Pipelines — There’s Always A Bull Market Somewhere

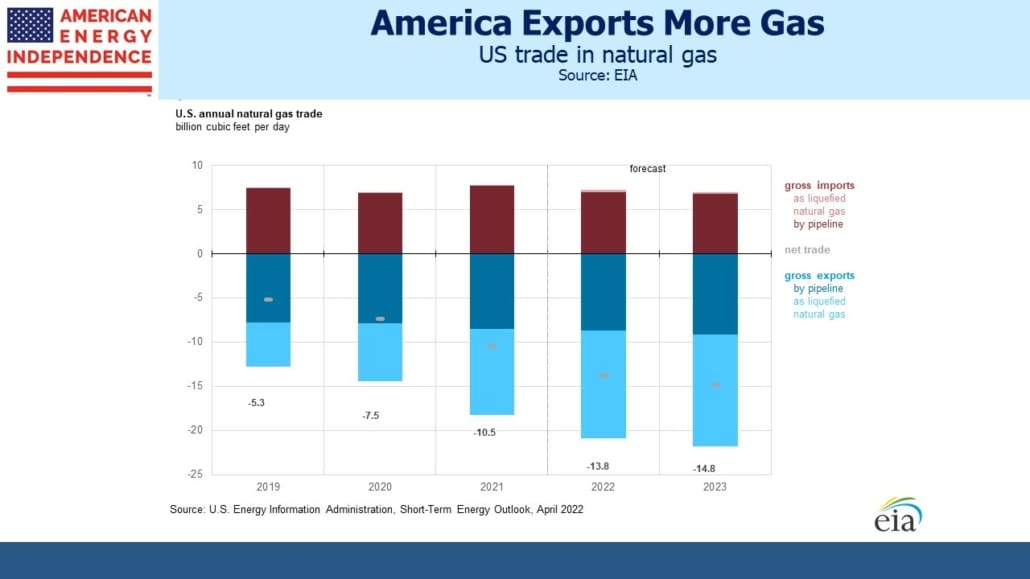

The US was increasing its net exports of natural gas before Russia’s invasion of Ukraine added an element of urgency. Liquefied Natural Gas (LNG) gets most of the attention, but this year we’ll export nine Billion Cubic Feet per Day (BCF/D) by pipeline, to Mexico and eastern Canada.

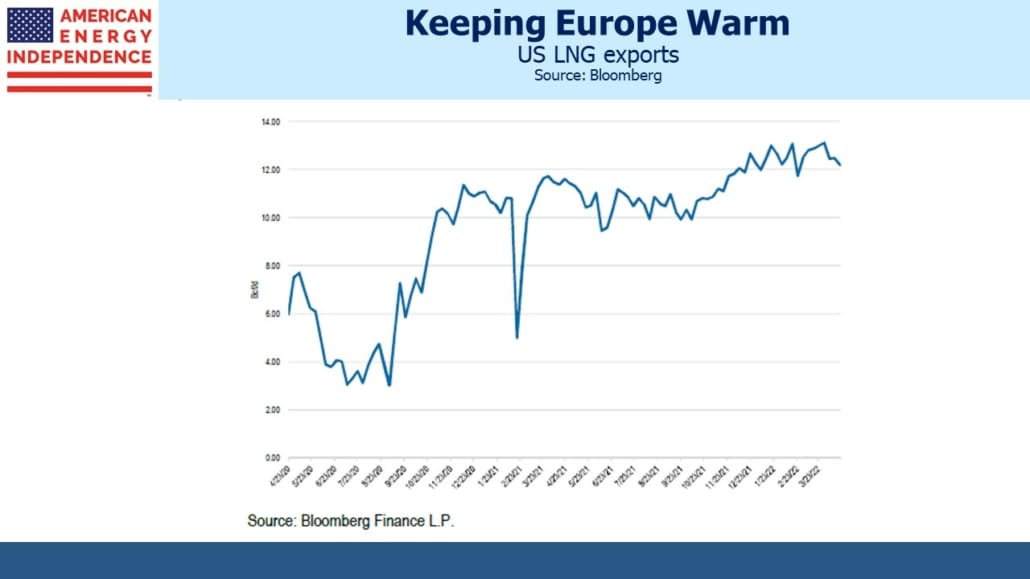

LNG exports are still rising, with most global trade directed to Asia. Cheniere, whose Sabine Pass and Corpus Christi terminals export over half the total, often signs flexible contracts that give the buyer (typically a large trading firm like Trafigura) destination flexibility.

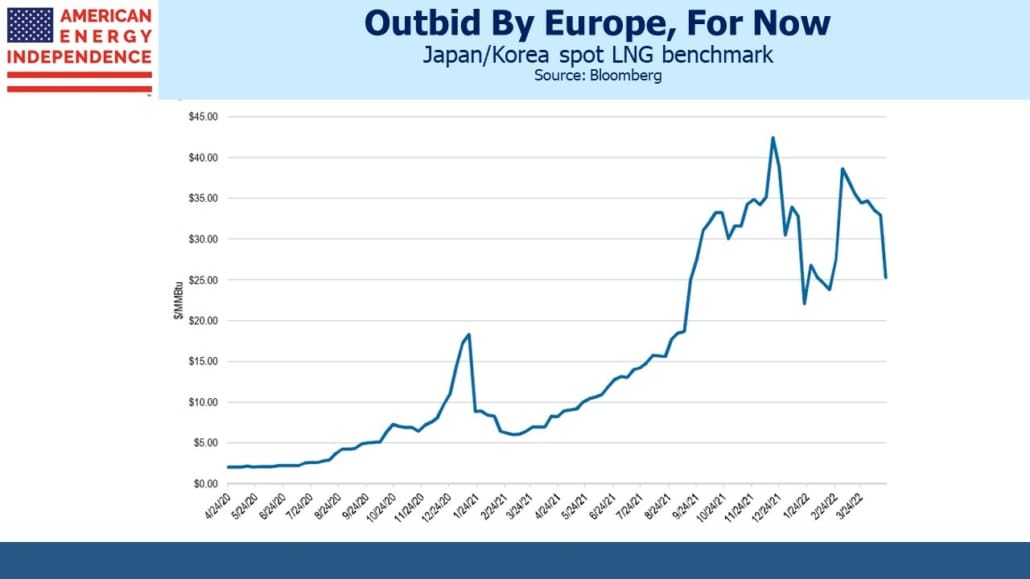

As Europeans buyers have scrambled to replenish storage, they have outbid Asian buyers. Competition between the two is likely to intensify later in the year. Germany hopes to begin using the four floating LNG terminals they’ve leased as soon as this winter, assuming the land-based infrastructure can be ready in time. Global LNG prices are likely to remain firm.

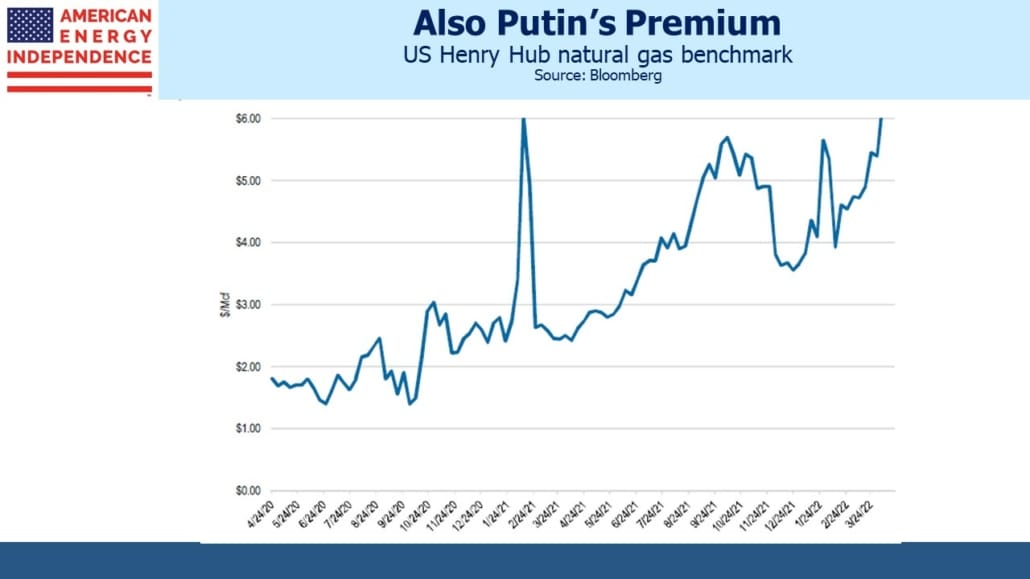

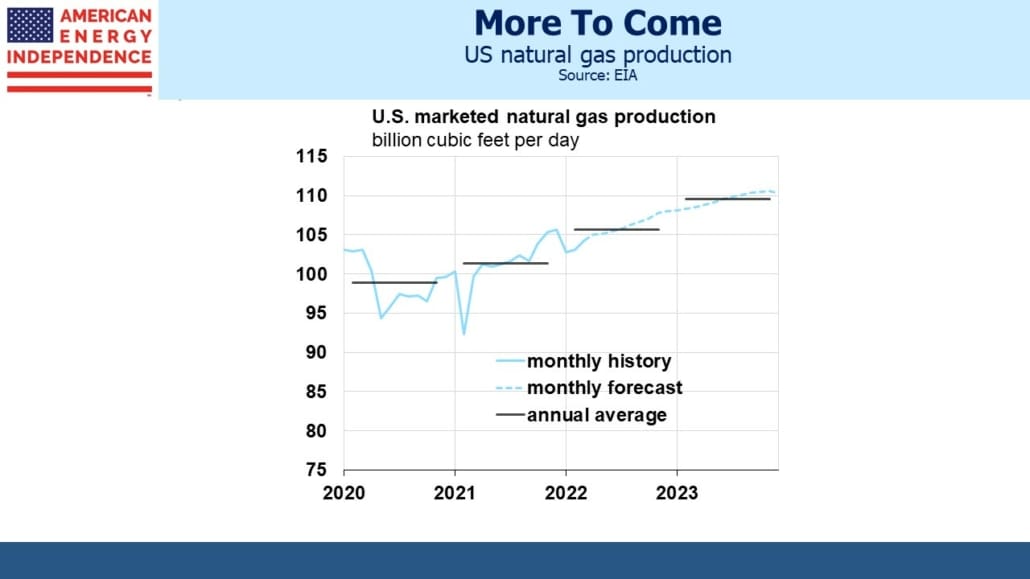

The difference between US natural gas prices and the two main overseas benchmarks remains huge – far more than necessary to induce higher exports which are limited by our LNG export capacity. As we send more LNG overseas, it will create some upward pressure on domestic prices. The good news is that domestic production is increasing to keep up with exports.

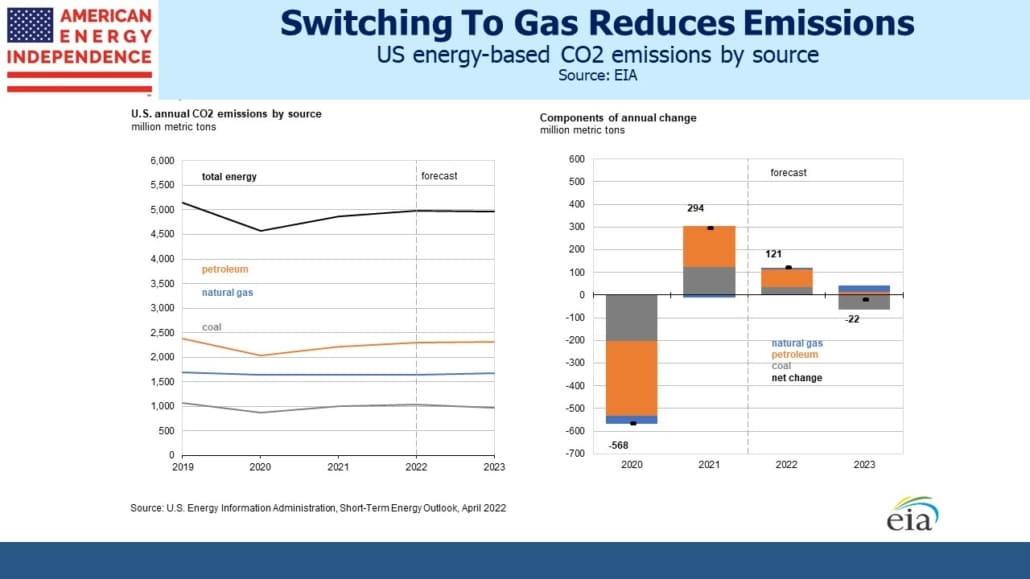

The US Energy Information Administration (EIA) in their current Short Term Energy Outlook US expects coal consumption to decline next year after rising in 2022. Power plants switching from coal to natural gas will be the driver, as it was for over a decade prior to Covid. The EIA expects US natural gas prices to ease from today’s relatively high prices because of increased production. This will keep our energy-related CO2 emissions flat next year.

Kinder Morgan (KMI) reported better than expected 1Q22 results last week, buoyed by their Natural Gas Pipelines segment. Growing natural gas takeaway capacity out of the Permian basin in west Texas is behind KMI’s decision to invest in more compression on their Permian Highway and Gulf Coast Express pipelines that run from west Texas to the Gulf of Mexico. Increasing capacity on existing pipelines is preferable to greenfield projects across most of the country. It heads off environmental extremists and requires less capex, so is preferable where existing infrastructure allows it.

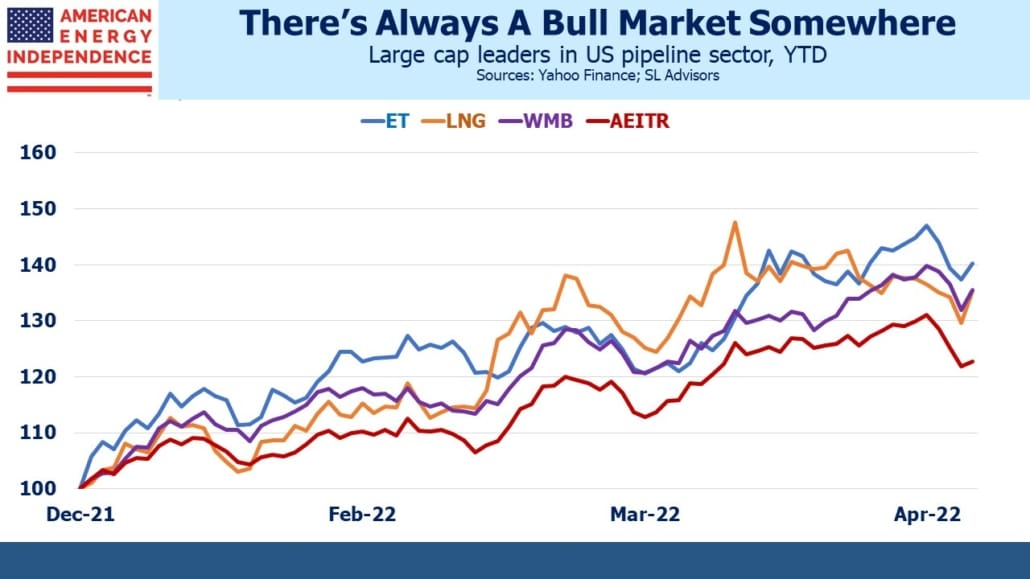

Energy Transfer (ET) is the individual name most often held by financial advisors we talk to. It has been consistently cheap, inexplicably so to many, for years even relative to a sector that has long been out of favor. This year it has been one of the leaders in the American Energy Independence Index (AEITR). Yesterday ET announced a 30% distribution hike, another step on the road to redemption for a company with a checkered history of fiduciary forgetfulness (see Energy Transfer: Cutting Your Payout, Not Mine).

Clients who are underinvested in the pipeline sector often look at recent returns and ask whether they’ve missed the rally. Those possessed of sufficient fortitude or recklessness to have bought on March 18, 2020 are up 4X. Returns from the Covid low are spectacular, but highly aberrant. The YTD return at that point was –64%, caused in no small part by the managers of MLP closed end funds who combined poor judgment with misplaced self-confidence (see MLP Closed End Funds – Masters Of Value Destruction). It is to their clients’ misfortune but everyone else’s gain that sufficient capital was destroyed in the rush to delever that they’re now too small to repeat.

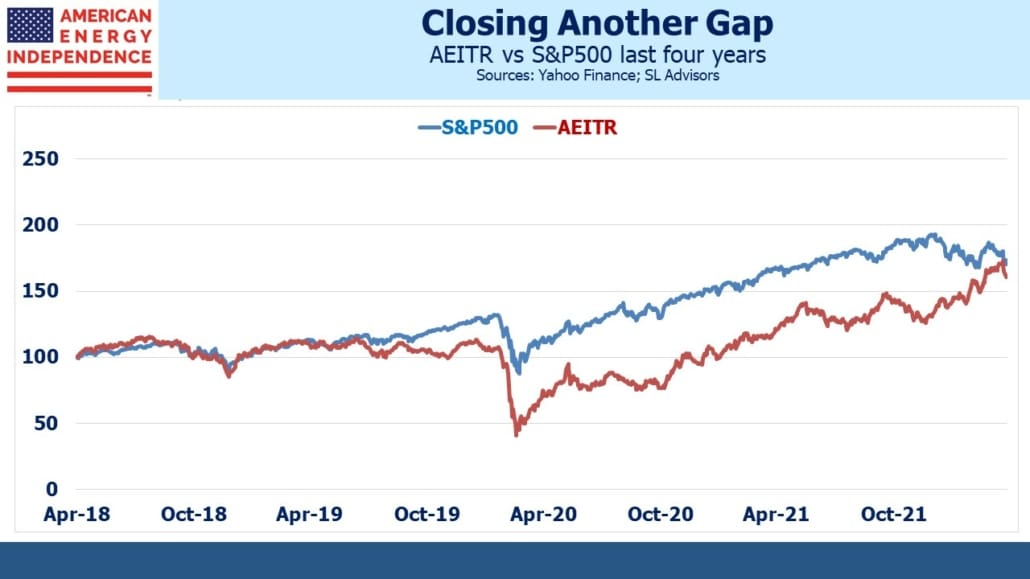

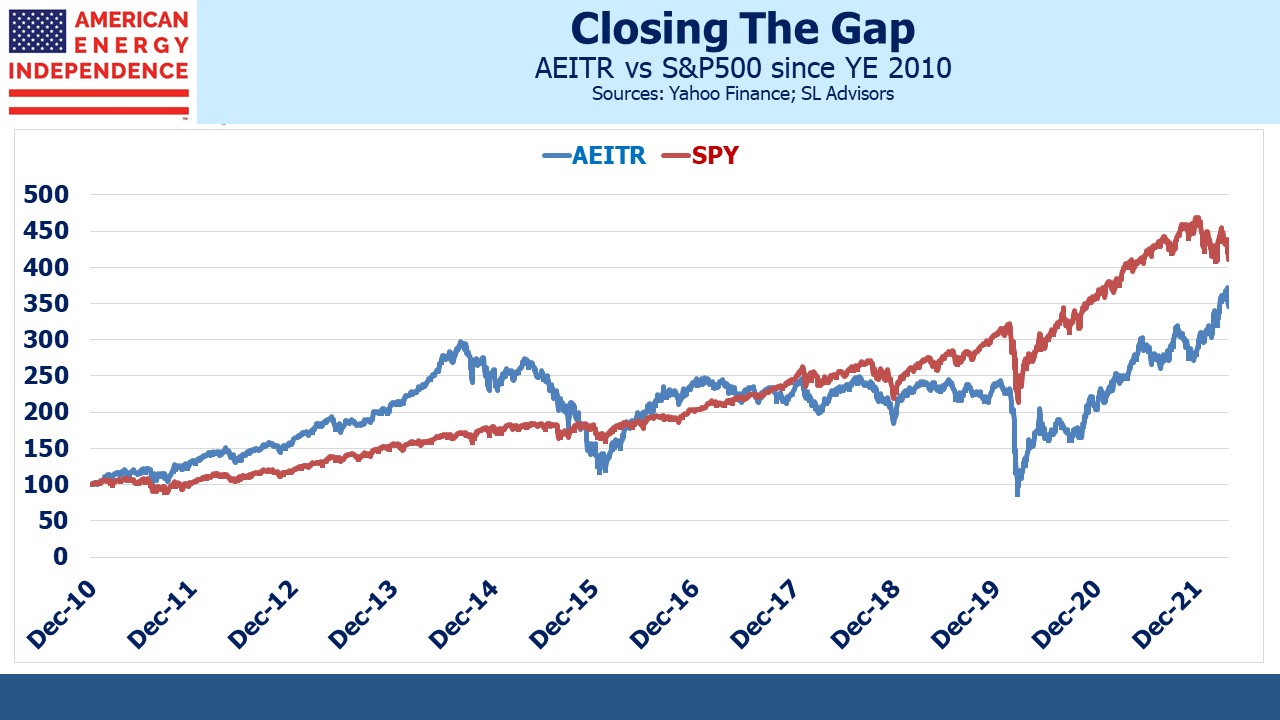

A longer timeframe is more meaningful. Over four years, the AEITR has delivered almost the same return as the S&P500 (12.5% pa vs 14.0% pa). Another couple of days of relative performance like yesterday (S&P500 lagged AEITR by 2.5%) will make their four year returns match.

An investor contemplating an equity allocation would scarcely be dissuaded by the stock market’s four year return. However, the prospects for inflation above the Fed’s 2% target for years might give her pause. Pipeline stocks should do well in such an environment.

Or she may consider the growing importance of energy security to Europe and the resulting demand for US LNG; the continuing financial discipline exhibited by energy companies, and the global opportunity for reduced CO2 emissions from coal to gas switching.

The point is that the traumatic V-shaped low of midstream energy infrastructure in 2020 creates high recent returns, but over longer periods pipeline sector returns look rather equity-like. Since December 2010, the inception of the AEITR, the S&P500 is ahead 13.3% vs 11.6%. The AEITR is 18% away from where its 12 year return would equal that of the S&P500, less than its YTD performance. We think it will close that gap too.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.