We’re All Crude Oil Traders Now

Pioneer Natural Resources (PXD) was dubbed “The MotherFracker” by David Einhorn last May at the Ira Sohn Value Investing Conference. Einhorn is bearish on PXD and other E&P companies that use hydraulic fracturing to release crude oil from shale formations because he calculates that after properly accounting for their capital investment they don’t grow their reserves or generate free cash flow. We have no position in PXD and no view on Einhorn’s bearish call. PXD has lost roughly half its value from its high is the Summer of 2014 and has also fallen sharply since Einhorn’s presentation last May. Like the Alerian Index, PXD has followed crude oil lower.

The other day an investor presentation from PXD caught our attention, in part because PXD executed a $1.4BN secondary offering. We never like it when a company issues new equity following a substantial fall, and I doubt PXD investors were happy about it either. But it shows there is money available to domestic E&P companies in spite of plummeting crude oil.

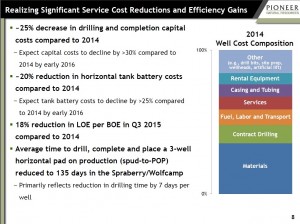

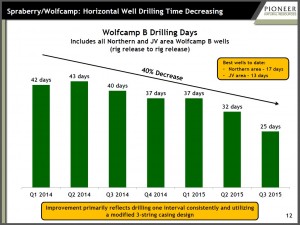

Part of the reason probably relates to the continued operating efficiencies being squeezed out by companies such as PXD. As the charts from their December presentation show, costs have been falling 18-25% over the past couple of years; time to drill a well has fallen 40%. As a result, they increased production by 12% last year.

Whether or not this is good for the oil market, it can’t be bad for the energy infrastructure companies that gather, process and transport their output. It highlights the resilience of the domestic E&P industry to the collapse in crude.

Not every E&P company looks like Pioneer though, and crude production is falling in North America as U.S. output expected to be lower this year versus 2015 with both the Bakken in North Dakota and Eagle Ford in south Texas contributing to the drop. Canadian producers in Alberta have long struggled with limited options to get their output to market. This is why the Keystone pipeline is such a big deal for them. The limited transport options mean Alberta crude trades at a substantial discount to the benchmarks, and it recently dropped below $20 a barrel which has caused some wells to be shut in rather than fail to cover even their operating costs. Reports indicate a reduction of more than 35,000 barrels a day of output from two producers.

At this point I imagine the discussions over crude oil strategy within the Saudi government must be heated to say the least. The stubborn refusal of large swathes of non-OPEC production to collapse is opening an enormous hole in Saudi Arabia’s budget as well as many other countries. If the Saudis have a strategy, it requires substantial optimism to find examples of its eventual success. What they need is a face-saving way to shift gears; to declare victory and leave the battlefield. They produced 10 million barrels a day in November and around 25% of this is consumed domestically. Assuming they receive $30 a barrel (their grades of crude are typically subject to a few dollar discount) and it costs them $5 a barrel to produce, they clear $188 million a day on the 7.5 million barrels they export. If they claimed that their strategy had been a success and were therefore announcing a one third reduction in exports, the loss of 2.5 million barrels of supply would cause the global oil market quite a jolt. A $12.50 jump in crude would see Saudi oil revenues unchanged. It’s a thought experiment, but with crude this low some odd things become possible.