Unloved Tariffs

There are few parts of America redder than Naples, FL. Kamala Harris signs were nowhere to be seen last year. Florida has shifted from purple to red in recent years. A friend once received hostile comments from a local who noticed his Connecticut license plate, demanding that he not relocate but should keep his liberal policies in the northeast.

In fact, it’s Republican voters who are heading south. New Jersey is more blue and poorly governed as a result.

Golf clubs in Naples are more red than Naples itself. And yet, even here you’ll find grumbling about tariffs. Nobody is yet disavowing their vote, but equity market volatility is unwelcome to wealthy retirees. This bothers them more than the price of eggs.

My friends here own a lot of stocks.

Some breezily say the rapid policy changes that can occur twice in one day are part of a sophisticated negotiating style honed in New York’s real estate market. Others aren’t so sure, and in any case dealing with countries is not the same as haggling with banks who have lent you money. Discerning a strategy from frequent tactical shifts relies heavily on subjectivity and is challenging the most devout MAGA followers.

If Naples golf club members are unenthusiastic about tariffs, support in the country is shallow.

The S&P500 has lost the gains achieved following the election, at least for now. The US runs a trade deficit of over $900BN. We buy a lot of stuff. So it’s plausible that an aggressive posture on negotiations could lead to improved terms of trade. Canada’s domestic banks dominate and are highly profitable. I’m sure JPMorgan could compete there if allowed.

The EU could surely use cheaper energy, and increased natural gas imports from Russia are implausible no matter what a few German politicians may suggest.

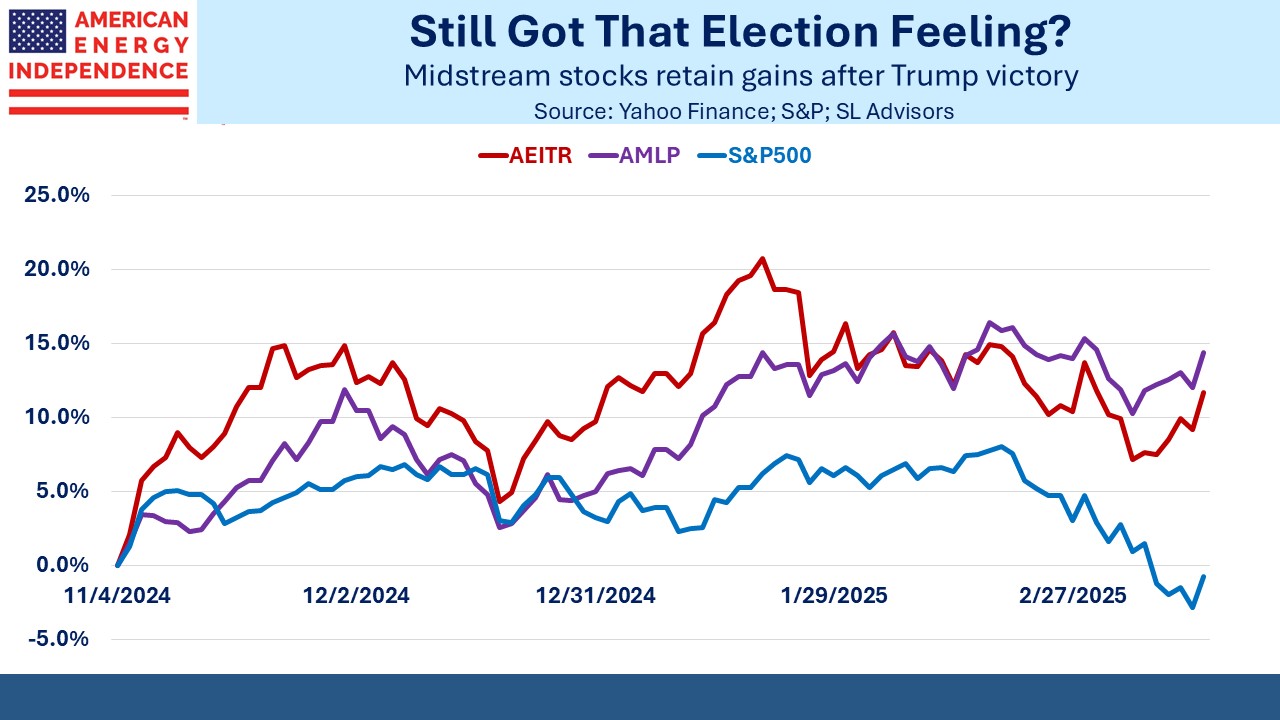

Midstream energy infrastructure has held onto its post-election gains, since it’s less exposed to tariffs as well as being within Trump’s favorite sector. Some may be surprised to learn that the Alerian MLP ETF, AMLP, is outperforming the sector as defined by the American Energy Independence Index (AEITR).

Although this might sound like rare praise from your blogger for AMLP, experienced readers know better. AMLP’s market-beating performance of recent weeks is due to its limited exposure to natural gas (see There’s No AI in AMLP). Power demand from data centers and increasing LNG exports have supported broad midstream for over a year. AMLP’s light natgas exposure and MLP concentration held it to a 22.6% return last year, less than half the AEITR’s 45.5%.

Natural gas oriented names have lagged recently on fears of slower demand growth from data centers and LNG, both of which seem unwarranted to us.

AMLP’s outperformance is because of its shortcomings.

And AMLP now has a healthy unrealized tax liability which will continue to drag on results when the sector performs well (see AMLP Has Yet More Tax Problems).

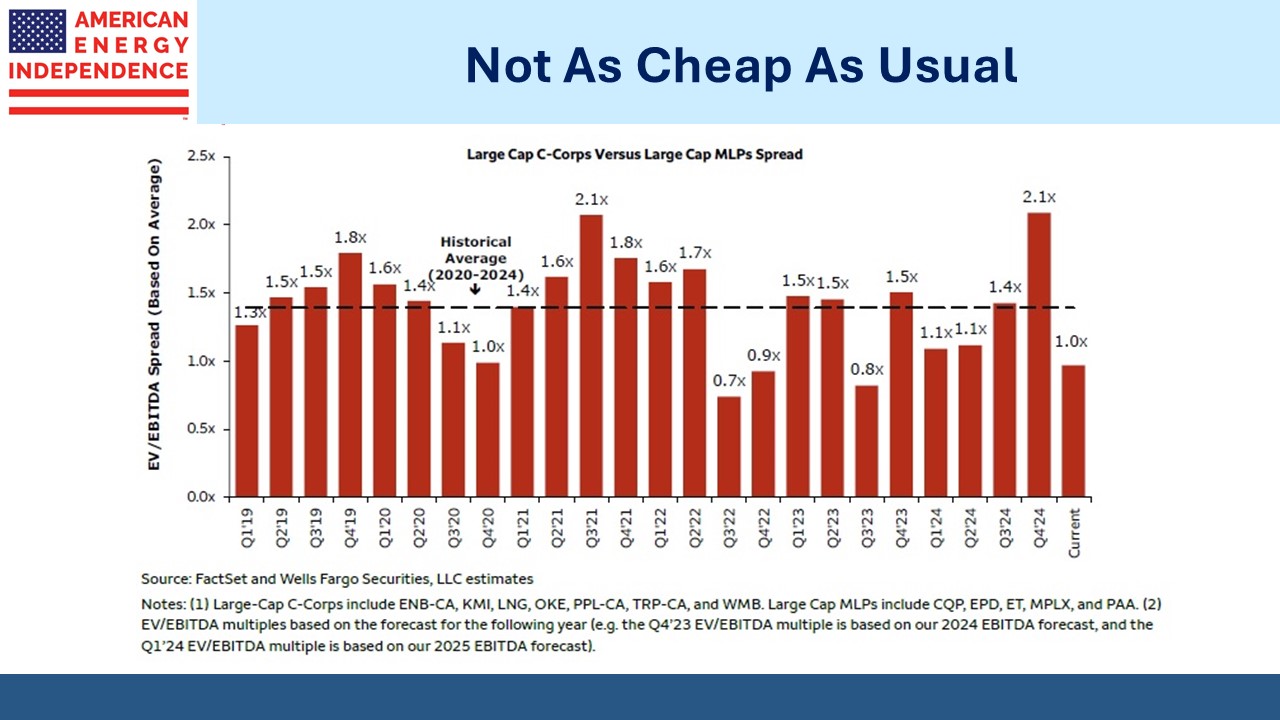

Data from Wells Fargo shows that large cap MLP valuations are relatively unattractive versus large cap C-corps.

This doesn’t mean MLPs are expensive in absolute terms. Energy Transfer yields 7.1%. It is rated overweight by Wells Fargo’s Michael Blum who likes their 8.6X EV/EBITDA and sees a 28% total return over the next year. Large MLPs are cheap, like c-corps. But from here, c-corps will probably do a little better given their relative valuations.

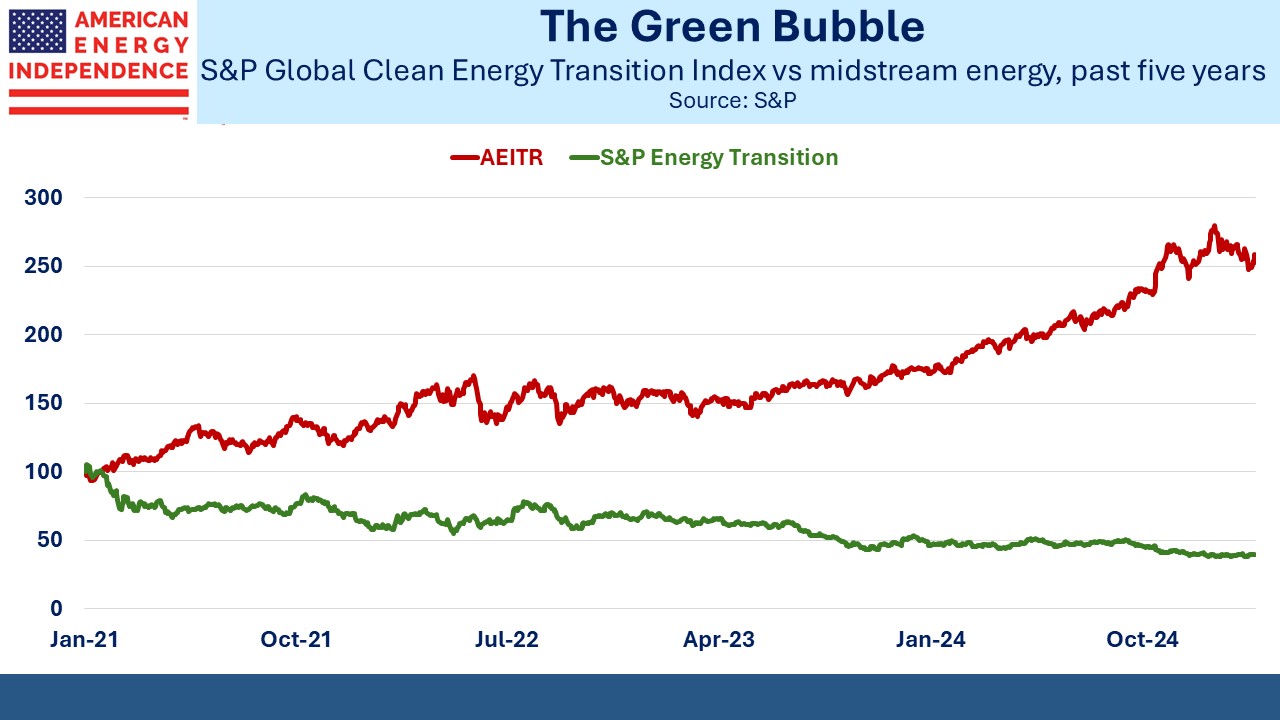

The S&P Global Clean Energy Transition Index is down 13% since the election. Trump’s attempts to reel back $BNs under the Inflation Reduction Act and his hostility to windpower have not helped sentiment. However, I can report that our neighbors on the Jersey shore (a red part of a deeply blue state) are ecstatic that offshore wind turbines they regard as unsightly will not be spoiling their view any time soon.

Renewables have been a lousy investment for years – it didn’t start in November. Prices peaked in January 2021, around the time of Joe Biden’s inauguration. What followed was capital destruction on an epic scale. S&P Energy Transition has returned –20.0% per annum. Those investors who confused socially conscious investing with the real thing can hardly blame Trump.

If solar and wind really produce such cheap electricity, why hasn’t the sector done better?

Midstream energy as defined by the AEITR and representing the traditional and reliable part of the sector, has returned 25.7% per annum over the same period.

Venture Global has bounced following a 60% collapse after its mis-priced IPO. We made a modest investment on weakness, but more importantly co-CEOs Michael Sabel and Robert Pender also bought. Seems like next time this company wants to sell stock you might want to wait.

The threat of tariffs will unfortunately remain for Trump 2.0. But perhaps their implementation will be more carefully considered and less negative to the stock market.

We have two have funds that seek to profit from this environment: