Measuring The Midstream Mood

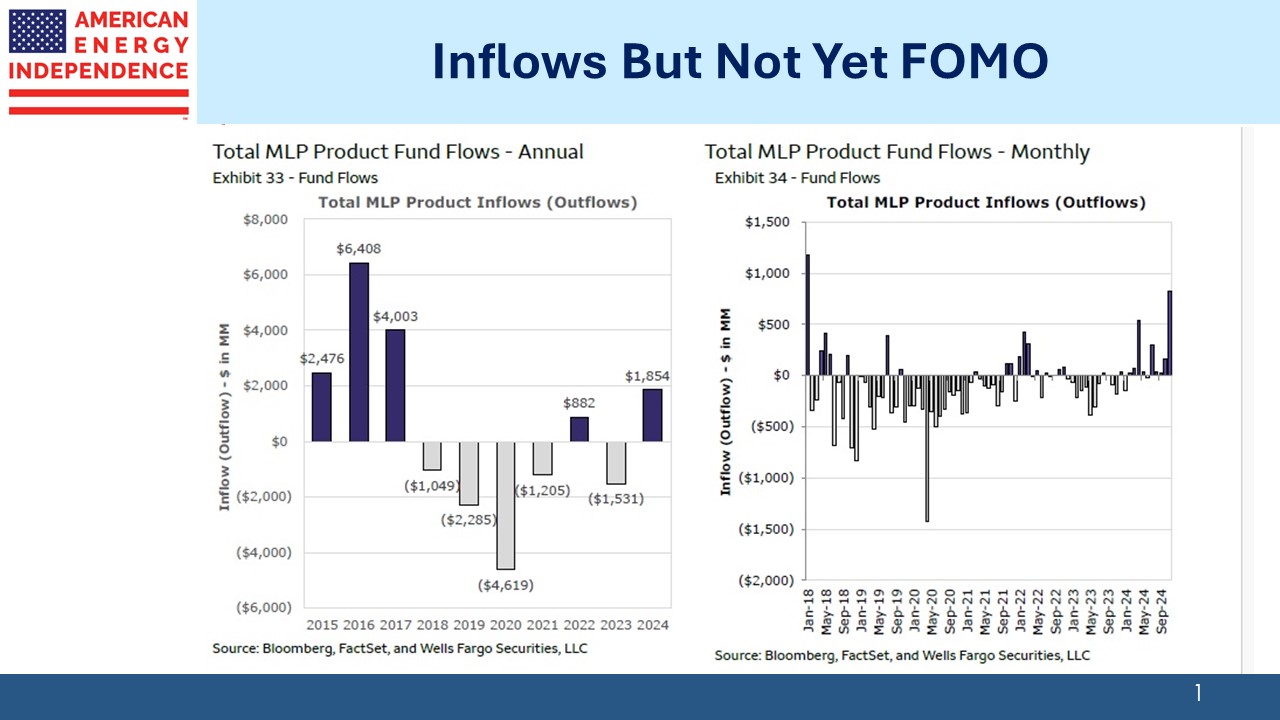

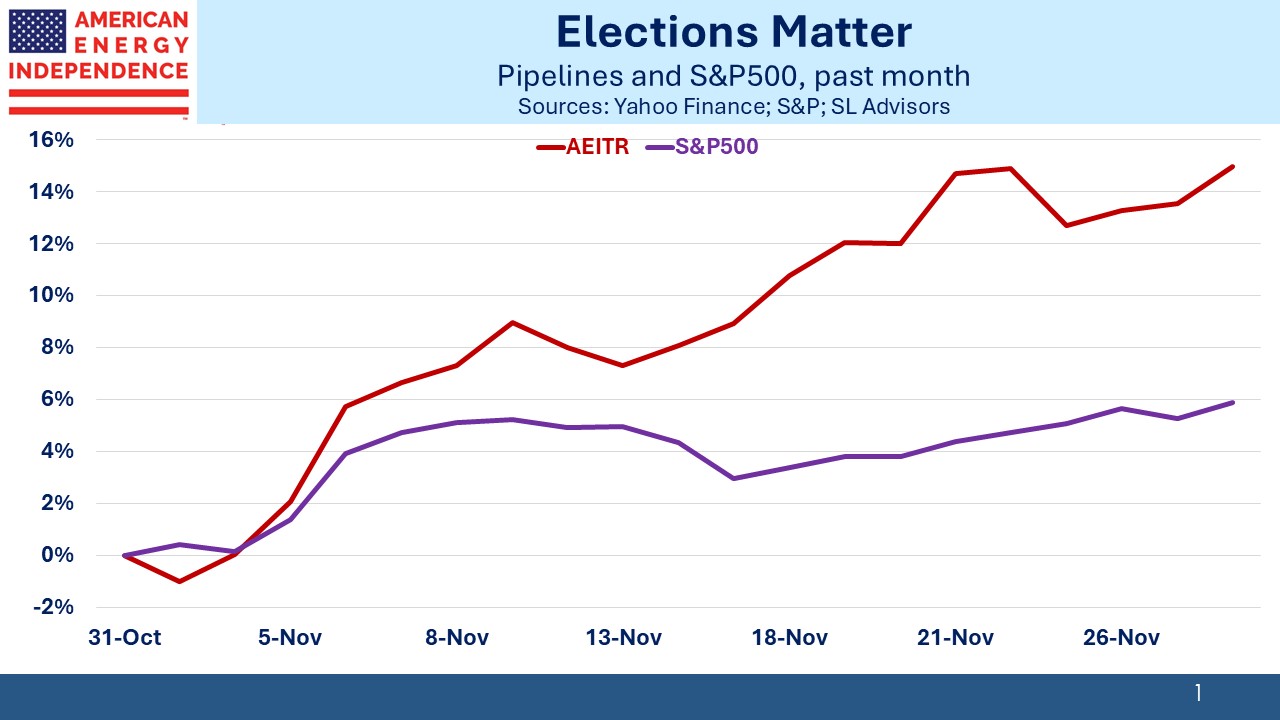

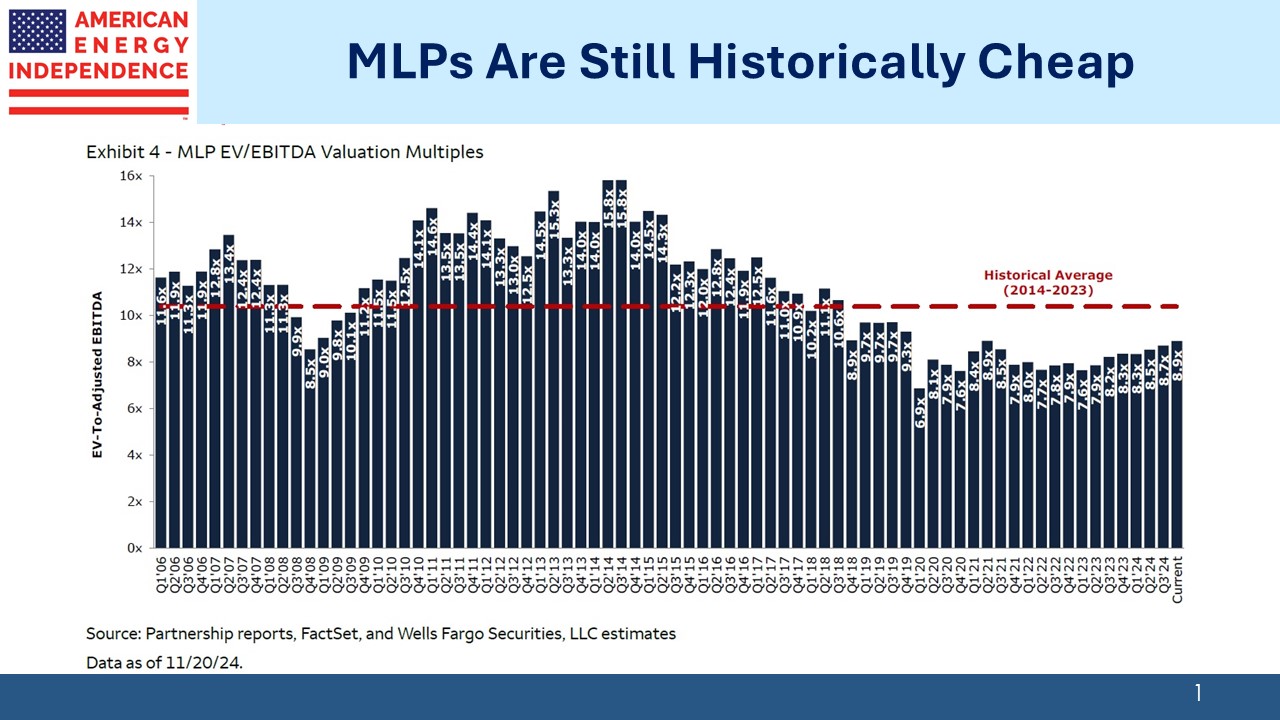

Last week my partner Henry Hoffman attended the 23rd Annual Midstream, Energy, and Utilities Symposium, held by Wells Fargo. The mood was understandably upbeat, underpinned by strong fundamentals and the more coherent regulatory framework expected following the election.

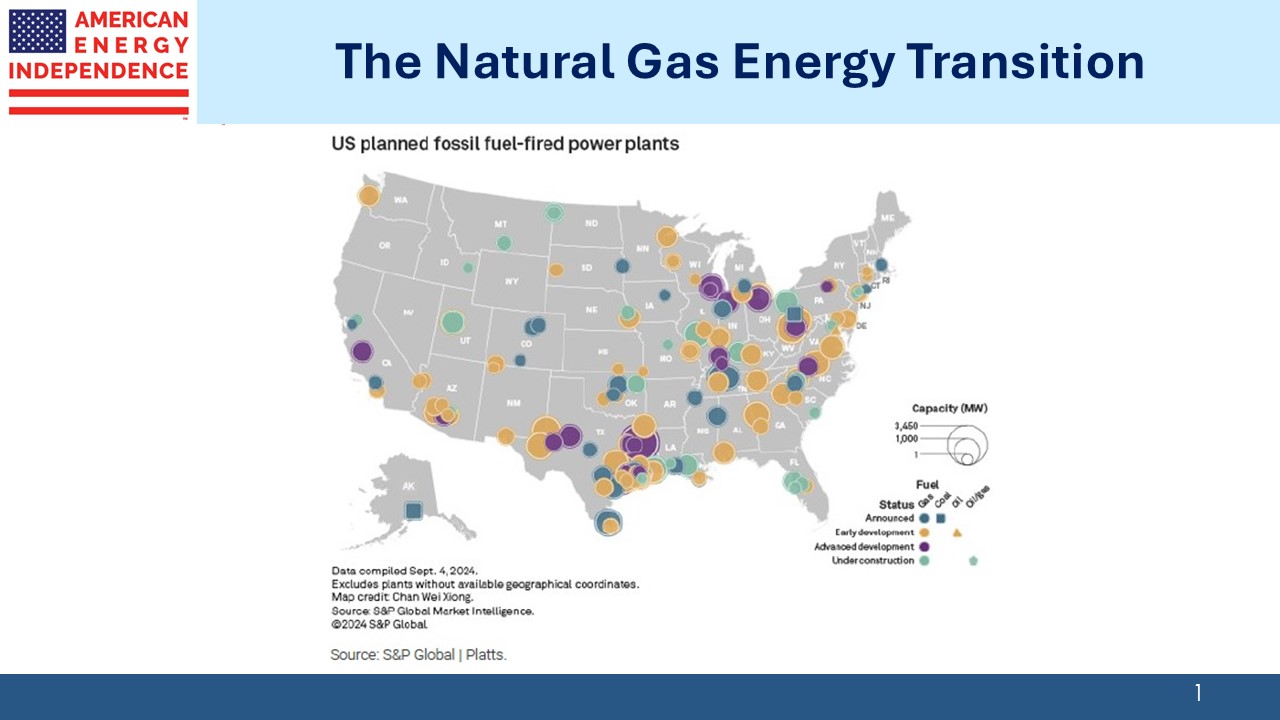

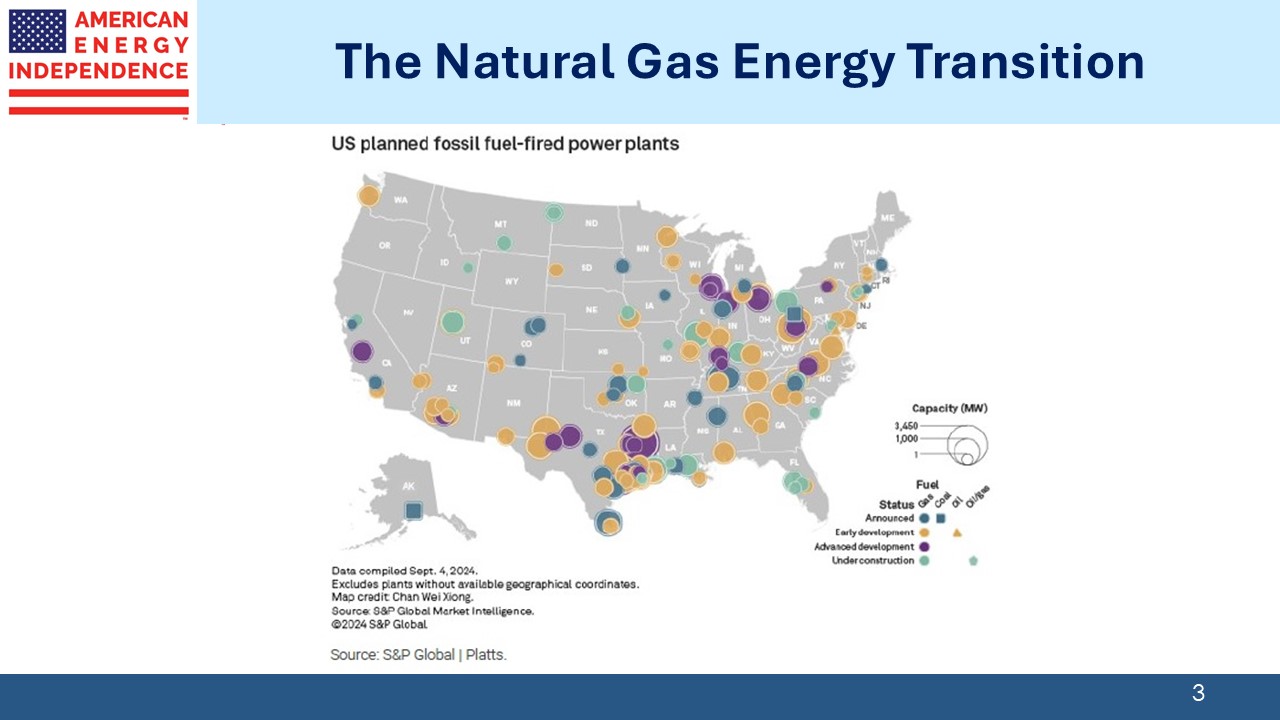

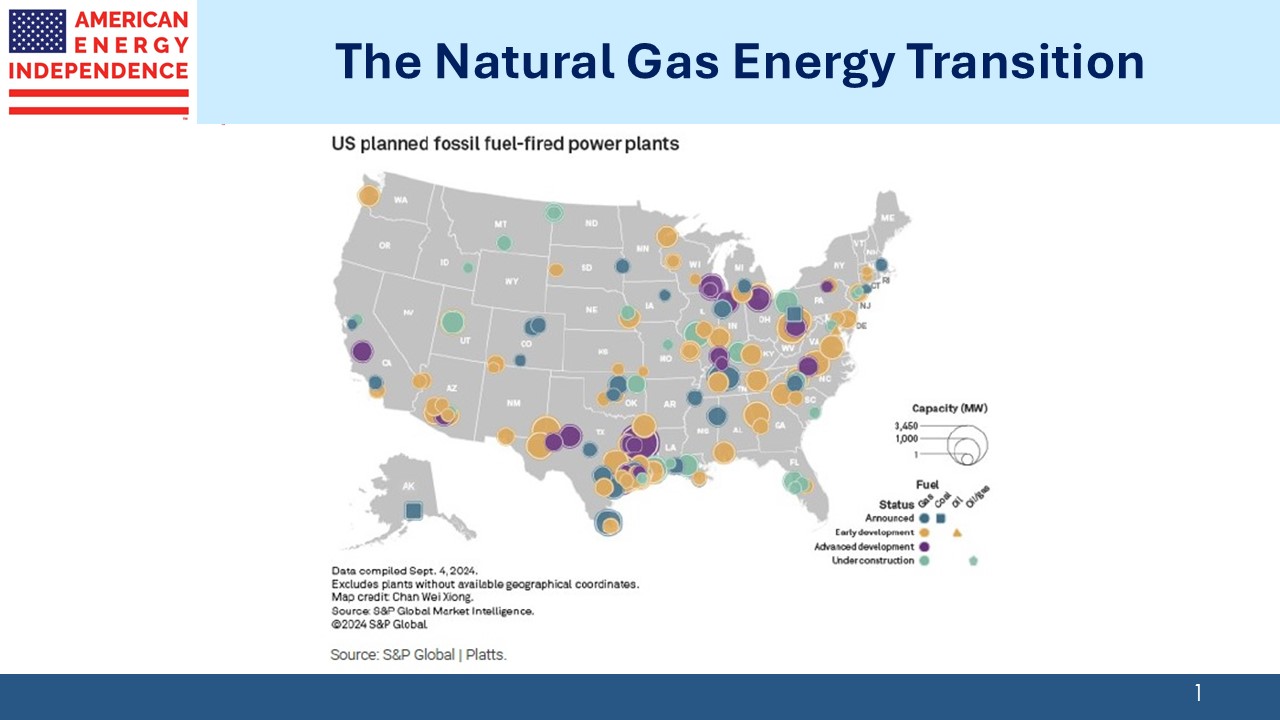

Given our focus on natural gas, we were naturally interested in this element of the energy story. Data centers in support of AI are driving power demand sharply higher. Randy Fowler, CEO of Enterprise Products Partners, noted that ERCOT which runs the Texas electricity grid is forecasting 150GW of power demand by 2030, up from 85GW currently. We heard other reports that demand may even double by then.

Grid expansions of this magnitude typically take several years. Therefore, it seems unlikely existing infrastructure will be able to meet the increased demand from data centers, which will lead to “behind the meter” solutions whereby a data center builds its own power source or buys it directly from a provider without going through the grid. The several announcements involving nuclear power contemplate this. However, the widely reported Microsoft deal to restart a reactor at Three Mile Island has run into problems with FERC as this power supply wouldn’t be totally separate from the grid.

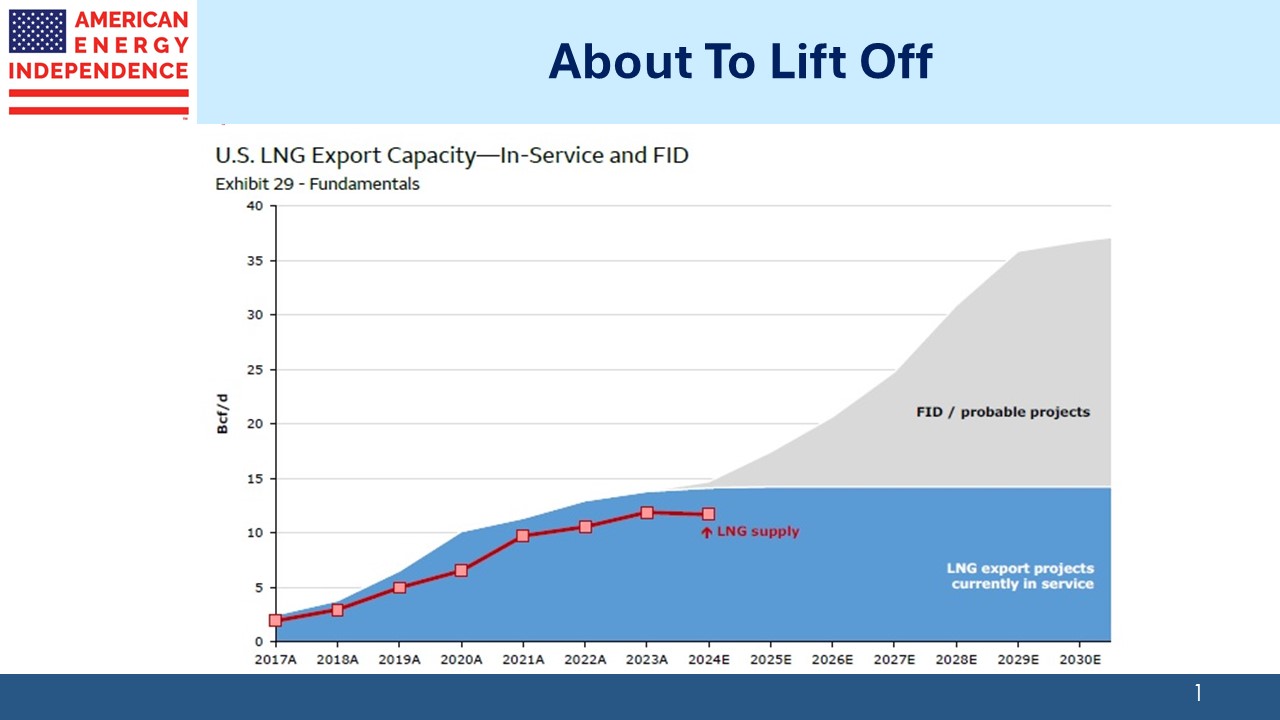

Cheniere is planning to take advantage of the more co-operative regulatory environment to “permit it all”, which in their case could bring their total permitted LNG capacity to 90 Million Tons per Annum (MTPA), around 12 Billion Cubic Feet per Day (BCF/D). This would give Cheniere alone more export capacity than any other country. Cheniere’s CFO Zach Davis expects the global LNG market to grow from 400 MTPA to 600 MTPA by the early 2030s. He also noted 1,200 MTPA of global regassification capacity, indicative of robust demand.

Anticipation of an improved regulatory environment has pushed midstream stocks higher since the election. Some of this can be achieved by the new administration through executive actions, but building any type of US infrastructure nowadays is too often tied up in legal challenges. Climate extremists have learned how to use the courts to slow hydrocarbon projects but just about anything can suffer interminable delays. Williams Companies’ (WMB) general counsel highlighted four areas that require attention:

- Limiting challenges to approved permits.

- Reducing state-level authority to block projects based on technicalities.

- Streamlining water-crossing permits under FERC jurisdiction.

- Imposing stricter time limits on federal reviews.

A bipartisan effort to pass legislation reforming permitting was moving forward until the election. Some attendees felt the political winds were shifting. WMB reported more frequent discussions with members of Congress. A handful of Democratic governors have suggested that shifting more oversight of infrastructure to the Federal level could ease political pressure they sometimes face.

NextDecade, a company we’ve followed closely as they’ve moved forward with their plans to build the Rio Grande LNG export terminal in Brownsville, TX, expressed confidence that robust demand would support adding further capacity beyond their Stage One project. They also expect any outstanding permit issues to be resolved by November next year.

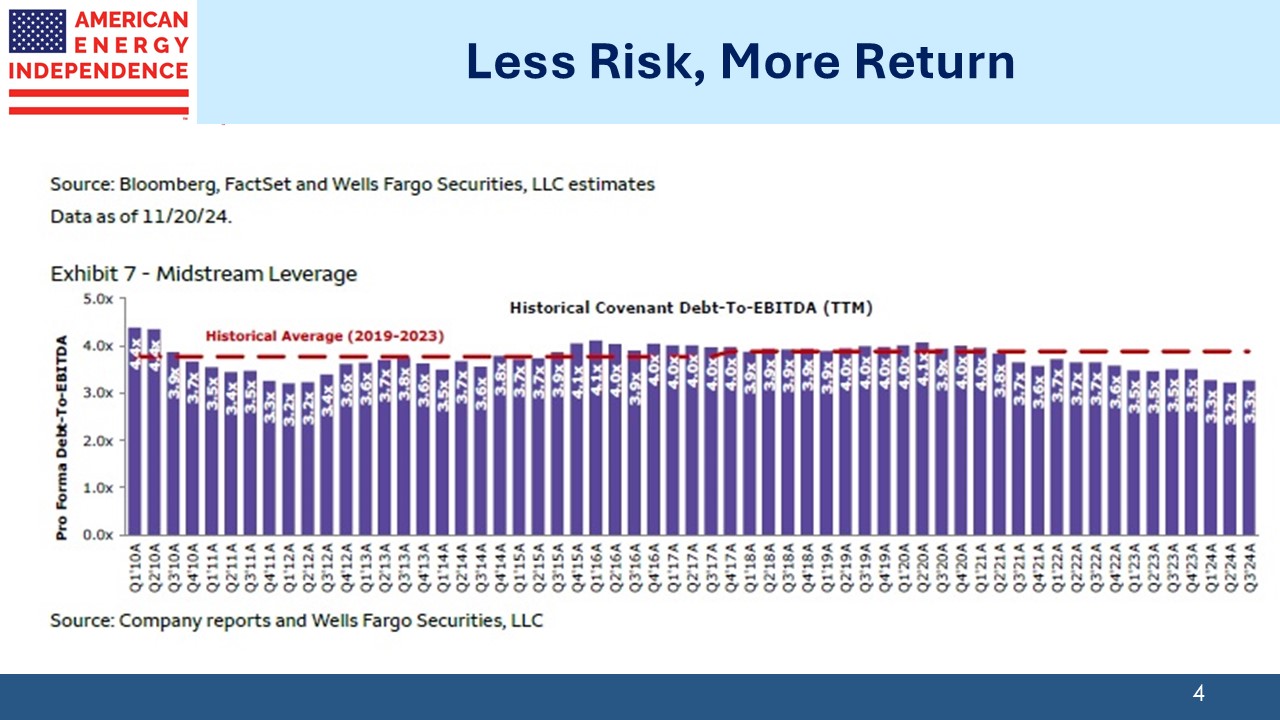

There’s very little evidence that the animal spirits of 2016 will offer a reprise of “drill baby, drill” with its subsequent poor investment returns. Most management teams were singing the same tune, which is to maintain strong balance sheets, prioritize accretive investment opportunities and focus on growing free cash flow per share.

Kinetik’s CEO Jamie Welch was more bullish, saying, “On January 21st, don’t be surprised if animal spirits take over.”

In other news, we recently made a small investment in New Fortress Energy (NFE) across our portfolios. NFE provides natural gas using floating terminals called “Fast Liquefied Natural Gas’ or FLNG. Accessing offshore reserves speeds delivery to customers, a significant advantage given the 3-5 years it typically takes to build an onshore LNG export terminal. The company has endured some cost over-runs and recently raised additional equity which enabled them to refinance their debt. It’s currently a small position but we think it’s attractively priced at current levels.

My wife recently retired as a pre-school teacher at our local church. She didn’t do it for the money, which is fortunate because their compensation structure might kindly be described as parsimonious. But she did receive a form of payment which is priceless, in the form of hand-drawn cards from five year old students saying I love you, a reward rare in investment management as I often noted.

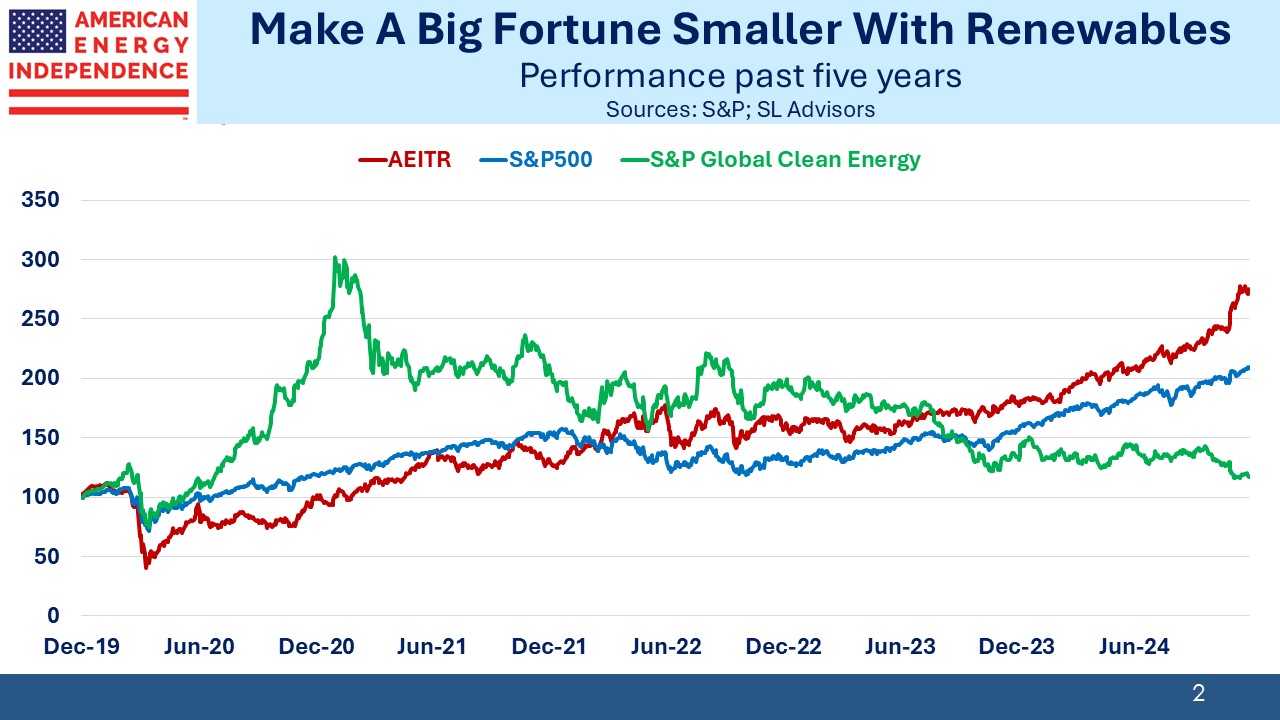

However, several years of strong performance in midstream has stimulated warm feelings among countless clients, and I have felt the love this year as I’ve met with and corresponded with many of you. The 2020 pandemic was a miserable period in so many ways. But there were sparkling rewards for those who retained their conviction.

One investor cited a tripling of the value of his investment (excluding dividends) which yields over 14% from his original cost. He called it, “a good result for sticking with things when your hands are bloody from the pain.”

Another long-time investor called me and read off similarly rewarding figures from client accounts.

We appreciate the continued support of so many investors, who are overwhelmingly long term and not just in for a quick trade. Some have been with us since the firm’s founding in 2009. We never forget that you’re the reason we are in this business.

We have two have funds that seek to profit from this environment: