Pipelines And The Jevons Paradox

Venture capitalist Marc Andreessen called it, ”AI’s sputnik moment.” The news that Chinese start-up Deepseek may have leapt ahead of the US in AI caused an unpleasant start to the week. In 1957 Sputnik’s orbit led to the creation of NASA and fears that Russian satellites could attack the US from space. While Americans have not yet been moved to gaze skyward for Chinese AI-powered threats, its impact was felt by AI-linked sectors of the stock market.

Natural gas pipeline stocks that have enjoyed a tailwind from anticipated data center power demand dropped sharply. At such times it’s worth reviewing valuation and the underlying fundamentals.

The yield on the American Energy Independence Index (AEITR) recently fell below 5% as pipeline stocks continued to appreciate. Last year’s 45% total return was well in excess of cash flow growth but yields at the start of last year were unreasonably high.

Distributable Cash Flow (DCF) yields on the largest pipeline stocks are above 11%, providing ample payout coverage. Some of the lowest-yielding stocks have the highest coverage. For example, Williams Companies yielded 3.6% after its stock dropped almost 10% on Monday. But its DCF yield rose to 7.8%, more than 2X its payout and expected to grow at 7-8% into 2026. They raised their dividend on Tuesday by 5.6%. Kinder Morgan’s (KMI) yield rose to 4.2%, also more than 2X covered by its 8.6% DCF yield.

The data center story boosted both stocks over the past year. Even so, last week’s KMI earnings call was not dominated by AI expectations, with only a couple of questions on the topic which CEO Kim Dang referred to as, “singles and doubles, connecting to power plants, that types of things.”

Energy Transfer’s yield rose to 7%, higher than the sector since it trades at an MLP discount. Its DCF is almost 2X its payout yield at 13.9%. On Monday they announced a 1.6% increase.

Investors will want to assess how much data center power demand is reflected in current valuations. The capex numbers being floated for construction have been startling. Just last week Mark Zuckerberg said Meta could spend up to $65BN this year to achieve its AI goals.

Microsoft (MSFT) expects to spend $80BN this year on data centers. Meta’s stock even rose on the news, as investors contemplated that less compute-intensive AI development could boost free cash flow.

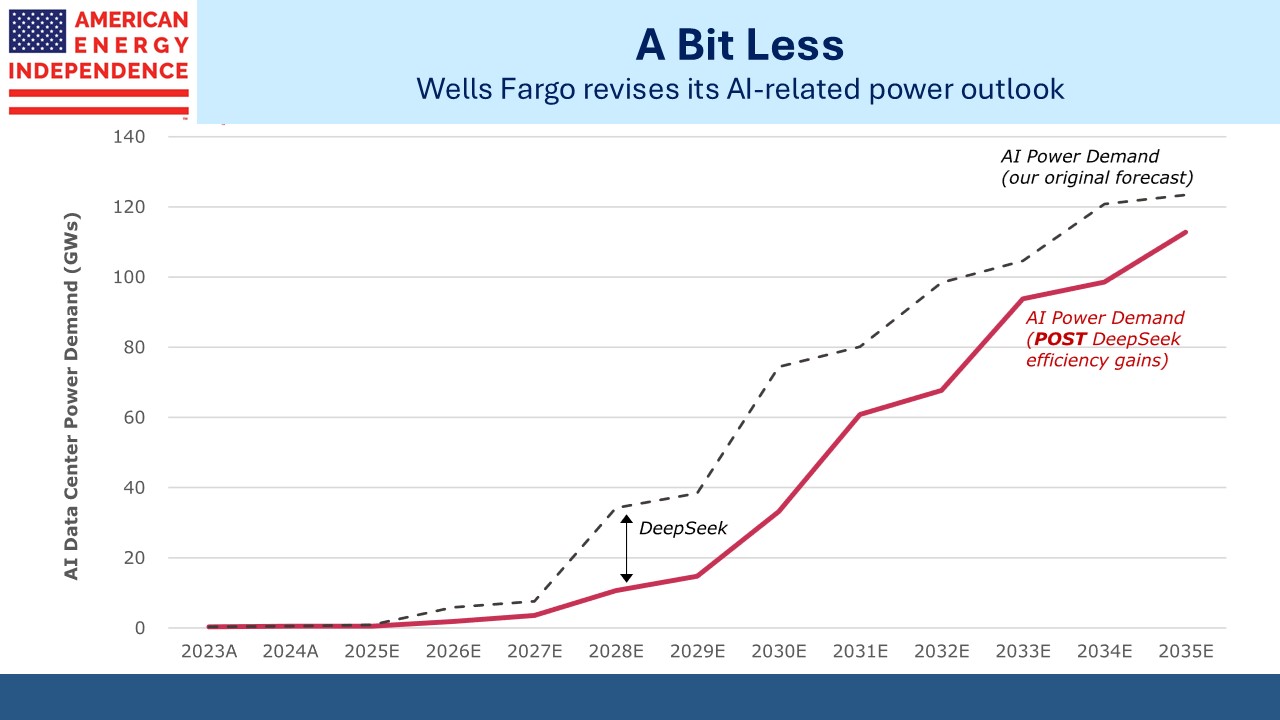

MSFT CEO Satya Nadella tweeted that the Jevons’ paradox could apply, in which efficiency improvements raise overall demand. Perhaps a breakthrough in training AI models will boost their penetration, which could drive power demand even higher than recent projections. DeepSeek’s insights will spread across the industry since it’s open source. It seems incongruous to conclude that better AI will reduce its use or its demand for reliable power.

Wells Fargo expects that the computational improvements demonstrated by DeepSeek will slow near term power demand but still sees 11 Billion Cubic feet per Day (BCF/D) of additional natural gas consumption by 2035, down modestly from their previous forecast of 12 BCF/D. Still, it’s not often that a single news development results in an altered ten year outlook.

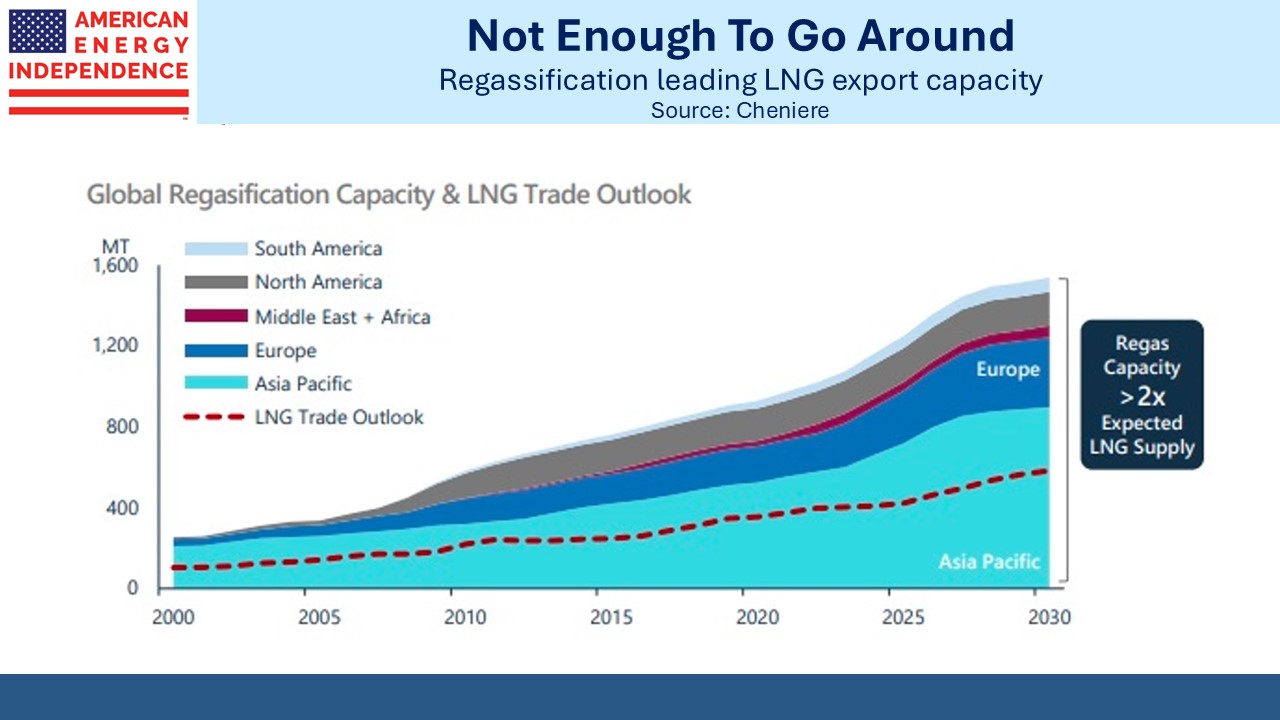

It’s worth remembering that data centers only caught investors’ attention last year. The outlook for natural gas demand was already strong based on rising living standards in developing countries. LNG offers both sellers and buyers flexibility versus pipelines, and the US is increasing its lead as the #1 exporter.

The world is preparing to buy more. Regassification capacity, which enables importers to turn LNG back into a usable gaseous form, is growing faster than supply. For every Billion Cubic Feet (BCF) the US exports, there will be 2 BCF of regassification available. These projects were not predicated on data centers. The fundamentals for traditional energy remain sound.

Enduring such market corrections is never pleasant. They’re rarely over in a day, but history shows that eventually judgment on valuations prevails and prices respond. One good development is that forced selling from MLP closed end funds isn’t likely to depress prices much. These hapless managers including Tortoise, Kayne Anderson and Goldman Sachs destroyed enough capital during the pandemic-induced collapse that they’re now of inconsequential size (see MLP Closed End Funds – Masters Of Value Destruction).

Recent market action reminds why adding leverage to an undiversified portfolio of stocks simply betrays the hubris of the portfolio manager at the expense of the investors.

The worst performance came from Venture Global which began trading on Friday after pricing its IPO at $25, which we felt was too high (see Nothing Ventured, Nothing Gained). On Tuesday it traded below $18, down 28% over two days and far worse than AI darling Nvidia.

Regardless of the outlook for domestic power demand, growing US gas exports will require a doubling of the natural gas pipelines supply to liquefaction terminals over the next four years. The regulatory environment will be more conducive to growing the production and movement of hydrocarbons. Energy is the president’s favorite sector.

AI is far from the whole story.

We have two have funds that seek to profit from this environment: