Stagflation

On Wednesday during Q&A following Jay Powell’s speech to the Economic Club of Chicago, he warned that the near-term impact of tariffs is likely to be rising unemployment and rising inflation. The Fed’s twin mandate is one of maximum employment consistent with price stability. Powell said, “I believe that for the remainder of this year, we may deviate from these goals, or at least not make any progress, and then we will restore progress as much as we can.”

Slower growth with higher inflation is stagflation, a word Powell managed to avoid but nonetheless described. The Fed can’t address both simultaneously and will generally prioritize whichever variable is farther from their long-term goal.

The White House has made no secret of its desire for lower rates. Trump has mused openly about firing Jay Powell, but in any event his term as chair runs out in May of next year. The pool of replacements who can satisfy both the president and bond market vigilantes is a small one. Trump’s a real estate guy, and in that business inflation and low rates are a great combination.

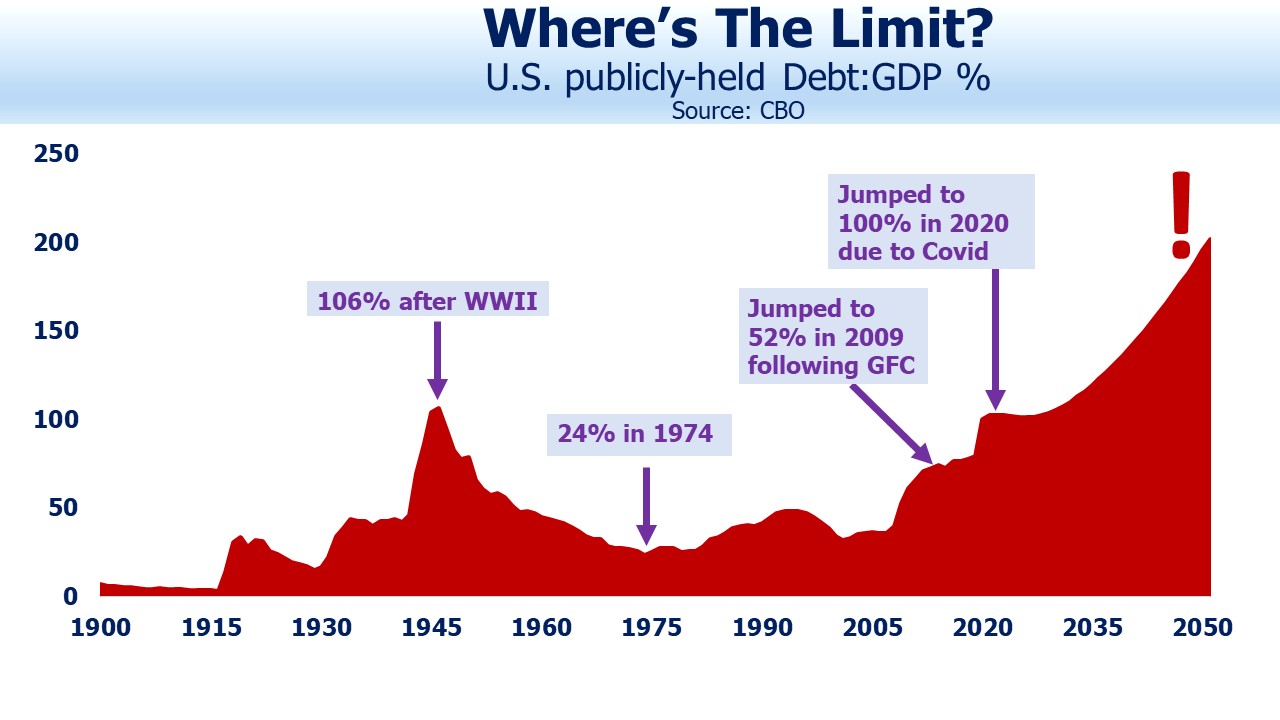

Given the choice, the White House would prefer low rates with debt issuance heavily weighted towards short maturities. Interest expense will exceed $1TN next year, 3.2% of GDP. The budget outlook and interest rate policy are becoming inextricably entwined. Political leaders will increasingly be able to blame the Fed for our budget deficit through pursuing needlessly tight monetary policy.

The obvious casualty of pursuing the lowest possible short-term rates will be inflation. But we have a lot of debt and its trajectory is no secret. Financing it at negative real rates has been the time-honored solution of profligate governments for centuries.

In 2013 I made the case that the US was going down this road in Bonds Are Not Forever: The Crisis Facing Fixed Income Investors.

We still are.

Part of that process involves debt monetization via the Fed expanding its balance sheet. Their holdings almost reached $9TN three years ago as part of the pandemic response, but since then have declined by over $2TN. Nonetheless at $6.7TN the Fed holds $5-6TN more than needed for the smooth operation of monetary policy.

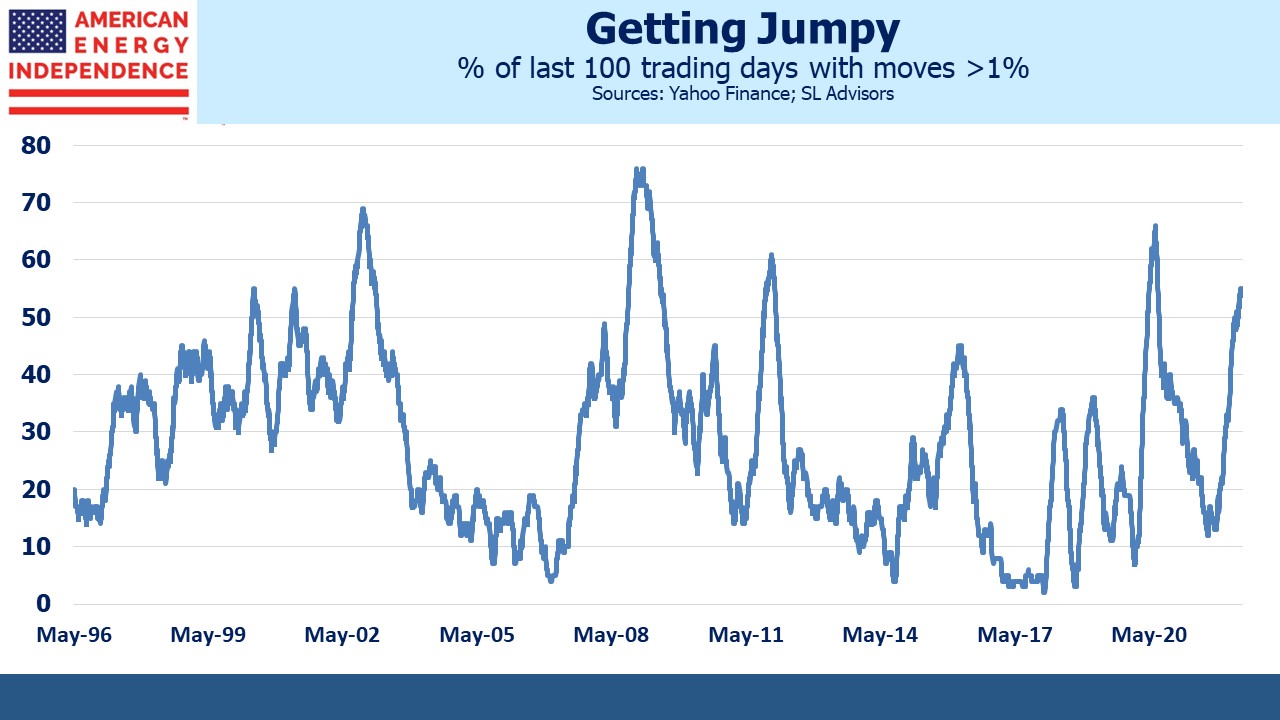

Oddly, long term yields have risen during the tariff turmoil. Theories why include liquidation of a huge basis trade by a Japanese hedge fund and concerns about unstable US policy, but there’s no consensus. A reduced trade balance will mean less foreign demand for our debt, since exporting countries will have fewer dollars to invest. This need not matter if we reduce our budget deficit commensurately, but absent that Americans will need to buy more bonds which will require higher yields.

China’s holdings are declining and will probably continue to. I doubt they’ll sell aggressively because it would be highly disruptive. But if yields move too high the Fed will conclude it must restart quantitative easing. And if it ever looks as if China is dumping bonds, Trump is just the guy to note that when you owe someone $784BN (China’s holdings as of February) it’s really the lender’s problem.

Another move from the real estate playbook.

None of this is intended to criticize. Aggressive debt management might be our best strategy when we’ve issued so much. You take the world as you find it. But surely, nobody can seriously believe in 2% inflation.

The University of Michigan consumer survey shows long term inflation expectations of 4.1%, similar to the levels reached during the pandemic. A quarter of respondents think it will exceed 10%. We have a president and budget outlook both acutely sensitive to interest rates.

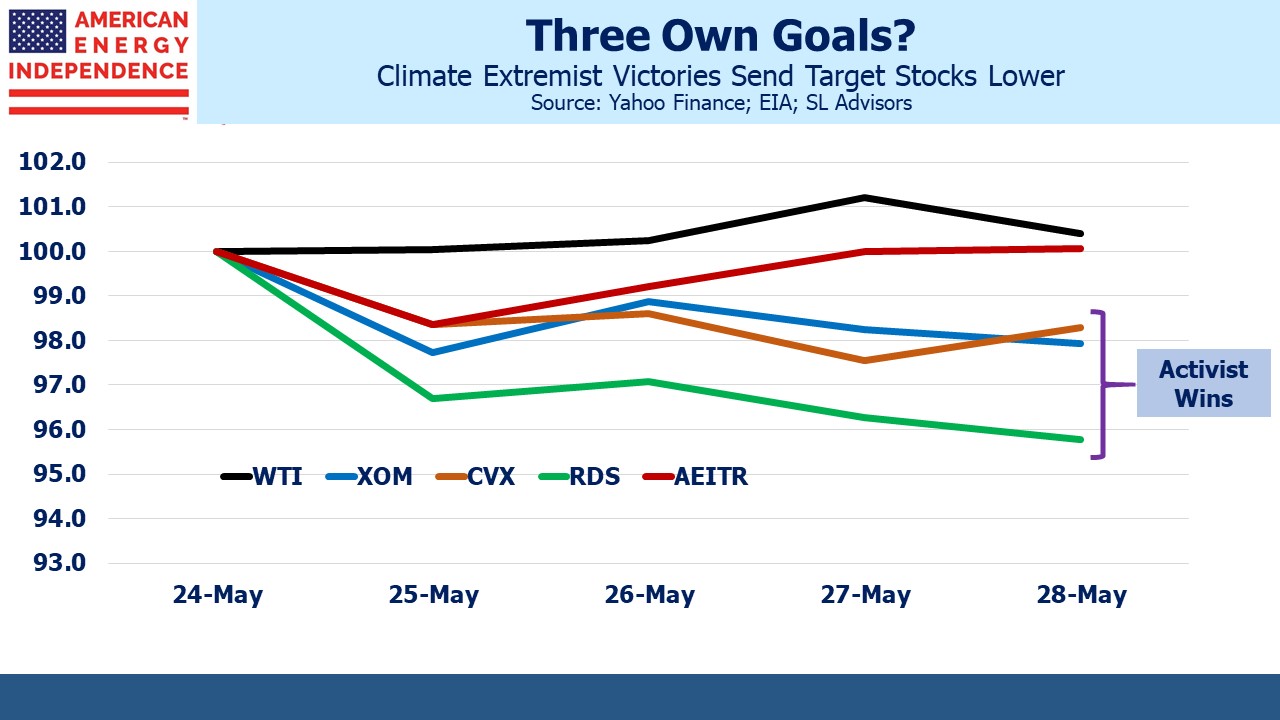

Pipeline tariffs – not to be confused with import taxes – are mostly regulated to prevent unscrupulous pipeline owners from exploiting their position. Wells Fargo estimates that around half the EBITDA of the industry benefits from annual price hikes linked to the PPI. Following the 2022 inflation spike, increases of 13% were not uncommon in 2023.

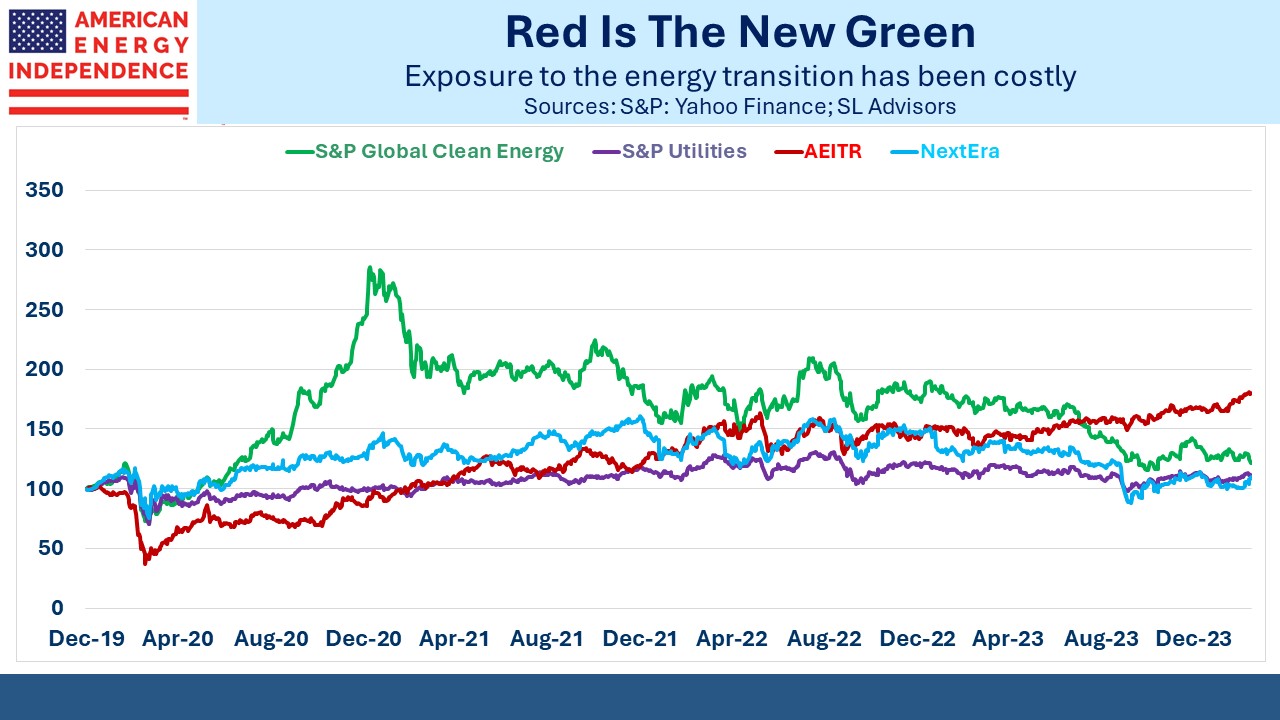

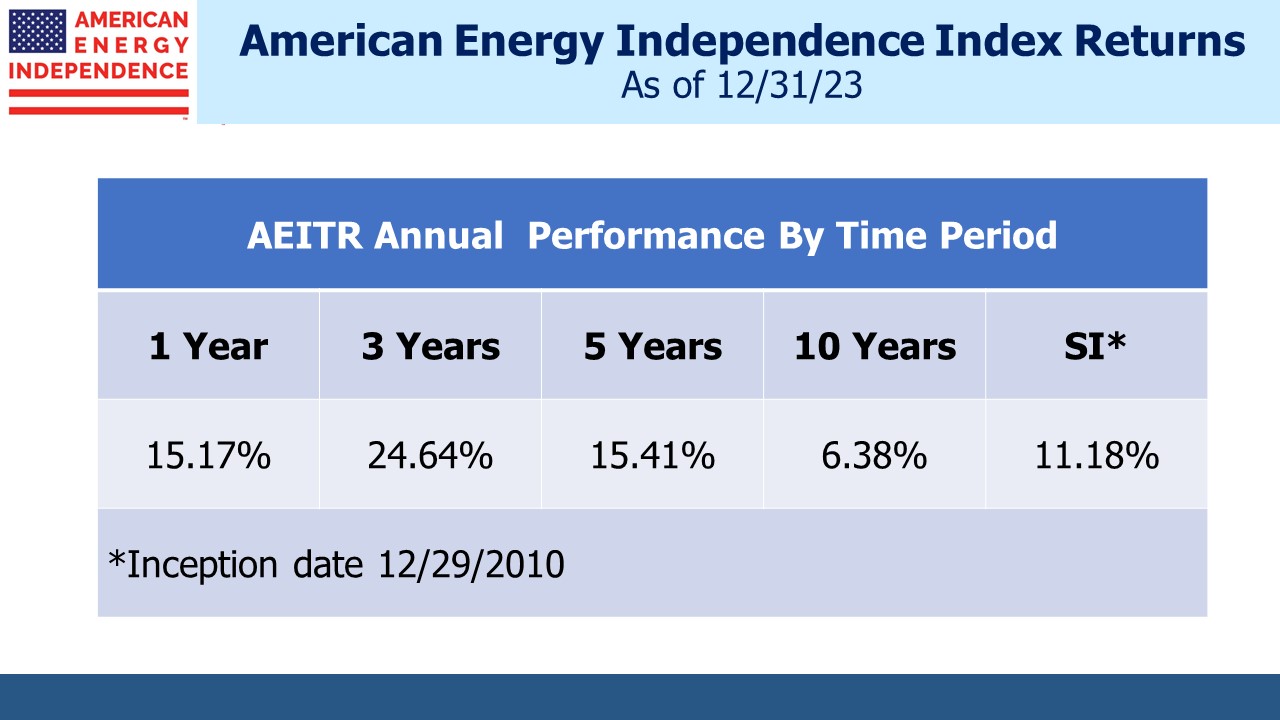

This supported 5% distribution growth in 2022, a level which has continued up until today. It’s why the American Energy Independence Index (AEITR) was +21% while the S&P500 was –18% that year.

Import taxes are having a modest impact on new construction projects. Kinder Morgan recently estimated it at around 1% of major project costs on their earnings call. But the dominant inflation impact is on companies’ ability to raise prices.

This is why we believe midstream infrastructure offers one of the most attractive ways to own inflation-protected assets. I’ve been invested in the sector for over two decades, partly because of my long term debt-fueled inflation outlook described in Bonds Are Not Forever. We’re probably facing an imminent bout of inflation. This is a sector that showed its resilience in such a scenario just three years ago.