Trump Energizes The Pipeline Sector

Donald Trump’s political comeback looks a lot like the recovery in the energy sector. In March 2020 during the pandemic pipeline stocks slumped as crude oil prices briefly turned negative. Within a year Trump was out of office, faced numerous civil and criminal charges and was widely believed to be a one-term president. By then midstream had rebounded but fears that the energy transition would lead to stranded assets caused many to remain skeptics.

But inexorably, substance overcame style. Between friends at golf clubs and energy investors my interactions are overwhelmingly with Republicans. My perspective is that Trump campaigned on policies while Harris argued that he was unfit for office. Voters pragmatically chose the substance of Republican policies, overcoming any misgivings about Trump the candidate.

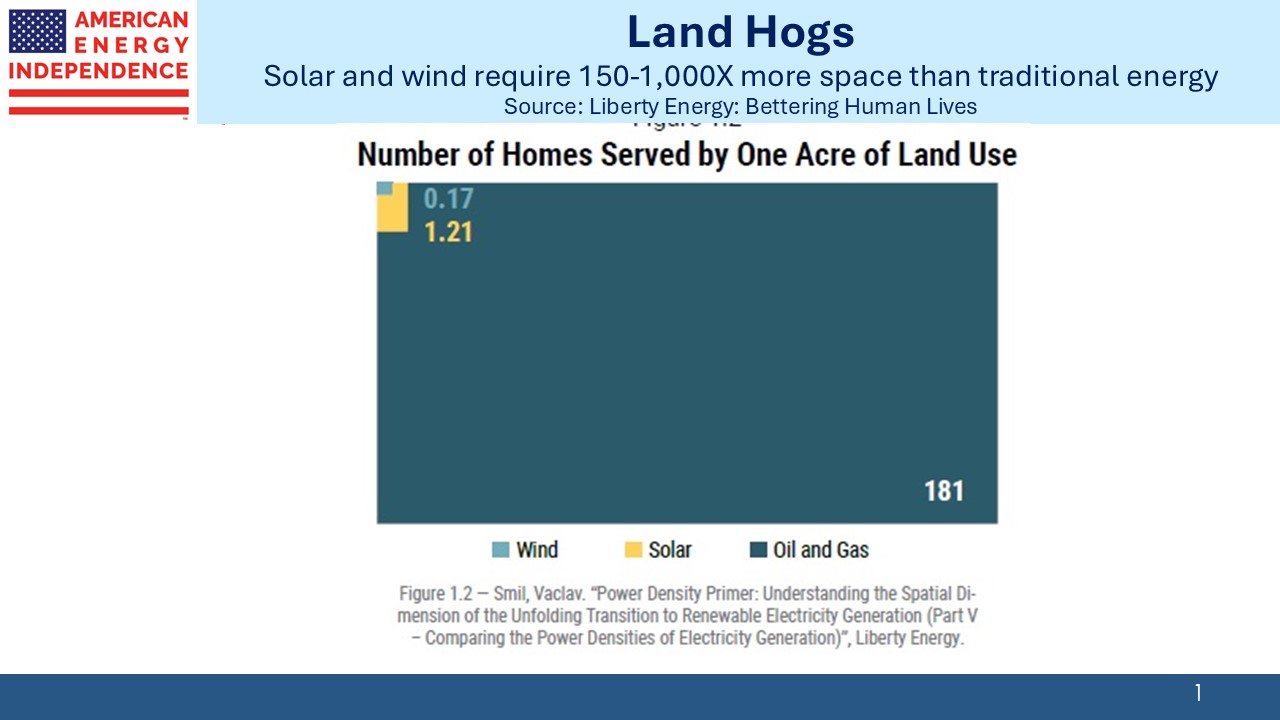

In the energy business, over-hyped renewables have been an investment bust while hydrocarbons have maintained their >80% share of the world’s expanding consumption of primary energy. The substance of reliability has trumped the style of virtue-signaling.

The discrediting of excessive PC, DEI, ESG and the rest of the woke acronyms helped both Trump and energy. A couple of years ago a friend at JPMorgan told me that employees were being encouraged to add their pronouns to their profiles on Bloomberg. I don’t think they/them realized how irritating that is for the rest of us not struggling with our gender.

The moment of maximum absurdity had been reached. Woke is broke.

BP until recently apologized for producing what the world wants. Browbeaten by left wing climate extremists they promised to kick their hydrocarbon habit. But investing in renewables leaves a big fortune smaller, and with their stock price slumping BP has belatedly acknowledged the market’s rejection of this strategy (see BP Decides To Follow The Money).

Midstream outperformed on Wednesday as markets digested the news. NextDecade rallied sharply because of the improved regulatory environment for LNG.

Liberty Energy (LBRT) provides fracking services to oil and gas E&P companies. In an inspiring and informative report called Bettering Human Lives, they claim the moral high ground from the climate extremists. Employees at Liberty “relentlessly dedicate our lives to energizing the world” They know that hydrocarbons have, “transformed the human condition over the last two centuries.” They reject the dystopian vision of that wretched little girl Greta, AOC and her squad, and the Sierra Club who all promote policies that will make life shorter and more miserable for billions of people.

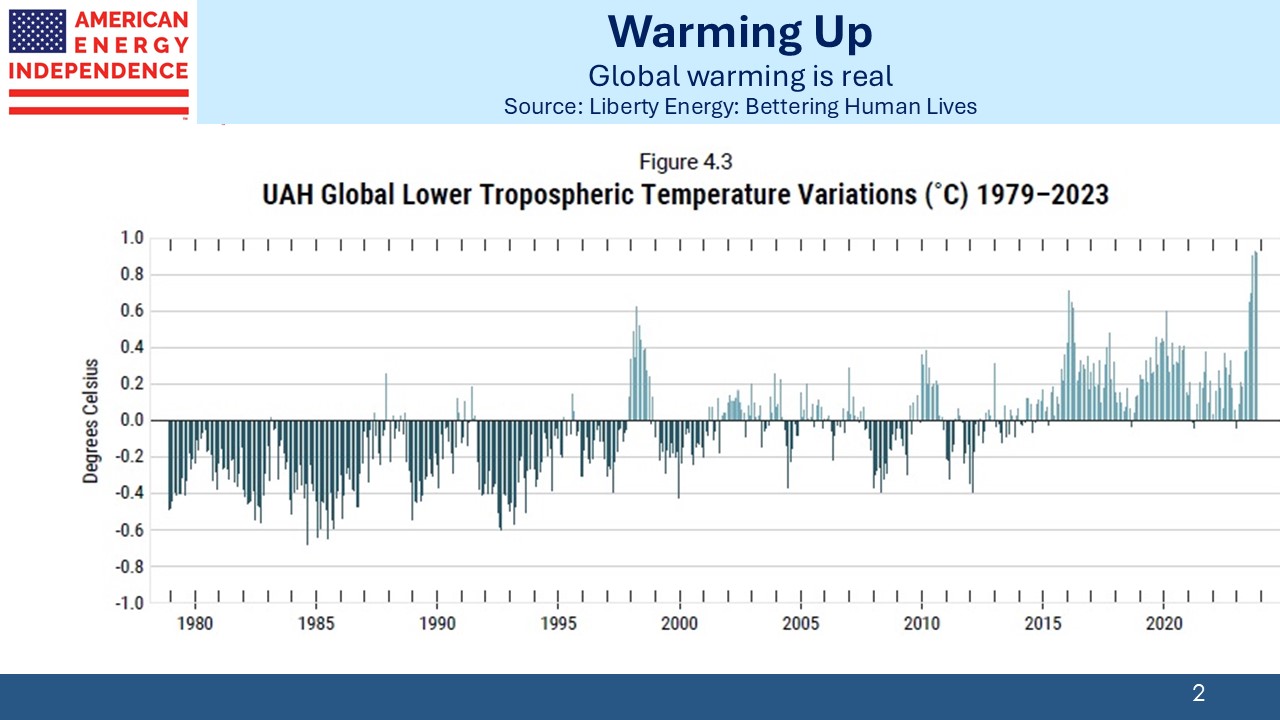

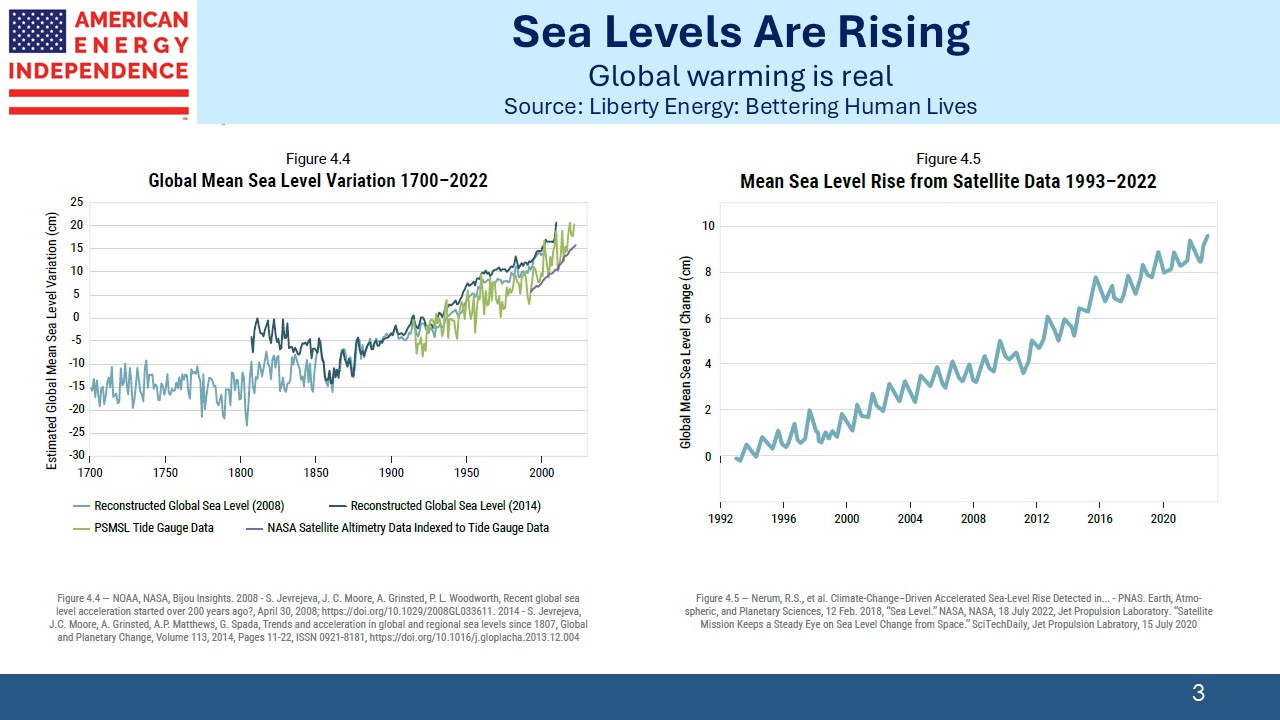

The Liberty Energy report doesn’t deny climate change but places it behind malnutrition, access to clean water, air pollution, endemic diseases and human rights as problems more deserving of the world’s attention. It acknowledges that temperatures and sea levels are rising because of human generated CO2, accelerating a trend that started in the mid-19th century at the end of the “little ice age”.

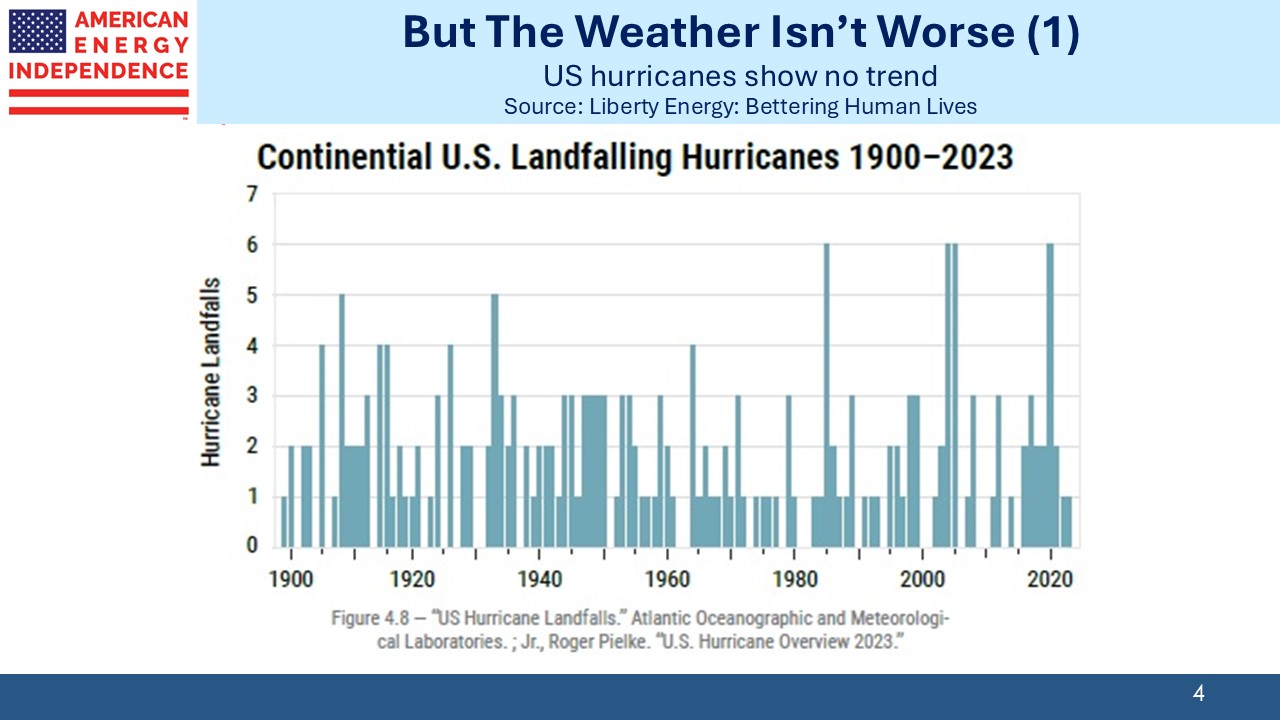

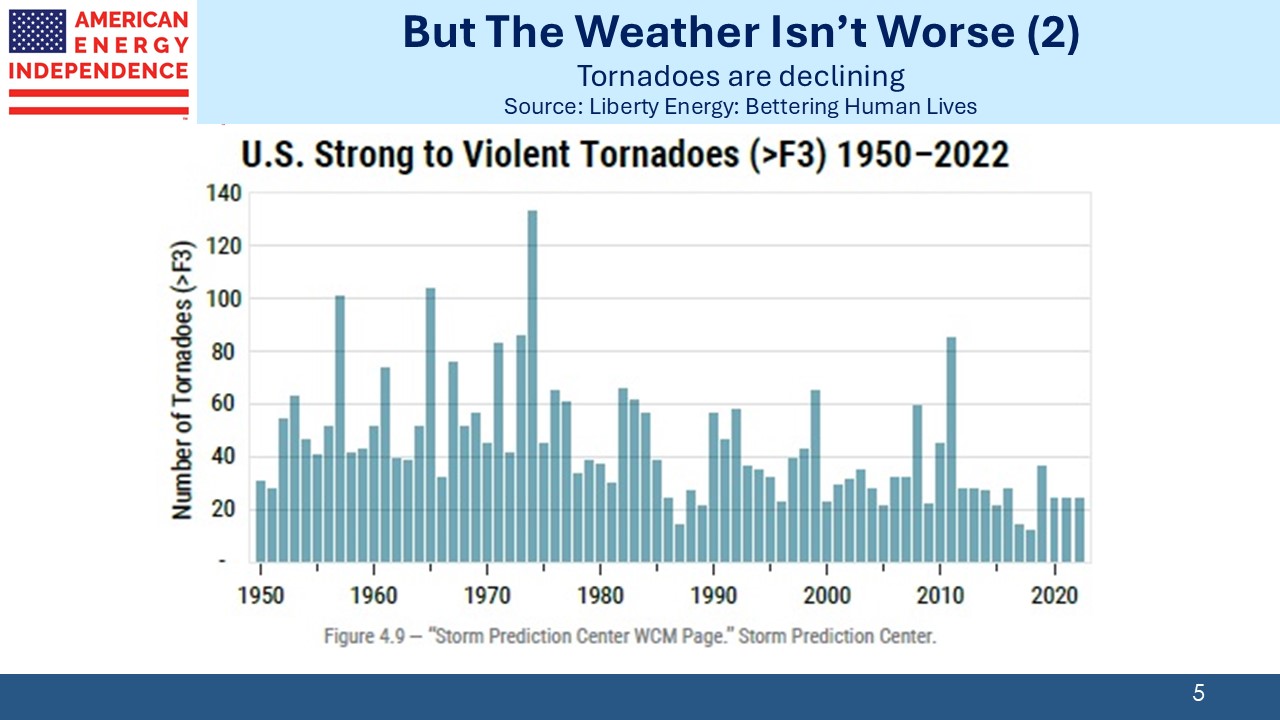

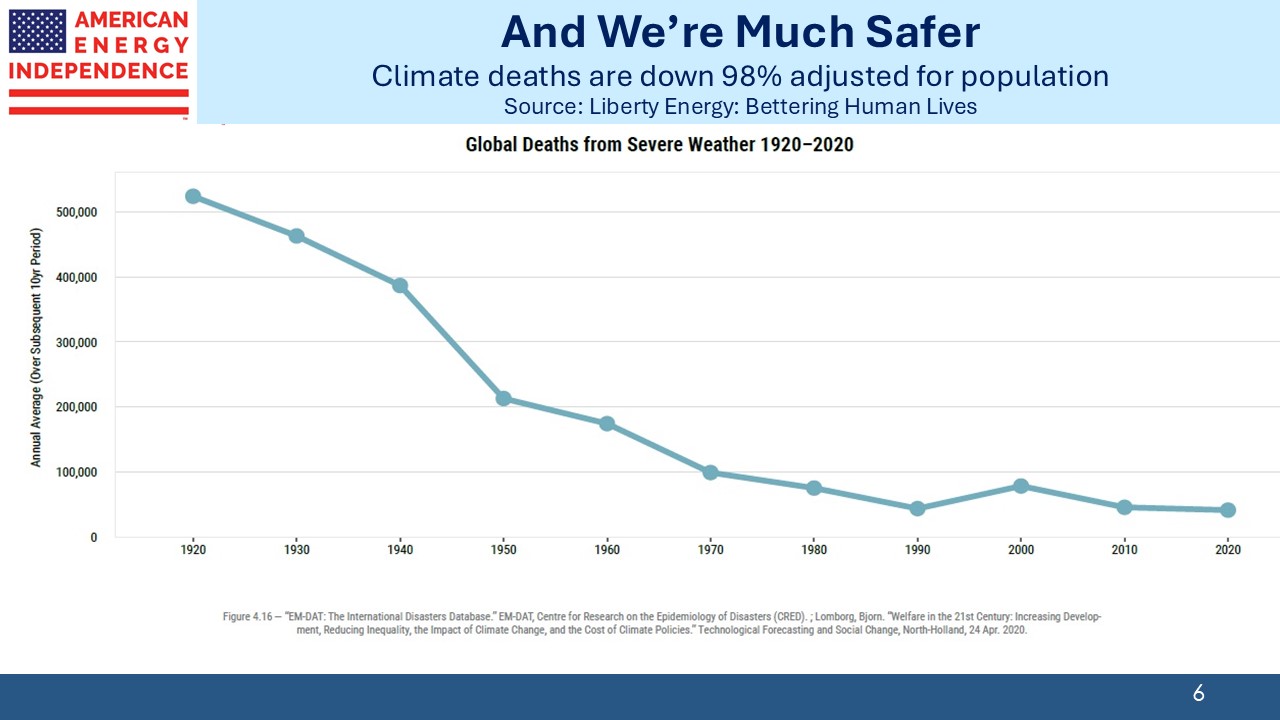

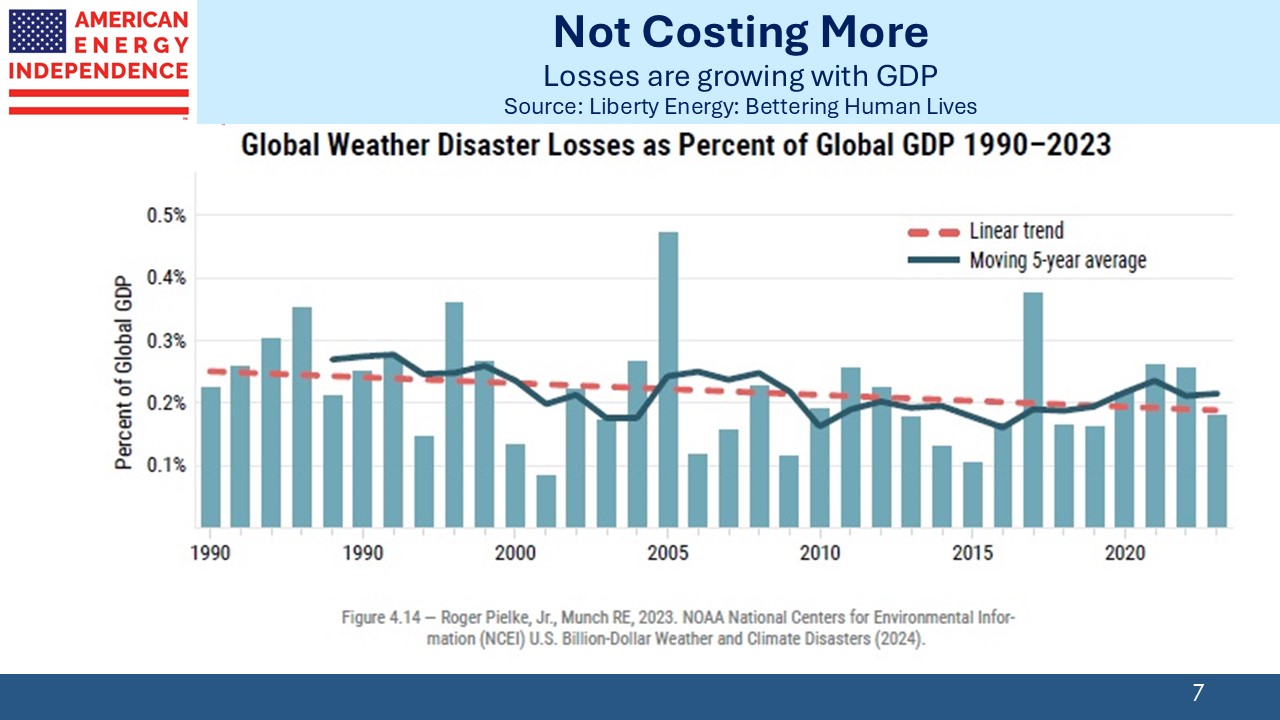

Every hurricane, flood and heatwave is blamed on global warming. But the data shows that global losses from extreme weather events as a % of GDP are falling, as are US flood losses. Global deaths are down 90% since 1900 even as the world’s population has increased five-fold. We are better prepared, through greatly improved weather forecasts and stricter building codes.

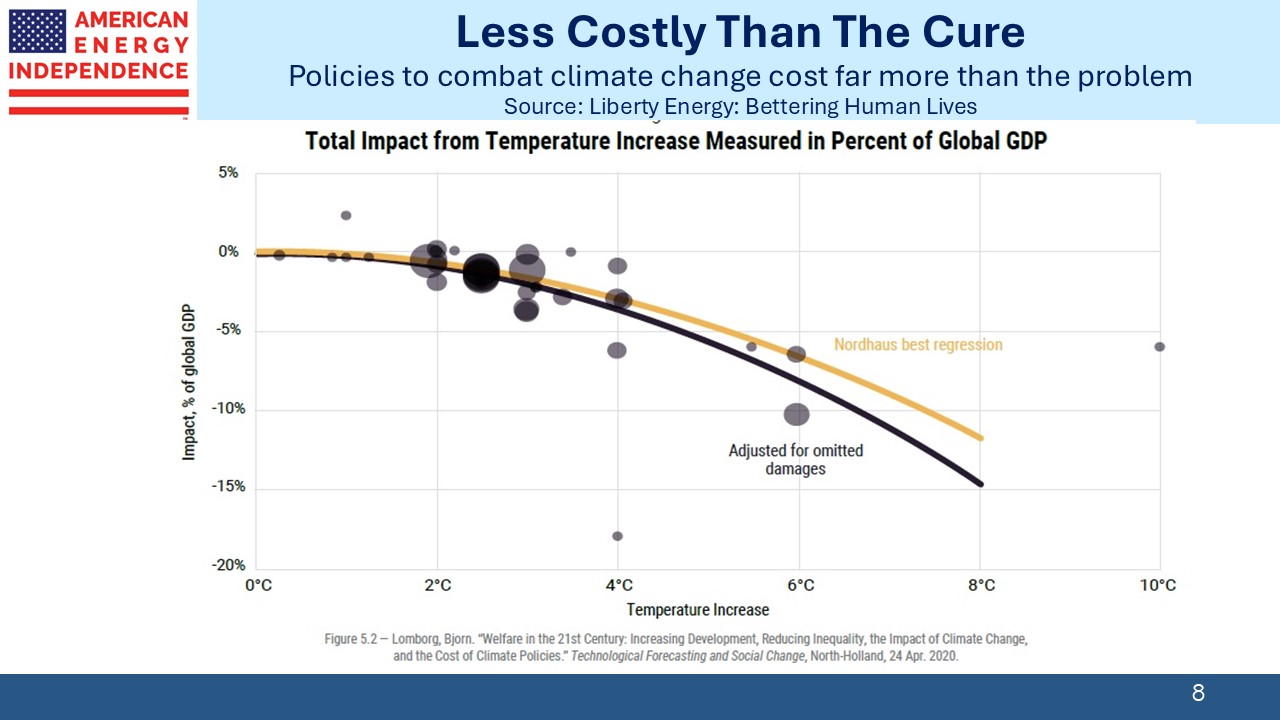

What’s most striking is the modest projected losses in GDP from increased temperatures of as much as 4 degrees C by 2100. Various independence forecasts are remarkably similar, at around a 3-4% loss of GDP in plausible extreme scenarios. It may sound a lot, but a 4% smaller GDP by 2100 means annual GDP growth of 0.06% less in the meantime. Even a 2100 GDP that’s 15% smaller than it would otherwise be, which is at the extreme end of forecasts, would reduce annual GDP growth by 0.22%.

Estimates of the annual investment needed to combat climate change are in the $TNs, out of a global GDP of $110TN. The International Energy Agency says annual clean energy investments of $4TN are needed, 3.6% of global GDP. The policy recommendations of climate extremists are devoid of any cost-benefit analysis, since they’d throw 25X or more at the problem every year than its annual cost.

Germany’s embrace of wind, rejection of nuclear and consequent reliance on coal to compensate for lost Russian natural gas is a form of economic self-flagellation that is leading to ruinously high energy prices, de-industrialization and no GDP growth (see Germany’s Costly Climate Leadership). Volkswagen is planning to close three factories, lay off tens of thousands of workers and impose 10% pay cuts because their commitment to EVs exceeds the enthusiasm of buyers.

The US has for the most part avoided such missteps apart from a few blue states. While American voters rejected extreme climate policies, as if on cue Germany endured a period of “dunkelflaute”, a wonderfully Teutonic word for endless calm, cloudy days that render wind and solar impotent.

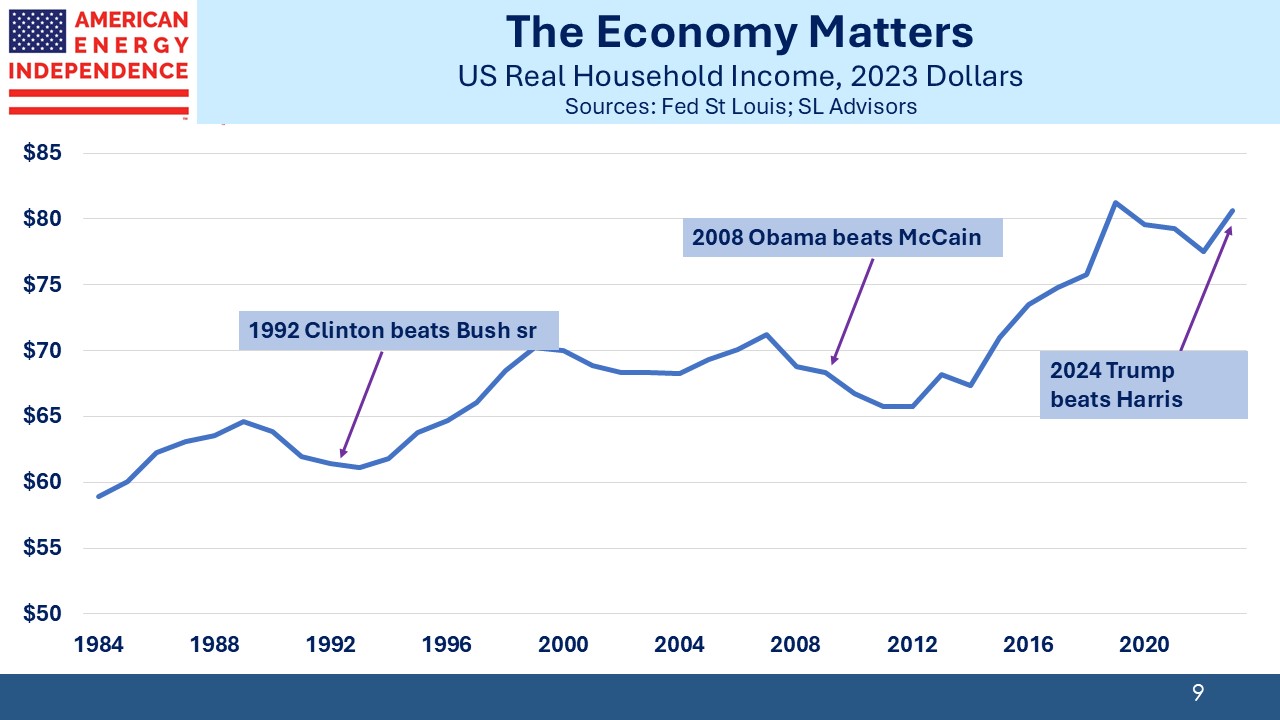

Finally, an illuminating chart showing median real household income. 4.1% unemployment shows everyone who wants a job can have one, and this blog often celebrates the strong US economy with its per capita GDP moving ever farther from former peers in the EU. But while the average looks good, the median household has lost purchasing power over the past four years.

The $1.9TN American Rescue Plan in 2021, the first major piece of legislation under incoming President Biden, was an excessive fiscal response to Covid at a time when a vaccine was available, and treatments were improving. It led to the 2022 inflation that so many voters maintain has left them worse off, driving them to vote Republican. Similar episodes of falling real incomes in 2008 (Great Financial Crisis) and 1990 (First Iraq War, Bush sr. tax hikes) also led to a change in the White House.

As Jim Carville said, “It’s the economy, stupid.”

We have two have funds that seek to profit from this environment: