US Sets Multiple Energy Records

President Biden probably won’t brag about US energy production, but when the final figures for 2023 are in the US will have set numerous records.

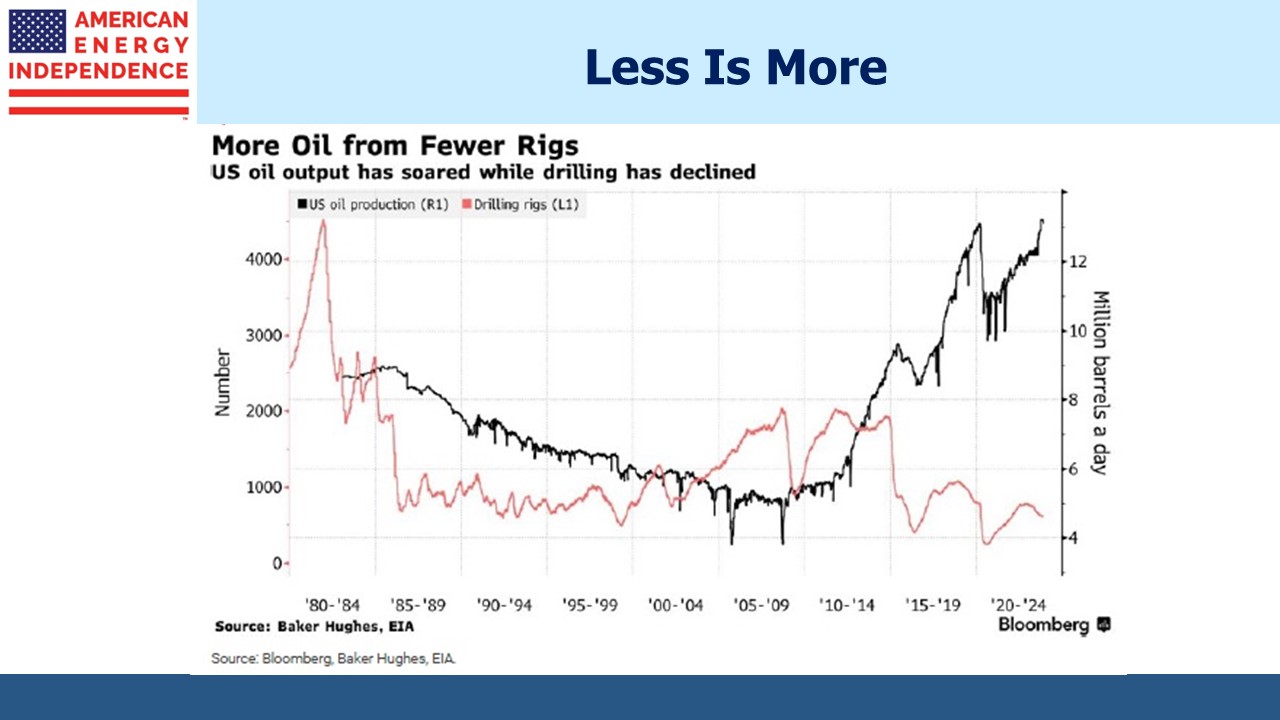

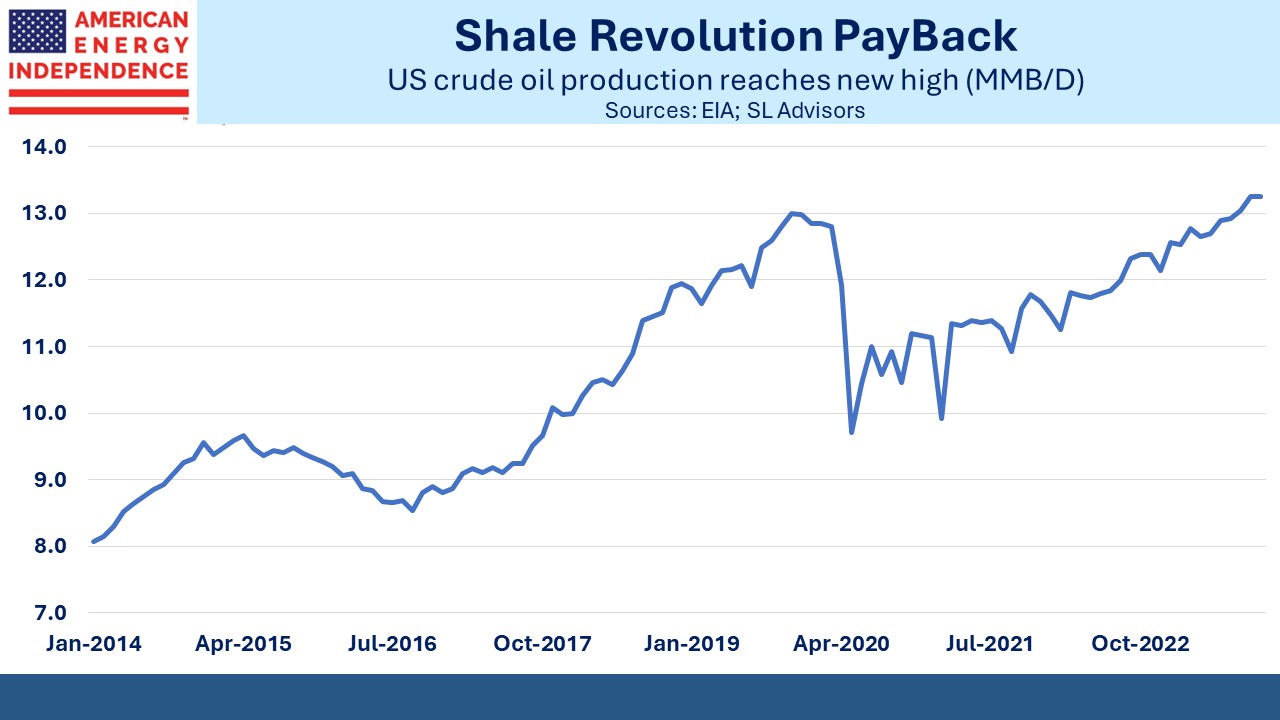

Crude oil production reached a record 13.2 Million Barrels per Day (MMB/D) in October, surpassing the prior record set four years earlier before the pandemic. Few analysts were projecting this at the beginning of last year. Upstream capital discipline was expected to moderate output growth. But drillers squeezed efficiencies out of their operations, producing more with fewer rigs and drilling longer laterals.

Biden complained bitterly two years ago that US oil production wasn’t increasing in response to higher prices. As he was reminded back then, it takes time to raise production and the Administration doesn’t exactly behave like a friend of reliable energy. But the market works, and most bullish price forecasts for crude oil last year were wrong because they didn’t expect increasing US supply.

Our crude exports averaged a record high of 3.99 MMB/D in 1H23.

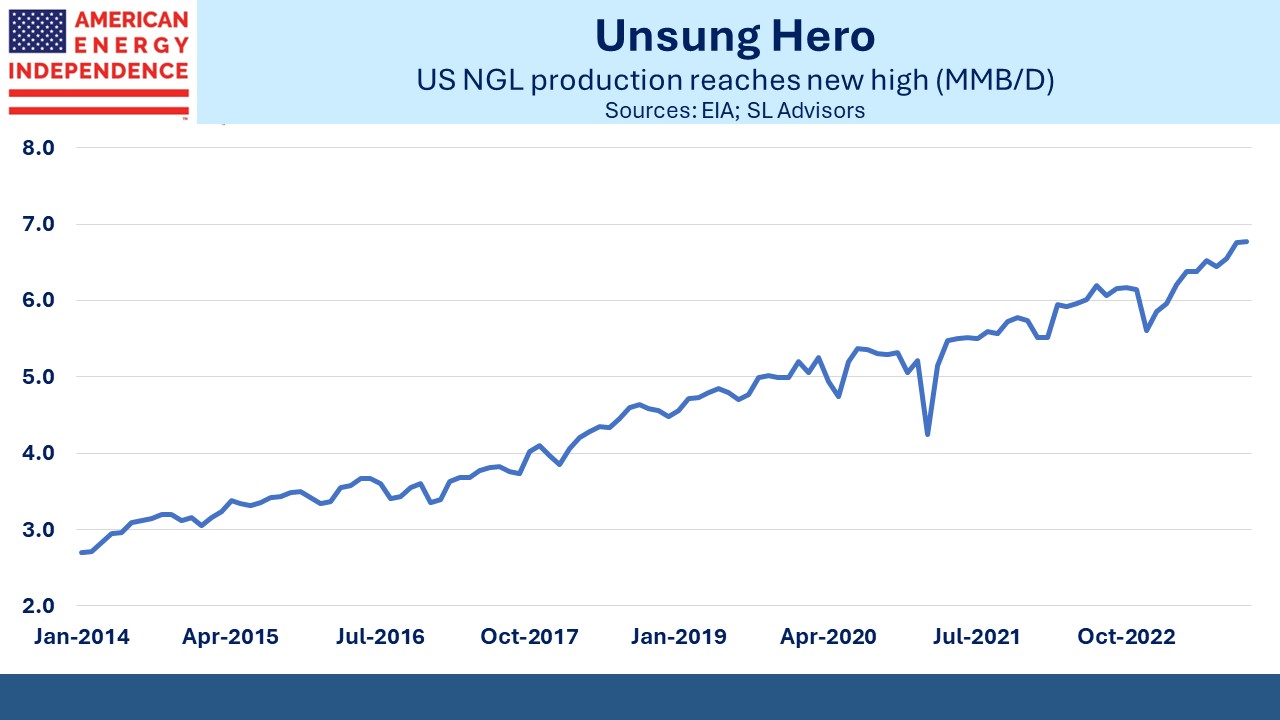

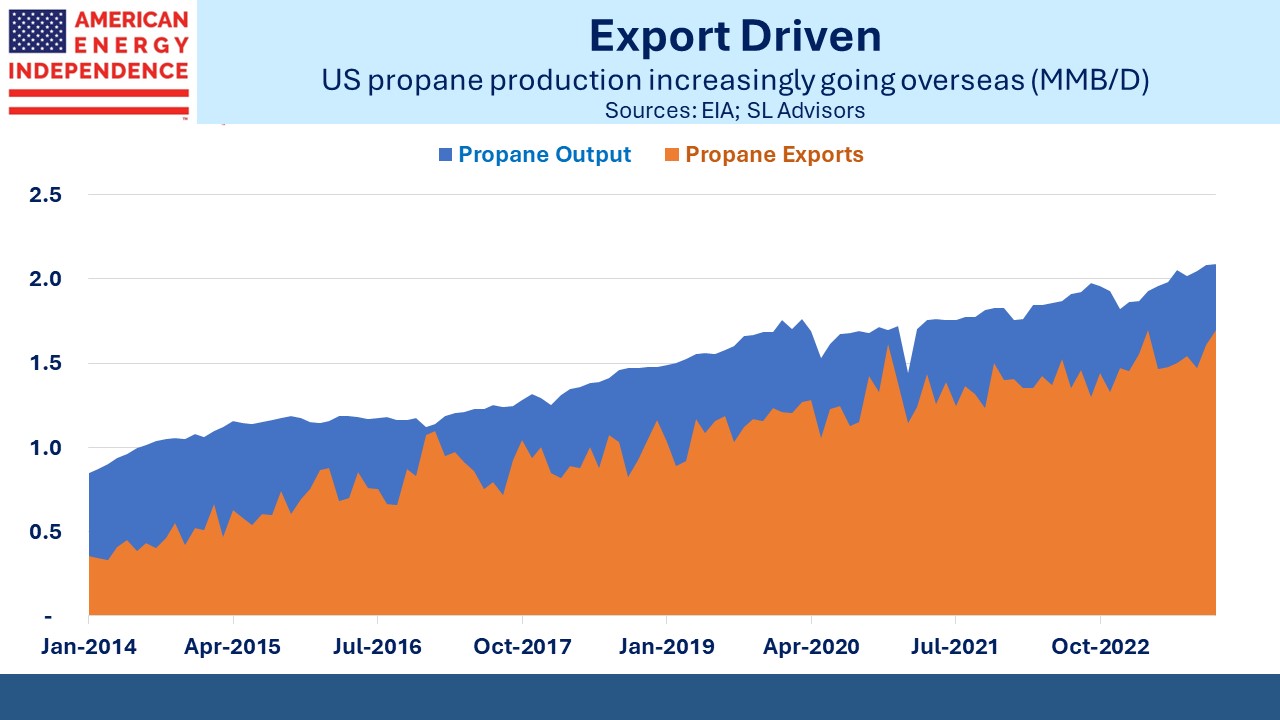

Natural Gas Liquids (NGLs, which include ethane, propane and butane) continue to set new records with volumes more than doubling over the past decade. Ethane is increasingly used in the petrochemical industry to manufacture various forms of plastics. Propane is used domestically for cooking where natural gas is unavailable, and by farmers for drying crops. But export growth is behind the steady increase in US propane production.

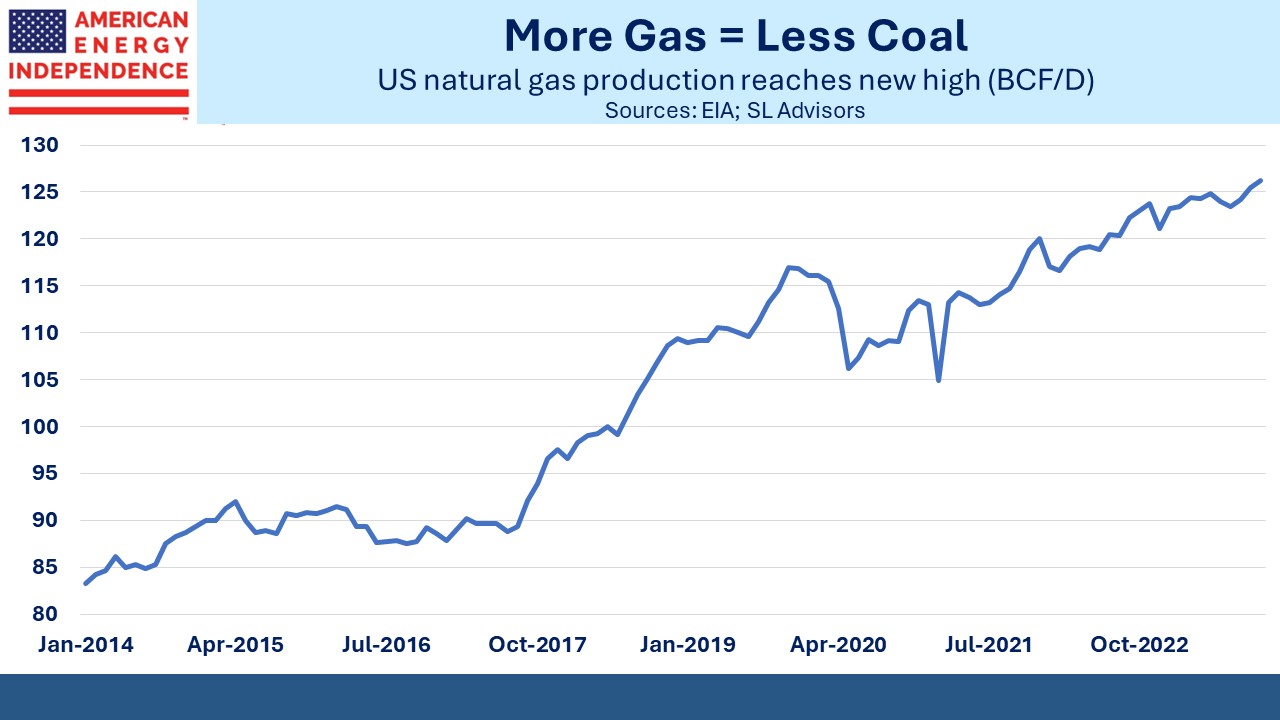

Natural gas production continues to set new records. As with crude oil, this has been done more efficiently, with the gas rig count falling 24% during the first ten months of last year. Some of the increased gas production has come from oil wells as associated gas, largely in the Permian basin in west Texas and New Mexico. The three major oil plays in the Permian are now producing almost 14 Billion Cubic Feet per Day (BCF/D) of gas, over a tenth of US output.

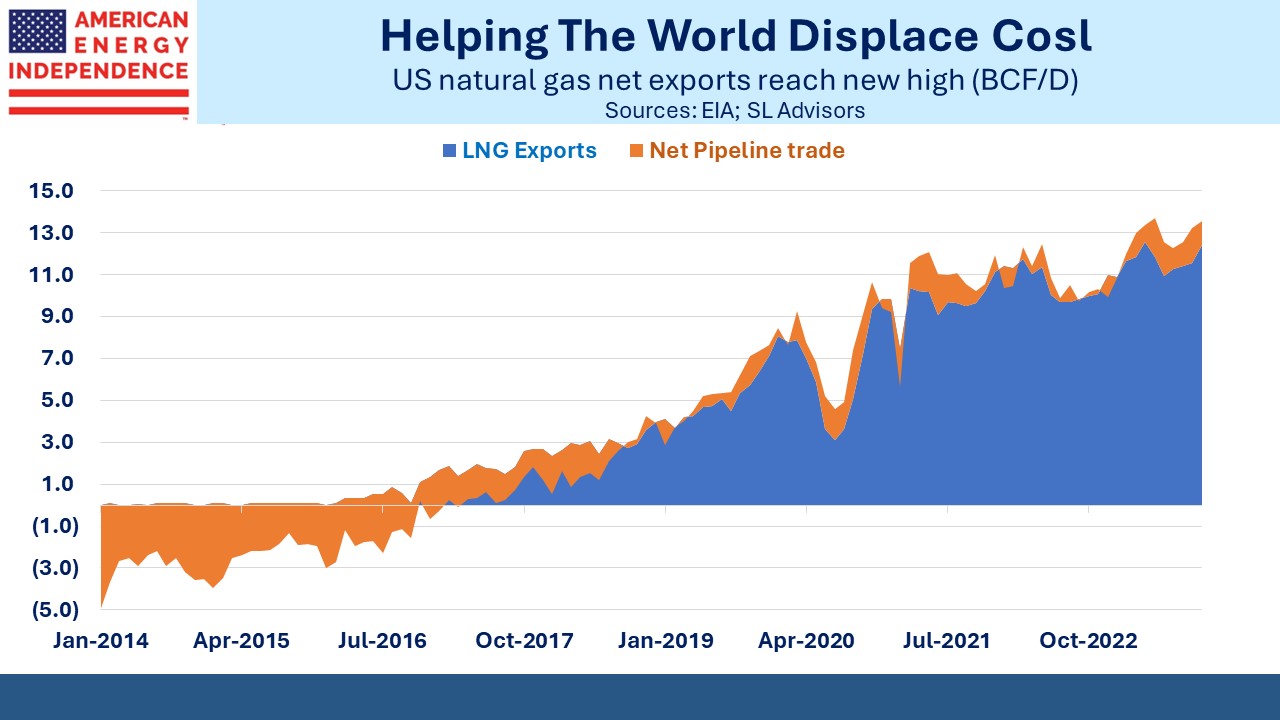

Natural gas production growth helped reduce our use of coal for power generation and is increasingly offering the same opportunity to our trade partners. LNG exports set another record last year, and the Energy Information Administration (EIA) expects export capacity to more than double by 2027.

This is all a big success story for America.

This abundance has weighed on prices for crude oil and domestic natural gas. Exxon Mobil warned that 4Q operating results could drop to $8.9BN, down 30% on a year ago. They also expect to write down California-based assets by $2.5BN in response to the Golden state’s hostile policies towards reliable energy.

Chevron expects to take $3.5-4.0BN impairment on its California assets due to “continuing regulatory challenges.”

Both stocks are down over the past year. Most of the energy sector had a poor year.

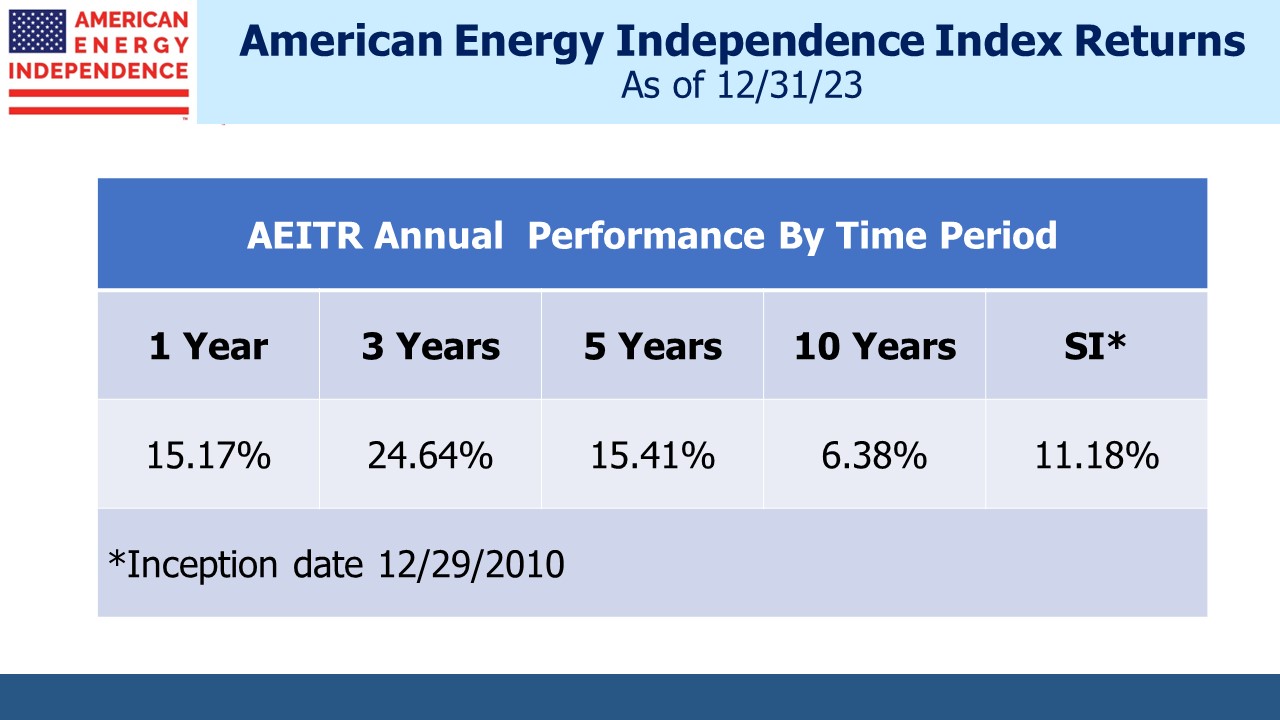

But the increasing volumes were good for midstream, with the American Energy Independence Index beating eight of the 11 S&P 500 sectors (see Higher Despite Retail Selling). The link between oil prices and pipeline stocks is weakening in response to lower leverage.

Record-setting US production of oil, NGLs and natural gas under a Democrat administration shows that the party in the White House has less influence than some think over the sector. Even though Biden famously promised to end fossil fuels four years ago when he was campaigning, that goal soon became aspirational and before long he was pleading for more oil.

VP Kamala Harris is from California, and assuming Biden keeps her on the ticket the presidential election will carry a real possibility that a second Biden term might be completed by a President Harris. There’s little about California’s energy policies that should endear investors to such a prospect.

But when you’re looking for energy policies to avoid, Germany usually offers a better example. The WSJ recently estimated that pursuing zero emissions will cost Germans €1.9TN by 2030. This is around half their GDP.

German voters have generally supported policies that are domestically ruinous and mostly serve to accommodate growth in emissions by emerging economies led by China and India. You’d think a willingness to spend so much would assure results – and emissions from Germany fell to 673 Million Metric Tonnes (MMTs), down by 73 MMTs and well below the government’s annual target of 722 MMTs. However, only 15% of this reduction was credited to improved efficiencies and renewables.

Half came from production cuts.

German policies have made energy so expensive, both because of the focus on renewables but also because of the reliance on Russian natural gas, that they are shrinking their way towards their climate goals.

Some of those German companies cutting back production are investing in new facilities in America.

Let’s hope the sharp contrast between American and German policies persists, unless German voters become more pragmatic – and more American.

We have three have funds that seek to profit from this environment: