Economists Having Fun With Inflation

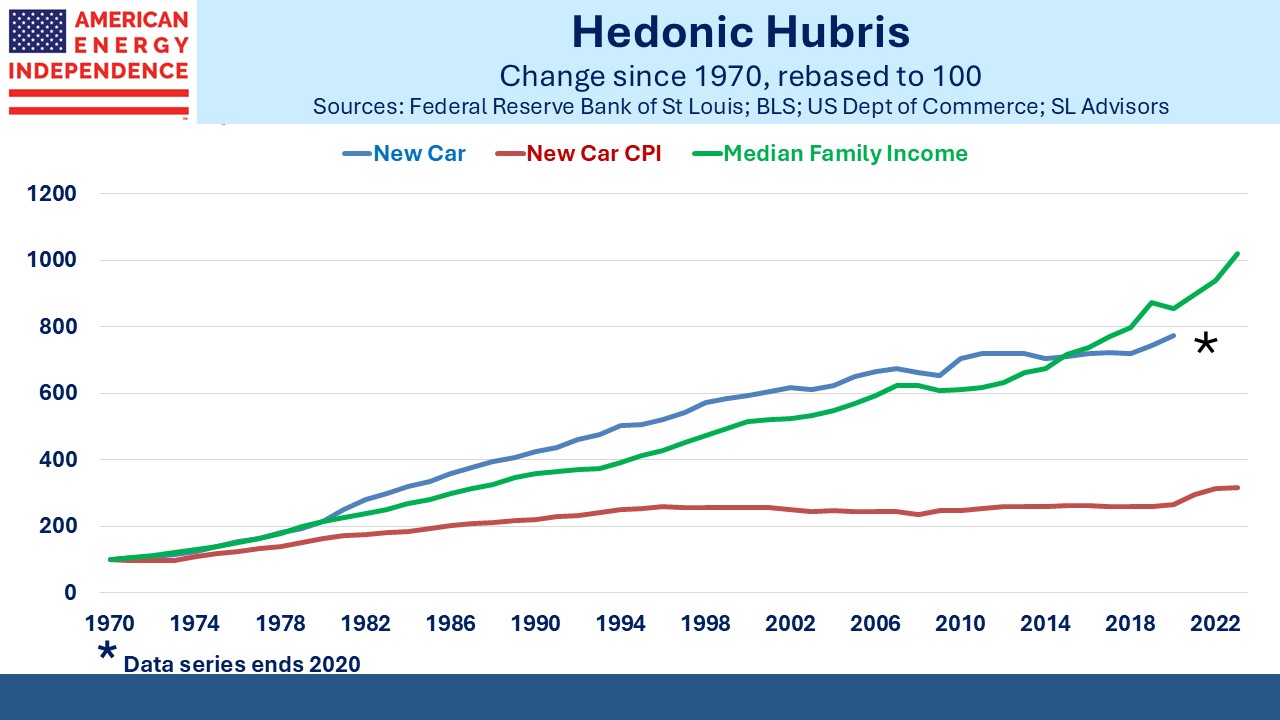

The other day I read a tweet complaining that since 1971 household family income had increased 5.5X (from $10K to $55K) while the median cost of a new car has gone up by 12X ($4K to $48K). It’s not quite correct. Median family income has risen to $101K, so has almost kept up. But it did remind me that car price inflation as calculated by the Bureau of Labor Statistics (BLS) has substantially lagged car prices. Car CPI has averaged 2.2% since 1970, resulting in a mere tripling and far less than actual prices.

The reason is what the BLS calls hedonic quality adjustments – not to be confused with hedonistic, although indulging in the latter might help consumers accept the result of the former.

The CPI is calculated on the basis of a basket of goods and services of constant utility. This last phrase is critical, because it means that any improvement in a product or service that provides increased utility gives you more for your money – in other words, a price cut. CPI seeks to keep this constant.

It’s a concept only familiar to economists, and we have written about it before (see Why Inflation Isn’t What You Think). Non-BLS economists – which is to say, most of us – think about how much more a new car costs than it did last year. Or an iphone, flight or house. We don’t think of improved quality as a theoretical price cut.

Economists around the world love hedonic quality adjustments. In their tribe this is not a controversial topic. However, I am increasingly convinced that their application is uneven, unintuitive to users of inflation statistics and not helpful to anyone interested in maintaining their standard of living.

In 2013 I wrote about airfares (Why Flying is Getting More Expensive) and noted that the only quality adjustment the BLS had made was to factor in easier cancellation terms as an implicit price reduction. Since then, few would dispute that flying coach has become a degrading experience with less legroom, no meals and a general feeling of being cargo rather than people. The BLS never makes adjustments for a decrease in quality, even though it’s certainly the case with flying. And I’d suggest that regular travelers to New York City on NJ Transit could identify another form of transportation where quality has dropped.

What’s the hedonic quality adjustment for regular delays?

The other problem with these adjustments is that they’re applied to indivisible objects. For example, if an improved car provides you with greater utility, what exactly can you do with the excess? Today’s new car provides more utility whether you like it or not. You can’t take the extra and apply it somewhere else. You’re unlikely to conclude that increased utility in one purchase allows you to accept reduced utility in another, such as an airplane ticket. Only BLS economists think like that.

From 2019-21 during the pandemic, household incomes rose 3%, lagging new car prices (+14%) along with most other things. Voters remembered in November.

But the real mistake lies in thinking that keeping up with inflation means keeping up with the neighbors. Social security payments are linked to CPI, but that just means slipping to a lower percentile of income over time. It’s even more important for anyone planning retirement in a decade or two. Assuming that today’s household expenses will increase at inflation so their savings only need to keep up will turn out to be inadequate.

A more realistic goal is to target median family income. That has increased by 4.4% pa over the past decade, versus CPI at 2.8%. $100K in household expenses in 2013 required $154K in 2023 to maintain its purchasing power relative to the median. If it grew at the CPI the family would have $131K and would have fallen behind their peers of a decade earlier.

The median family income has roughly kept track with car prices over the past fifty years, which has enabled car prices to increase well ahead of car price inflation. It simply shows that car price inflation as calculated by the BLS isn’t a very useful figure. For savers this applies to inflation statistics more generally.

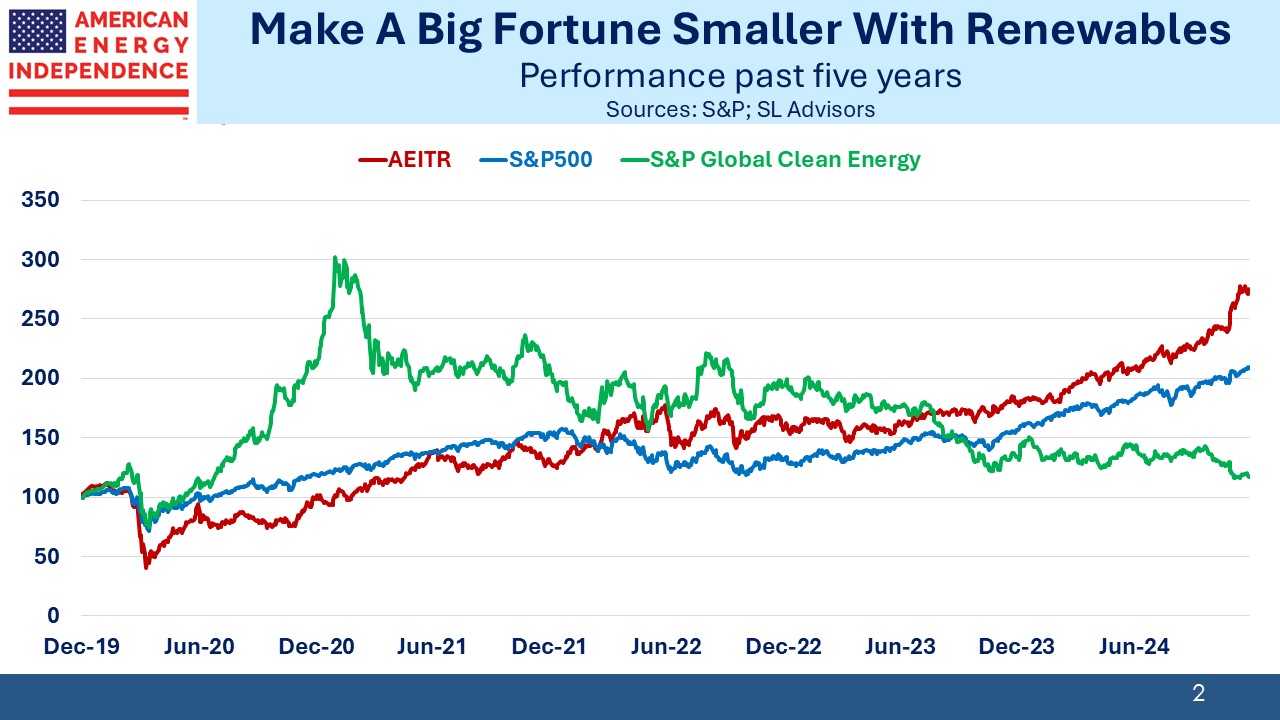

So make your new year’s resolution to grow your savings at a more appropriate rate. We will naturally suggest that midstream energy infrastructure has a better chance than most investments of delivering.

And if this New Year’s Day discussion of hedonic BLS weaknesses is challenging your foggy brain, I hope you can blame it on excessive hedonism the night before.

We have two have funds that seek to profit from this environment: