Which Pipeline Companies Are Best At Capital Allocation?

An axiom of capitalism is that a business must earn a Return On Invested Capital (ROIC) in excess of its Weighted Average Cost of Capital (WACC). It’s just as true for a lemonade stand as for a conglomerate.

I should note here that fifteen years ago our younger daughter (then about nine years old) set up a lemonade stand at the end of our backyard on the 12th tee at our golf club. Due to the generosity of the golfers passing by she earned an excessively high ROIC. This should have invited competition, but she sensibly took early retirement, concluding that capitalism wasn’t that complicated.

Wells Fargo recently updated their estimates of ROIC for midstream energy infrastructure companies. Results varied widely. They define this as capital invested versus change in EBITDA over rolling five-year periods. It’s not a perfect measure – for example, it excludes the management of existing assets. And a project that was funded at the end of the five years will generate future EBITDA not captured in the calculation.

Nonetheless, over time it offers a decent measure of how effectively management teams are making capital allocation decisions.

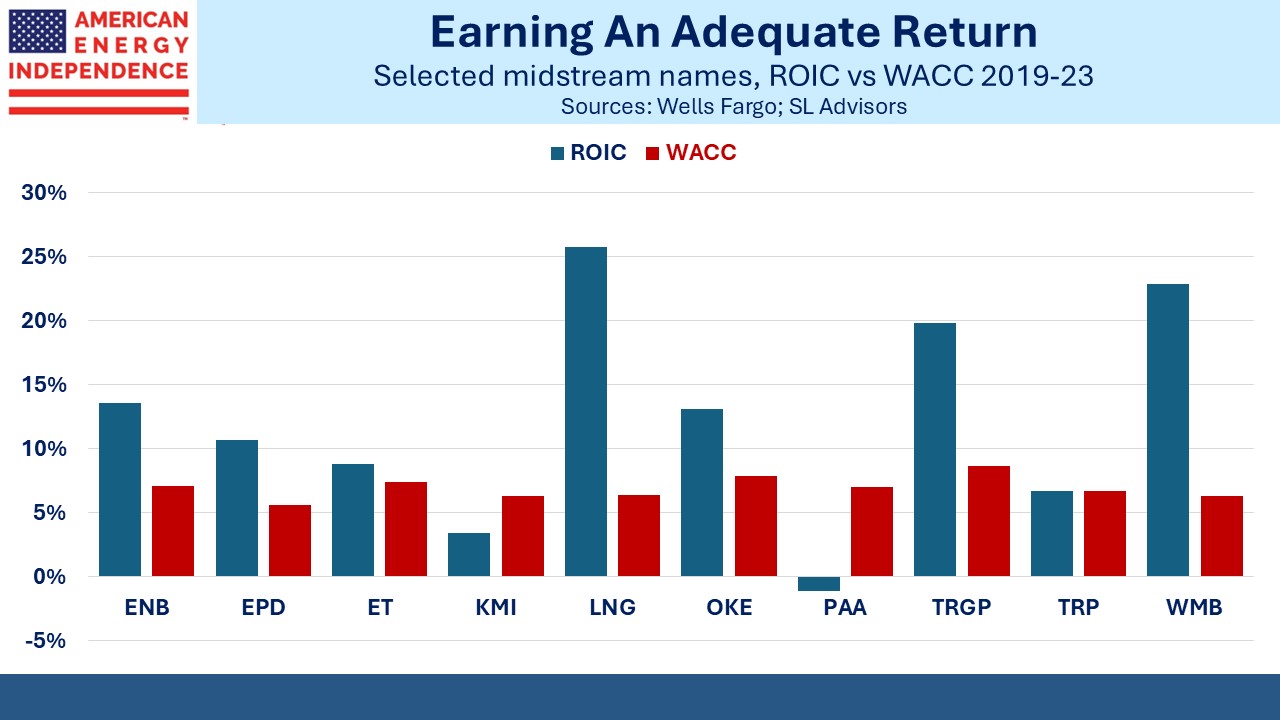

The first chart compares returns with cost of capital, or ROIC against WACC. Less risky businesses in theory enjoy a lower WACC, allowing them to profitably invest in lower return projects. The bigger the gap between ROIC and WACC, the happier the investors are. Cheniere (LNG) stands out as earning their owners a substantial return. Williams Companies (WMB) and Targa Resources (TRGP) are also very good.

At the other end, Kinder Morgan’s (KMI) capital allocation earned an inadequate return. The calculation for Plains All American (PAA) shows that their projects generated negative EBITDA, although this was more accurately the result of lower fees on Permian oil pipeline tariffs when they negotiated new rates.

Five years may be too short a time to judge. But Wells Fargo shows that skill in capital allocation seems to be persistent, in that for KMI and PAA, the results don’t look much better over the past decade either. When these companies talk excitedly about the growth projects they’re planning to finance, the non-fawning analyst might enquire whether their track record justifies such enthusiasm.

Of course, a business can perform well because of great returns from assets it already owns. The weak capital allocators in recent years are being supported by better decisions made long ago by their predecessors on the management team.

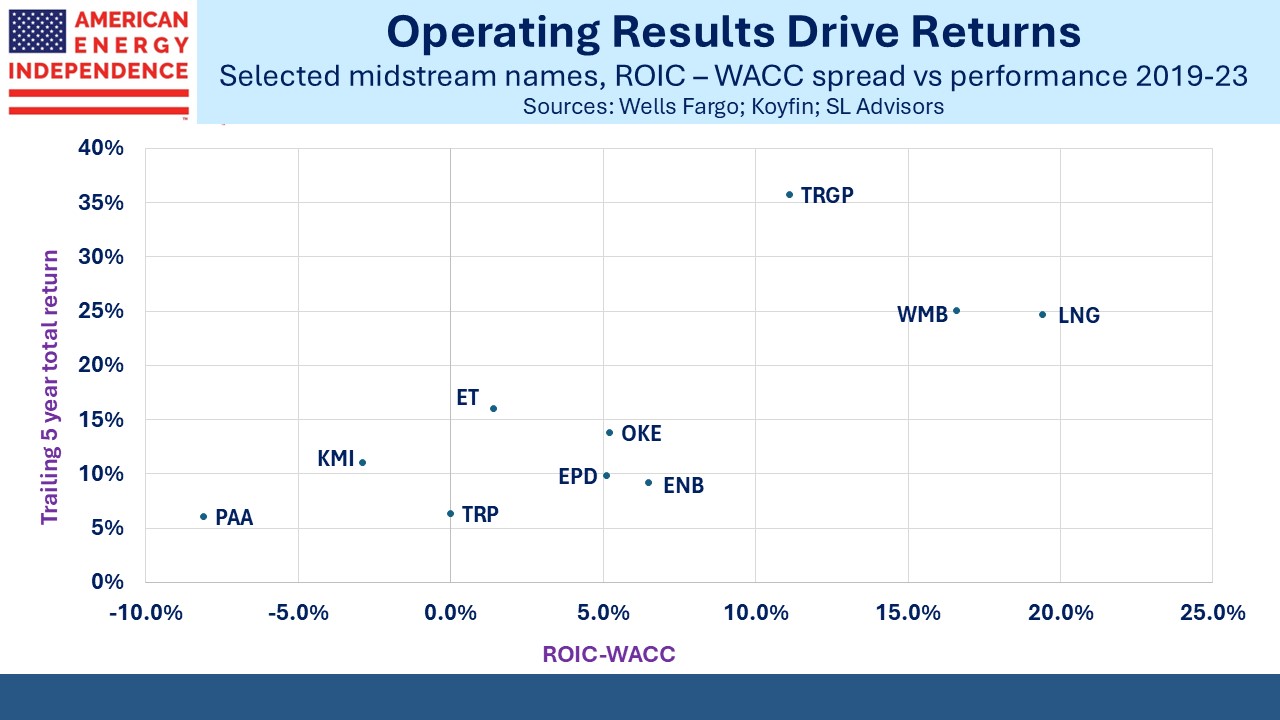

One would expect that proficiency in capital allocation drives longer term returns, and the second chart shows that’s generally true.

Targa Resources (TRGP) is the standout here. Five years ago TRGP was often criticized for its capex plans at a time when most companies were cutting spending after several years of poor returns. We were among the critics (see When Will MLPs Recover?).

In November 2019 we wrote, “Former CEO Joe Bob Perkins flippantly talked about new projects as ‘capital blessings’. Investors won’t miss his self-serving arrogance.”

It turns out that those decisions were on balance good ones. However, the same math showed that over the prior decade 2009-19, TRGP’s ROIC on capex ranged between 3% and 6%, so our skepticism was well founded. They showed that results can improve, although it’s uncommon.

One of TRGP’s best decisions was in 2018 when they took a majority stake in the Grand Prix NGL pipeline. By bringing NGLs from the Permian in West Texas to their Mont Belvieu processing facility and Galena Park export terminal in Texas they became more vertically integrated. In January 2023 they took complete control of Grand Prix by acquiring Blackstone’s remaining 25% interest.

Cheniere has both the best spread of ROIC vs its WACC as well as the highest overall ROIC. Completing projects on time and under budget helped. Cheniere also profited from the jump in global natural gas prices following Russia’s 2022 invasion of Ukraine.

Cheniere is benefiting from substantial capex in prior years. Their export terminals require comparatively little spending on upkeep. Their maintenance capex as a % of EBITDA is consistently at the low end of their peer group, which feeds through into a higher ROIC.

TC Energy was hurt by cost overruns on their Coastal Gas Link pipeline in Canada and spending on the proposed Keystone XL crude pipeline, which President Biden canceled in January 2021 shortly after taking office.

Looking ahead, Wells Fargo generally expects history to repeat, Differentiating among companies based on their capital allocation is one of the most important variables to consider in constructing a portfolio. We expect the industry to continue delivering good results on this metric.

We have two have funds that seek to profit from this environment: