Pipelines Grow Into Lower Risk

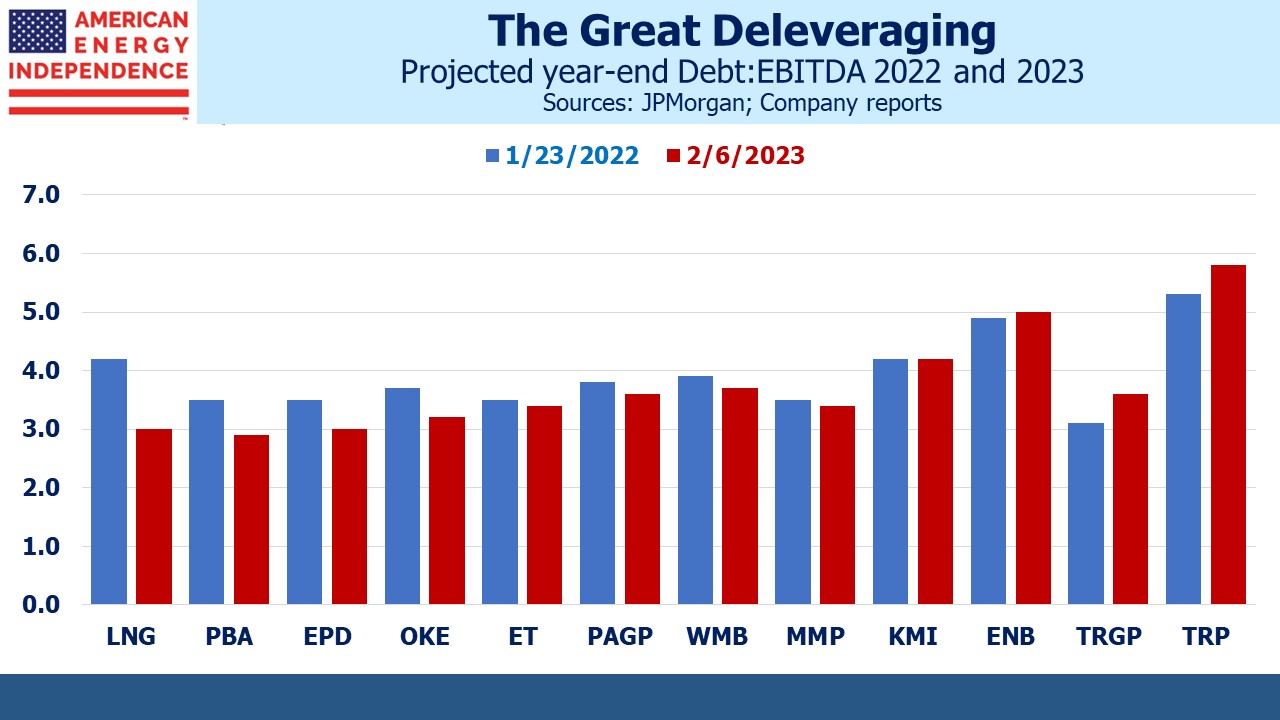

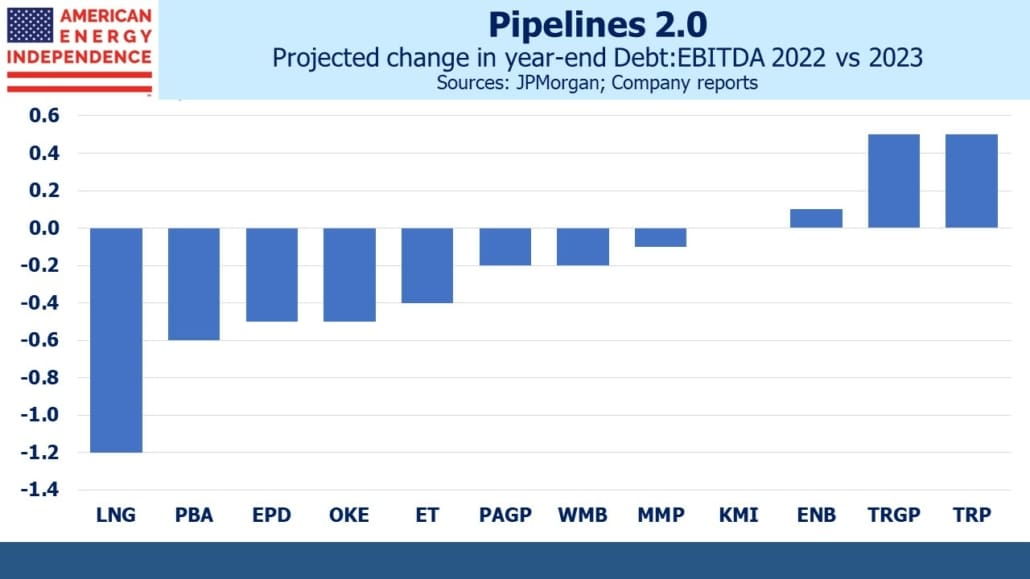

Enterprise Products Partners’ (EPD) earnings release last week revealed that leverage (Debt:EBITDA) fell to 2.9X at the end of last year. They are now targeting 3.0X, down from 3.5X previously. This is among the lowest in the industry, and reflects a continuing trend to strengthen balance sheets, de-risking the businesses. Years ago, Kinder Morgan argued to rating agencies and investors that their diverse asset footprint justified a 5.5X debt multiple. Poor capital allocation (see Will Kinder Morgan Cover Its Cost Of Capital?) led to distribution cuts and KMI has since fallen in line.

Also cheering for investors is that higher EBITDA has been the main driver of the lower risk profile. Growth is creating stronger balance sheets.

JPMorgan estimates that average leverage at big US pipeline corporations and MLPs this year will average 3.5X. Canadians Enbridge (ENB) and TC Energy (TRP) push this figure higher. ENB’s business includes gas distribution with regulated rates and is generally perceived as less risky.

The International Energy Agency recently forecast continued demand growth for global supplies of LNG.

News from the energy patch has been uniformly good in recent weeks, led by strong earnings but supplemented by greater realism about energy security and its impact on the energy transition. Emerging economies, especially in Asia, are growing and how they provide increasing energy to their upwardly mobile populations will determine the path for CO2 emissions.

The US shift from coal to cleaner-burning natural gas for power generation is a great success story in reducing global Green House Gases (GHGs). India is providing encouraging signs of emulating this, with its biggest LNG importer looking to add an additional 12 million Metric Tonnes per year under long term contracts.

Asia-ex Japan burns vast quantities of coal for power generation. The Asia Pacific region consumes an astonishing 80% of the world’s coal output. China is in a league of its own, burning more than the rest of the world combined. India is a distant second at 12% of global demand. PM Narendra Modri recently said he wants natural gas to provide 15% of India’s power by 2030, up from 6% today.

Poorer countries following the US lead in relying more heavily on natural gas to produce electricity offer our best chance of curbing emissions. It won’t be done with only solar and wind.

South Korea is recognizing the shortcoming of intermittent, weather dependent energy. They’re now planning for nuclear to meet a third of their power needs by 2030, up from 24% in their prior forecast. Renewables have been downgraded from 30% to under 22%. In countries with growing energy needs, reliability is a priority.

Exxon and Chevron both reported record profits recently. BP just followed suit, and now plans to increase its spending on oil and gas production although they’re still targeting a production cut of 25% by 2030 (previously 40%). This follows earlier reports that investments in renewables are delivering disappointing returns, leading to less emphasis on ESG goals. BP’s capex decisions are now guided by a long-term price target for Brent crude of $70 per barrel, up from $60 previously.

Siemens Energy is an example of the low returns in windpower, having recently announced a 4Q22 loss of €598MM due to quality issues on installed wind turbines. Siemens is planning to raise €1.5BN in additional equity to shore up its balance sheet.

ESG-driven capital allocation doesn’t assure profits.

Asian urgency around securing long term commitments of LNG supplies contrasts with Europe. Buyers are fearful that signing 20-year deals typically required by suppliers to ensure an adequate return on infrastructure investments will conflict with government regulations on hydrocarbon use. The EU is the region most willing to impose higher costs and inconvenience on their population in pursuit of reduced emissions.

Carbon capture is also growing in Europe. Denmark just approved a project that will by 2030 inject up to 8 million metric tonnes a year of CO2 into depleted oil and gas formations under the North Sea. Returning carbon in the form of CO2 underground into the formations it left as hydrocarbons has a certain logic to it. We noted a similar virtuous loop in Enlink’s plan to transport CO2 in south Texas from a petrochemical plant for eventual storage in the Eagle Ford (see Putting Carbon Back In The Ground).

Energy companies are showing they’re critical to providing secure energy with reduced emissions. It seemed improbable just three years ago, but the sector is having a good energy transition.

We have three funds that seek to profit from this environment: