Hyperscalers Plow Ahead

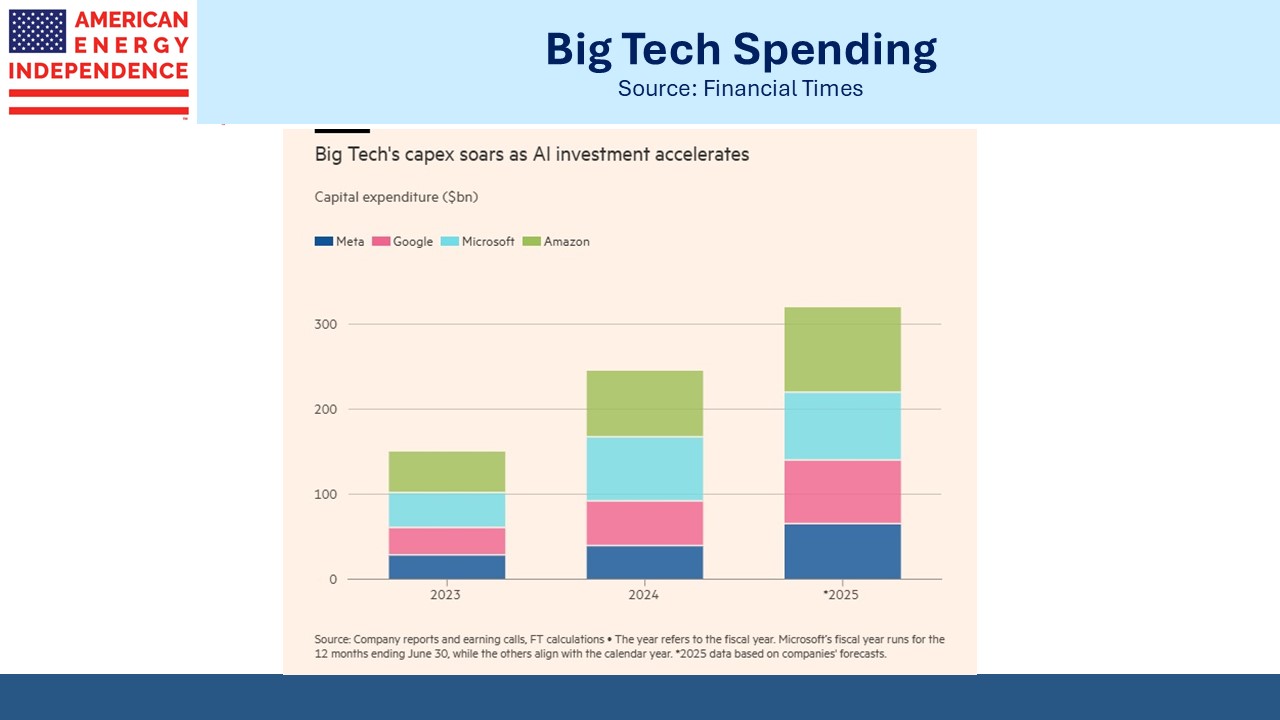

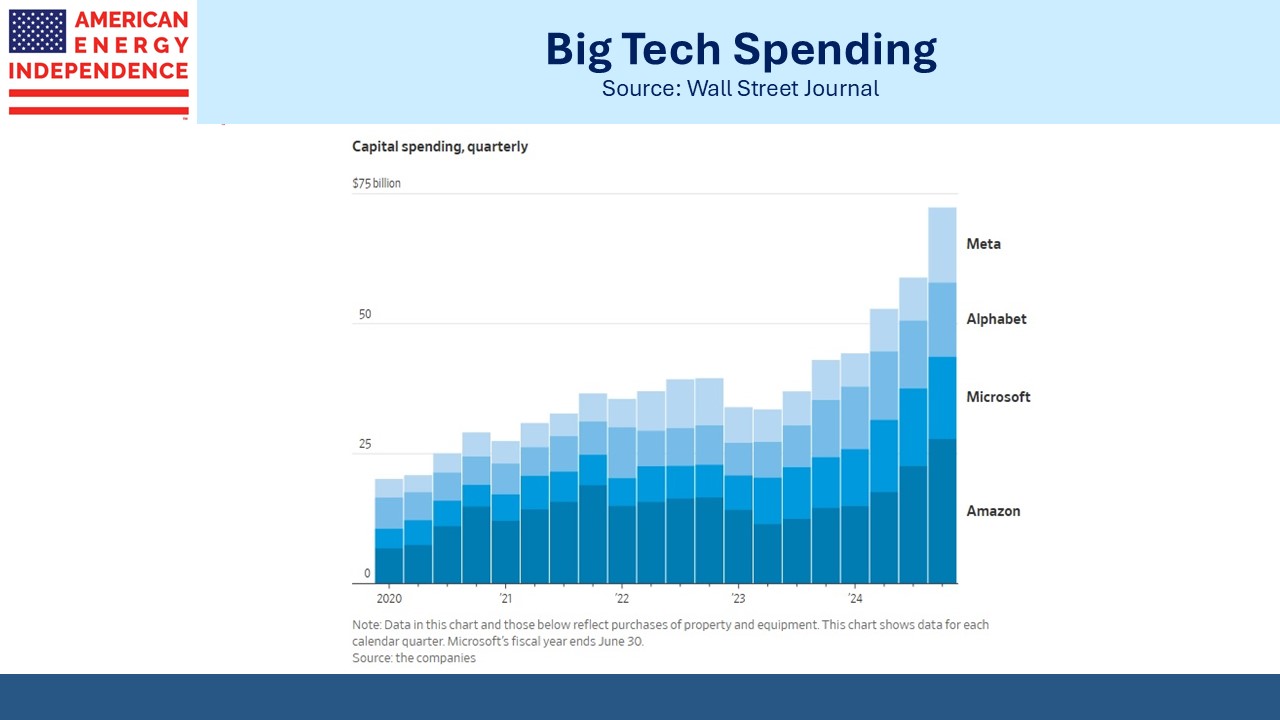

On Friday both the Wall Street Journal and the Financial Times ran stories about planned capex on data centers by the big US tech companies. The DeepSeek news of two weeks ago hasn’t resulted in any discernible change. The case for increased power generation remains intact.

On Wednesday Williams Companies will report their quarterly earnings. They have hinted that they may announce a “behind the meter” (BTM) deal to provide natural gas for a dedicated power station co-located with a new data center. They have in the past said there are numerous discussions under way. BTM arrangements bypass the existing grid, which speeds up approvals and installation.

Electricity grids operate with high fixed costs that are broadly shared across customers, commensurate with their usage. Adding significant new infrastructure to accommodate growth in demand spreads that new expense across the user base, in effect subsidizing the new users at the expense of the existing ones. Regulators will look carefully at this to ensure rates don’t go up unreasonably.

Talen Energy and the PJM grid plan to provide nuclear power to a new data center being built by Amazon Web Services. FERC rejected the agreement, finding it was potentially adverse to utility customers because it would require additions to the existing grid infrastructure and possibly increase rates for everyone. BTM is a way to avoid that.

However, it means the data center is exposed to downtime on its co-located power source. Natural gas combined cycle power plants typically run 95% of the time, far better than the 20-35% common with solar and wind, which is why renewables aren’t much use to data centers. Nonetheless, even 5% downtime for maintenance leaves a coverage gap that a grid connection could otherwise alleviate. As further announcements are made we’ll see how the industry is addressing the challenge.

Liquefied Natural Gas (LNG) stocks slipped last week on reports that the White House is negotiating directly with Russia to end the war in Ukraine. There’s some speculation that the conclusion of hostilities could prompt a resumption of EU imports of natural gas from Russia, reducing the need for US LNG.

The Nord Stream gas pipelines that sent Russian gas to Germany rank up there among the dumbest energy policies in history. Trump railed against this dependency during his first term in office, rightly asking why US troops were stationed in Germany to protect against an attack from their gas supplier. Since the invasion Russia’s natural gas exports have fallen by more than half. It has struggled to find buyers and to get its gas to market.

We think any natural gas agreement as part of a Ukraine ceasefire is more likely to embed EU imports from the US not Russia. Thoughtful European policymakers won’t want to repeat the misplaced trust in Russia of former German Chancellor Angela Merkel, who should be spending her retirement giving speeches apologizing for her strategic blunders.

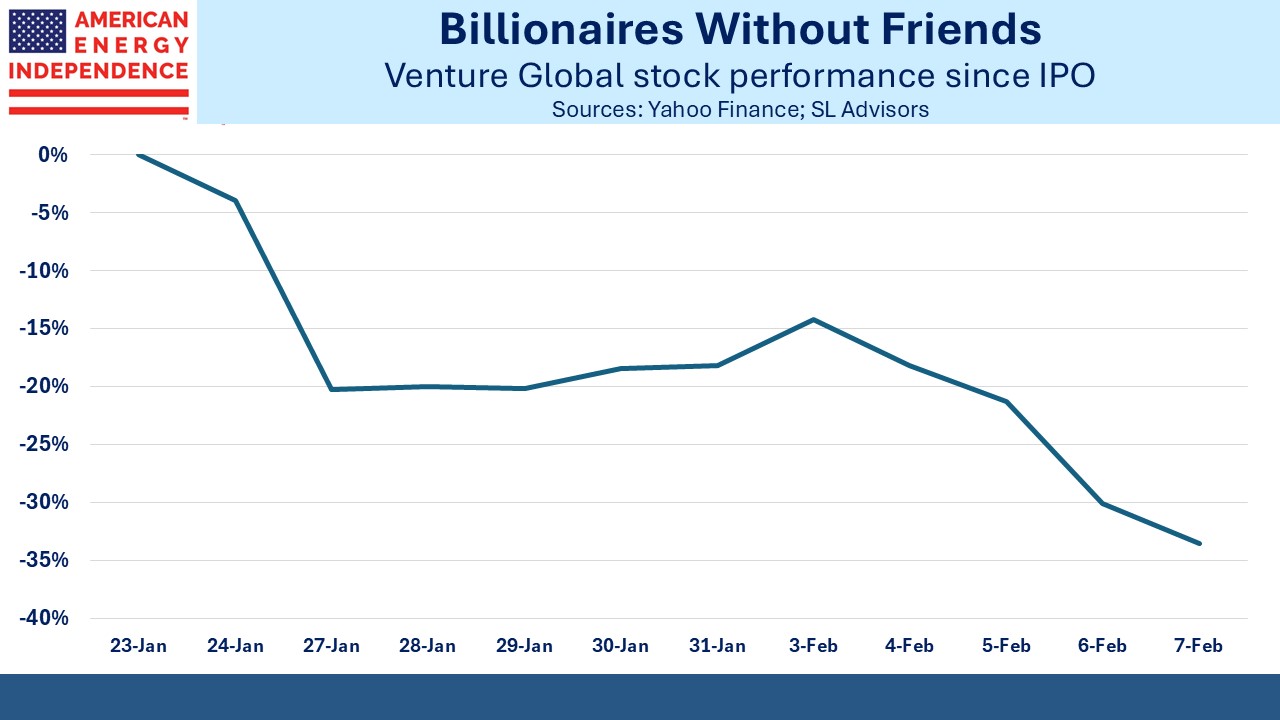

Venture Global (VG) has traded off sharply since its IPO. The market is applying a management discount based on how they’re perceived by customers. Last week Total CEO Patrick Pouyanné said they decided not to become a long term buyer of LNG from VG because they didn’t trust the company. This was in spite of the attractive terms being offered.

Once an LNG “train” or export facility is fully commissioned it is generally expected to begin shipping LNG under the terms of its long term contracts. VG’s interpretation of commissioning for its Calcasieu Pass terminal has resulted in a dispute over $BNs in profits that Shell, BP, Galp and Repsol believe they should have earned. VG said the terminal wasn’t complete, allowing them to reap huge profits following the spike in gas prices after Russia invaded Ukraine (see Nothing Ventured, Nothing Gained).

The dispute is in arbitration. Even if VG prevails, their reputation is in shatters. Some of the biggest buyers of LNG won’t do business with them. Even if they do, it’s likely that they’ll negotiate from the perspective that good faith isn’t in the VG lexicon.

Add to this VG’s initial IPO price target which would have valued the company at over $100BN, more than double Cheniere who handles half of America’s LNG exports. Even at its greatly reduced IPO price it was still, briefly, the most valuable publicly listed LNG company. Since then it’s slumped, to the chagrin of IPO buyers who are down by a third.

It seems that if VG shows you an attractive LNG export proposal, you’re supposed to be wary. And if the founders want you to buy some of their stock, the profitable move is to go short.

Founders Michael Sabel and Robert Pender have become billionaires while alienating a lot of key industry figures. VG’s management discount to its valuation is going to be around for a long time.

We have two have funds that seek to profit from this environment: