Why Pipeline Construction Is Hard

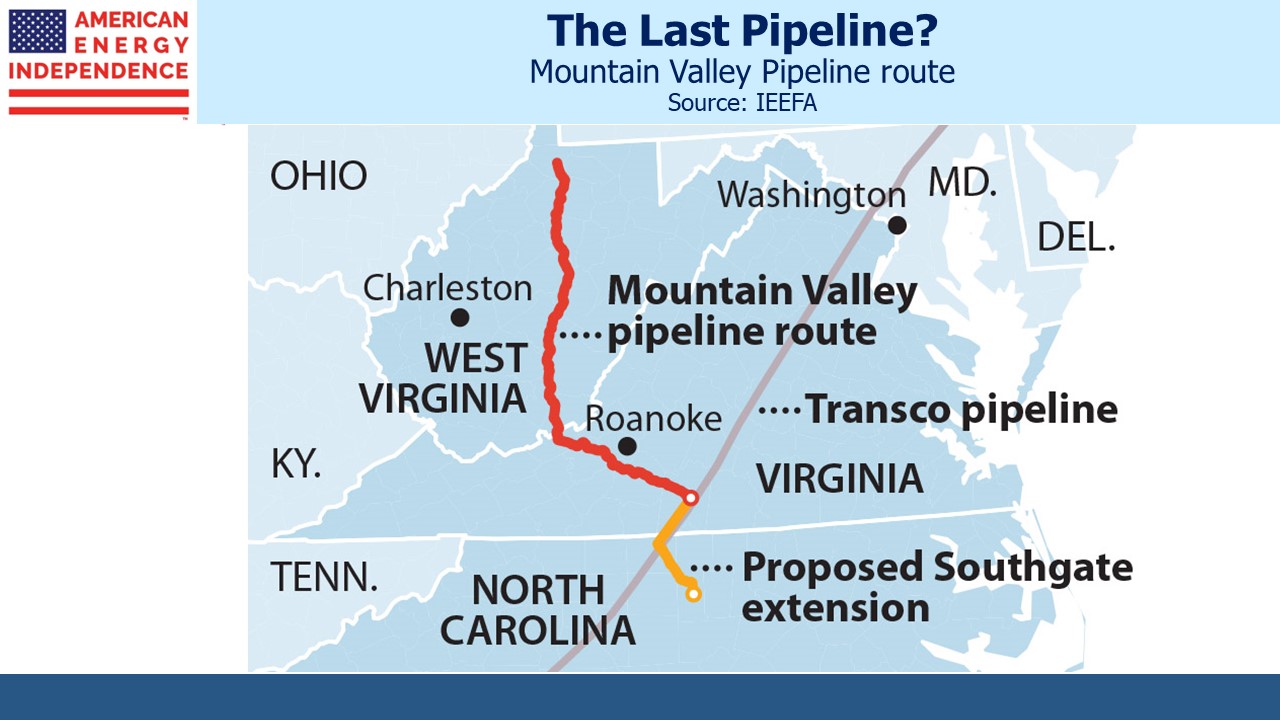

Mountain Valley Pipeline (MVP) will soon move 2 Billion Cubic Feet per Day (BCF) of natural gas from West Virginia to southern Virginia. It will allow increased takeaway capacity from the Marcellus and Utica shale plays in Appalachia. By connecting to Transco (owned by Williams Companies) it will allow for natgas to be transported south, in some cases reaching Cheniere’s LNG export terminals in Sabine Pass, LA or Corpus Christi, TX.

MVP will play a small but important role in getting US natural gas to our friends and allies around the world. It will enable buyers to reduce their dependence on coal for power generation, lowering GreenHouse Gas (GHG) emissions and local pollution. It will offer improved energy security to its buyers. If you’re a strategic environmentalist or climate advocate – and few are – MVP is part of the solution to how we reduce CO2 emissions.

Instead, MVP will probably be the last greenfield natgas pipeline attempted in the US. This is mostly because we have the network we need, but also because navigating the US permitting process is more torturous than being stranded on a desert island indefinitely with that wretched little girl Greta.

Planning for MVP began in 2014. RBNEnergy.com, which publishes regular informative blog posts on US energy, has 19 articles dedicated to MVP and mentioned it in at least 37 different posts this year alone. MVP became a victim of climate extremists who learned how to weaponize the judicial system to insert uncertainty and delay into any project they dislike.

While Equitrans was pressing on with MVP, several other projects to move Appalachian natural gas to the US east coast were dropped. These included Enbridge’s Access Northeast expansion of its Algonquin Gas Transmission pipeline, which had already obtained FERC approval. Kinder Morgan’s Northeast Energy Direct expansion of Tennessee Gas Pipeline is another. These and other pipeline companies concluded that permits didn’t assure completion, perhaps anticipating the travails of MVP.

By May 2021 the 303-mile pipeline was 90% completed. The last thirty miles would average less than one mile per month. MVP required permits from numerous government agencies, including FERC, the US Bureau of Land Management (BLM), the US Army Corp of Engineers and the Virginia State Water Control Board. To cite just two examples, in 2018 a judge on the 4th Circuit struck down Nationwide Permit 12, which had been granted in 2017 by the Army Corp of Engineers and reissued in 2018. The court acted because stream crossings need to built within 72 hours to limit environmental damage, and it was believed MVP was not complying. The court also annulled MVP’s right of way through Federal lands that had been previously granted by the BLM.

Constructing infrastructure projects is often disruptive to the local community, and society is unlikely to accept unquestioned Federal permits allowing work to move forward. But under the current system, a company can acquire all the needed approvals and move forward in good faith, only to find work halted by a court. In effect, a permit issued by a government agency can’t be relied upon.

Equitrans (ETRN), which owns MVP as part of a consortium, has been struggling to complete the late, overdue project for years. They finally reached the goal line when Senator Joe Manchin (D-WV) insisted on Congress by-passing any remaining challenges as part of the increase in the debt ceiling in the summer. MVP was deemed by Congress to be in the national interest (see A Pipeline Win From The Debt Ceiling).

Even then the Court of Appeals for the 4th Circuit blocked construction to allow the Department of the Interior to assess construction through Jefferson National Forest. In August the Supreme Court finally weighed in and progress resumed. In an October 17 SEC filing, ETRN warned of further added costs because, “The ramp up of MVP’s contractor workforce has been slower and more challenging than expected, due to multiple crews electing not to work on the project based on the history of court-related construction stops…”

The permitting uncertainty isn’t limited to fossil fuels. The SunZia Wind and Transmission project filed for permits in 2006 and is only now starting construction. Navigator CO2 Ventures recently canceled a proposed pipeline aimed at supporting carbon capture because of “unpredictable state regulatory processes”.

Every infrastructure project faces opposition, and climate extremists are far from a homogeneous group with a coherent set of strategic objectives. Communities on the Jersey shore, where we have a summer home, are the red part of a blue state and their opposition to Orsted’s proposed offshore wind turbines helped scupper that project (see Windpower Faces A Tempest).

We concluded years ago that the impossibility of building new pipelines in the US would improve Free Cash Flow (FCF), because with less capex companies would return more cash to shareholders. This is what’s happening. As climate extremists learned how to use legal challenges to further their aims, “Hug a climate protester and drive them to their next protest” began to make sense.

But the tool of limitless court challenges knows no political ideology, and it’s being used against projects that seek to build more intermittent energy (solar and wind) as well as carbon capture. It no longer affects the midstream energy infrastructure sector – the present pipeline network is going to have to be adequate, because there’s little industry appetite to endure another MVP. Ironically, liberals convinced the planet is burning up should be the most vocal supporters of the permitting reform that MVP shows is so sorely needed.

Last week ETRN said they were considering selling themselves, and the stock duly rose. MVP should go into service next quarter, years late and at more than double the initial estimated cost. According to analysts at Citibank, the list of potential buyers includes Williams Companies, Kinder Morgan and Energy Transfer. Some potential acquirers dropped plans years ago to build pipelines adding natural gas takeaway capacity out of the Marcellus. One of them will likely conclude that it’s better to buy a finished project and avoid the painful construction process.

Last year NextEra Energy, an owner of the MVP JV, wrote down their interest in the pipeline. Earlier this year, ETRN’s market cap ascribed zero value to MVP. Consensus among investors was that the project would never be completed. Now that it is, there will be multiple suitors. It shows that climate extremists don’t just support the pipeline sector’s FCF, they also make existing infrastructure more valuable.

We have three have funds that seek to profit from this environment: