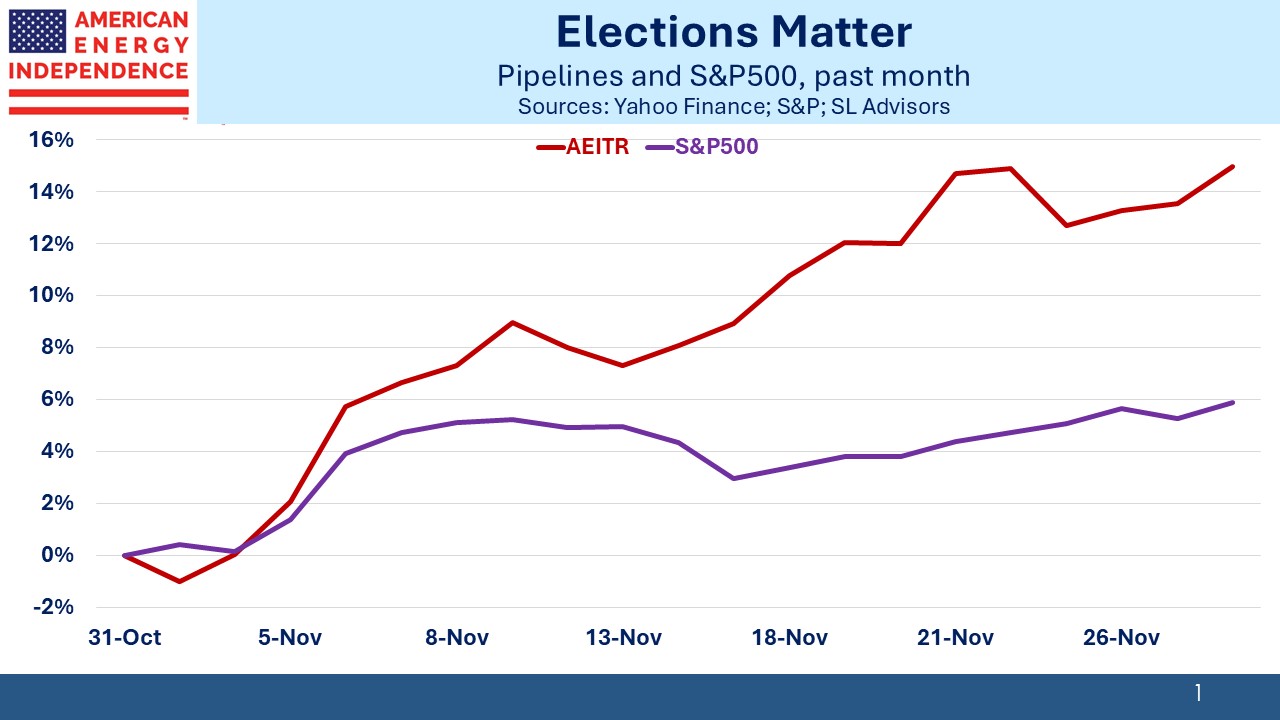

US Leads Natural Gas Demand And Supply

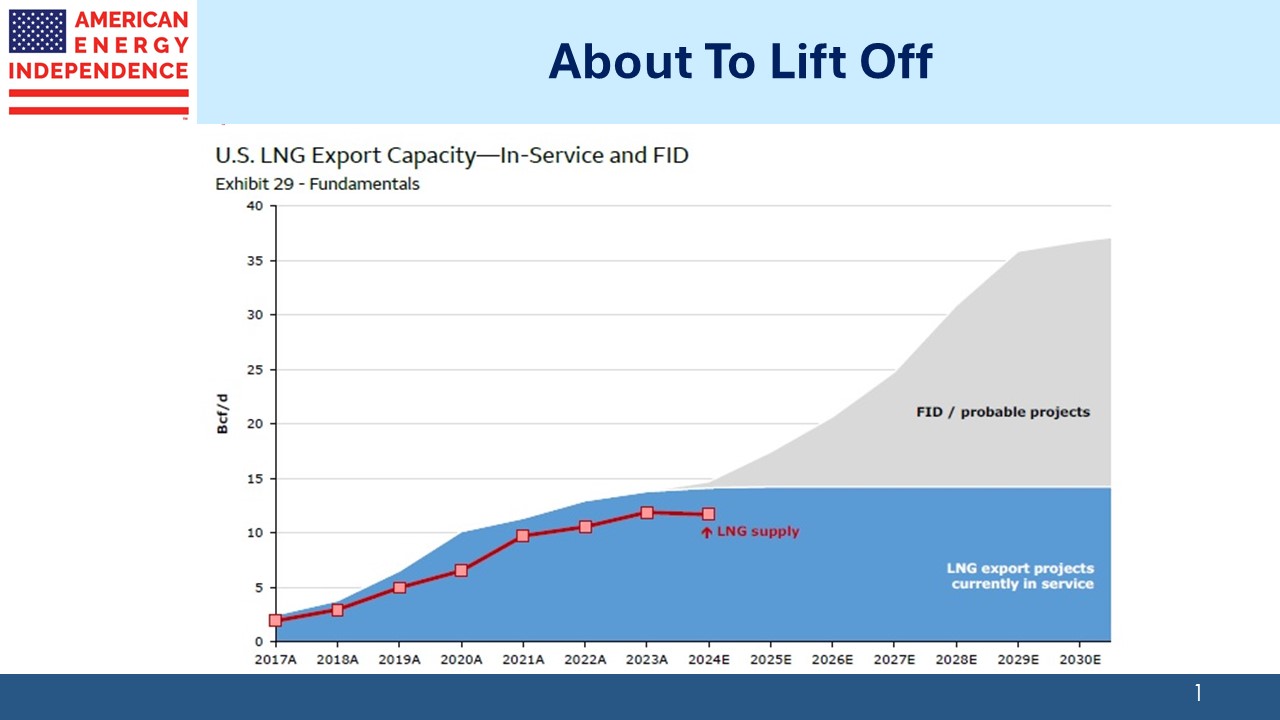

It’s clear that natural gas demand is heading higher over the next few years. It’s less certain that this will push prices higher. New LNG export terminals are going to double our volumes sent overseas over the next five years. The widely criticized pause on LNG permits that President Biden imposed last January only applied to new projects.

Previously issued permits were unaffected and those construction projects largely continued. The pause did inject uncertainty into contract negotiations for projects that were seeking enough commitments to reach a Final Investment Decision (FID). Japan is one foreign buyer that expressed concern at the time over the uncertainty this created about the US as a supplier.

Incoming President Trump is widely expected to lift the permit pause soon after he’s in office. This will lead to more visibility about export volumes from 2030 and on, given that it’s not uncommon for a new project to require five years to build following FID.

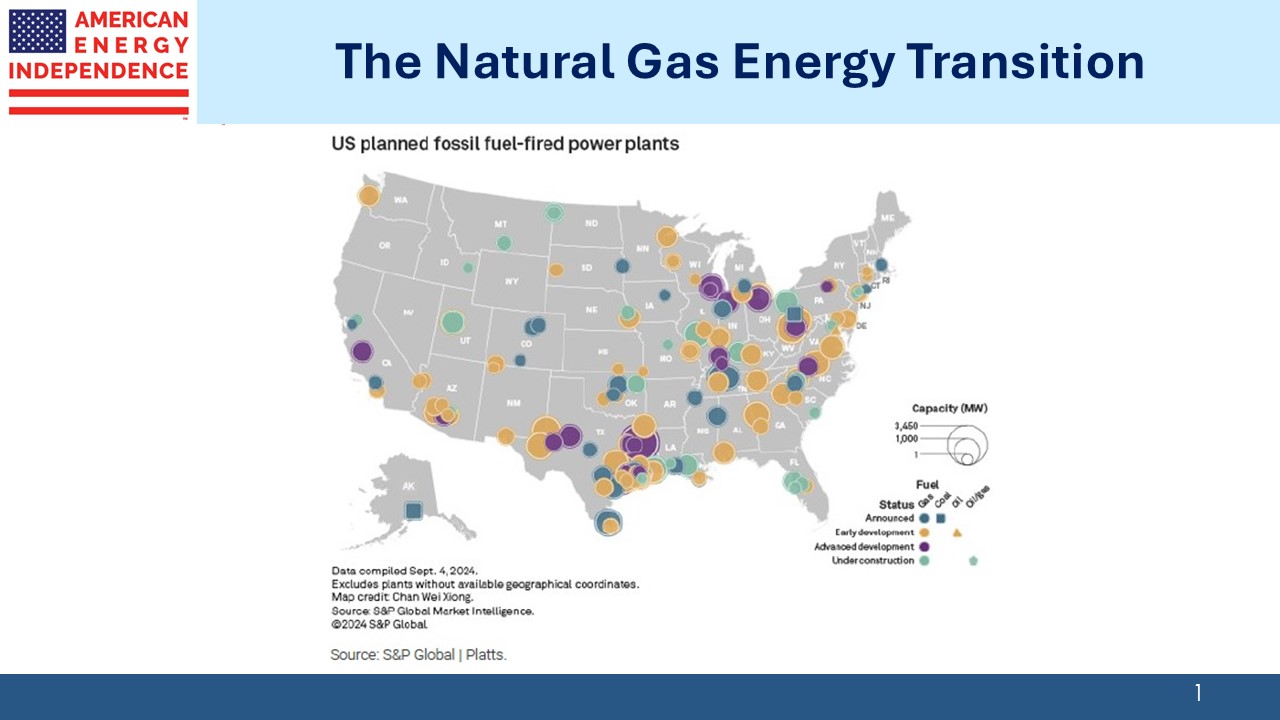

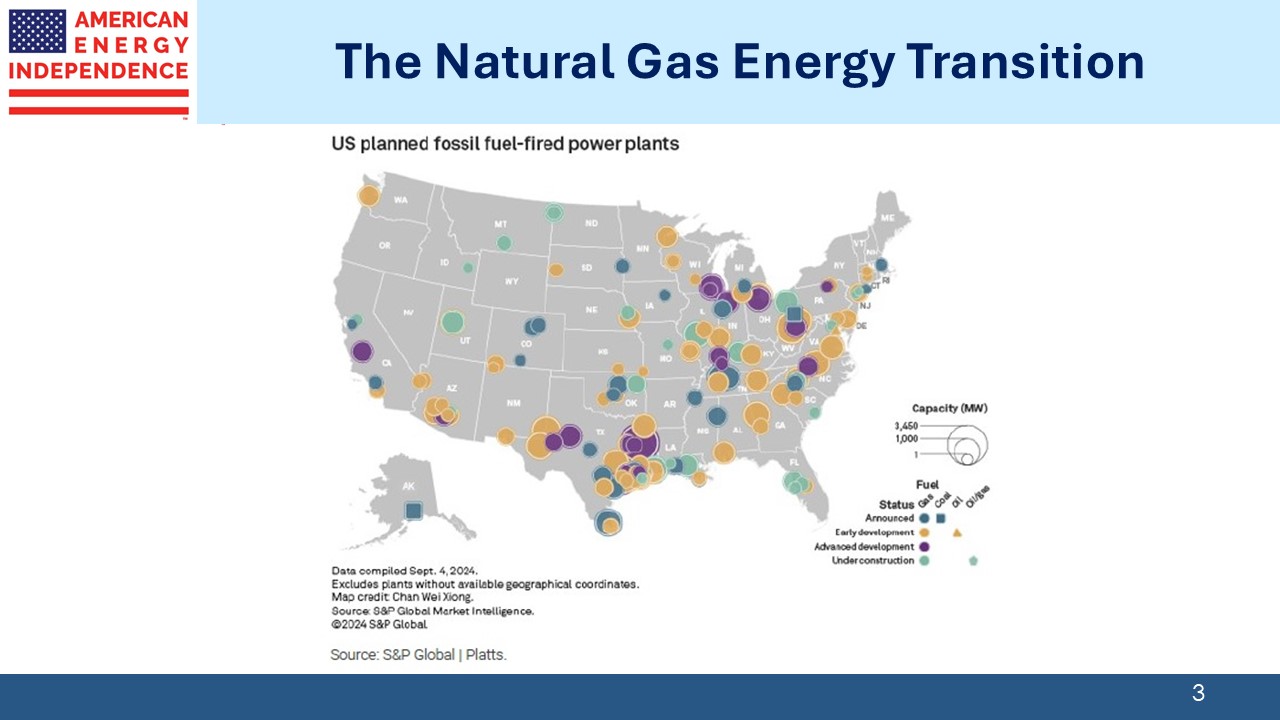

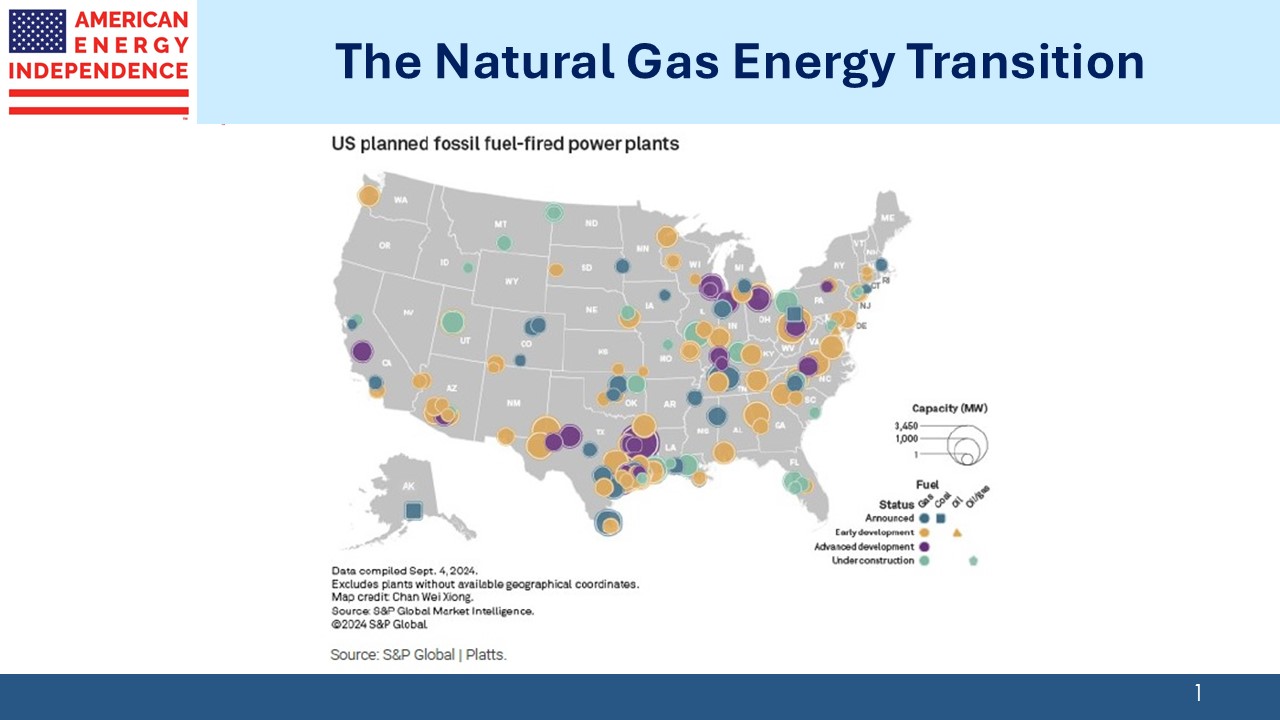

The second source of new demand is from new natural gas power plants to power all the new AI-related data centers that are planned. JPMorgan reported that global gas turbine orders are +33% YoY, driven by demand in Saudi Arabia which is replacing many older turbines with more efficient models, and the US because of data centers. Excluding China orders are +61% measured by GW of output capacity.

Demand for heavy-duty turbines able to provide baseload supply (defined as 100MW of output), is similarly strong.

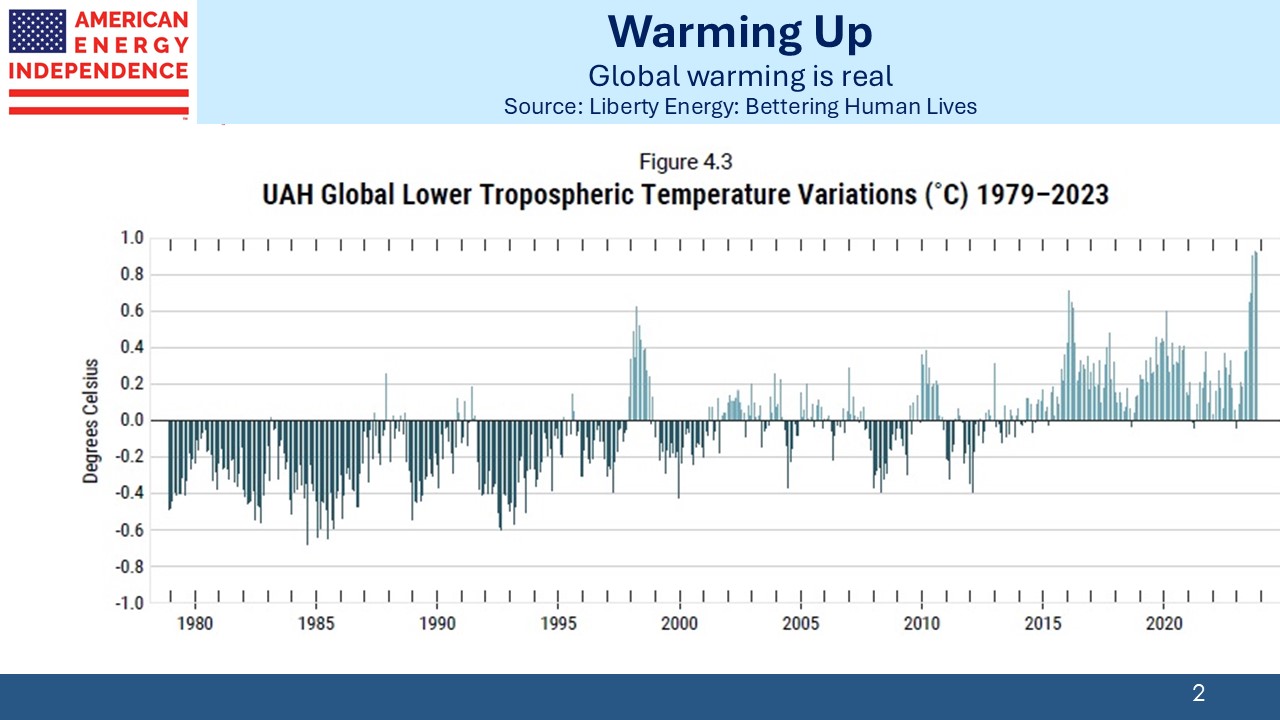

Continued coal-to-gas switching, our biggest source of reduced CO2 emissions in the US, is a third source of natgas demand.

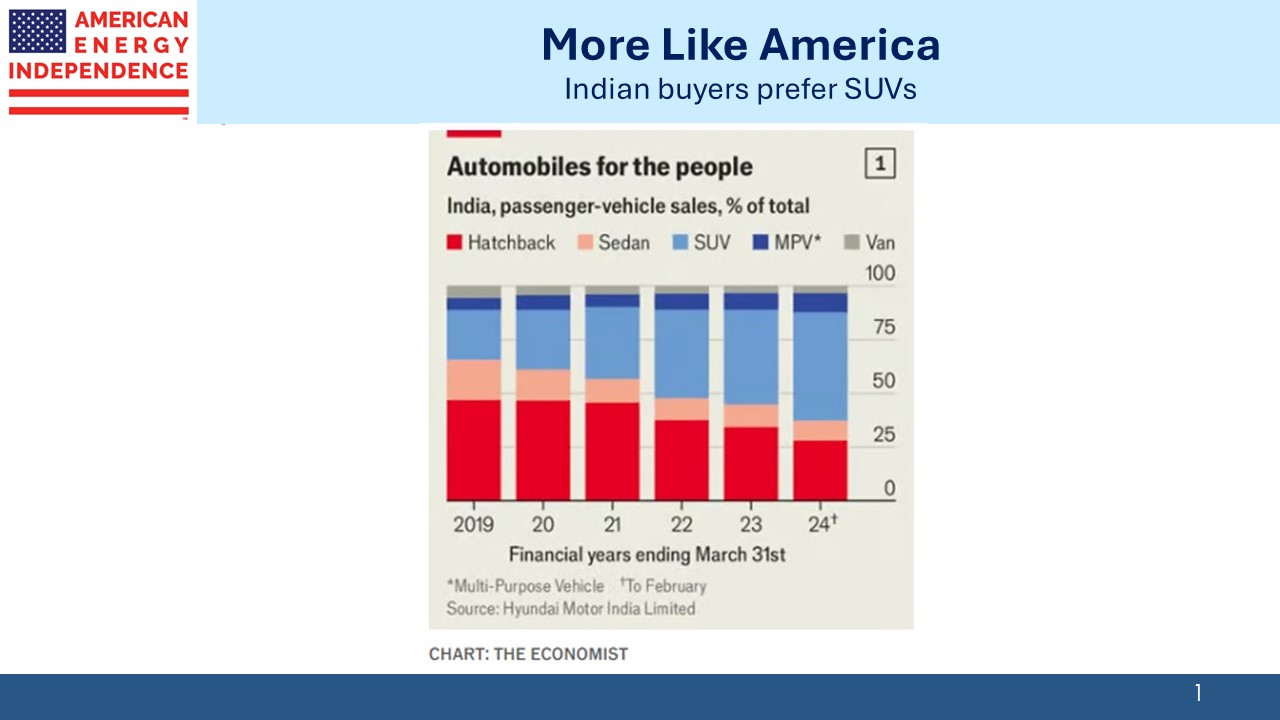

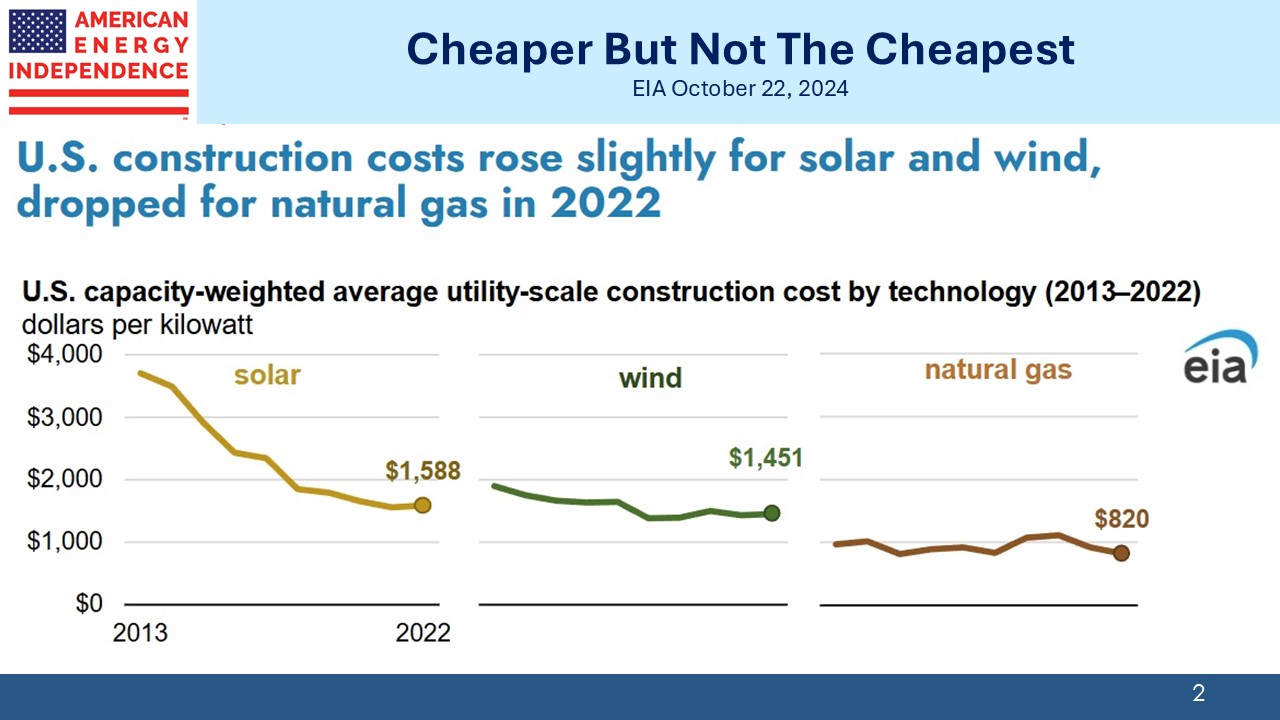

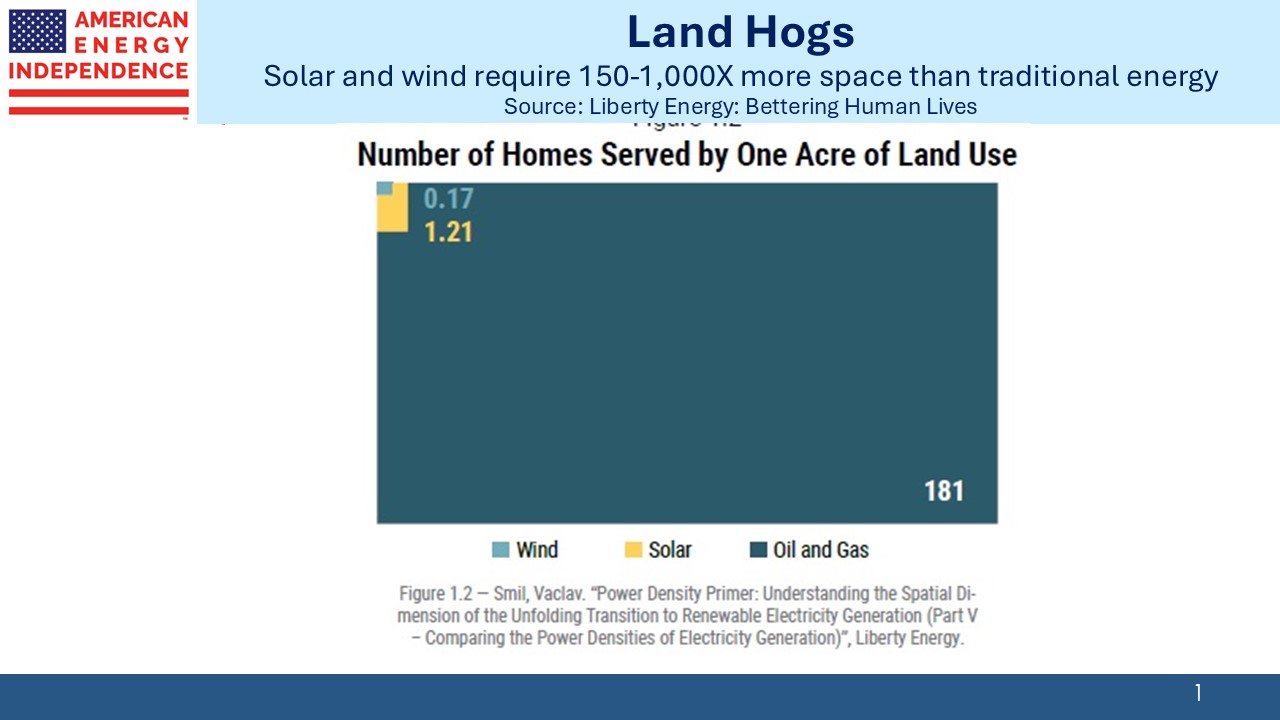

A google search of, “Is solar power cheaper than gas?” delivers numerous affirmative responses, including Google’s AI result. There are at least that many journalists toiling away in willful defiance of overwhelming evidence to the contrary. Saudi Arabia is a reliably sunny place and they’re driving the growth in gas turbine demand.

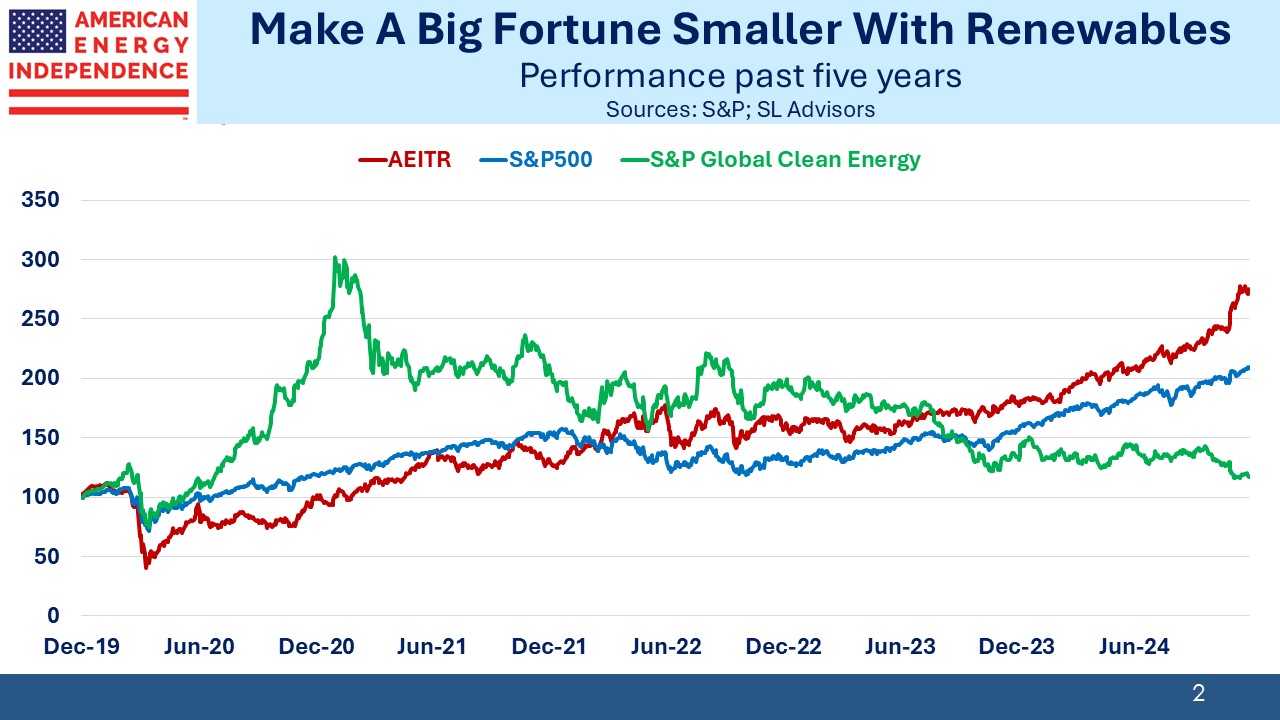

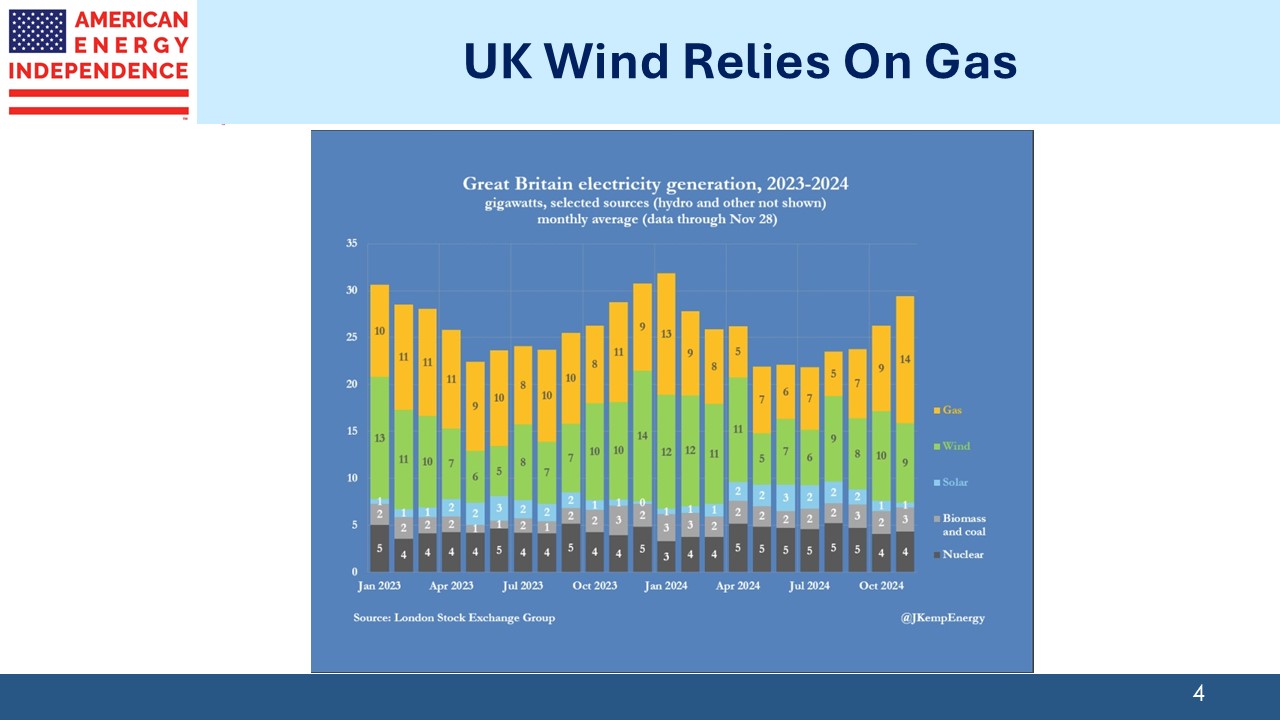

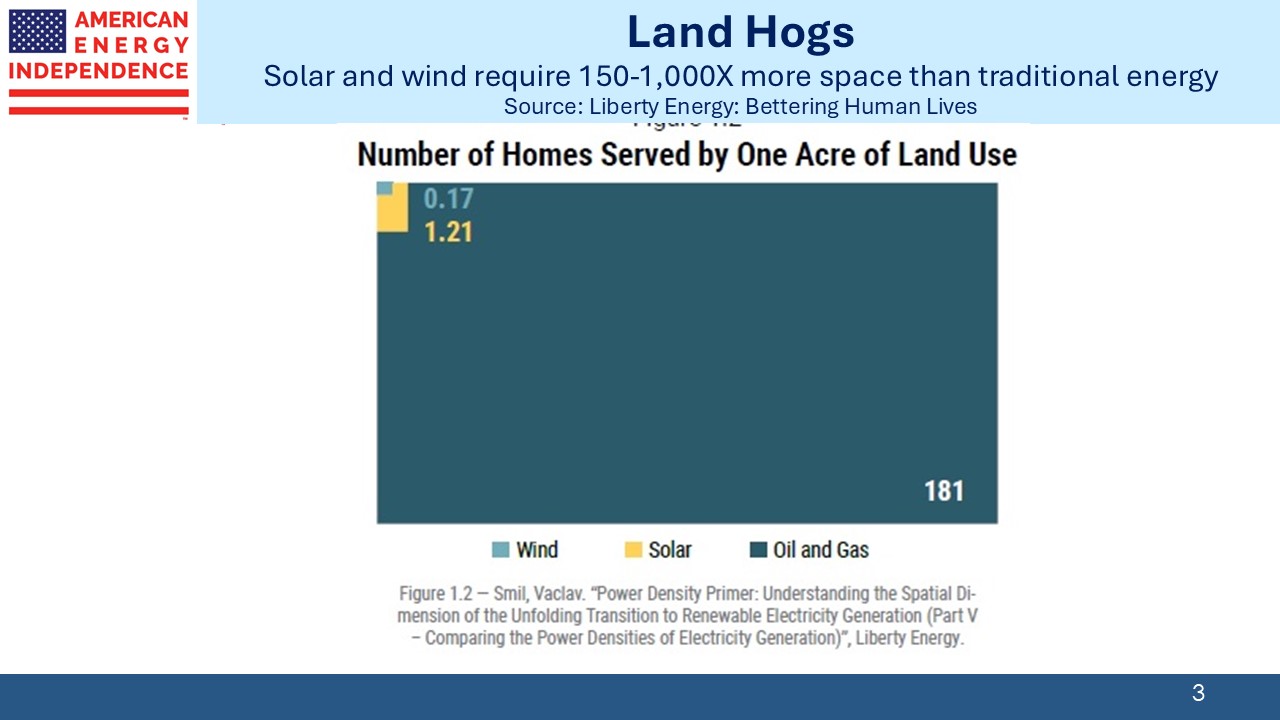

In the US, renewables’ advocates routinely overlook the cost of intermittency. In the marketplace for reliable power, solar and wind have no place. The persistent championing of renewables by the International Energy Agency and other progressive commentators denies empirical evidence to the contrary. They’ve helped countless investors create small fortunes from big ones by investing in clean energy. The real money has been made from independent thinking.

It’s clear that demand for US natural gas is headed higher. But even though US gas volumes are set to rise prices, which are perennially among the cheapest in the world, may remain low as supply increases commensurately.

US oil output is likely to rise somewhat. Trump’s new Treasury Secretary Scott Bessent’s “3-3-3 plan” targets 3% GDP growth, 3% deficit to GDP and 3 million barrels a day of new oil production. His ability to influence oil output is limited. For example, Chevron expects this year to be their peak capex spend in the Permian as they prioritize growing free cash flow over production.

Markets still expect some higher production in response to more pro-energy regulation and greater access to Federal land. Increased oil from the Permian in west Texas could add to the supply of associated gas, an unsought companion to the crude that’s produced there.

In their investor day recently, Enbridge raised 2025 EBITDA guidance modestly on the back of organic growth in their natural gas pipeline business which is their major area of focus.

Nuclear power can be part of the solution for new data centers, albeit not until the 2030s given how long new plants require for construction. Small Modular Reactors (SMR) have seemingly been on the horizon for years. However, earlier this year the Department of Energy released a guide to help companies use the sites of retired coal plants for nuclear facilities. This takes advantage of already existing connections to the grid.

TerraPower, led by founder and chairman Bill Gates, recently broke ground on its Natrium SMR project in Kemmerer, WY which would be the first nuclear plant to be situated on a former coal plant. It’ll use molten salt (natrium is the Latin word for sodium) rather than water as coolant, since it has a much higher boiling point.

As Terrapower points out, it is the only “coal-to-nuclear project under development in the world.” Why isn’t the Sierra Club behind efforts like this?

Between increased natural gas and ongoing innovation in nuclear, one day we’ll find we’ve transitioned away from intermittent renewables. Among the many positives will be that wretched little girl Greta being consigned to the dustheap of history.

We have two have funds that seek to profit from this environment: