US Midstream Is Far From Conflict

To trade the daily moves in the market is to be an armchair strategist. JPMorgan estimates the crude oil market reflects a 17% probability of a worst-case supply disruption out of the Middle East. Presumably an oil spike would hasten the war’s conclusion via US pressure on Israel.

So Israel’s attacks on energy infrastructure are focused on disrupting Iran’s domestic supplies. Therefore, Iran must have an incentive to impede flows. Perhaps their military capabilities have already been too degraded to provide this option. Or maybe this country with few friends in the region doesn’t wish to further alienate its neighbors.

Will there be a ceasefire? Or will the US use bunker-busting GBU-37 bombs each weighing 30,000 pounds to wipe out Iran’s nuclear capability? To us it seems that the opportunity to destroy the Fordo nuclear site will never be as good as it is now. Few of Iran’s neighbors would be sorry to see the theocracy finally denied the capability to make a nuclear weapon. Trump has promised the world something better than a ceasefire. This would seem to check the box.

But it’s hard to make a confident forecast. The worst case for energy supplies is not the most likely outcome but would cause sharply higher prices. In that regard, midstream companies provide some optionality.

Consequently, the news affecting midstream has been in North America, and therefore drawing less attention than Israel’s pummeling of its long-time adversary.

Last week the Ohio Power Siting Board approved the 200MW Socrates South Power Generation Project. Will-Power, a subsidiary of Williams Companies (WMB), will develop two power plants that will run on natural gas provided by WMB. This is an example of the behind-the-meter (BTM) solution to providing electricity to data centers without impacting residential customers.

WMB as well as other large natural gas companies such as Energy Transfer have been promising BTM solutions to meet the needs of data centers for rapid increases in electricity. Meta will be the main customer of the Socrates project. It is expected to be operational by 2H26, fast by the standards of new power generation. Ohio’s electricity customers won’t be adversely affected.

In an example of what happens when data centers boost demand, residents of New Jersey and other neighboring states that are part of the PJM Interconnection grid system are now paying higher prices for electricity. It’s complicated to assign blame. PJM says 70% of the recent increase in demand is attributable to data centers.

But supply is down too. In 2023 New Jersey’s Democrat governor Phil Murphy mandated that the state cease all hydrocarbon-based power generation by 2035. The state’s last two coal-fired power plants were shuttered in 2022. Windpower has come up short, with Danish firm Orsted abandoning two offshore projects because they became too costly.

Liberals say not enough renewable supply is being added, but they’ve lost credibility on energy policy.

This is exactly the problem that BTM is supposed to avoid. Across the region covered by PJM, data centers are driving up power prices for everyone.

Worried about Democrats being blamed by voters for a big jump in electricity prices when they vote for governor in November, Murphy has announced subsidies for household utility bills.

Democrat energy policies are to blame.

Clean energy stocks dropped sharply yesterday as it became clear that the Senate tax package would immediately end most tax breaks for wind, solar and EVs. Given the lead- times involved and reliance on tax credits, it’s likely that swathes of the renewable energy business in the US will be permanently impaired. The electoral cycle is shorter than their investment cycle, leaving any proposed project at risk.

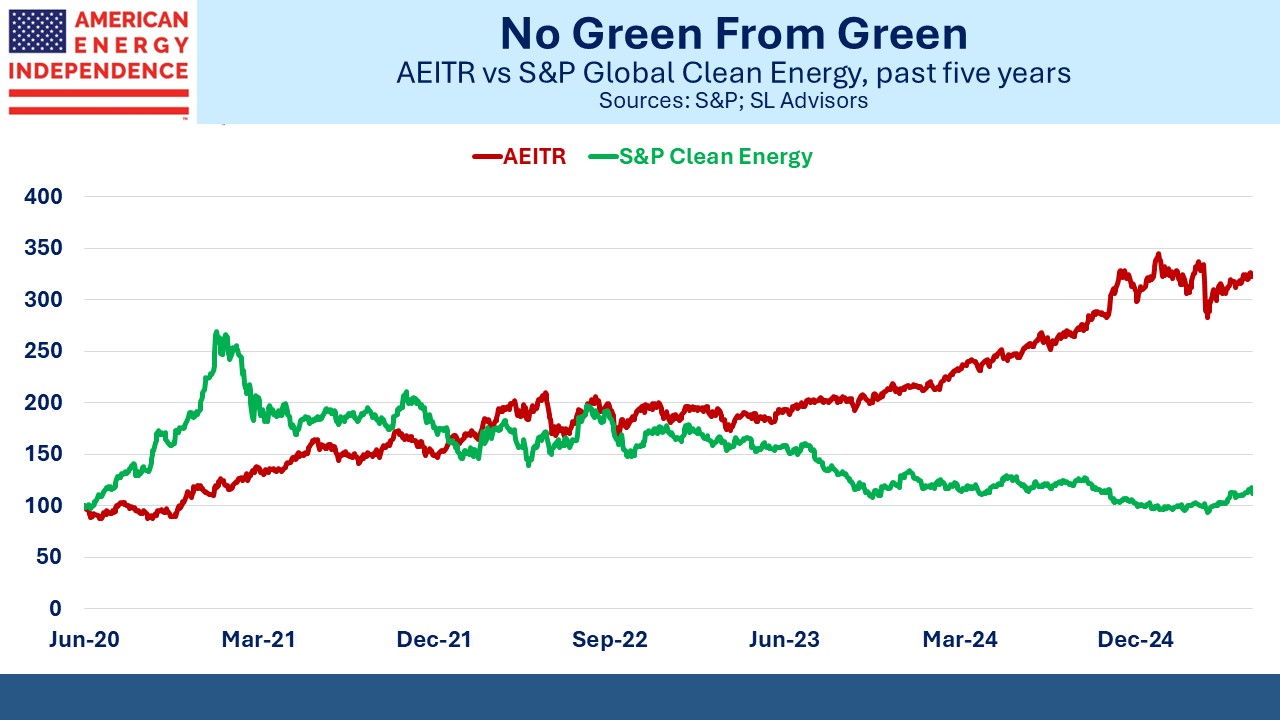

Renewables have been a lousy investment. The S&P Global Clean Energy Index has returned just 3% pa over the past five years. The American Energy Independence Index has returned 27% pa over the same period.

EVs are losing attraction in western countries. A recent survey carried out by Shell found that only 31% of US owners of conventional cars were interested in switching to an EV, down from 34% last year. The slow rollout of charging infrastructure under the last administration didn’t help, and it’s unlikely to change now. In Europe, interest in switching to an EV fell to 41% from 48%.

EVs continue to gain adherents in China, which is supporting their coal consumption since this provides 80% of electricity generation in China. Progressives who cite China’s EV leadership as evidence of their commitment to reducing greenhouse gas emissions need reminding of this regularly.

We have two have funds that seek to profit from this environment: