Time For Powell To Go

At some point Congressional oversight of the Federal Reserve should result in a careful examination of the central bank’s error-strewn record under Chair Jay Powell. Below is a roadmap for discriminating legislators willing to conduct a critical review of the Fed’s serial mistakes.

Above the Fed’s twin mandate of seeking maximum employment with stable prices sits their overarching responsibility for financial stability. The collapse of Silicon Valley Bank (SVB) was an isolated event, the result of a largely non-FDIC insured deposit base that quickly ran when excessive interest rate risk forced the bank to dump bonds at a loss. But the banking system’s challenges are bigger than one bad interest rate bet in Santa Clara.

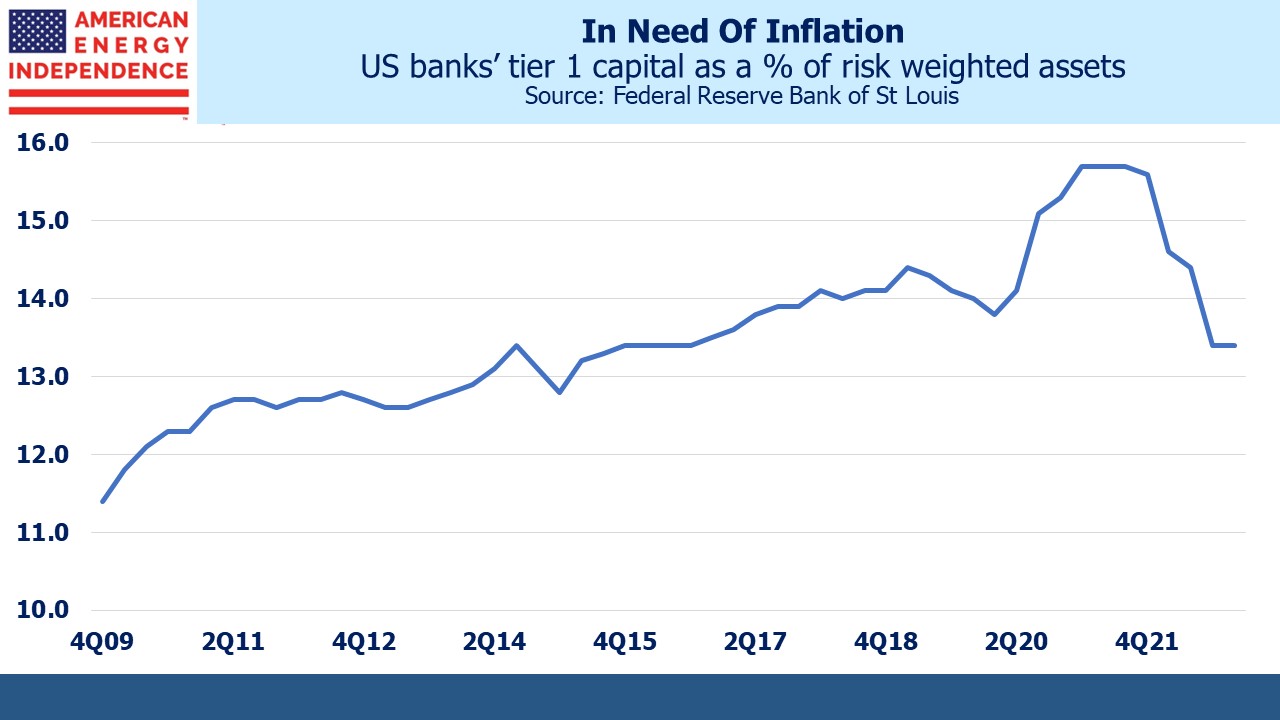

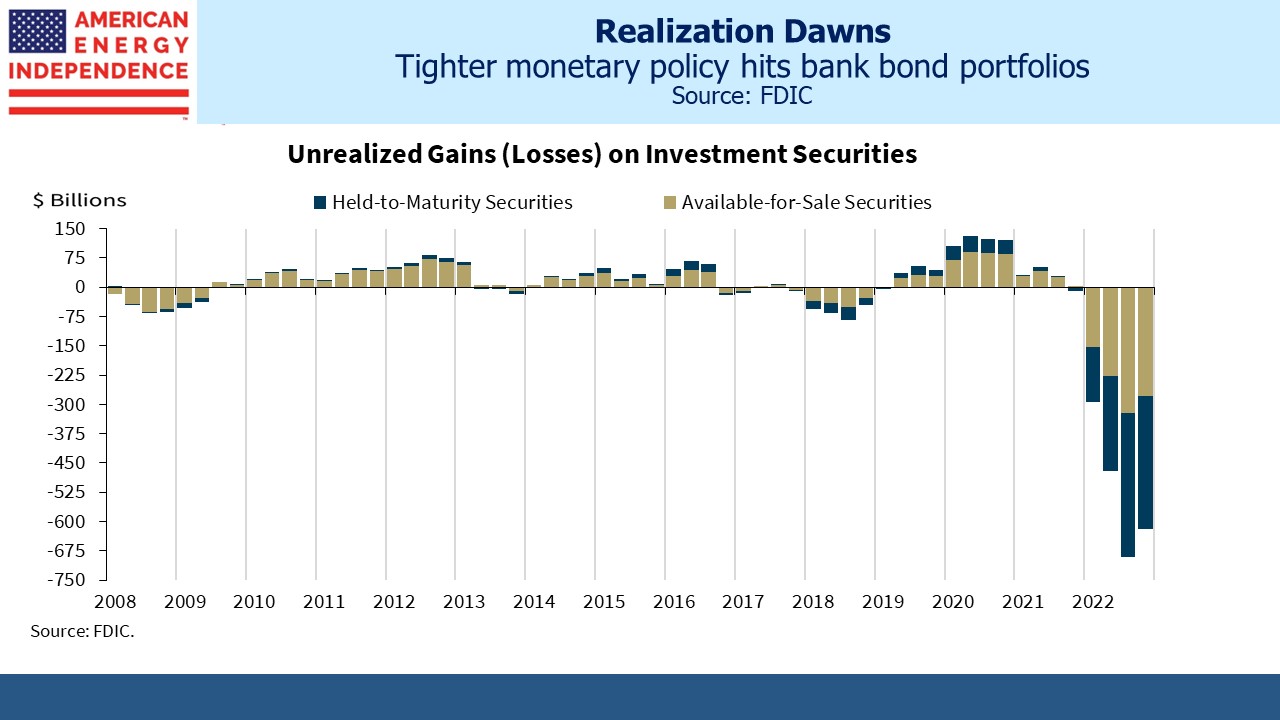

SVB might be the worst run bank since the 2008 Great Financial Crisis (GFC), but similar imprudence is reflected across much of the industry. Loans and securities that are classified as Held To Maturity (HTM) don’t fluctuate in value on bank balance sheets, but they can still cause losses. Tier One equity capital of the US banking system fell by 2.2% last year (from 15.6% to 13.4%) partly due to lower valuations on Mortgage Backed Securities (MBS) and treasury securities. This is a bigger loss than at the outset of the pandemic, when provisions for bad loans soared. Unrealized losses are estimated at $620BN, against capital of around $2.2TN. US government debt carries favorable capital treatment because it has no credit risk. But that doesn’t mean it’s riskless.

Including unrealized losses on loans would show bank capital is almost wiped out. Loans are rarely marked to market and are treated like HTM securities. But two recent academic papers show that, if they were valued like securities available for sale and assuming a duration of 3.9 years, banks would show losses of $1.7– $2.0TN.

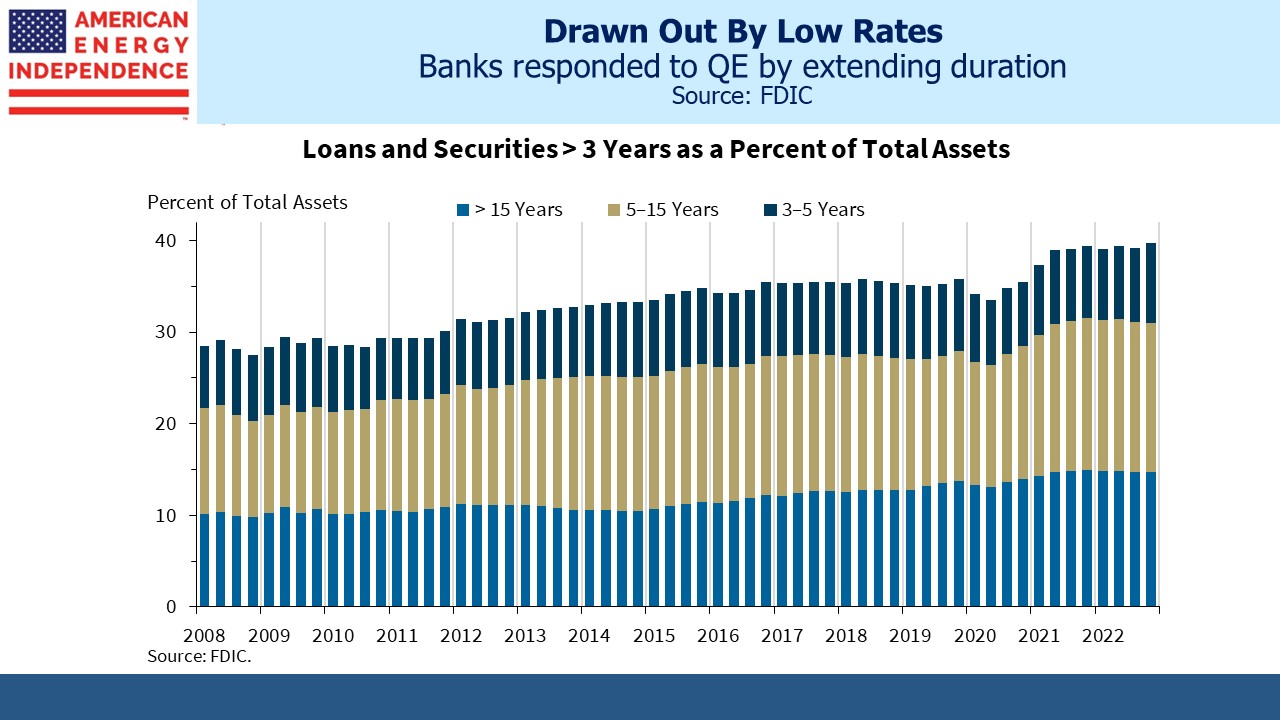

Interest rates have been unrealistically low since the GFC. Banks have responded by loading up on risk – the portion of loans and securities held with longer than three years’ duration has increased from 28% to 40% over the past fifteen years. Quantitative Easing (QE) saw the Fed’s balance sheet expand to $9TN as they acquired almost a fifth of all US government debt and depressed yields. SVB and many peers concluded that lower returns justified greater exposure.

As a regulator the Federal Reserve has watched over this increase in duration with little public comment. FOMC minutes reveal no concern. Their Summary of Economic Projections (SEP) released quarterly provided little reason until recently for banks to worry that their low-yielding portfolios of assets would continue to be funded with even lower-yielding deposits. In March of last year the SEP still only forecast mildly restrictive policy of 2.8% vs a long run neutral rate of 2.4%. It wasn’t until June that the SEP warned of higher short term rates that would increase banks’ cost of funding and create competition for deposits from money market funds and treasury bills.

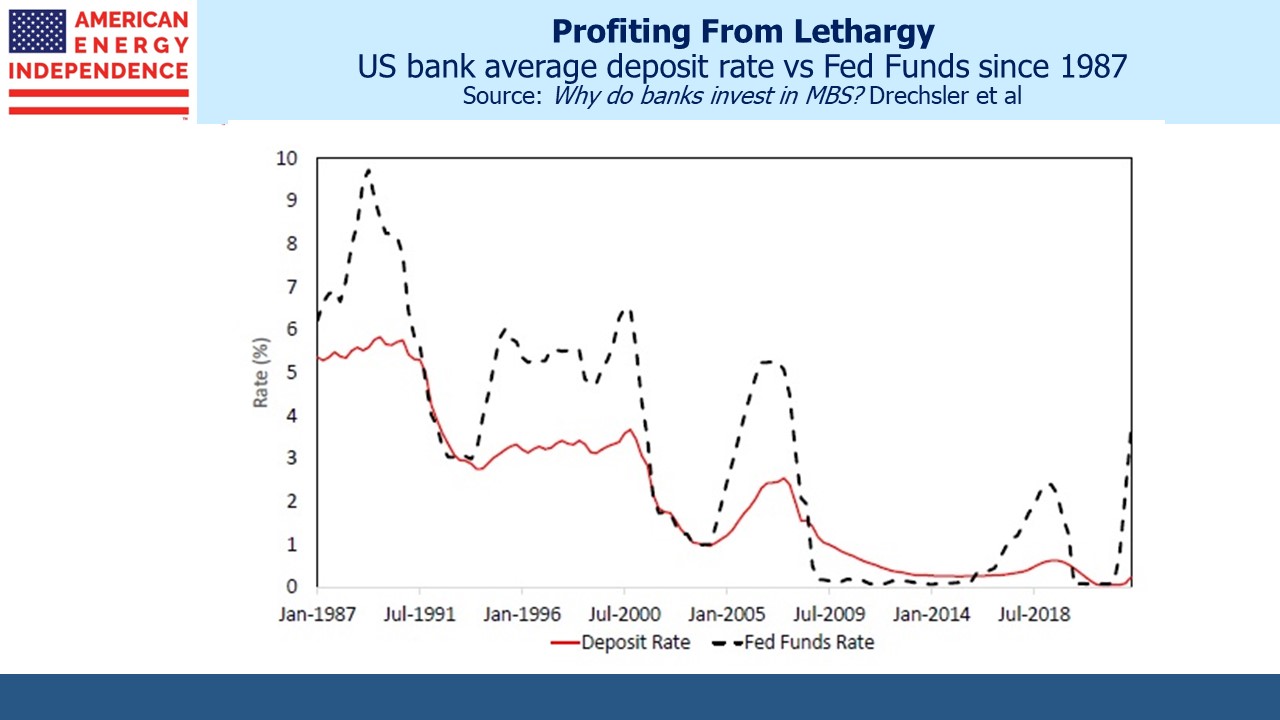

Banks benefit from lethargy among depositors when rates rise by only slowly increasing the rates they pay. The average savings account pays 0.40%, compared with three month treasury bills at 4.5%. It’s as well most depositors don’t leave banks for higher returns because resorting to the Fed Funds market would create a negative spread against their low-yielding portfolios. SVB’s rejection of this choice led to their sale of bonds, aborted equity raise and FDIC takeover.

You might think that years of low rates and a steady increase in duration would lead regulators to include the impact of an abrupt reversal among the many stress tests they run on banks. But in an absence of macroprudential foresight, there is no meaningful inflation stress test. They assume a benign 1.25% increase. Regulators model a sharp drop in real estate, jump in unemployment and emerging market crises but monetary accommodation is assumed to ameliorate the impact of any such shocks on the real economy. The only interest rate stress test contemplates a steepening yield curve with a 0.49% increase in ten year treasury yields and three month treasury bill rates up 0.14%.

The Fed has overseen stress tests since they were introduced in 2013 under Dodd-Frank. The biggest stress banks have undergone since then has been caused by the Fed and wasn’t one of the scenarios they tested.

Today’s economic and financial environment is the result of a series of errors and poor judgment by the Fed. They have implemented one of the fastest increases in monetary policy in modern times, which if banks marked their assets to market would wipe out virtually all their capital based on reasonable assumptions. FOMC minutes reveal very little awareness of exposure in the banking system the Fed oversees to sharply higher rates.

Bank portfolios are full of low yielding assets because the Fed incorrectly maintained QE for too long. QE was a singularly useful tool during the GFC with little to justify its subsequent use. The pandemic’s economic hit was severe but brief. The Federal government’s initial fiscal and monetary policy moves were exemplary, but the largesse and accommodation were ultimately excessive, synchronized and damaging.

Low mortgage rates and a behavioral shift to hybrid work boosted housing. This was evident to all except the FOMC with their slavish devotion to Owners’ Equivalent Rent (OER) and its theoretical notion of the cost of shelter (see The Fed Is Misreading Housing Inflation). Two thirds of American households are homeowners. Home prices matter to almost everyone. OER lags real estate by around eighteen months. The FOMC was similarly late in seeing inflation.

In summary, the Fed has raised interest rates sharply because they were late, ravaging the capital base of the banking industry they oversee. On their watch banks have increased duration in low-yielding assets because the Fed maintained low yields with QE. The Fed has in effect led ruinous competition with banks for yield-bearing assets, and is now leading competition for cheap deposits with which to fund them, all with little apparent understanding of the industry’s overall exposure.

SVB failed because of a depositor run, but that was preceded by a steady loss of deposits to higher-yielding money market funds and treasury bills. Banks now depend to a substantial degree on continued acceptance by customers of pygmy yields on cash, so they can continue to fund assets that yield too little. If money keeps leaving the banking system more banks will face SVB’s unenviable choice between funding assets at a loss or dumping them at a loss.

First Republic National Bank is reported to have a tangible book value of negative $73 per share once their assets are marked to market. Who would buy a bank today?

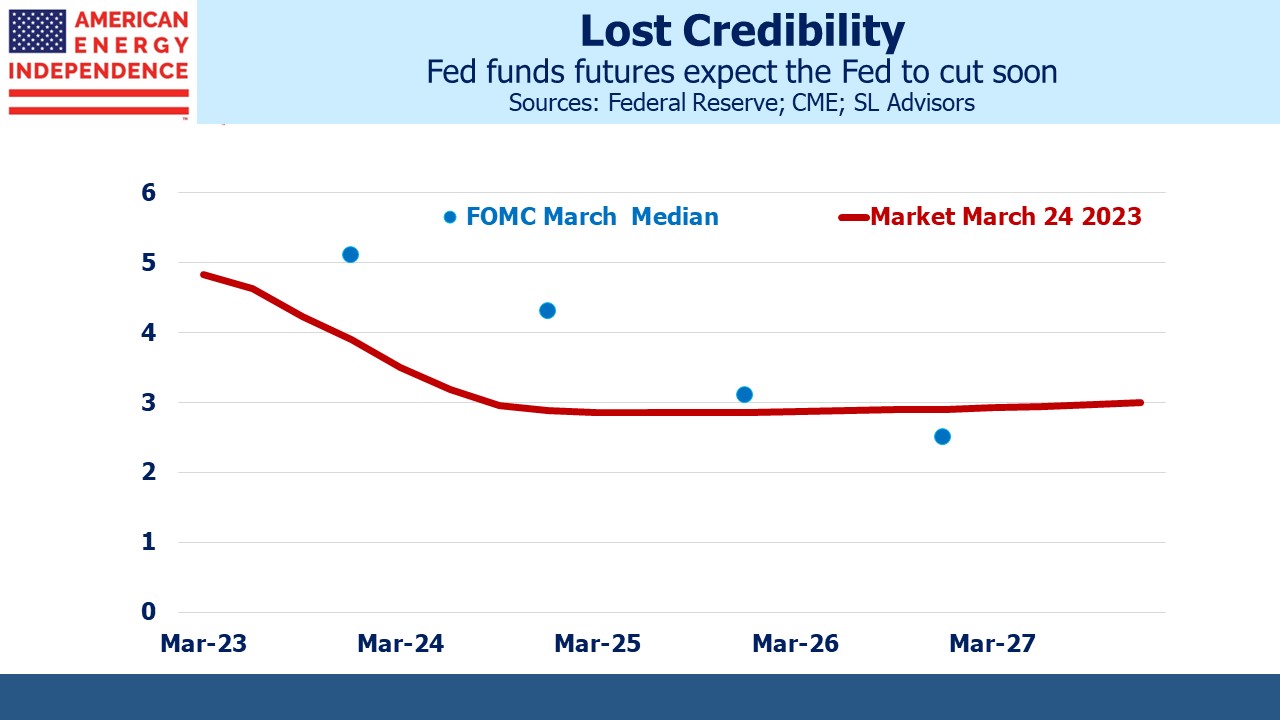

The FOMC released their latest SEP last week, forecasting another rate hike before the end of the year. Based on Fed funds futures, this is wrong by at least 1%. Such a gap between the FOMC and market expectations is testimony to the Fed’s loss of credibility. The inflation fight will be paused or declared won so that reduced short term rates can ease the banking system’s pain.

The Fed can at least claim success in maximizing employment. Unfortunately, consumers and households report being as pessimistic as ever, reflecting today’s uncertain outlook. This is in spite of what remains, for now, a reasonably strong economy with a job available to anyone that wants one. Perhaps consumers and households have an intuitive understanding of how poorly monetary and regulatory policy have been administered.

Fed chair Jay Powell should go.

We have three funds that seek to profit from this environment: