Update From Williams Companies

Yesterday Williams Companies (WMB) provided an investor update on their business. WMB isn’t directly involved in crude oil, and they’re best known for owning Transco, a natural gas pipeline network running down the eastern U.S.

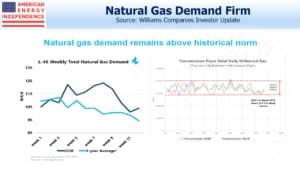

So far, natural gas demand is un-impacted, and slightly above historical norms.

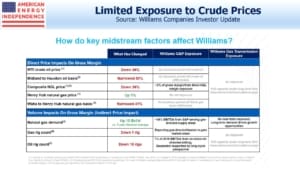

WMB provided some information on their overall sensitivity to the drop in economic output. Natural Gas Liquids (NGL) prices have collapsed along with crude oil, and this affects 2% of their business on the Gathering and Processing (G&P) side. Somewhat counter-intuitively, natural gas prices have firmed with the drop in crude. This is because Permian oil production results in associated gas, which has weighed on prices in recent months. The looming drop in Permian output will reduce natural gas supply, benefiting natural gas dedicated plays where WMB earns 38% of its EBITDA and 85% of that is associated with gas directed drilling. 7% of their EBITDA comes from oil-driven G&P.

On the gas transmission side, which includes Transco, they expect no near term impact. Two thirds of their gas transmission customers are utilities and power companies, and 90% are investment grade credit.

Overall, WMB expects 2020 EBITDA to come in at the low end of their prior guidance, due to weak NGL prices and lower output from oil drilling. They expect cash flow to support their dividend, which currently yields over 12%, as well as any spending on growth projects which they expect to revise down.

We are invested in WMB.