AMLP Has Yet More Tax Problems

Last November SS&C Alps Advisors, the people who manage the Alerian MLP ETF (AMLP), admitted that they’d screwed up calculating the taxes owed by their fund. Mutual funds and ETFs don’t pay taxes as long as they comply with the rules of the 1940 Investment Company Act for an exemption. AMLP does not comply, because it invests in Master Limited Partnerships (MLPs). Owning more than 25% renders a fund non-RIC compliant and therefore liable for taxes like any other American company. AMLP is 100% MLPs.

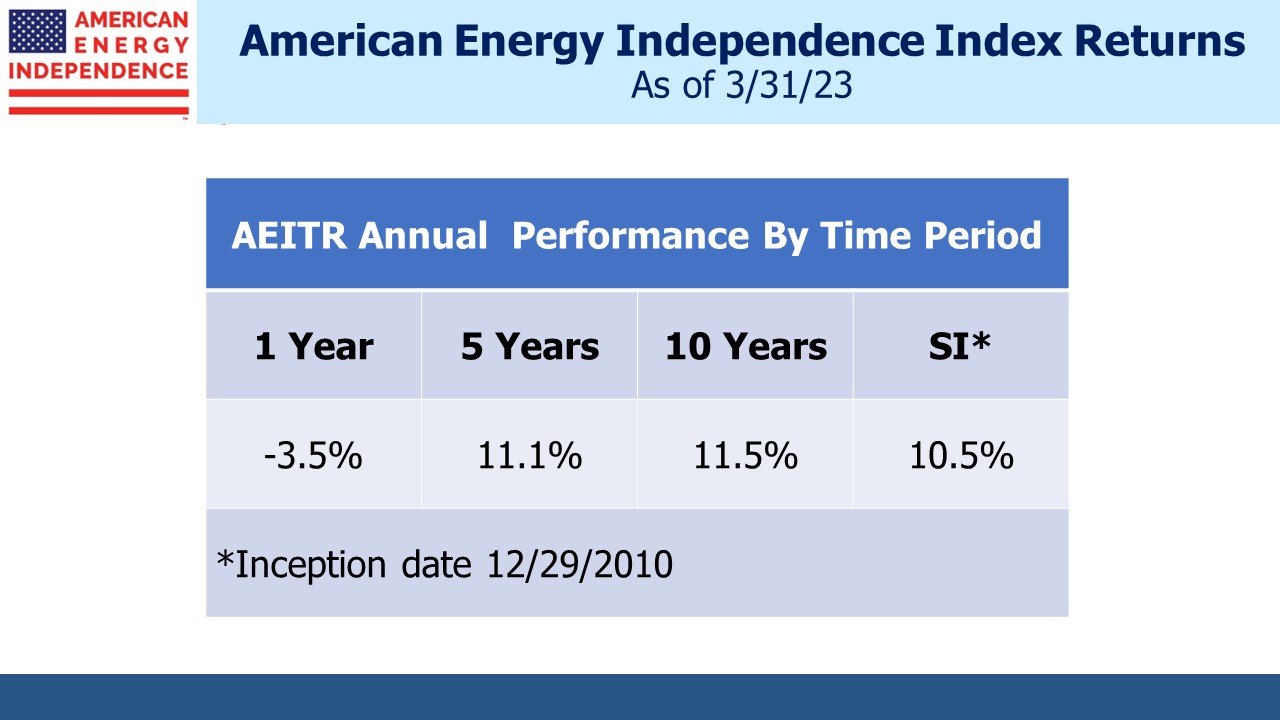

We have written tirelessly on the topic (see MLP Funds Made for Uncle Sam). Last December we noted AMLP’s reduced NAV (see AMLP Trips Up On Tax Complexity) which fell 3.9% at their November fiscal year-end. Because of its flawed structure concentrated on MLPs and thereby liable for corporate taxes, AMLP has a five year annual return of 4.97%. The Alerian MLP Index, which it seeks to track, has returned 7.42%. The 2.45% difference is partly AMLP’s 0.85% annual management fee, but mostly the burden of taxes. By contrast, the investible American Energy Independence Index (AEITR) has a five year return of 11.06%.

Nobody would create AMLP today. MLPs are around a third of the sector, and their numbers continue to decline. It is a relic of a decade ago when the MLP structure dominated. That is no longer the case.

Oneok’s (OKE) proposed acquisition of Magellan Midstream (MMP) a couple of weeks ago caused smaller MLPs to briefly catch a bid as traders calculated the rebalancing within a shrinking pool the loss of MMP would cause for AMLP. The OKE-MMP transaction is looking less likely, as explained later in this blog post.

Nonetheless, AMLP is still the sector’s biggest ETF by a considerable margin. That AMLP retains any holders is confirmation that inertia and benign tolerance still inform investment decisions for some.

November’s tax-based NAV correction wasn’t the advisor’s last word on the issue. Last week they provided a tax update that, “modified the estimate of the Fund’s deferred tax liability” by $188 million, an additional 2.27%.

This will push AMLP’s five year underperformance against an index that has itself severely lagged midstream energy infrastructure to close to 3%.

Since November, AMLP’s NAV has been adjusted down by over 6% as Alps hopes it has finally got its arms around the complex tax issues the fund faces. Their lawyers, who will have carefully drafted the latest press release, wisely added, “The Fund’s estimates regarding its deferred tax liability are made in good faith; however, the daily estimate of the Fund’s deferred tax liability used to calculate the Fund’s NAV could vary significantly from the Fund’s actual tax liability.”

In other words, there could be more to come.

There must exist a hardcore group of AMLP investors who resemble the reliable and extreme primary voters of either political party. They accept their flawed choice with no regard for continued evidence of his (her) failings, because to change now would mean conceding an earlier error. There is no helping these investors. They fork over $50 million in management fees annually to an advisor who has now made two tax errors equal to multiples of that.

But there also exists a swathe of financial advisors holding AMLP for clients whose fiduciary fitness can be questioned by having selected such a poorly run, anachronistic fund. You may be one of these advisors, or you may be a client of one. $405 million of tax-related restatements is starting to look like a situation best avoided. Perhaps a class action lawsuit will seek to restore some of those losses out of past management fees.

AMLP now reports a Deferred Tax Liability (DTL) of $373 million (as of June 2, 2023). Market appreciation will create additional unrealized gains and an increased DTL, which will act as a headwind in a rising market.

The case for not owning AMLP could not be clearer. In fact, its best use may be as a short position, as we’ve noted in the past (see Uncle Sam Helps You Short AMLP).

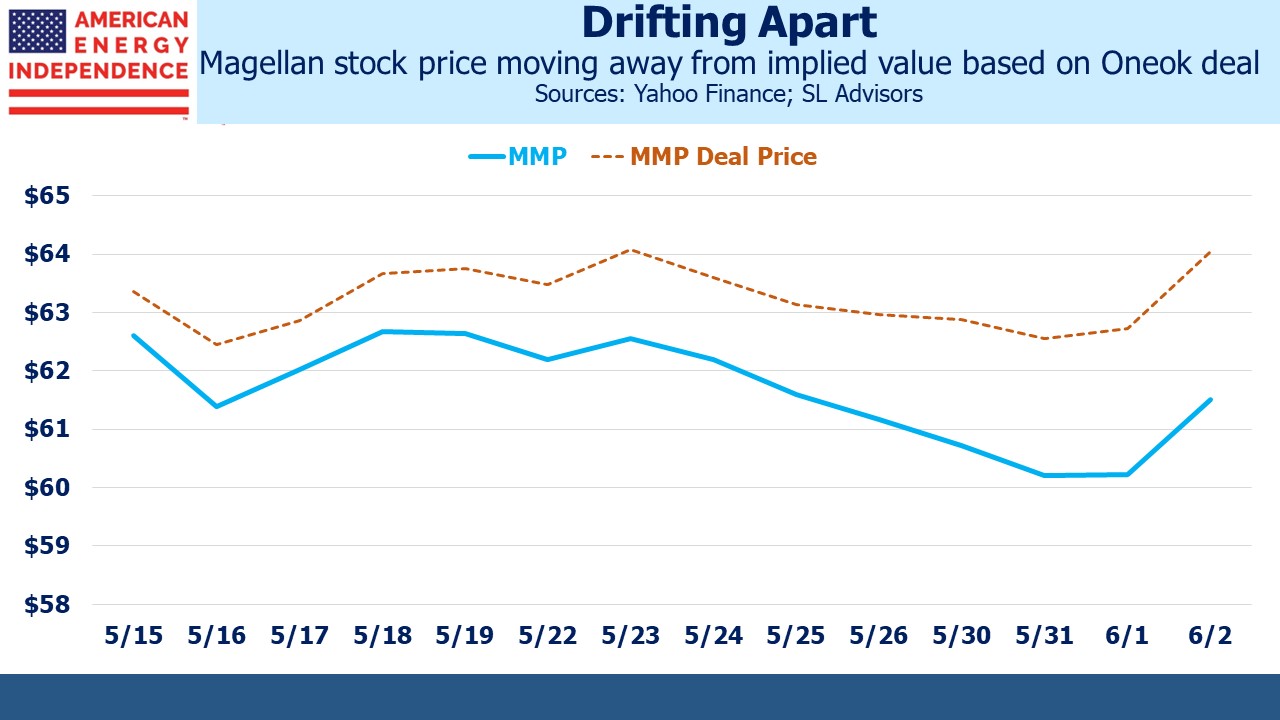

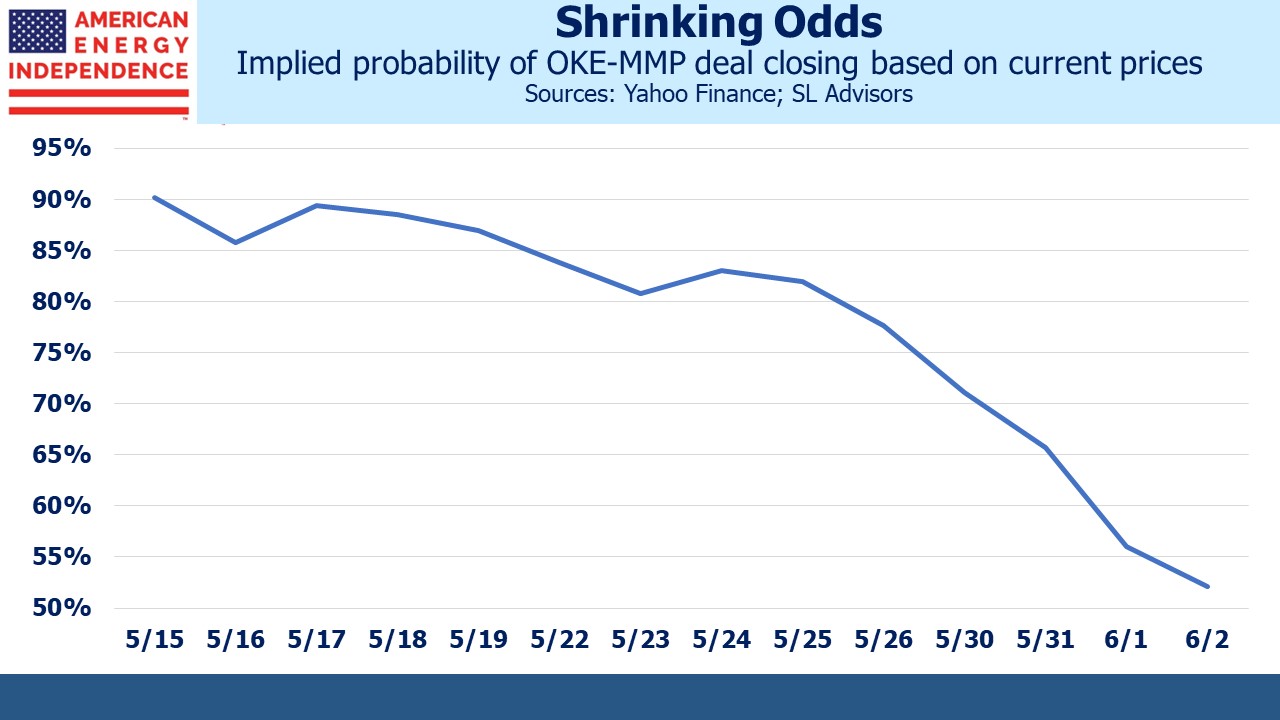

Investors in OKE and MMP will be encouraged to see a widening spread between MMP’s price and the value of OKE’s proposed acquisition. This means traders are increasingly skeptical that the deal will get done. Since the announcement on May 12, OKE is down 8% and MMP is up only 11%, half the promised premium. The AEITR is +2.5%. It’s one of those rare transactions that is bad for both sides (see Oneok Does A Deal Nobody Needs). OKE gets higher leverage and MMP investors face an unwelcome tax bill.

Hopefully it’ll get voted down. We calculate the market-implied odds of it going through are now barely above 50/50*.

We have three funds that seek to profit from this environment:

*The probability of the deal happening is estimated as follows:

Let:

MMP = current price of MMP

MMPD = price of MMP implied by deal

MMPND – the price MMP would drop to if the deal was canceled, which is assumed to be its pre-deal level adjusted for subsequent move in sector as defined by AEITR.

Deal Probability, or DP = (MMPD-MMP)/(MMP-MMPND)

Therefore, odds of No Deal = 1-DP