Why Are Real Yields Rising?

The members of the Federal Open Market Committee (FOMC) could be forgiven for feelings of quiet satisfaction. They’ve raised short term rates higher than most observers expected, and odds of the consequent recession have been receding. The increase in the unemployment rate to 3.8% on Friday leaves it still well below full employment. Yet inflation expectations remain well contained. The University of Michigan survey reports a five year outlook of 3%. Republicans (3.3%) are more pessimistic than Democrats (2.7%), but members of the White House’s incumbent party are generally more willing to think things will work out.

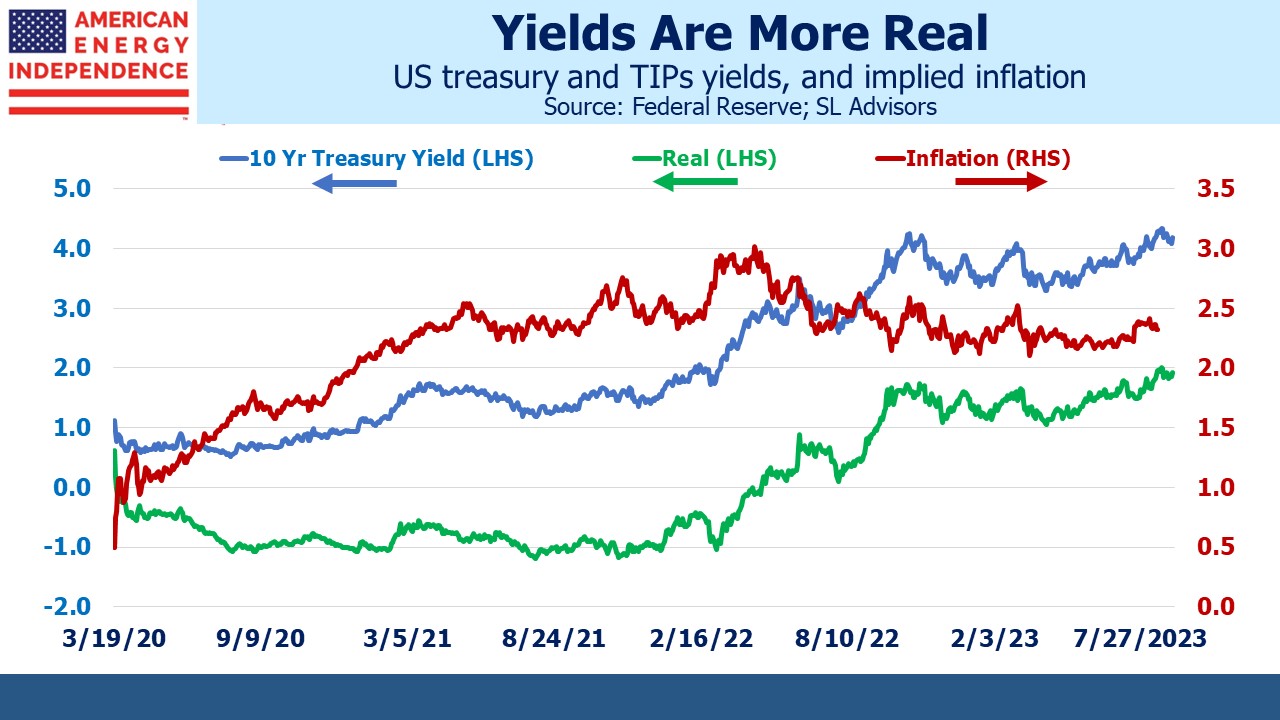

Inflation expectations from the bond market tell a similar story, with ten year inflation derived from TIPs at 2.3%. All this is consistent with a Personal Consumption Expenditures (PCE) deflator of 2%, since its construction means it tends to run a little lower than the CPI that most people rely on. Fed credibility remains intact.

But there’s always something to worry about. Because the ten year treasury yield has drifted up to 4.25% while the inflation outlook hasn’t changed, it means real yields have risen to almost 2%. As recently as eighteen months ago real yields were negative. The distorting effect of central banks and other return-insensitive investors was sufficient to guarantee a loss of purchasing power on buyers. The current 2% real yield is close to the long term real return on treasuries.

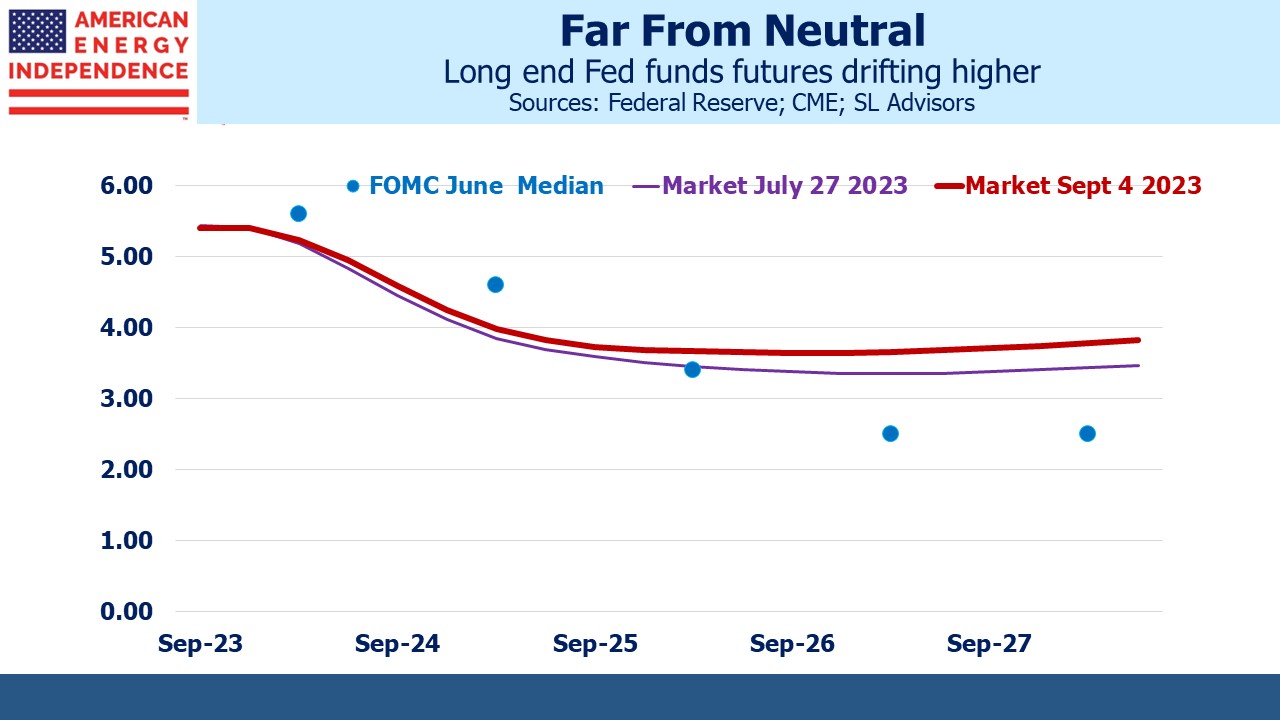

Near term SOFR futures have barely moved over the past few weeks. Contracts five years out and longer have borne most of the upward adjustment caused by the increase in treasury yields.

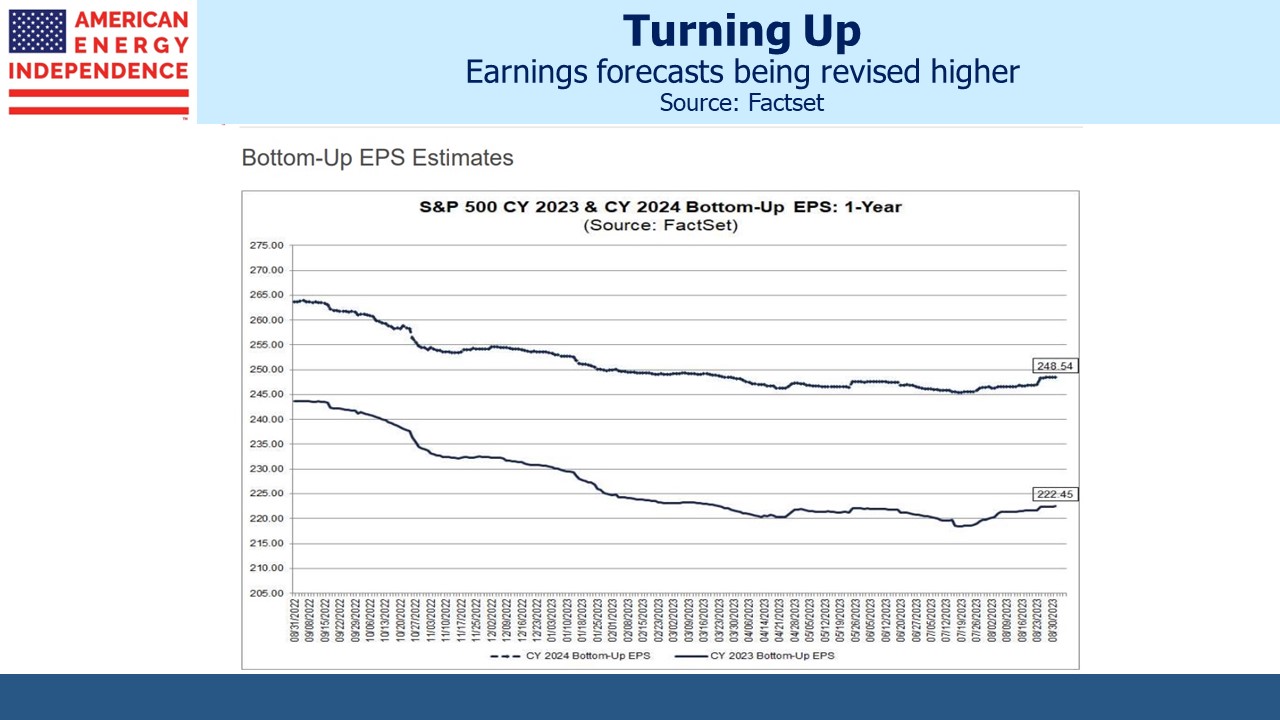

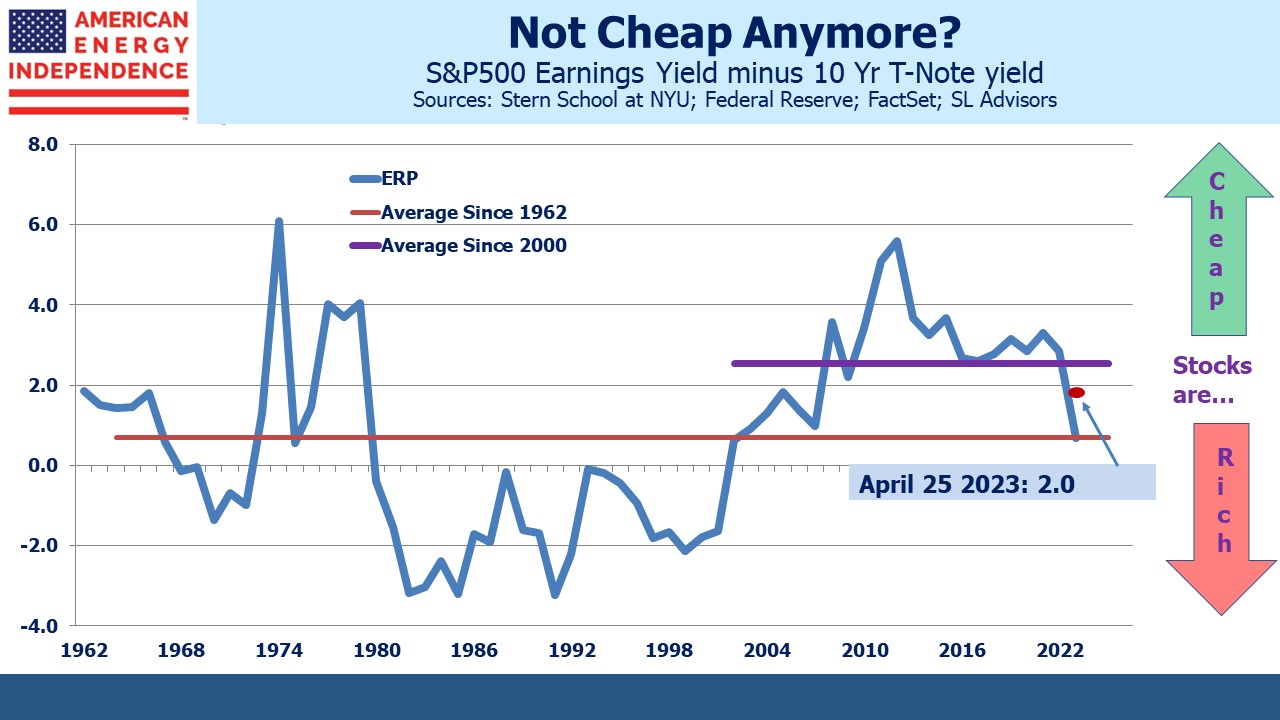

JPMorgan revised up their 3Q23 GDP forecast to 3.5%. A few months ago they were among those forecasting a mild recession by year’s end, something they no longer expect. Factset bottom-up earnings forecasts have started to edge higher. It’s just as well, because the Equity Risk Premium (ERP), defined here as the difference between the yields on S&P500 earnings and ten year treasuries, makes stocks look as expensive as at any time in the past two decades.

The corollary to an expensive equity market is that bonds are cheap. It’s not something you see often on this blog, but treasuries look more attractive relative to stocks than in a long time. We wouldn’t suggest switching, because the poor US fiscal outlook makes inflation a long-term risk and fixed income investments won’t offer much protection.

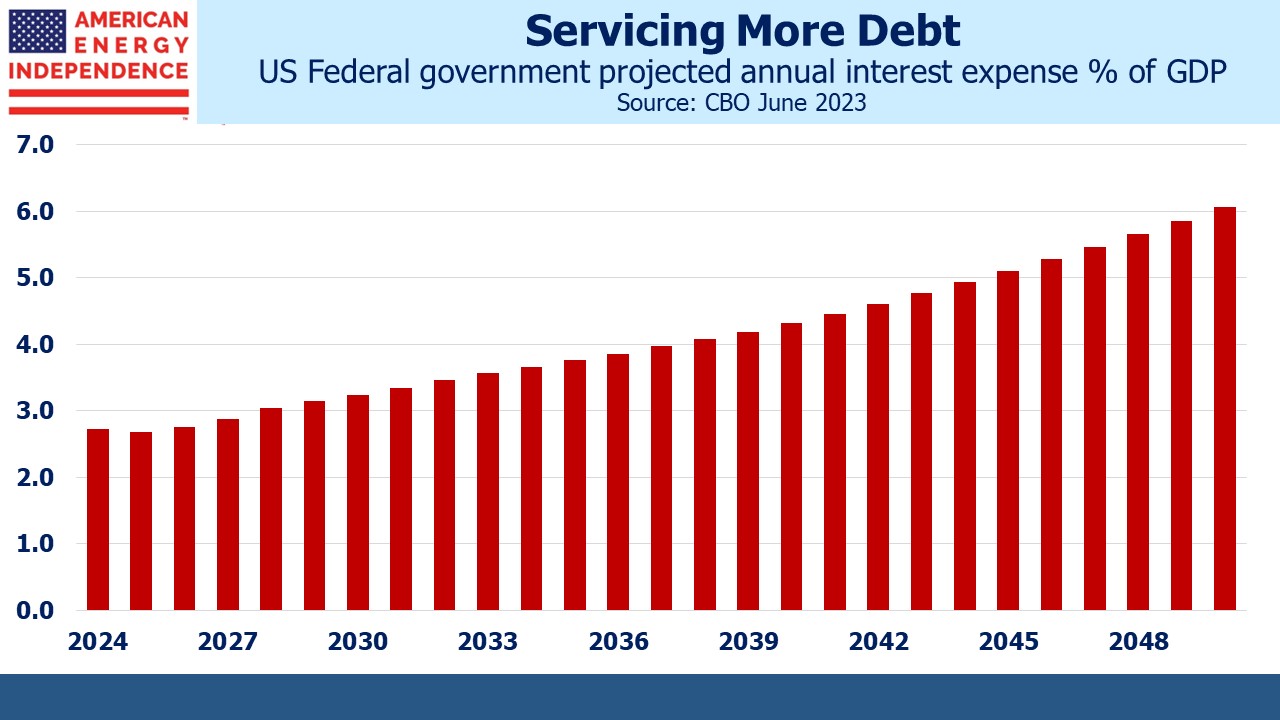

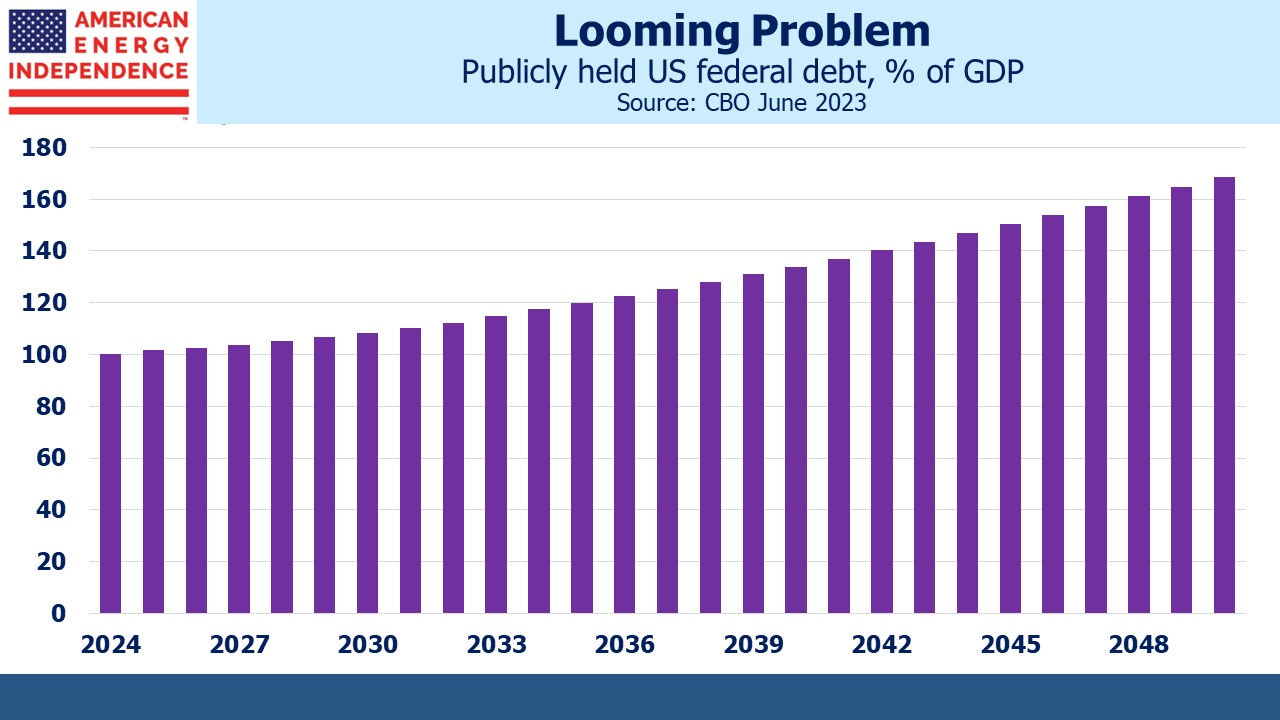

Interest expense on the US federal debt is forecast to more than double as a percentage of GDP over the next 25 years, according to the Congressional Budget Office. Publicly held debt will rise from 100% of GDP to 169% over the same period. One of the mysteries of finance is how long term US interest rates have maintained levels seemingly oblivious to our helpless profligacy. Thirty year bonds at 4.4% can only be justified by substantial demand from buyers willing to ignore that. As well as central banks, there are sovereign wealth funds with hundreds of $BNs to invest satisfied simply with the assurance of getting their money back. Add pension funds with inflexible mandates that continued to require a fixed income holding even when yields were below 1%.

Even US banks adopted the same behavior during QE, which is why Silicon Valley Bank failed and why the industry had $515BN in unrealized losses on securities in the first quarter, albeit with an improving trend since 3Q22.

However, there are signs that the appetite for bonds among those that care least about the return may be waning, which is allowing real yields to rise. Kevin Coldiron is a long-time friend and retired hedge fund manager who is now a finance lecturer at UC Berkeley and co-authored The Rise of Carry. Kevin writes thoughtfully on financial markets, and a recent blog post Inflation in the Twenty-First Century Part III: A Circular Flow No Longer addresses this issue.

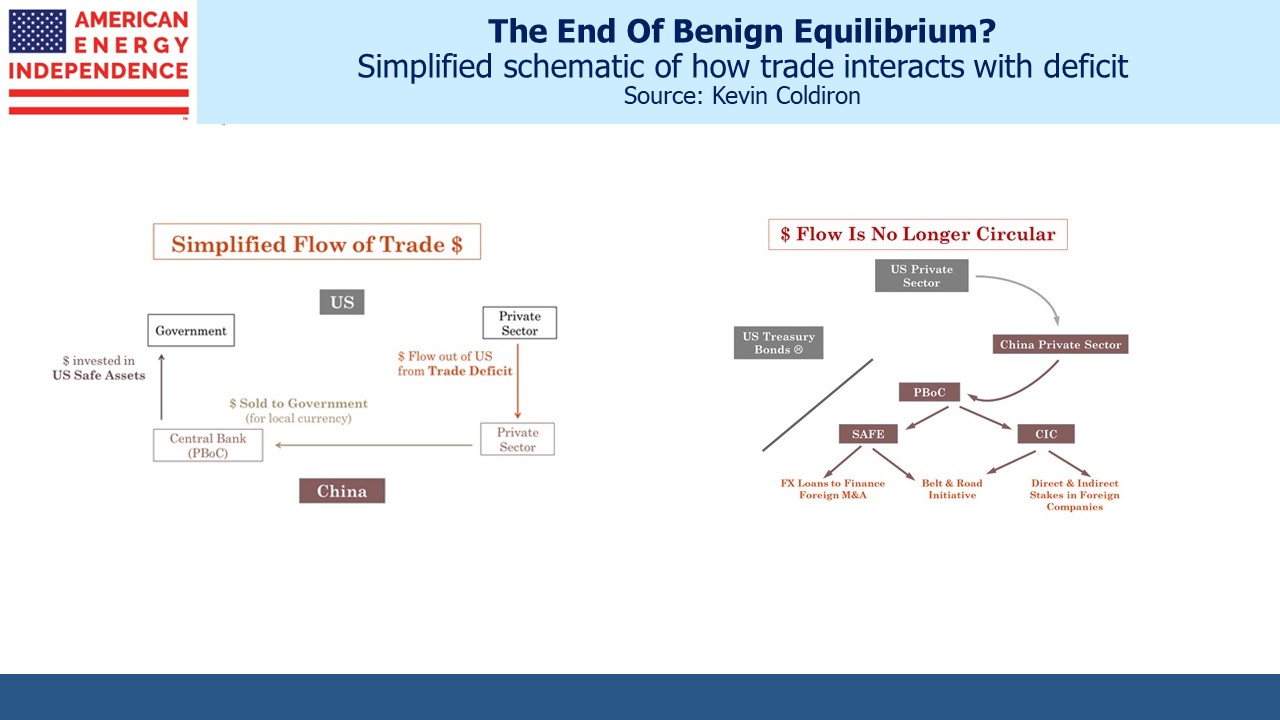

For decades the US has run a trade deficit. In aggregate, this leaves the world’s exporters with more US$ than they need, and some of them get reinvested back into US treasuries. It’s often pointed out that a trade deficit requires financing by foreigners, through asset sales or debt issuance, because our exports don’t generate enough foreign currency to pay for our imports.

Kevin neatly displays this in the first of his two charts. But he goes on to suggest that this happy state of affairs may be ending. China is reducing its holdings of US treasuries. Perhaps the sanctions imposed on Russia following its invasion of Ukraine was a factor. A $1.1TN investment in US government bonds doesn’t look like a smart move for a country pledged at some point to reunify with Taiwan.

The Federal Reserve is also shrinking its balance sheet, albeit ponderously.

There’s little reason to expect real yields to stop rising. 2% is simply the long run average. It’s only high compared with the past few years. The factors causing China and the Fed to cut back will remain indefinitely. Maybe the bond market, which is far bigger now than in 1994 when Jim Carville famously said it could “intimidate everybody,” is about to command more of our attention.

We have three funds that seek to profit from this environment: