Why Gold Miners Can Outperform the S&P500

Towards the end of last year we felt there was an interesting opportunity to be long equities hedged with a short position in the Euro. Our thinking was that equities were attractively priced as long as a crisis was averted, and most of the bad things we could imagine would either begin in Europe (i.e. Euro collapse) or affect it more than the U.S. (such as an Israeli strike on Iran given the EU’s greater reliance of Middle East imports than the U.S.). We employed this bias in Fixed Income where long positions in bank debt were combined with short Euro positions.

That trade is no longer interesting, because a short Euro is a less effective hedge now that it’s weakened. But a similar concept exists with gold miners and equities.

Gold and Silver miners have for many months been trading at a healthy discount to the NAV of their reserves. Although the optionality provided by a long position in a miner should be worth something (since a rising gold price ought to create a disproportionate increase in the stock through operating leverage while if gold falls to unprofitable levels they can simply stop digging) the market continues to price the sector at a discount. One obvious move is to buy the Gold Miners ETF (GDX) and short gold itself (GLD). However, this means simply betting on a reversion to the mean of the relationship, and there’s no knowing when that might happen.

Instead, long GDX and short S&P 500 is an interesting trade. Gold is out of favor and a short position isn’t likely to provide much protection from here. If gold does sink, along with GDX, it’s likely to be in response to slower growth so the short equity hedge should provide some protection. But in that scenario the odds of QE increase, so reflation ought to provide some support for the yellow metal. Conversely, if the world avoids all the various disasters that may afflict it, rising markets are likely to lift commodities with them, and the weaker US$ that would result in that scenario would also provide support for GDX.

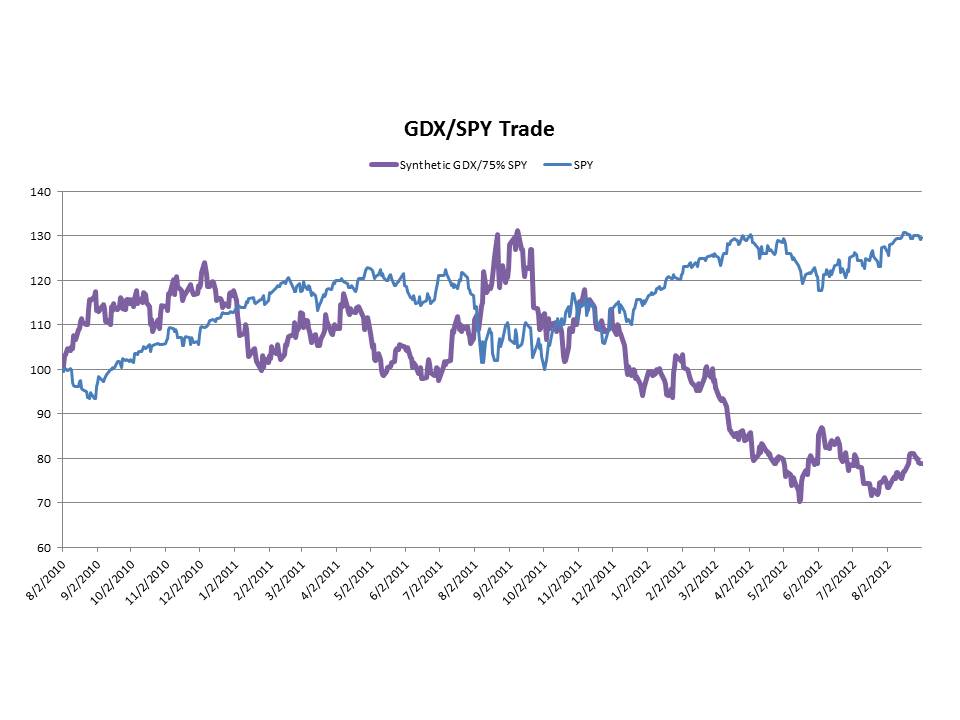

The correct hedge ratio is less than 1:1 – we prefer something closer to $1 of GDX versus short $0.75 of SPY. And the correlation between GDX and SPY is not as strong at with GLD, but we think this combinaton of exposures makes more sense. In the long run (i.e. years) we don’t think gold will perform as well as equities. Warren Buffett and others have articulated most eloquently the problems with an asset that does nothing, pays no dividend and costs money to store. But we’re entering a period where developed world central banks will be redoubling their efforts at reflating, with the ECB likely to adopt their own form of QE in the next several weeks. Long GDX allows one to invest in mining stocks at a current discount to their reserves without direct exposure to the relationship continuing to deteriorate. This is why we are currently invested in GDX in our Deep Value Equity Strategy, since we think it offers an attractive risk/return profile compared with the broader equity markets.

The chart below shows the last two years of a position long GDX/short 75% SPY, and also the S&P500 itself, both rebased to 100 on August 2, 2010.

Disclosure: Author is Long GDX