Pipelines Returning More Cash

The old MLP model rarely saw stock buybacks. Traditionally the General Partner (GP) would sell assets to the MLP it controlled in a non-arms-length transaction. The MLP would issue equity and debt to pay for them. MLPs were sellers of their own units, not buyers.

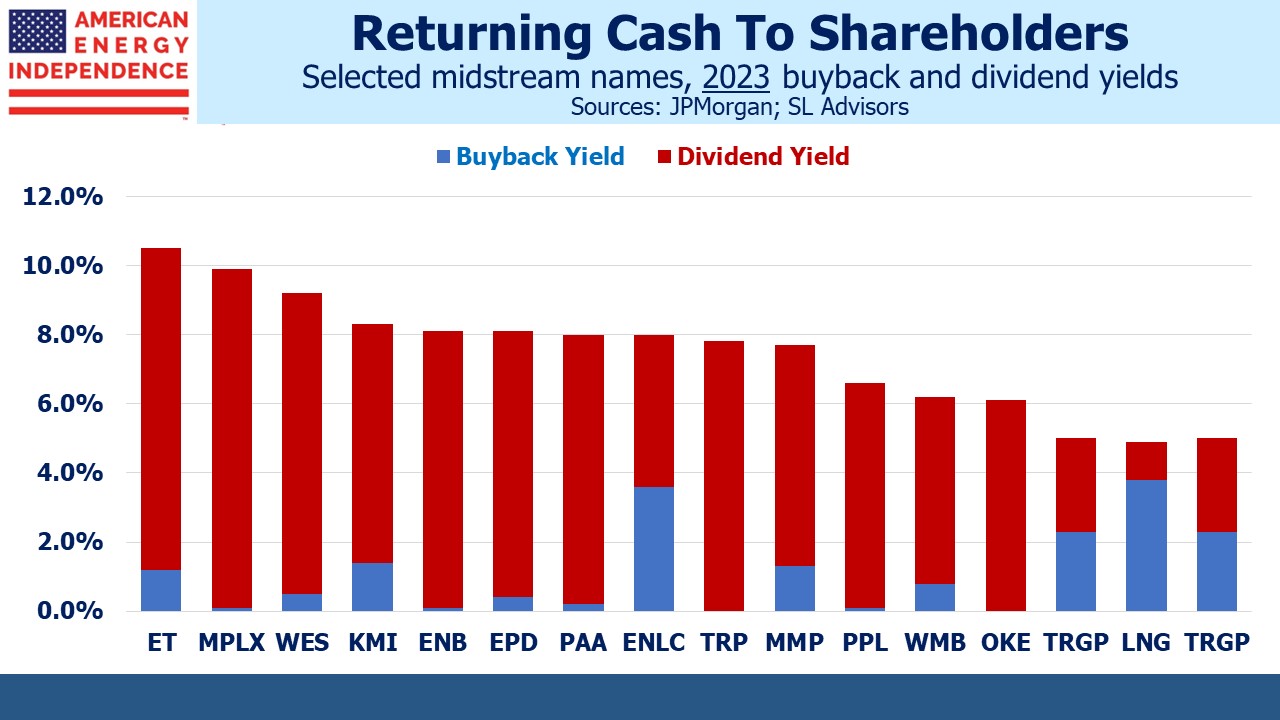

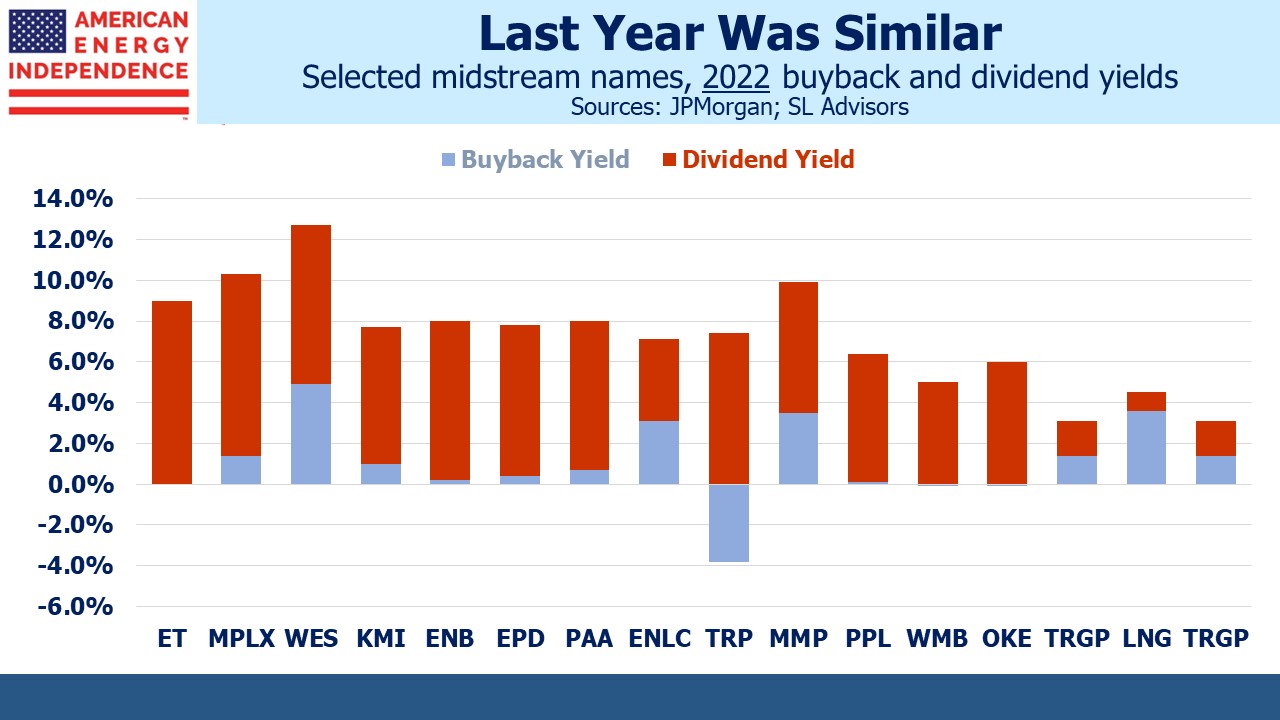

Today’s midstream energy infrastructure sector has left that model behind. Most companies are corporations and most have buyback programs in place. Of the names listed, 12 of 16 retired some stock last year and 14 are expected to do so this year.

The buyback yield (ie portion of outstanding shares repurchased) can be added to the dividend yield to give the total return to shareholders exclusive of price changes. By this measure, half the sixteen companies listed offer a return of 7.9% or greater, assuming they execute their buyback programs as JPMorgan projects through the remainder of the year.

This year’s median dividend yield + buyback yield of 7.9% is up from 7.4% last year, a 7% growth rate. Returns are increasing.

MLPs are repurchasing shares alongside their c-corp peers. Without a controlling GP poised to drop down assets they have more conventional growth capex opportunities of acquisitions and re-investing back in the business.

M&A activity has picked up recently, with Oneok’s (OKE) acquisition of Magellan Midstream (MMP) and Energy Transfer’s (ET) purchase of Crestwood. Investors worried that ET’s issuance of $2.7BN in equity to fund this purchase indicated that buybacks were a lower priority. But the company assuaged these fears with a presentation that earmarks up to 20% of distributable cash flow to buybacks once they’ve reduced their Debt:EBITDA ratio close to 4.0X.

The OKE/MMP deal looks likely to receive shareholder approval now that independent proxy firms Glass Lewis and ISS both recommended a yes vote.

The dealmaking reflects increased confidence in the sector’s outlook by management.

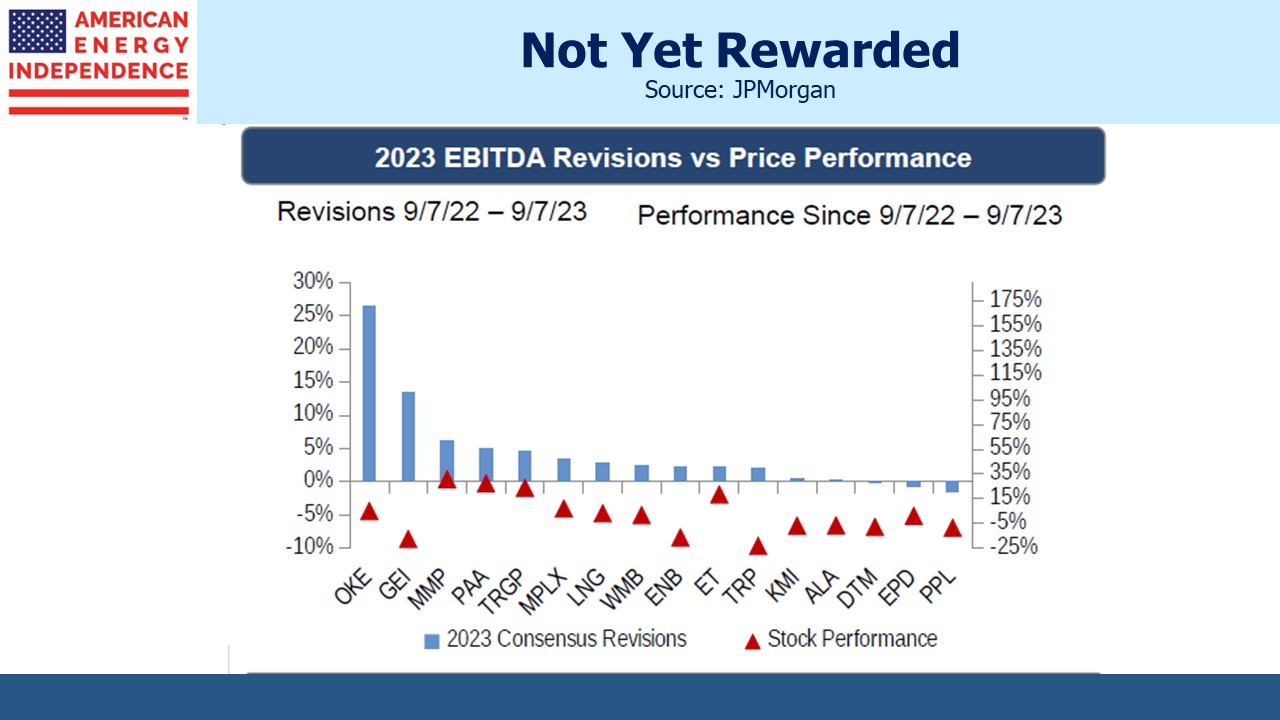

Many companies have revised up their 2023 EBITDA over the past year without seeing it reflected in stock price performance.

Valuations are still below where they were in 2019 before the pandemic, even though companies have de-risked by reducing leverage. Enterprise Value/EBITDA averaged 11.5X for the sector according to JPMorgan and is below 10.0X today. Leverage is coming down and dividends are growing. Capex remains well below the levels of 2018, partly because environmental extremists have turned the courts into a weapon against all kinds of infrastructure including renewables (see Windpower Faces A Tempest). This has helped improve free cash flow among pipeline companies.

Canada has similar problems. The TransMountain expansion from Alberta to British Columbia has quadrupled in cost since Kinder Morgan deftly sold it to the Canadian government in 2018. The ultimate tab might go even higher. Engineering difficulties have led the company to request a different route, but the indigenous community is opposed. Public hearings are scheduled, and the crude pipeline’s completion could be pushed back a further nine months to the end of next year. Unlike in the US, Canada’s native tribes never signed peace treaties with the European settlers. As a result they have greater legal rights including limited sovereignty over their land. Canadian construction projects often have to work around this, as TransMountain is having to.

Unexpected delays are common in pipeline projects, which is why it’s unattractive to build them. This makes the existing stock of infrastructure more valuable.

I used to think climate extremists were trying to put us out of business, but I have since developed a more subtle appreciation of their positive impact on free cash flow since there’s less spending on new pipeline construction.

Hug a climate protester and drive him to his next protest.

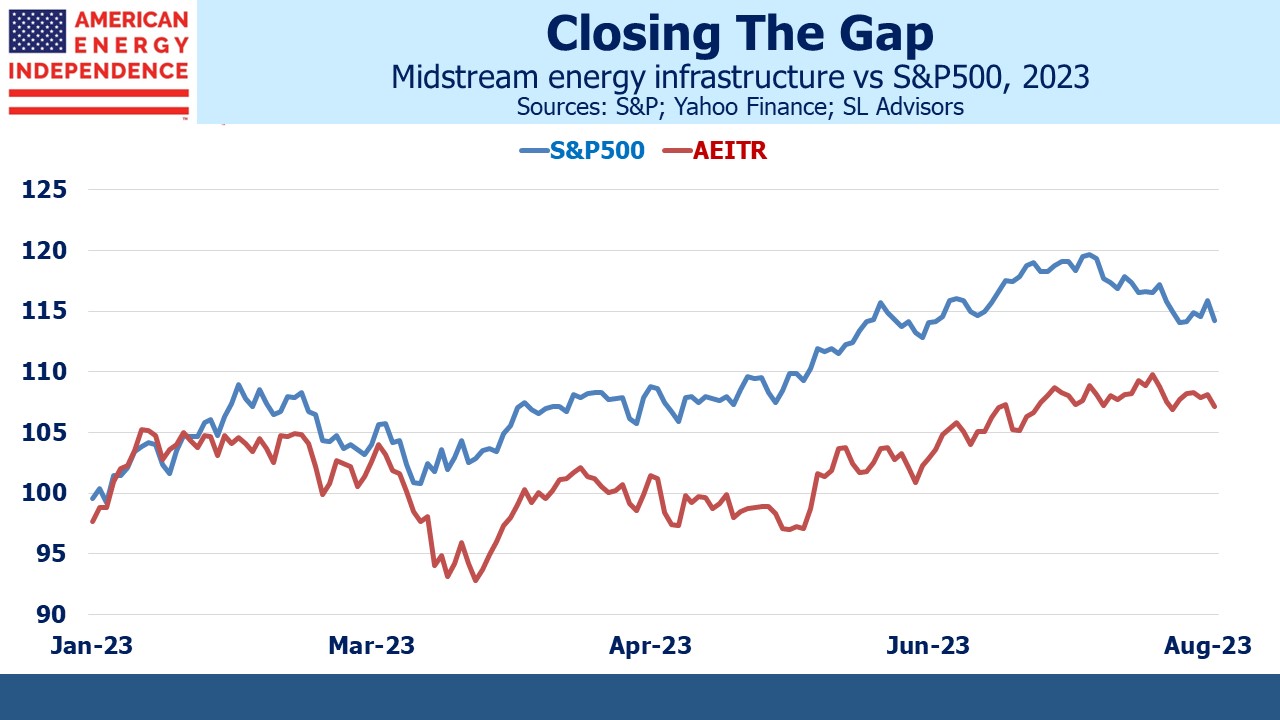

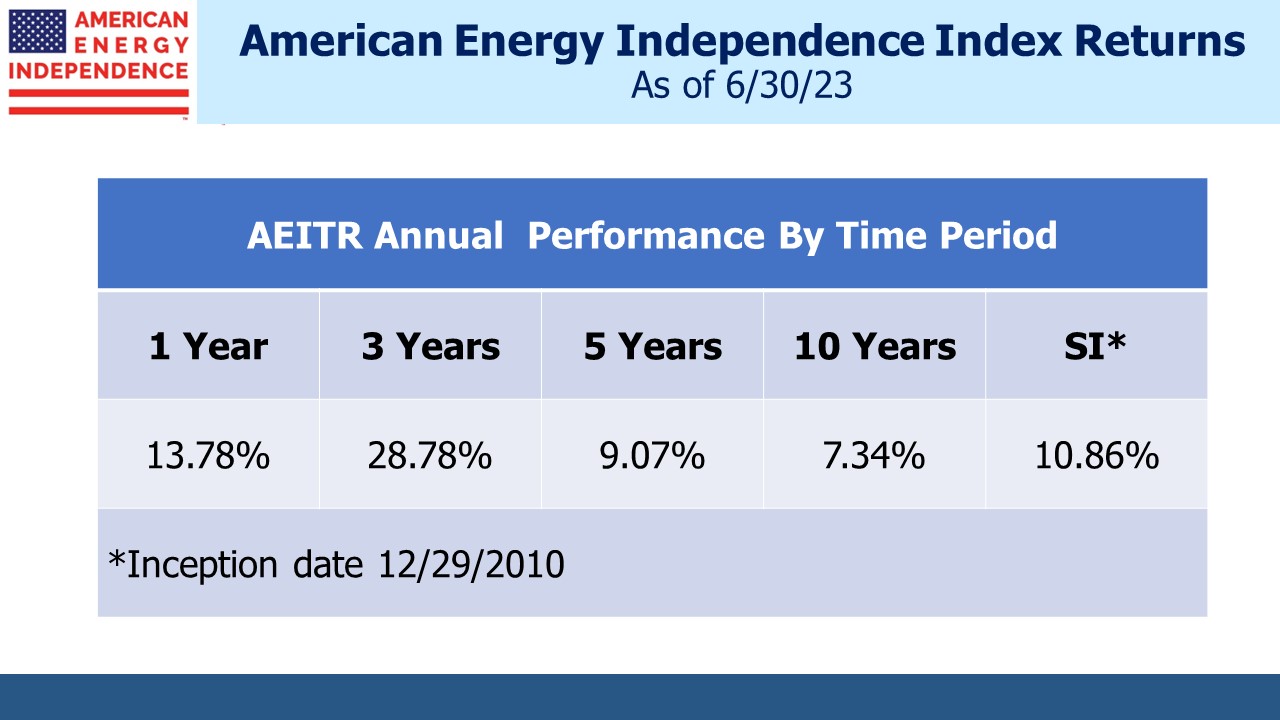

In spite of all these positives, after two very strong years the pipeline sector as represented by the American Energy Independence Index is lagging the broader market this year. It looks cheap to us.

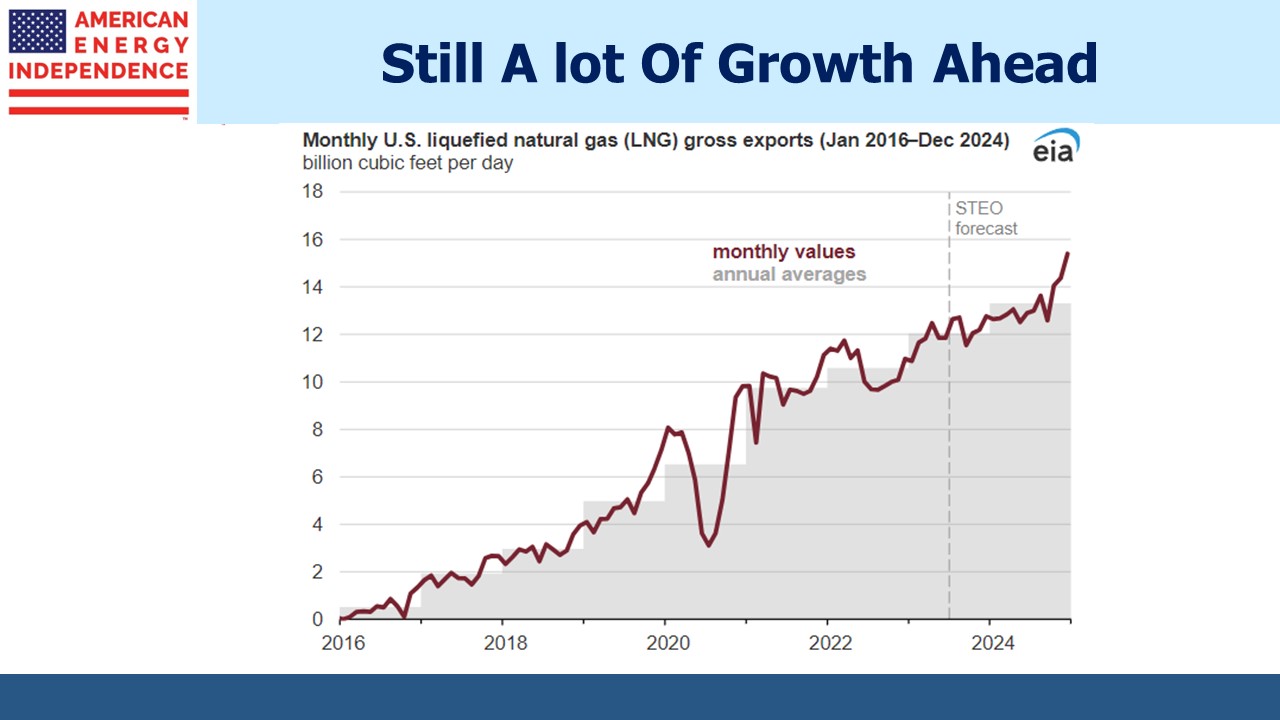

US natural gas prices have been weak in recent months. Domestic demand isn’t growing fast enough to match production – the market needs more liquefaction capacity.

Fortunately, that’s coming. The US Energy Information Administration (EIA) expects gross LNG exports to reach 14 Billion Cubic Feet per Day (BCF/D) by the end of next year. The net may be smaller if Massachusetts imports LNG as they have in the past (see Why Staying Warm In Boston Will Cost You).

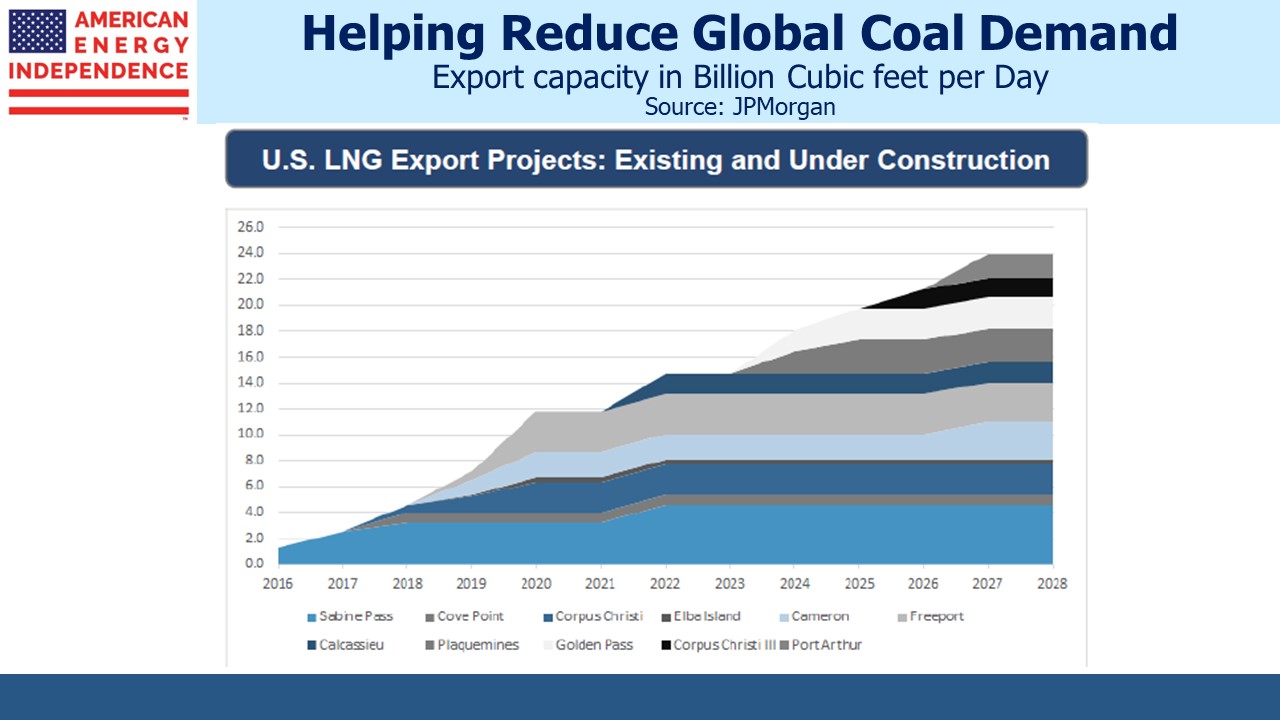

Based on projects under construction, we should be exporting 24 BCF/D by 2027, a doubling over five years. This will add upward pressure to cheap US prices and will enable other countries to reduce their use of coal for power generation.

The valuations, strong fundamentals and growth prospects make this one of the most overlooked sectors in the market.

We three have funds that seek to profit from this environment: