Oneok’s Deal Makes Everyone Happy

Oneok (OKE) is developing a habit of surprising the market with their acquisitions. Last year’s deal with Magellan Midstream (MMP) was roundly criticized, including by us, because of few obvious synergies and an unwelcome tax bill for MMP unitholders (see Oneok Does A Deal Nobody Needs).

MMP’s refined products business didn’t look like a natural fit with OKE’s oil and gas pipeline network. For a while it looked as if shareholder approval might not be forthcoming, but OKE executives eventually got it across the line. Efficiencies from the combination have turned out to be more lucrative than expected, and strong operating performance has seen OKE return 46% over the past year.

However, the tax bill was as bad as expected. Being a long term MLP investor means an increasing deferred tax liability, and the recapture of this took all the fun out of tax time.

OKE has returned to the acquisition trail by purchasing a controlling interest in Enlink Midstream (ENLC) from Global Infrastructure Partners (GIP), with the intention to acquire the remaining publicly traded interests in ENLC via a tax-free transaction.

Once again, we own both stocks, and as with MMP had no reason to consider they might combine. We had been looking at ENLC more closely than usual in the past couple of weeks and found the relative value compared with Williams Companies (WMB) sufficiently appealing that we shifted some exposure towards it.

Casting around for a blog topic, I summarized our thought process last week (see Deciding When To Sell). Once published, I waited for the relative valuation to explode back through our entry point, exposing our timing on the switch as inopportune while providing great mirth for the blog gods. 44 years of navigating markets is enough to ensure humility comes with every buy or sell decision.

Thanks to OKE the opposite happened. I imagine they were attracted to the distributable cash flow yield, which was 15% prior to the news. They must have been drawn to the prospects for NGL pipeline tariff savings like us but went further and identified multiple points of synergy with their existing business.

OKE paid $14.90 for GIP’s ENLC units. There’s an expectation that the remainder of the outstanding units will be purchased at the same price, but it probably depends on how events play out in the meantime. OKE may conclude that they paid a control premium and that the remaining units can be acquired at a lower price. In any event, ENLC’s value has been more properly recognized.

The transaction is expected to close next quarter, and OKE’s acquisition of the remaining ENLC units during 1Q25.

ENLC is an LLC that elects to be taxed as a corporation. So although investors don’t receive a K-1, it is a holding in the Alerian MLP ETF (AMLP). Like its MLP-dedicated peer funds, AMLP will once more have to hunt among the shrinking pool of MLPs for a replacement.

Analysts responded favorably to the transaction. Wells Fargo’s Michael Blum raised his price target for OKE from $91 to $100 since the ENLC deal, along with the acquisition of Medallion, a private crude oil pipeline and storage business, “…transforms OKE into a vertically integrated competitor in the Permian.”

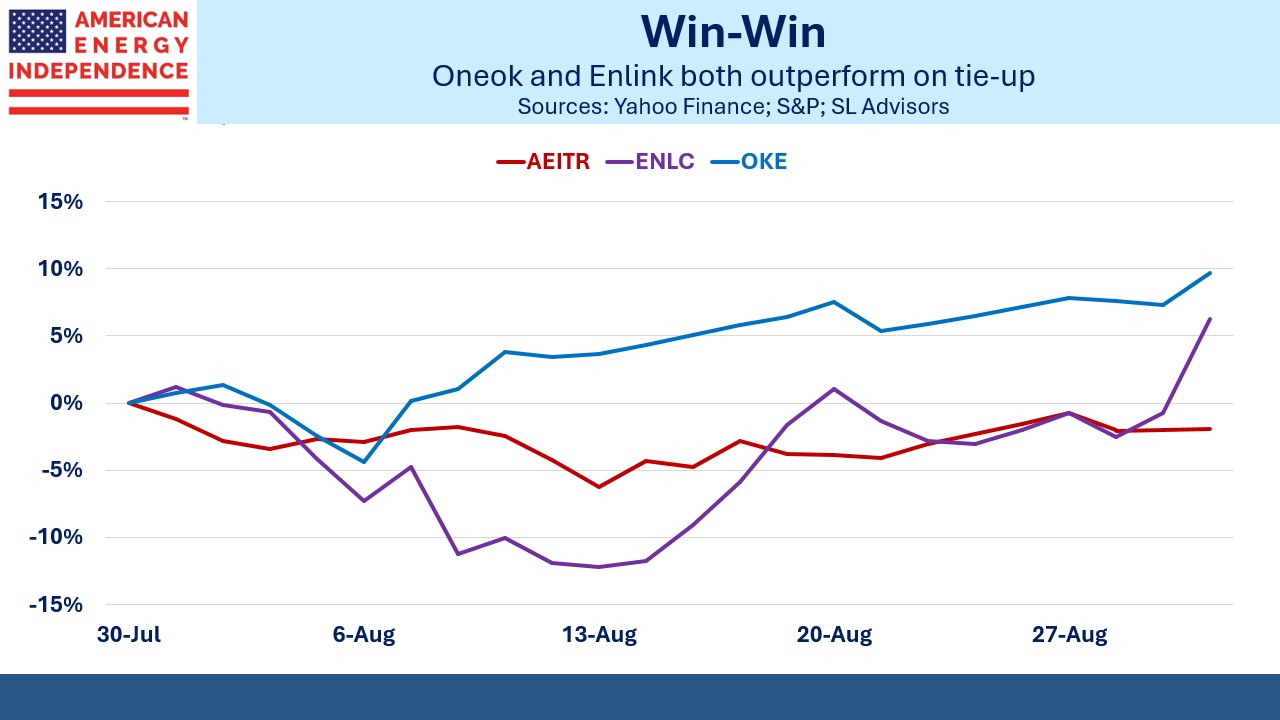

It’s quite a deal when both the acquirer and target stock rise. Over the past month both have now handily outperformed the American Energy Independence Index (AEITR). Following the successful integration of MMP last year, there’s little skepticism among investors that OKE will be able to realize synergies this time around.

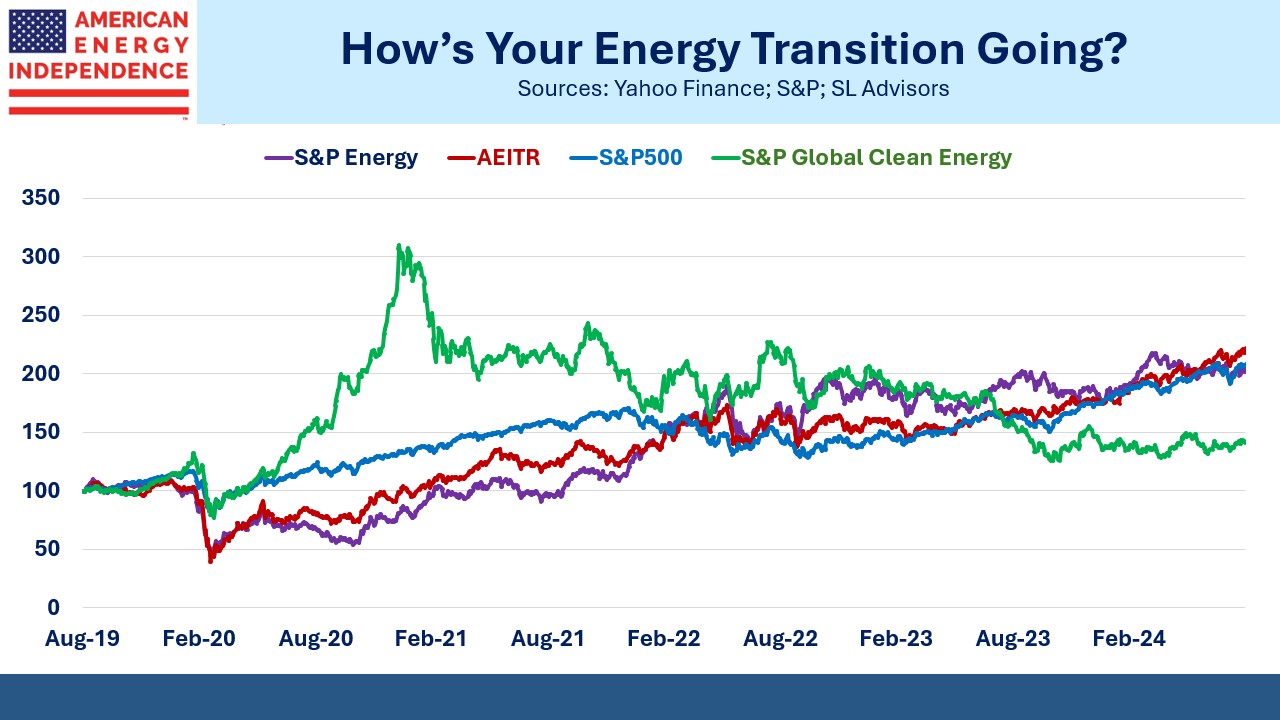

The brief but very sharp collapse in stocks during the early stages of the covid pandemic is increasingly a distant memory. Over the past five years midstream energy infrastructure has continued to outperform both the S&P500 and the energy sector itself. Capex fell in response to some cases of overinvestment in shale plays, although Americans continues to benefit via cheap energy and higher employment. Midstream companies have stronger balance sheets and with less to build they’ve been increasing cash returns to owners via buybacks and dividend hikes.

Existing investors know this, and yet also understand how narrowly it’s appreciated by the larger market. The energy transition continues to deter many from committing capital to traditional energy because of fears of stranded assets. This overlooks the fact that the portion of the world’s primary energy provided by fossil fuels remains consistently around 83%. Increases in solar and wind are barely enough to satisfy additional energy demand.

As a result, energy businesses that generate reliable, growing cashflows have generated the best returns. The S&P Global Clean Energy Index has lagged the S&P500 by 8.5% pa over the past five years, and the AEITR by 10% pa.

The pick-up in M&A activity illustrates greater comfort in the outlook.

From where we sit, the energy transition is going well.

We have three have funds that seek to profit from this environment: