Lower Volatility Stocks Gain Favor

Low volatility is outperforming. In a rising market, taking more risk usually pays off. The recent reversal has investors seeking tangible value.

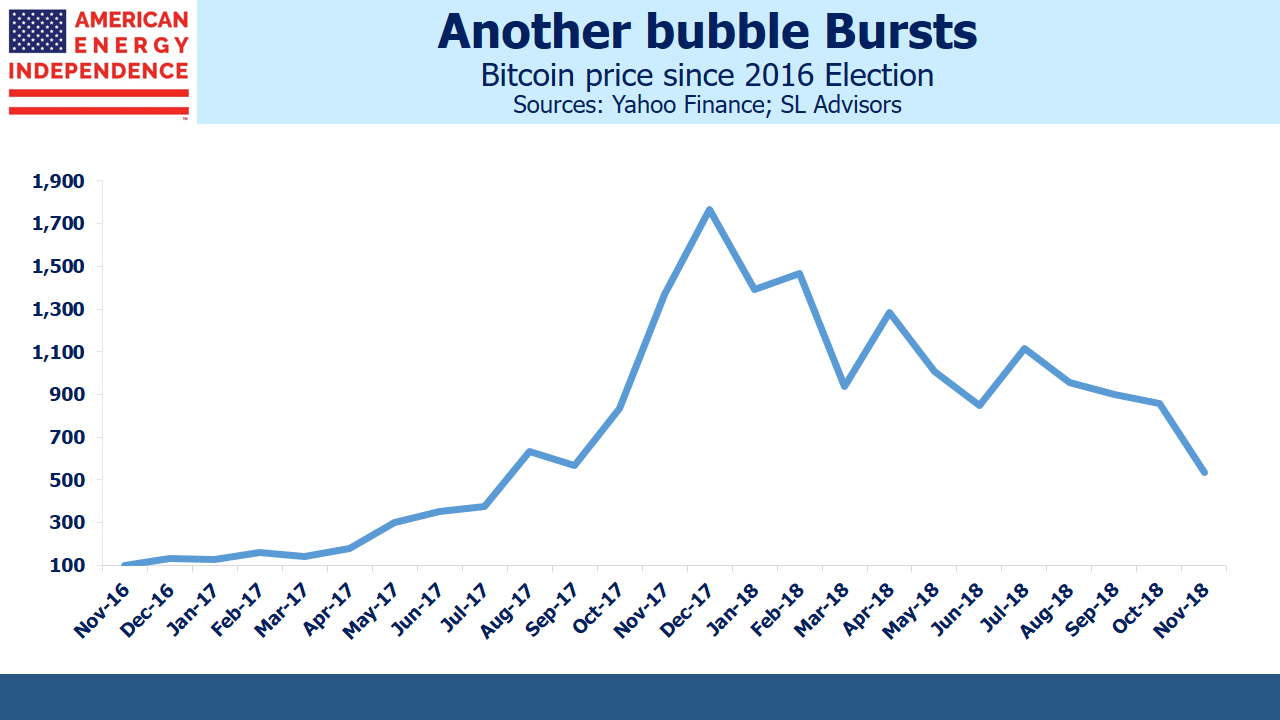

Nothing exemplifies intangible value, or more accurately ephemeral value, better than Bitcoin. The great Risk On trade began the day of Trump’s election victory, when an overnight market swoon quickly reversed. Bitcoin buyers embraced the new mood more exuberantly than most, running the price briefly as high as $20,000 by last December, from $730 at the time of the election.

As a currency, Bitcoin has spectacularly failed the “store of value” test. Its proponents assert that freedom from government oversight ensures its value cannot be manipulated for political purposes. It’s similar to the argument made by gold investors, although fiat money (what followed when Nixon suspended convertibility of the US$ into gold in 1971) has done pretty well. Bitcoin is a solution in search of a problem. Among the many risks that Bitcoin investors face is that their exchange is hacked, with scant protection from the governments whose protections they skirt.

Bitcoin has now lost 80% of its peak December 2017 value. Wherever speculators take it from here, the case for a new currency free of government control and protected by no-one is lost.

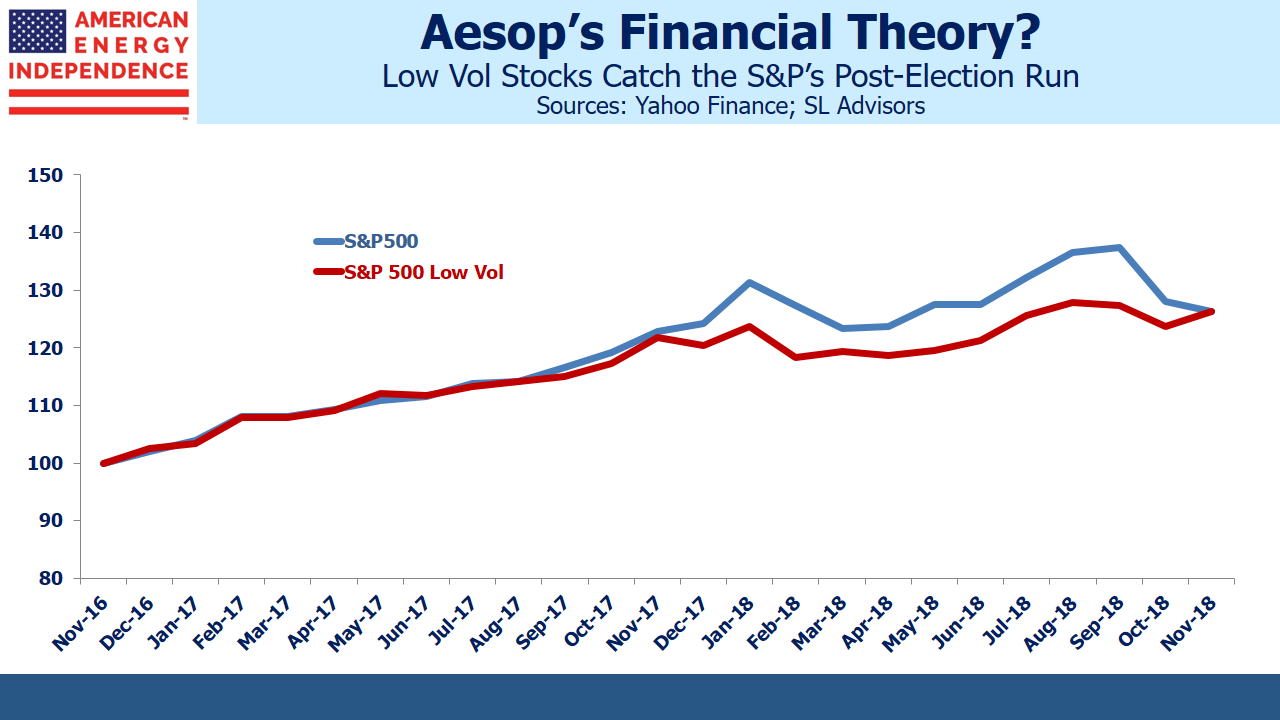

By contrast, low volatility stocks, possessed of more tangible value than Bitcoin, are enjoying a resurgence. The rapid exit from momentum that Bitcoin previewed a year ago is rippling across equity markets (see FANG Goes Bang). The beneficiaries include consumer staples, such as Clorox (CLX), Kimberly-Clark (KMB), McCormick (MKC) and Procter & Gamble (PG). The sector was boring when CNBC was debating the relative merits of FANG stocks Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG), but earnings stability can be attractive too. The S&P Consumer Staples Index has a beta of 0.69 and dividend yield of 2.75%, whereas the FANG stocks have an average beta of 1.47 and pay no dividends.

The Low Beta Anomaly examines a weakness in the Capital Asset Pricing Model (CAPM), a widely used framework for valuing securities. It relies on the sensible premise that more risky investments should generate a higher return. History shows this isn’t true, and numerous academic papers offer reasons why. A compelling explanation is that active equity managers, paid to beat the market, are drawn to stocks that move more than the market (“high beta”). New clients are most easily found when the averages are rising, and relative outperformance helps. The result is that in aggregate, investors pay more than a CAPM-derived price for high beta, lowering the subsequent return on such stocks and correspondingly driving up the return on less-sought low beta names.

It’s Wall Street’s version of the tortoise and the hare. Consumer staples stocks are solidly in the low beta, or low volatility category. As the post-2016 election endorphins subside (admittedly, it’s taken a long time), less risky stocks look better. After lagging for much of the year, low volatility has caught up with the S&P500 (which is burdened with a healthy number of high beta names). The new darling sector is the one that grows slowly, albeit reliably. It’s the antidote to Bitcoin and FANG-fueled excitement.

Our portfolio of low volatility stocks has a beta of 0.49 and a dividend yield of 3.2%. Most of the names have decades of consecutive annual dividend increases. Although its yield is half that of energy infrastructure (the American Energy Independence Index has a dividend yield of 6.3%), the absence of high volatility is drawing more buyers.

We are invested in CLX, KMB, MKC and PG

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).