Why You Should Follow The Money In Pipelines

Last year fund outflows totaled $1.94BN for the midstream energy infrastructure sector (still often referred to as the MLP sector even though most of the market cap is corporations) according to JPMorgan. October was the only positive month, at a modest $6MM. 2021 was the third straight year that fund outflows exceeded $1.9BN. The last full year of inflows was in 2016.

It would seem hard to find much positive in those statistics – so read on.

Commentators often refer to money flowing into or out of a market – a description that often betrays intellectual laziness. Since for every buyer there’s a seller, trading flows rarely result in net flows of money. The notable exceptions are (1) IPOs, when new money is invested to purchase shares, and (2) buybacks, when a company retires shares leaving the sellers with net cash taken out from the market.

Ordinarily, the $1.94BN in sales from pipeline sector funds would have been bought by other investors – institutions, high net worth or retail investors – and would simply represent a change of ownership.

But in recent years MLPs and midstream corporations have been announcing buybacks. It’s another example of the industry’s continuing desire to demonstrate financial discipline and return capital to shareholders. When the MLP model prevailed, buybacks were rare since the MLP was always intended to be a funding vehicle, issuing equity when directed by its General Partner (GP) in order to build or buy assets – often from the GP itself in “drop-down” transactions. It’s why we believed GPs were always a better bet than the MLPs they controlled (see The Power of the MLP GP from 2014).

For an MLP to repurchase its own shares would be contrary to its raison d’etre.

Poor capital allocation decisions during the Shale Revolution led to many big MLPs converting to corporations. This was so they could access more traditional investors rather than the US taxable, K-1 tolerant high net worth buyers that had become disillusioned with serial distribution cuts, as well as for various tax advantages for the GP.

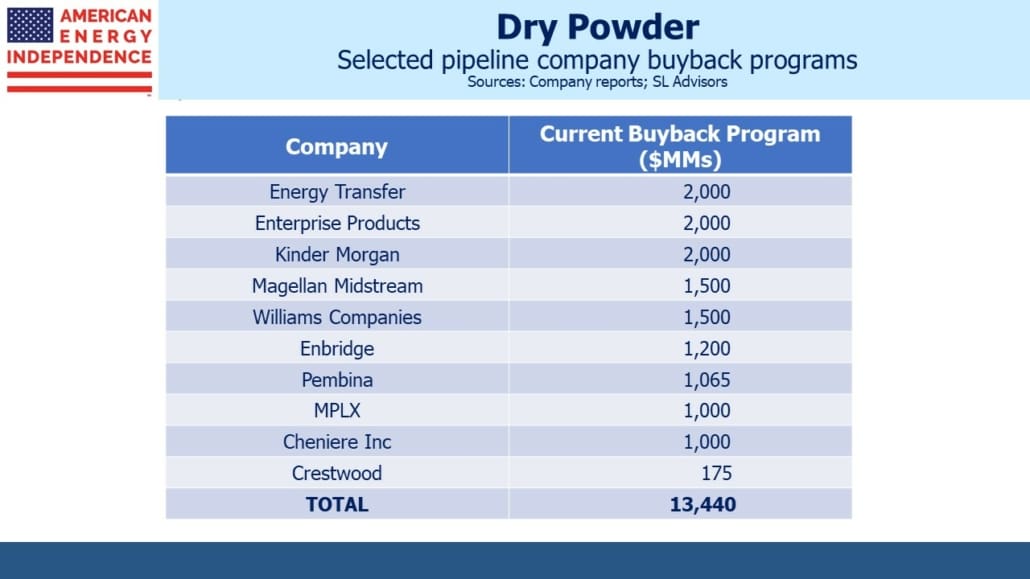

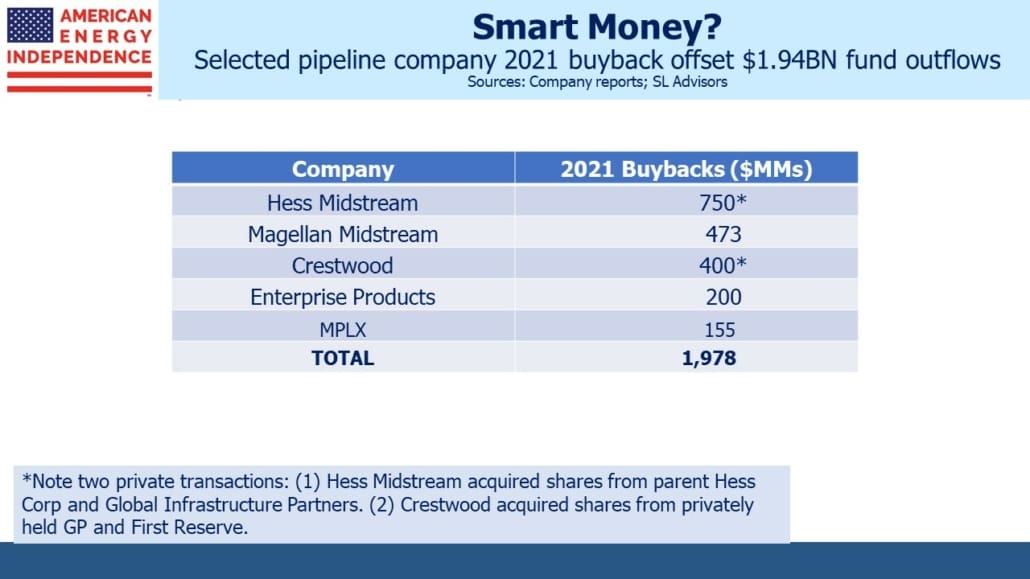

This led to a shift to more traditional performance metrics including total shareholder return (dividends plus buybacks). A selection of the biggest companies shows over $13BN in announced buyback programs. These only impact flows when they’re implemented though – but three companies’ actual 2021 buybacks executed in the open market equal 43% of the $1.94BN in net fund outflows from the sector. They are Enterprise Products Partners, Magellan Midstream and MPLX.

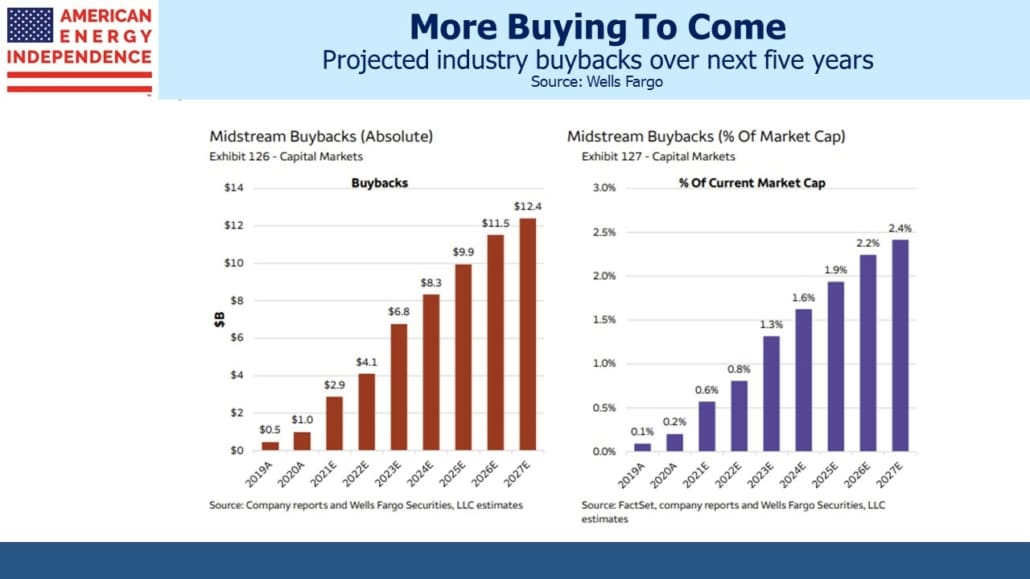

Most companies have yet to announce full year earnings with 4Q21 buybacks – of the three, only the EPD figure is for all of 2021. Wells Fargo estimates that midstream companies in their coverage repurchased $2.9BN of stock in 2021 and see that number steadily increasing in the coming years.

In the first of two privately negotiated transactions, Hess Midstream (HESM) repurchased $750MM in LP units from its parent and investor Global Infrastructure Partners, which also resulted in a commensurate sharecount reduction and increased ownership of HESM by its shareholders. The second private deal saw Crestwood buy out their general partner and investor First Reserve for $400MM.

What it means is that when all the figures are added up for last year, all the fund redemptions by retail investors were easily absorbed by the operating companies themselves. Once FY 2021 reports are published this figure will move higher.

The last five years have been emotionally draining for anyone with an overweight to the energy sector. Your blogger can attest that equal measures of resilience and stubbornness were necessary to maintain holdings through early 2020, so as to participate in the strong recovery that followed. Some of the retail sellers were just weary.

Energy executives are genetically engineered to spend on new projects – new oil and gas output for E&P companies, and new infrastructure for midstream. Thousands of executives have made their careers by putting money into the ground. All these companies and others have rejected internally generated capex proposals, some with optimistic IRRs, in favor of buying back stock. Given the energy sector’s culture, CFOs must show that reducing the share count by returning cash to shareholders to be exceptionally attractive to compete with the desire of some colleagues to spend the money on building projects instead. Also thank environmental extremists for throwing up so many roadblocks that capex has become less attractive.

In other words, in 2021 the less-informed sellers were taken out by better informed buyers.

It’s why net fund outflows didn’t visibly hurt performance. The broadly representative American Energy Independence Index (AEITR) was up 38.6% for the year, beating the S&P500 by almost 10%.

Given the size of the announced buyback programs, any sustained weakness in the sector is likely to be countered with more companies buying back their stock. There are also signs that funds outflows are ending – we’ve been seeing steady inflows into our products for some time, and interest to set up calls by existing and new clients has never been stronger. As the sector switches to experiencing fund inflows, it’s likely to propel prices sharply higher.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.