Trading On Trump

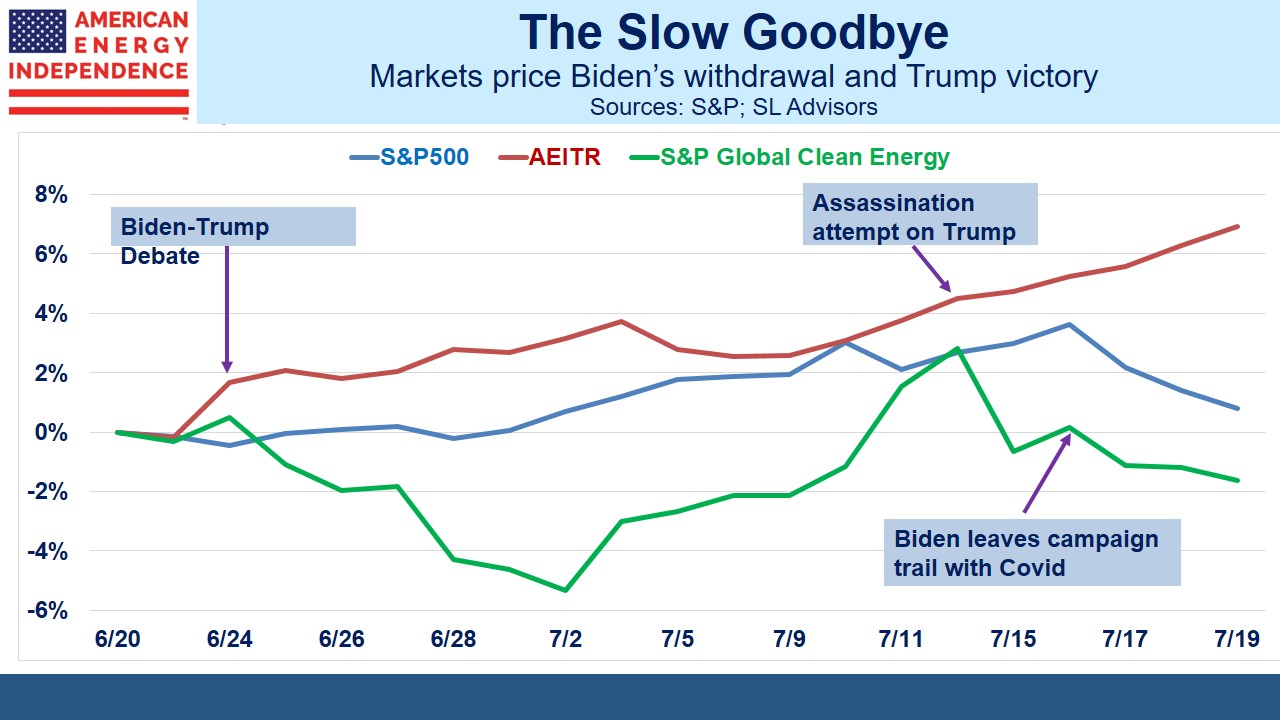

Press reports suggest President Biden will bow to the inevitable and withdraw from the election – the first time since Lyndon Johnson an eligible president has declined to run. Betting websites and financial markets have been pricing for a new Democrat candidate since the debate. Presidential candidate Kamala Harris is unlikely to fare much better, so whether Biden drops out as he should or defies almost the entire Democrat party, they’re in for a drubbing. It’s plausible that the Republicans could regain Congress, enabling policy shifts in several areas.

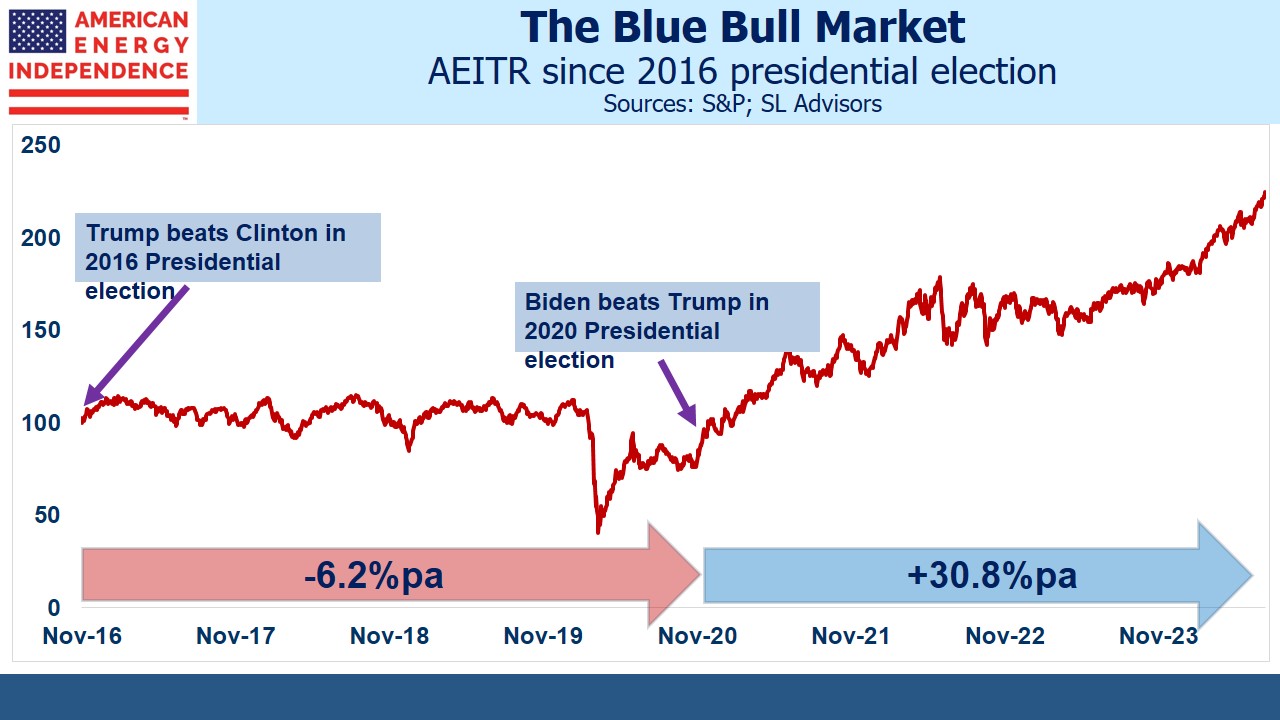

Trump’s first term in office wasn’t good for energy investors. “Drill baby, drill” doesn’t align with capital discipline, and the pandemic completed the trifecta with over-spending and energy transition fears that had depressed returns. An observer blissfully unaware of America’s politics might infer that Democrats are good for traditional energy.

Although climate extremists helped induce caution among energy executives, the last four years of strong performance are more accurately viewed as the result of a switch to financial discipline and positive cashflow. The current administration’s policies have not been intentionally good for the energy sector, and recent strength in the American Energy Independence index (AEITR) is attributable to the recognition that Republicans are in the ascendancy.

A lighter regulatory touch will boost energy sector profitability at the margin. More Federal land will be opened for drilling, although much of America’s E&P activity falls under state oversight. For example, the Marcellus shale extends into New York state, but the prohibition on fracking will remain regardless of who’s in the White House.

The pause on new LNG export permits will be lifted, which will benefit just about everyone by eventually allowing cheaper, low emission US natural gas to displace polluting coal in developing countries. This will eventually push domestic gas prices higher but even over the next five years exports will go from 12% to maybe 22% of supply, so any effect will be small and slow to appear.

Globally, Iran will probably face increased barriers to its oil exports. A cessation of hostilities in Ukraine will allow a resumption of Russian exports. US output may increase but shale faces the tyranny of decline curves much steeper than conventional drilling, which impedes sustained higher levels of output. Fears of lower prices from increased supply could be negated with surprisingly robust demand in emerging economies as they seek higher living standards.

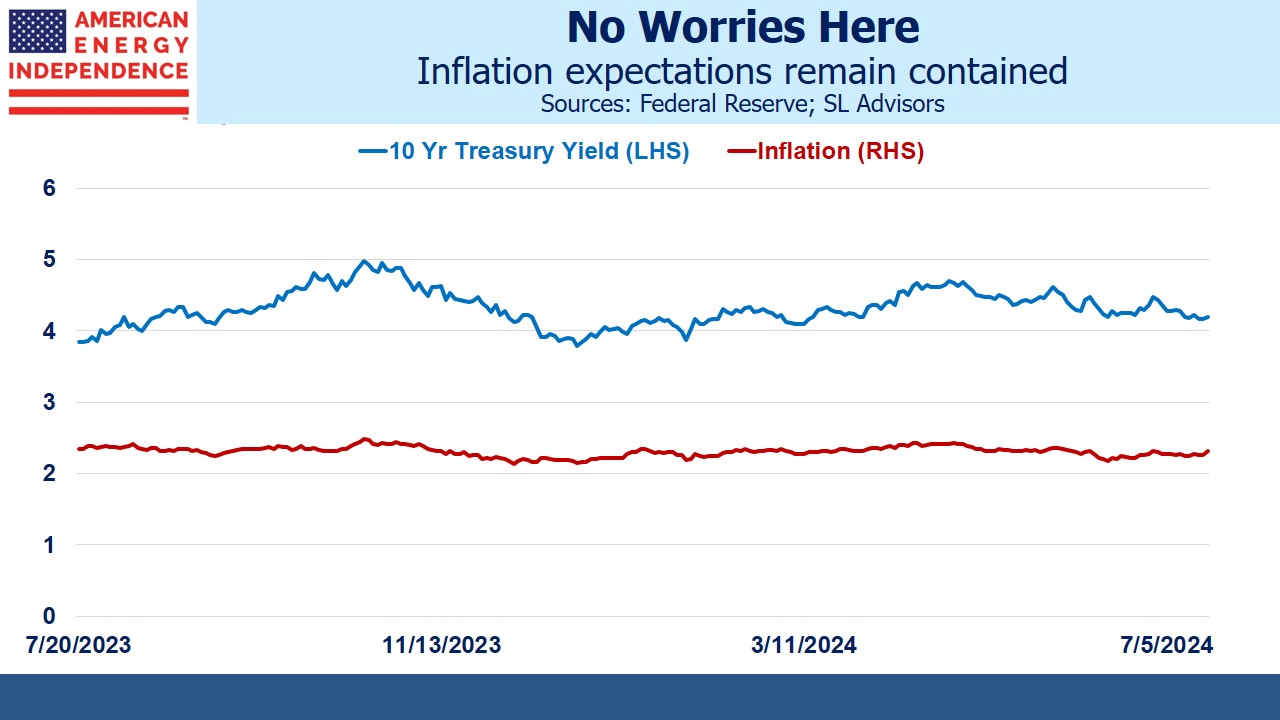

So far the bond market hasn’t considered the outlook for inflation. Having grown up in fixed income I naturally retain the bias that bonds represent the cool-headed unemotional investors while equities are full of manic-depressives. Because markets are connected, the recent strength in energy must be attributable to a more positive regulatory environment and not the inflation protection that the sector offers.

A Republican sweep in November will introduce asymmetric inflation risk. Neither party has shown much interest in fiscal discipline, concluding correctly that there are few votes to be gained in promising to tax more and spend less. As a debt-financed real estate developer, Trump probably appreciates the asset appreciation inflation brings as well as its erosion of the real value of debt.

A recent interview with Business Week offered a summary of inflationary policies. These include tariffs and tax cuts including a renewal of the 2017 Tax Cuts and Jobs Act. Curbs on immigration will push wages higher. Fed chair Jay Powell can expect public pressure to cut rates as soon as the election is over, and when his term ends in May 2026 he’s unlikely to be replaced with a hawk.

Moderately higher inflation is the least painful solution to our fiscal outlook. Trump will like that foreign investors will figure prominently among those enduring an erosion of the real value of their holdings. He’ll blame the Fed for higher treasury bill yields (see Monetary Policy Is Increasing The Deficit).

One thing about divided government is that gridlock constrains the ability of either party to press forward with its agenda. There’s nothing about Trumponomics that should provide comfort to the fixed income investor. The first 100 days of a Trump presidency with an aligned Congress could quickly adopt policies that are pro-growth with little regard for fiscal prudence.

This blog offers no view on the rightness of such policies, although our personal investments are positioned for them. You take the world as you find it. Investments in real assets would seem to offer the best protection. Midstream energy infrastructure, with its barriers to entry and inflation-linked contracts, is in our opinion an inevitable beneficiary as the market outlook adjusts.

For now inflation has receded as a concern. The disarray in the Democrat election campaign could enable policies that rekindle it. Owning US midstream energy infrastructure is, in our opinion, part of the solution.

We have three have funds that seek to profit from this environment: