Cheaper AI Probably Means More

Following Monday’s “sputnik moment” for AI the market has had a few days to consider the ramifications of DeepSeek’s apparent breakthrough. Mark Zuckerberg reaffirmed Meta’s plans to spend $60-65BN on data centers. They have embraced an open-source approach to AI, believing that sharing code freely will drive penetration. Since DeepSeek also published their code any insights will spread to other platforms.

On Tuesday Chevron announced plans to partner with GE, Vernova and investor Engine No 1 to build gas-powered data centers. So far there’s little sign that capex plans are being trimmed, although as Zuckerberg noted it’s still too early to judge the full impact of DeepSeek.

Meanwhile Microsoft (MFST) is probing whether DeepSeek improperly used OpanAI’s proprietary model to improve its own. Energy investors are educating themselves on the power needs of AI.

Wells Fargo trimmed their forecast of the long term boost to US natural gas consumption from 12 Billion Cubic Feet per Day (BCF/D) to 11 BCF/D in 2035. Although directionally it’s not what energy investors would like, an 8% revision a decade out comes with substantial uncertainty.

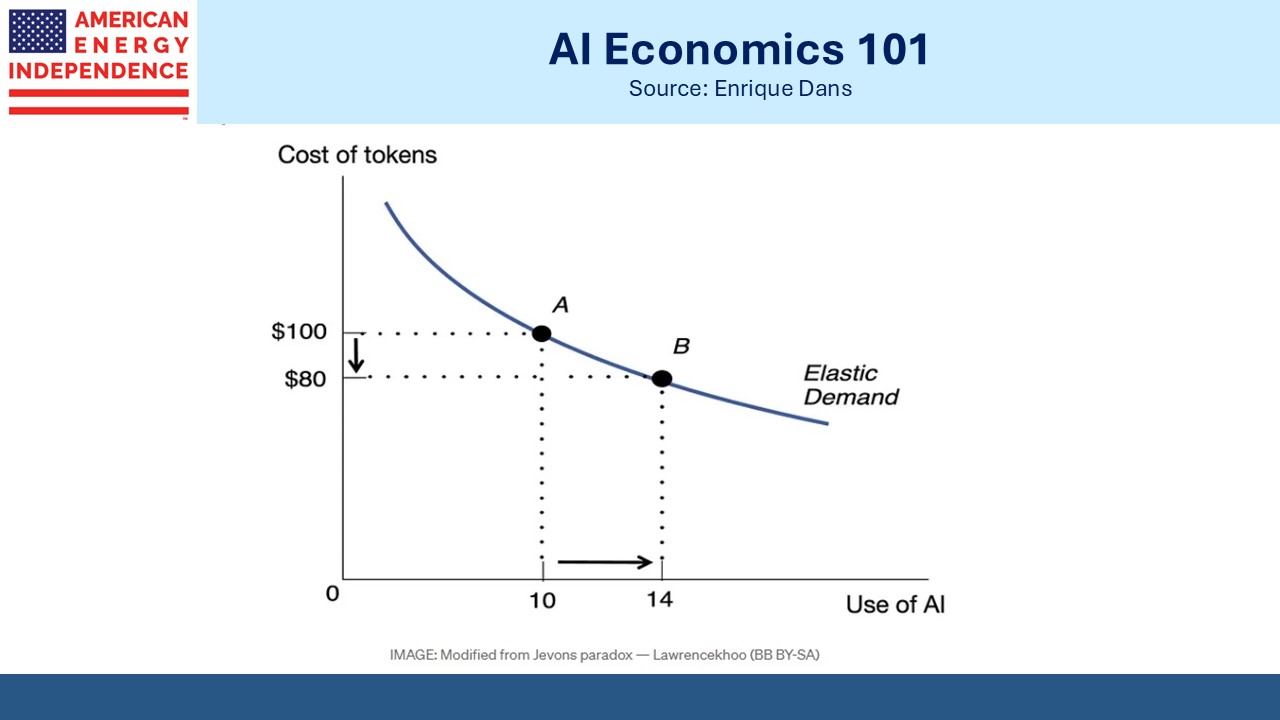

In 1865 British economist William Jevons observed that improved efficiency in coal use led to greater consumption. Appropriately I asked ChatGPT to explain: … as technology improves the efficiency with which a resource is used, the overall consumption of that resource may increase rather than decrease.

Jevons Paradox simply means if demand elasticity exceeds supply elasticity consumption will rise, something taught in every beginner’s Economics class. This prompted MSFT CEO Satya Nadella’s tweet that the same effect might add a further boost to AI use.

We’ll just have to monitor developments in the months ahead.

Meanwhile the LNG export story continues to unfold positively. Morgan Stanley has buy recommendations on Cheniere and NextDecade (NEXT). They have a $10 price target on NEXT assuming Train 4 is completed, but they go on to add that they also expect Train 5 and that would push their price target to $15.

FERC is expected to issue their preliminary supplemental Environmental Impact Statement (EIS) by the end of March with the final one in July. Current expectations are for the issue to be resolved by the end of the summer.

Last year environmental extremists persuaded a judge to issue a stay on the original EIS that NEXT had relied on to move ahead with the project (see Sierra Club Shoots Itself In The Foot). It’s hard to see how the world gains from being denied cheap US natural gas. It makes energy more available to those without in emerging countries and provides a cleaner alternative to coal.

For example, India is boosting its use of domestic coal for power generation while it reduces imports, hitting another record high for coal-derived electricity last year. Renewables boosters continue to assert that solar and wind are the cheapest form of power generation, while developments relentlessly show the opposite. High renewables penetration comes with higher prices.

The Alerian MLP ETF (AMLP) is losing another constituent as the remaining outstanding shares of Enlink are absorbed into Oneok (OKE). This follows a well-established trend of publicly traded partnerships going away and the pipeline sector increasingly being made up of conventional c-corps, a trend we’ve noted since 2018 (see Are MLPs Going Away?).

For investors in MLP-dedicated funds it exacerbates the problem of concentration (see AMLP Is Running Out Of Names). This is compounded by their costly non RIC-compliant structure (see AMLP Has Yet More Tax Problems). Add to these shortcomings that MLPs are generally more involved in crude oil than natural gas, which left many of them bystanders to last year’s big story (see There’s No AI in AMLP).

We are having more conversations with investors about ways to avoid these three problems.

Lastly, at the time of writing the White House is preparing to impose tariffs on imports from Canada and Mexico. US refineries are configured to process Canadian heavy crude more readily than the light crude that comes from shale formations. Concern about tariffs is more prevalent outside the country than here, which suggests who’s more vulnerable.

Canada’s Energy Minister Jonathan Wilkinson reminded listeners on a recent Politico Energy podcast that tariffs on Canadian crude will increase US gasoline prices, especially in the mid-west where refineries import Canadian crude. He also suggested that Canada might slow exports of hydro-based electricity from Quebec to northeastern states and natural gas to the Pacific northwest. This is ironic, since both regions have robust political commitments to renewables and are generally blue states.

Trump has suggested that oil imports may be exempted from the tariffs. There’s little apparent concern among US energy companies about the potential for economic disruption. We’ll see how it plays out, but the US looks to be in a strong position.

We have two have funds that seek to profit from this environment: