Americans Work More Remotely

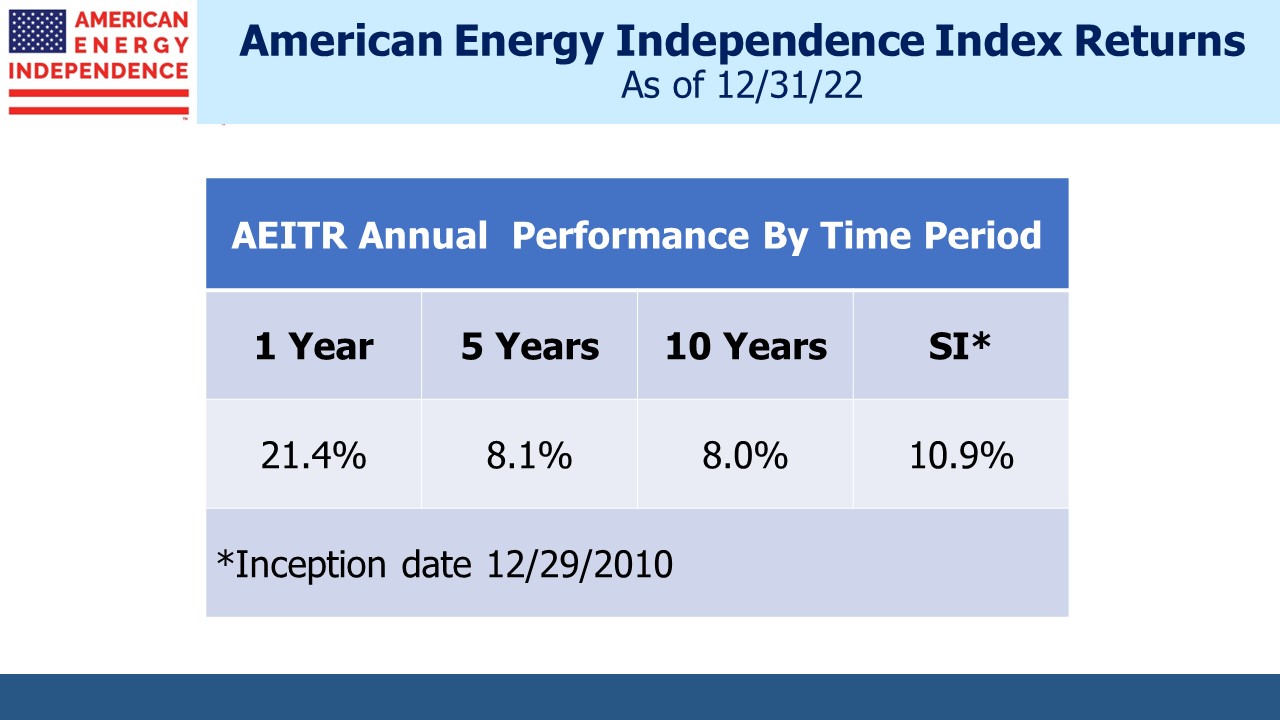

Real estate investors are keenly attuned to the Fed’s efforts to curb inflation. The Vanguard Real Estate Index Fund (VNQ) is down 18% over the past year, lagging the S&P500 which is –6% and the American Energy Independence Index (AEITR) which is –1%.

Rising rates have cooled the hot property market that the Fed’s bond purchases caused following the pandemic. The Economist believes real estate is signaling an imminent recession. An economic slump has been forecast for months even though hiring remains strong. Last month’s unemployment showed the startling resiliency in the job market. In my experience recessions rarely arrive when expected, and don’t start with 3.4% unemployment. Acknowledging the fortunate failure so far of doomsayers, the WSJ explained “Why the Recession Is Always Six Months Away.”

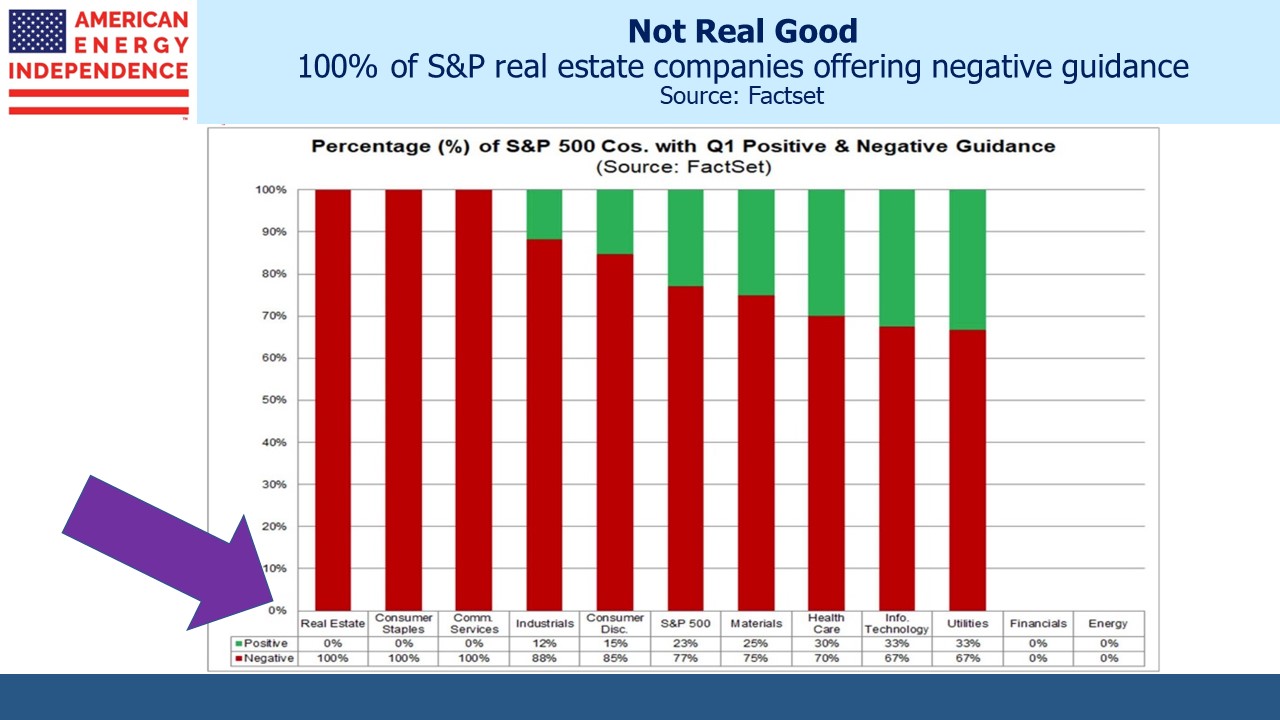

But real estate companies are getting more cautious. Forward guidance for 1Q23 was negative for all 26 members of the S&P500, and 20 of them revised down their full year outlook. Property may be a good long term inflation hedge, but rising mortgage rates and a realization that hybrid work is becoming permanent are substantial headwinds.

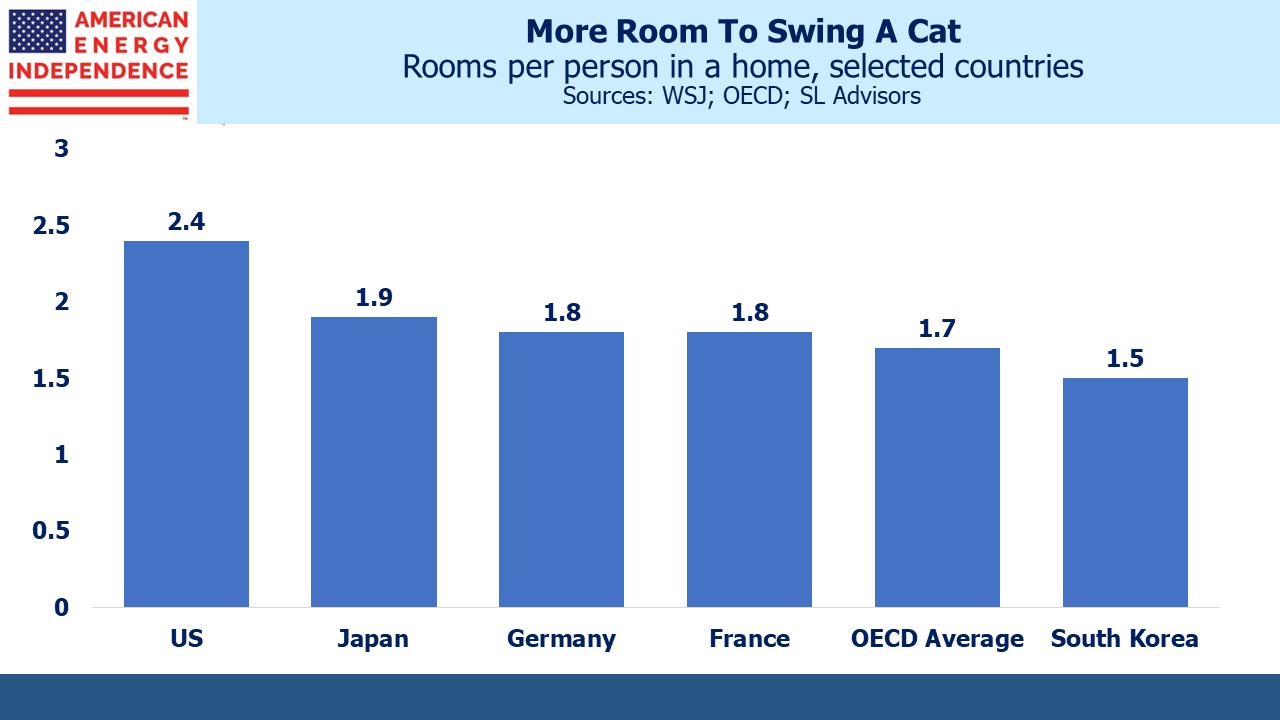

The Wall Street Journal recently reported that US office occupancy is around 40-60% of pre-pandemic levels compared with 70-90% in Europe and the Middle East. Asia is even higher, at 80-100%. This is partly due to American homes being bigger, averaging 2.4 rooms per person compared with other rich countries that are generally below 2.0 and average 1.7 across the OECD. If you live in Hong Kong which must be close to 100% apartments, going to the office and grabbing dinner afterwards is understandably more appealing.

Two years ago we converted the formal living room of our house, rarely used and little more than a furniture showroom, into my office. My wife didn’t share my enthusiasm for more efficient use of our home, but it’s the best office I’ve ever had. You can see it in our company video.

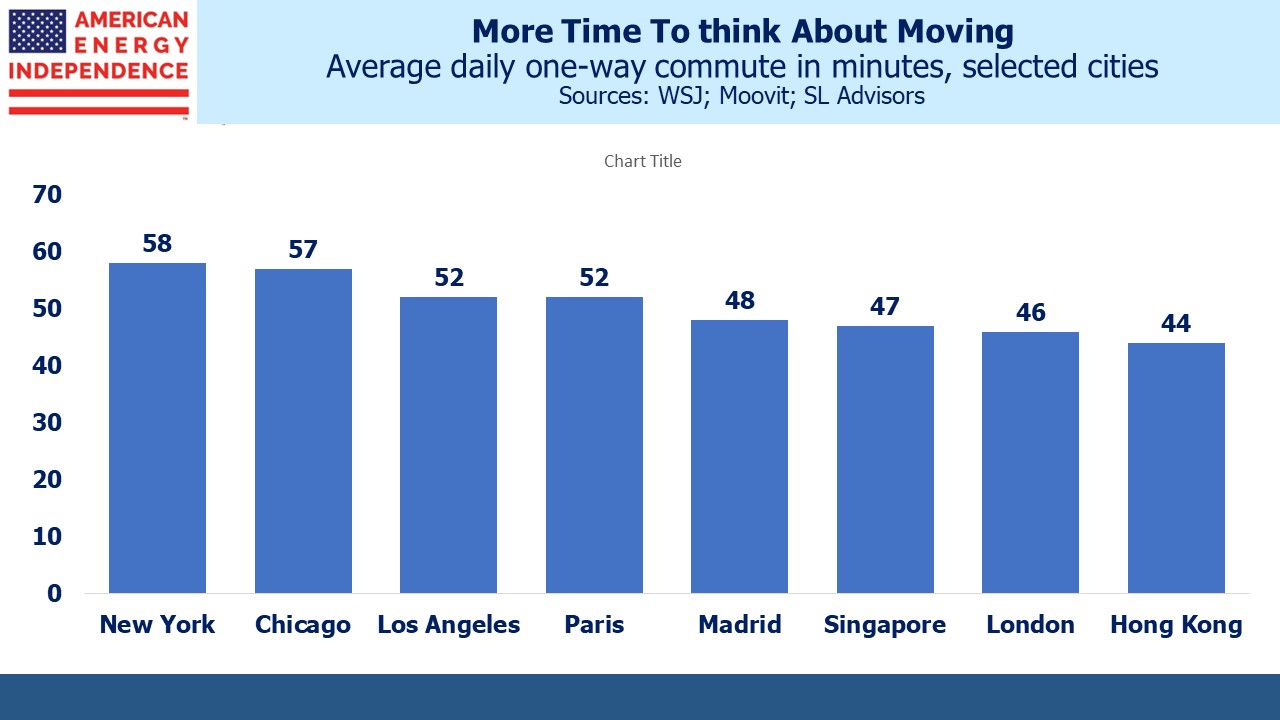

For 25 years I endured a daily commute of 75 minutes each way (or more) from New Jersey to New York City. Transit infrastructure in many US cities is often inadequate, and inferior to other big cities around the world. Like tens of millions, I have first hand experience.

Now I walk downstairs.

It helps that America is a big country. Covid caused us to spread out. There is a lot of available space. But bigger homes mean longer commutes which is another reason Americans are happier working remotely.

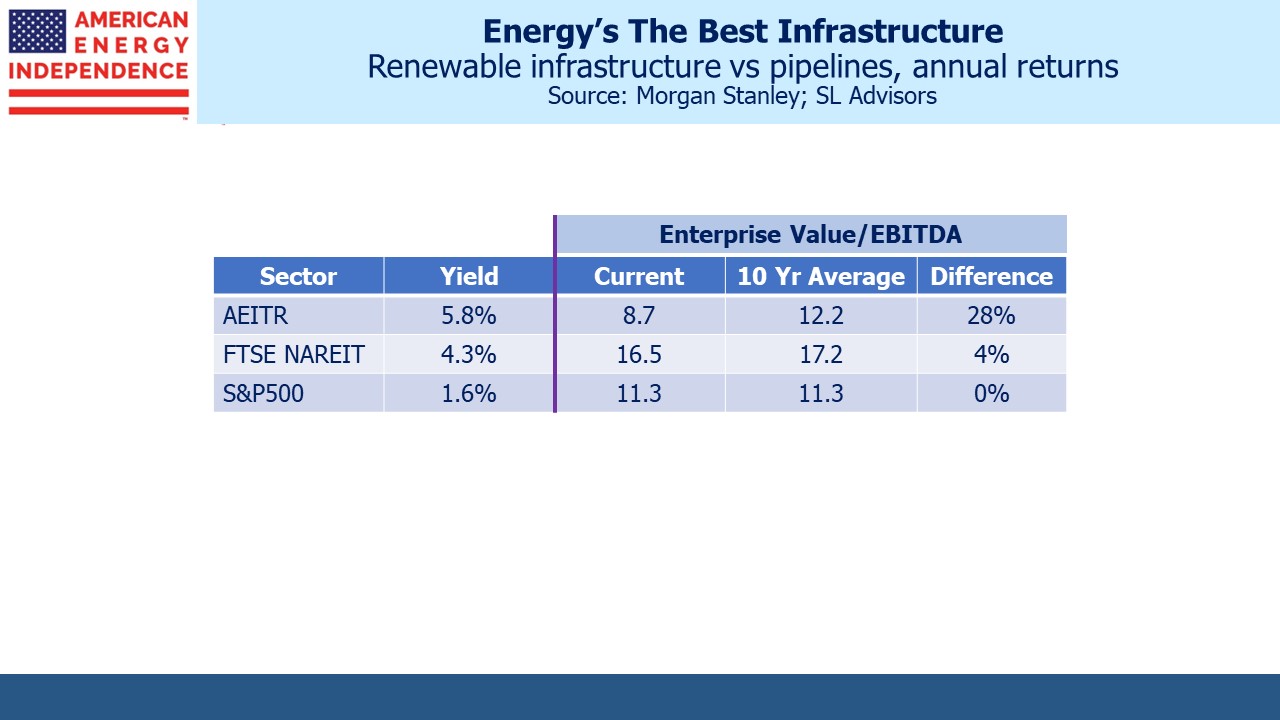

Real estate may be performing poorly, but it’s not yet attractively valued. The FTSE Nareit Index which covers the US commercial real estate industry yields 4.3%, less than two year treasuries and midstream energy infrastructure. It’s close to its ten year average EV/EBITDA multiple, whereas energy infrastructure is 28% cheap. One measure of the real estate sector’s rich valuations is that its current multiple is almost 2X the pipeline sector.

Wells Fargo has estimated that around half midstream’s EBITDA is derived from pipeline contracts that have explicit inflation linkage, usually via the PPI or CPI (see Pipelines Still Linked With Inflation). For energy infrastructure investors, inflation raises the value of the real assets they own as well driving commensurate increases in tariffs. Few investments offer the potential to so readily maintain their value with inflation.

Many innumerate climate extremists assert that solar and wind are the cheapest way to generate electricity. Nonetheless, running a profitable renewables business is surprisingly difficult. Last month wind turbine manufacturer Siemens Gamesa, which calls itself “the global leader in offshore power generation,” announced a quarterly loss of $967million.

BP has moderated an earlier pledge to reduce emissions and its production of oil and gas, because that’s where the returns are highest. Along with Shell, because they’re based in Europe both companies are more vulnerable to pressure from activists. Recently the market has perceived flexibility in their energy transition goals, because traditional energy is so profitable. Their stocks have performed well as a result.

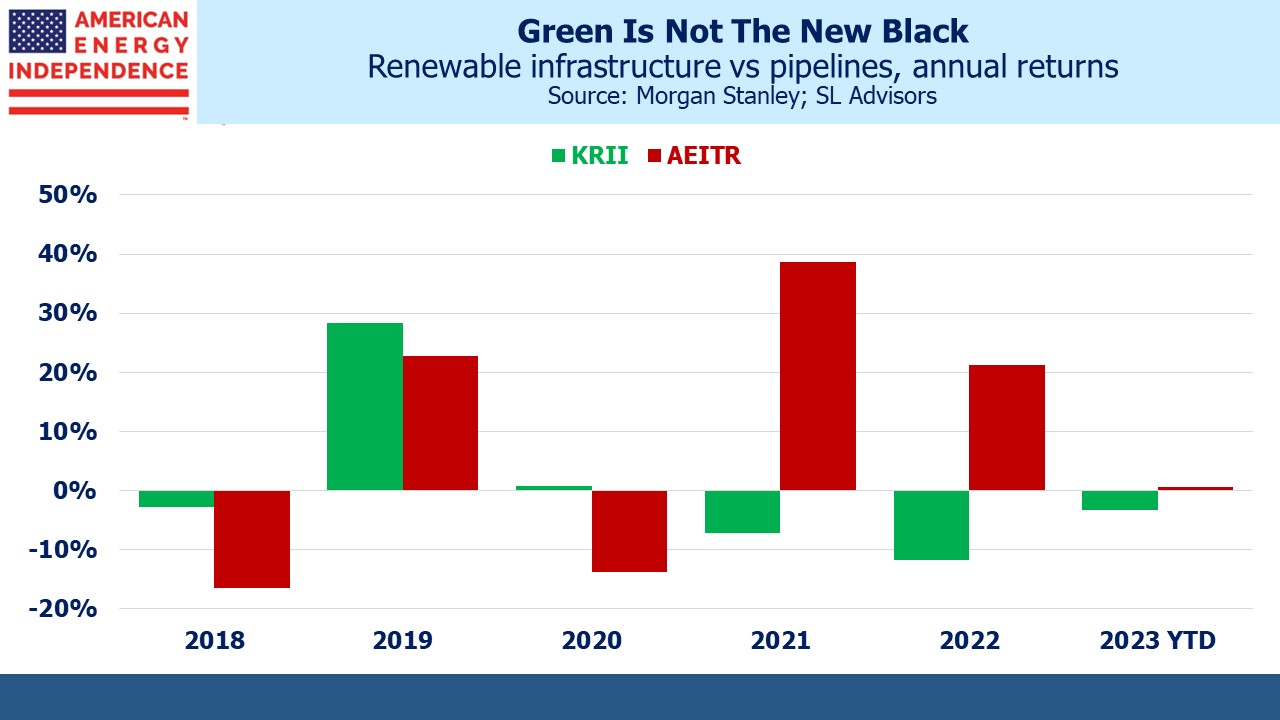

Renewable infrastructure has been an especially poor investment. The Kayne Anderson Renewable Infrastructure Index is flat since 2018 (earliest available data) compared with midstream energy infrastructure which has returned 6.9% pa over the same period. We’re biased towards natural gas infrastructure because that’s where we believe the returns are most attractive. When windmills can offer similar cash flow visibility, we’ll take a closer look.

For now, it’s increasingly clear that when it comes to hard assets, or infrastructure, traditional energy is the place to be.

We have three funds that seek to profit from this environment: