Energy Independence Is Not Just For America

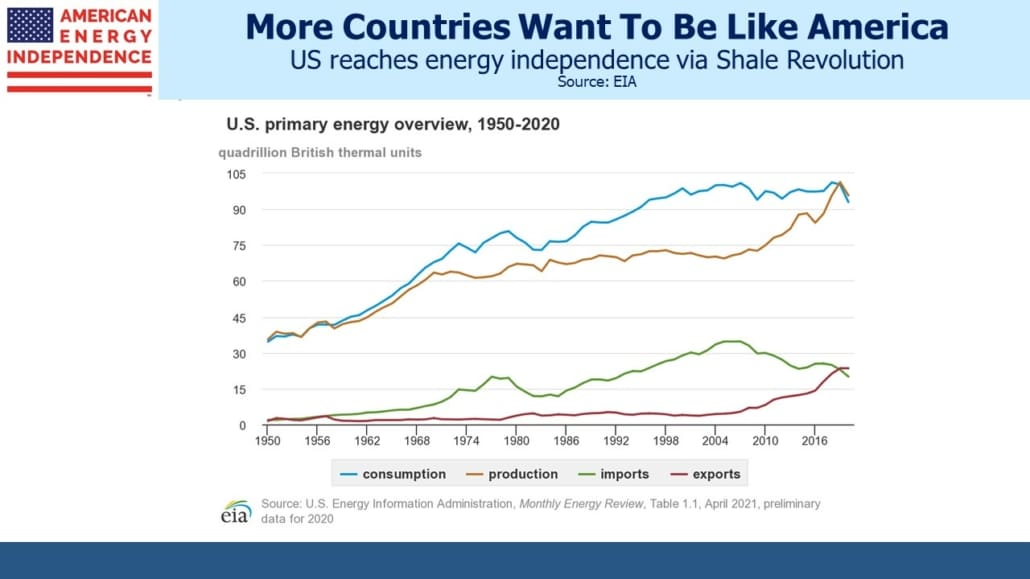

In the US, energy independence has been a sought after goal for generations. Ever since the 1973 Arab oil embargo in response to the Yom Kippur War, US presidents have spoken out in favor of reducing our dependence on foreign oil – notably OPEC. There are several definitions of energy independence — The definition of independence. Traditionally it’s applied to crude oil because of the iconic photos of American drivers sitting in gas lines in the 1970s. A broader and more accurate definition combines all primary energy into British Thermal Units (BTUs) and calculates that trade balance. By this measure the perennial quest for US energy independence was finally achieved, in 2019. Thanks to the Shale Revolution and fracking, we now produce more energy than we consume.

Few other countries have been as focused on energy independence. Some, such as Germany, in hindsight embraced energy dependence in a catastrophic effort to draw Russia closer through trade ties.

Russia’s invasion of Ukraine has elevated energy independence as a pillar of national security. Germany might be the most connected to Russia, and therefore the most vulnerable. They hurriedly abandoned their previous strategy and announced their intent to drop Russian oil and gas imports just as soon as they can be replaced. Since Russia knows its gas trade to Germany is on borrowed time, it’s a good bet the flows will stop when Russia chooses and not when Germany is ready. It’ll provide a further lesson to everyone on the importance of diversified sources of energy.

Hydraulic fracturing (“fracking”) is almost exclusively a US practice. We listed the reasons in a blog six years ago (see Why the Shale Revolution Could Only Happen in America). The right type of rock, plentiful water and availability of capital are among the most important reasons. Less appreciated is America’s unusual form of property ownership in which mineral rights often belong to the owner of the land beneath which those minerals lie. We haven’t come across another country with anything similar. This makes it easy for private companies to partner with landowners to extract oil/gas and share the profits.

In the UK, like most countries, the government owns mineral rights. So when Cuadrilla set out to frack beneath the land of Lancashire in northern England, their activities quickly became a political issue since the government was approving exploitation of a resource they owned.

Cuadrilla’s efforts quickly ran into bitter local opposition, and in 2019 the British government finally bowed to public pressure (see British Shale Revolution Crushed: America’s Unique Ownership of Oil and Gas).

Cuadrilla’s two wells are due to be capped for good soon. But UK PM Boris Johnson responded to the Russian invasion by promising a revised “energy supply strategy” that would be more reliant on domestic energy resources. Britain was importing Russian Liquified Natural Gas (LNG), so can at least source elsewhere with America an obvious beneficiary. Meanwhile, Cuadrilla is now making a last-ditch attempt to revive their efforts.

Rethinking energy security isn’t limited to those countries that buy directly from Russia. Argentina’s Vaca Merta (“dead cow”) shale rock formation is the world’s second biggest shale formation for natural gas (behind the Marcellus shale in the northeast US). Argentina has struggled to develop this resource, but just announced a new concession to Chevron as part of a 282 sq km area area they hold rights to.

Greece has announced plans to speed up gas exploration in order to reduce their reliance on Russia, and hopes to do their first test drill in two decades by the end of next year.

Israel has reached gas independence thanks to resources in the eastern Mediterannean, and now provides natural gas to neighboring Egypt and Jordan. They see opportunities to export to the EU as it drops Russian supply.

India is planning to increase domestic coal production – both to meet growing internal demand but also to lessen its reliance on foreign supply. Indonesia, Australia and South Africa are the country’s largest suppliers, and together account for over 90% of coal imports.

The consequences of the war in Ukraine are being felt all around the world. The virtual cessation of global trade with Russia has caused many governments to reassess their vulnerability. Israel has fought wars against its neighbors and is in a hostile neighborhood. India probably worries about more strenuous efforts to reduce CO2 emissions impeding the trading of coal, on which their power sector relies heavily.

All of a sudden, energy independence is not just for America even though it’s been a goal almost since Saudi Arabia discovered oil. Every country is or will assess their vulnerability to disruption of imports. Diversity of supply is now vital. New pipelines will only link countries that have very high confidence of stable relations (ie US/Canada).

The US is an attractive trade partner in a world that is looking for more LNG. American energy independence is set to help other countries achieve the same for themselves.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.