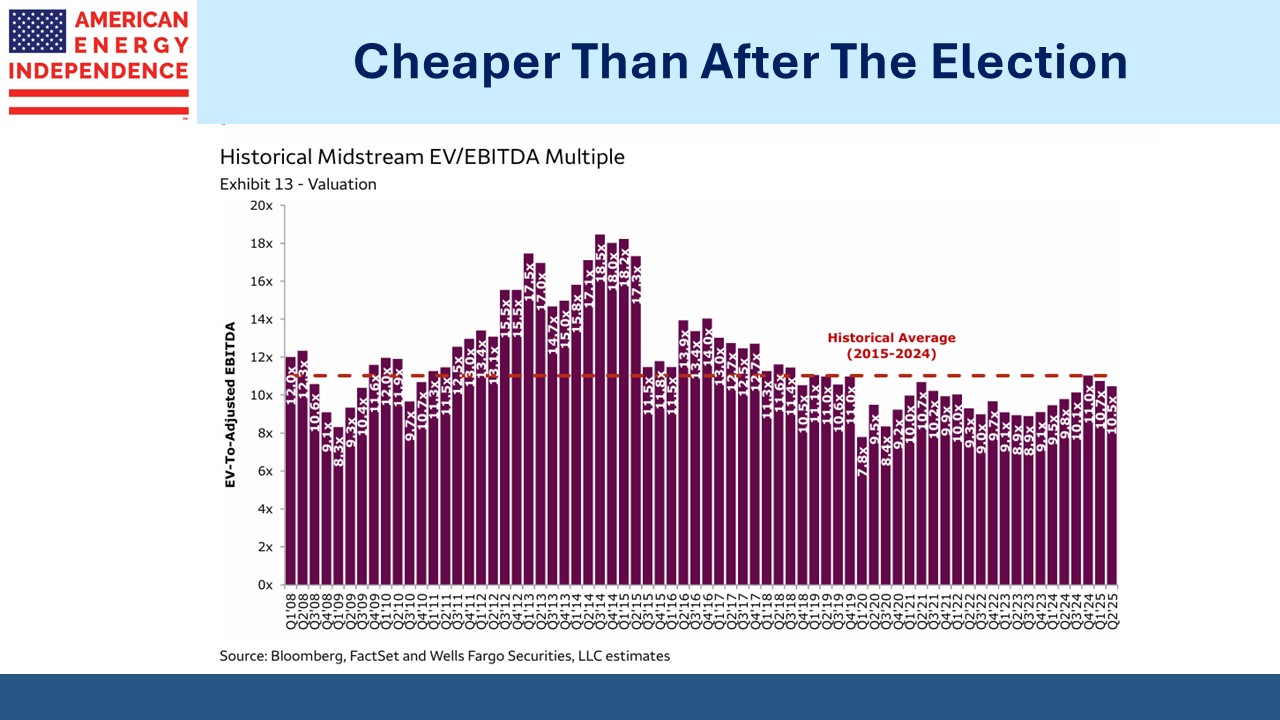

So far this year, midstream energy infrastructure is +3.5%, lagging the S&P500 by around 3%. Operating performance has remained strong, resulting in cheaper valuations for those still inadequately allocated to the sector.

Consequently, EV/EBITDA has slipped from the ten year average of 11.0X at the end of last year to 10.5X now. Dividend yields of around 4.5%, added to dividend growth of 3-4% and buybacks of 2-3% imply a prospective total return of around 10% pa (ie 4.5% + 3.5% + 2.5%). A return to 11.0 EV/EBITDA would mean a 4.76% increase in enterprise value (i.e. 0.5/10.5 = 0.0476) which given the prevailing 50/50 split between debt and equity liabilities would result in a 9-10% price increase (4.76% X 2).

In other words, pipelines are cheaper than they were following the election. White House policies have been at least as supportive towards traditional energy as was hoped eight months ago. The fundamentals support appreciation from current levels.

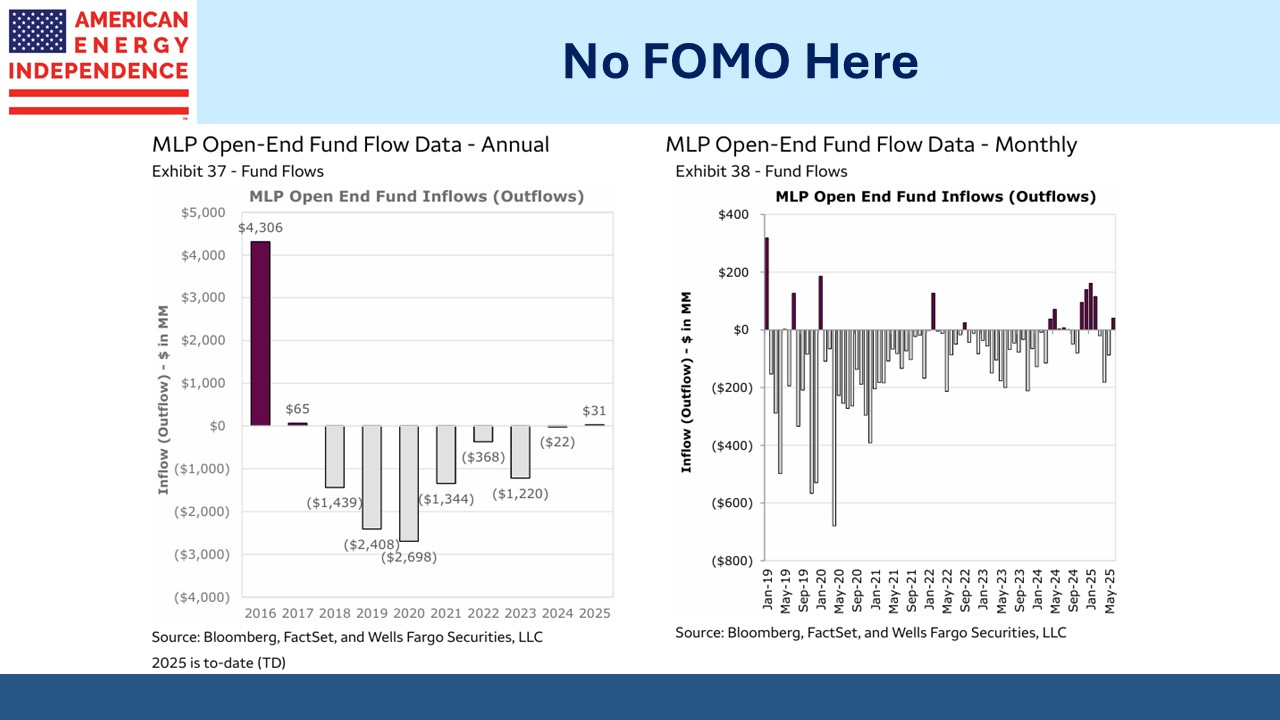

Retail investors remain cautious after a spurt of buying earlier in the year. Open-ended MLP funds, which confusingly includes c-corps which are now the dominant corporate form, have seen minor net inflows this year after seven straight years of outflows. This should soothe the fears of any potential buyer that it’s a hot sector. Sentiment is at odds with valuations, as is often the case.

We’re happy to report that net inflows to products managed by your blogger and partner Henry here at SL Advisors are well in excess of the $31million net adds to the sector.

We have two have funds that seek to profit from this environment: