Few Laughs In Gas Last Year

Energy was a laggard in 2025, and within that Liquefied Natural Gas (LNG) stocks were especially weak.

The S&P Energy Index was +9.1%, 8.8% behind the S&P500. The American Energy Independence Index (AEITR) was +1.7%. The five-year annual trailing return on the AEITR is well ahead of the broader market (23.6% vs 15.3%). Over the past ten years they’re still close (14.3% vs 14.8%) which is pretty good given the MAG7 impact on the S&P500 and the current attractive valuations for midstream.

Macro headwinds hurt LNG. Many analysts are forecasting a supply glut over the next few years as global liquefaction capacity grows, especially in the US. The spread between global import benchmarks TTF (Europe) JKM (Northeast Asia) and the US Henry Hub narrowed, reducing the arbitrage opportunity in the spot market. And White House efforts to force a cessation of hostilities in Ukraine has made increased Russian LNG exports more likely.

The EU imported over 142 Billion Cubic Meters (BCMs) of gas in 2025, with Russia their second biggest provider behind the US representing probably over 15% of that supply. That the EU continues to buy Russian gas while selling Ukraine weapons to kill Russians confirms that they’re a big market but geopolitically incoherent.

Softer global LNG prices weighed on America’s two largest LNG exporters, Cheniere and Venture Global (VG), by reducing the arbitrage opportunity from using uncontracted liquefaction capacity on the spot market. Many expect soft global prices to persist, although futures going out to 2030 for TTF and JKM don’t reflect this.

If the feared LNG glut does materialize over the next couple of years, the buyers who have signed multi-year Sale Purchase Agreements (SPAs) are more exposed. LNG exporters typically contract out most of their liquefaction capacity at fixed prices. VG has retained more spot exposure than Cheniere, which introduces more variability to their cash flow forecasts.

VG quickly sank from its $25 IPO price in January to less than half that level in the spring. It looked attractive, but losing the arbitration case to BP in October (see Gassy Isn’t Happy) caused the market to price in adverse outcomes in all the remaining cases plus an additional haircut. Because in August VG won the case Shell brought with similar facts and circumstances, it’s hard to be confident about how the rest will turn out.

VG had a good year operationally. They reached FID on Calcasieu Pass 2 and signed six SPAs all for twenty years. The expansion of their Plaquemines facility is on schedule and phase one ramped up volumes faster than many expected. VG’s liquefaction capacity will rival and at times exceed Cheniere’s over the next several years.

Nonetheless, the continued uncertainty leaves the stock priced for more than the worst case, down over 70% from its IPO price.

Weakness in NextDecade (NEXT) has been especially hard to explain. They have limited exposure to soft LNG prices for now because they’re not generating any cash and when Stage 1 is completed they’ll only own 21% of the economics. They reached Final Investment Decision on Trains 4-5 (Stage 2) where they have better economics.

NEXT acquired the needed equipment before prices rose, which derailed other less developed projects such as Energy Transfer’s (ET) Lake Charles facility. Although ET has signed multiple SPAs, rising demand for specialized equipment has depressed their anticipated liquefaction margins. This benefits projects that are further ahead by reducing any potential LNG glut.

NEXT continued to sign strong SPAs. Their contractor Bechtel is ahead of schedule and on budget for Phase 1. And they didn’t issue any more equity. For now, it’s a development stage company with no revenues and if it wasn’t already public wouldn’t seek a listing. But the long-term story remains intact and we think double digit multi-year returns are in store for current holders.

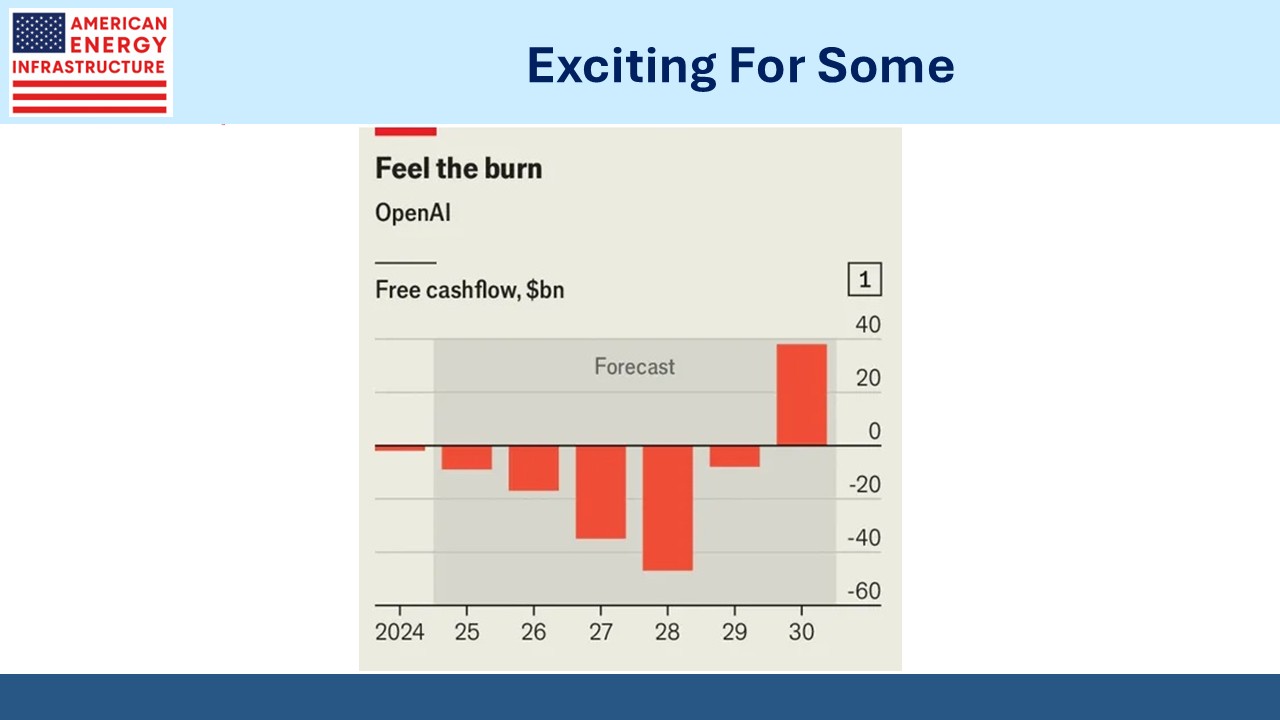

NEXT’s cashflow trajectory over the next five years is similar to OpenAI, albeit of smaller magnitude and with a little less hype.

New Fortress Energy (NFE), focused on LNG and power solutions in the Americas, faces an uncertain future following several execution failures. CEO Wes Edens, who became a billionaire by co-founding Fortress Investment Group, has disappointed investors with project delays and failures in Brazil, Mexico and Puerto Rico.

Five year 12% bonds issued in late 2024 soon lost value, and in May slumped to 40. One usually thinks of bond investors as taking a more jaundiced view of a company’s finances given their risk/return asymmetry, but in this case they weren’t skeptical enough.

In November, NFE missed an interest payment and is currently under a forbearance agreement, which was extended from December 15 to January 9. Bond holders could claim a default if it’s not extended further.

The deft touch that Wes Edens showed in finance hasn’t extended to NFE.

The outlook for global natural gas demand remains underpinned by electricity consumption. Data centers for the AI revolution as well as generally rising living standards are driving it higher. America derives a relatively high 43% of its electricity from natural gas, because at $3-4 per Million BTUs it’s cheap. China is around 3%, but if LNG prices fell sufficiently switching from coal could make commercial sense across Asia, providing a floor to LNG prices.

Domestically, demand from LNG export terminals continues to increase. Gas for power generation fell slightly last year, but the Energy Information Administration expects that to reverse this year with 1.6% growth.

The Permian in west Texas produces associated gas (i.e. as a byproduct of crude oil) and if oil prices fall enough to make some wells unprofitable, that could in turn lower gas production. There’s still insufficient takeaway capacity in the region, which caused gas prices at the Waha hub to be negative almost a quarter of the time last year. But steadily rising gas output overall seems highly likely.

Natural gas infrastructure assets are cheap. Cheniere trades at a 12% Distributable Cash Flow (DCF) yield and is best in class. If VG was to lose $5BN (a worst case scenario) in arbitration cases and penalties, they’d still have a DCF of 11%. ET was –9% last year and has a DCF yield of over 15%. Stock performance for many midstream names was disappointing, but valuations remain compelling.

We have two have funds that seek to profit from this environment: