There's More to Pipelines Than Oil

If I had $1MM for every time an MLP investor has asked me where crude oil is going, well I could probably buy a good chunk of Plains All American (PAA), the biggest crude oil pipeline operator in the U.S.

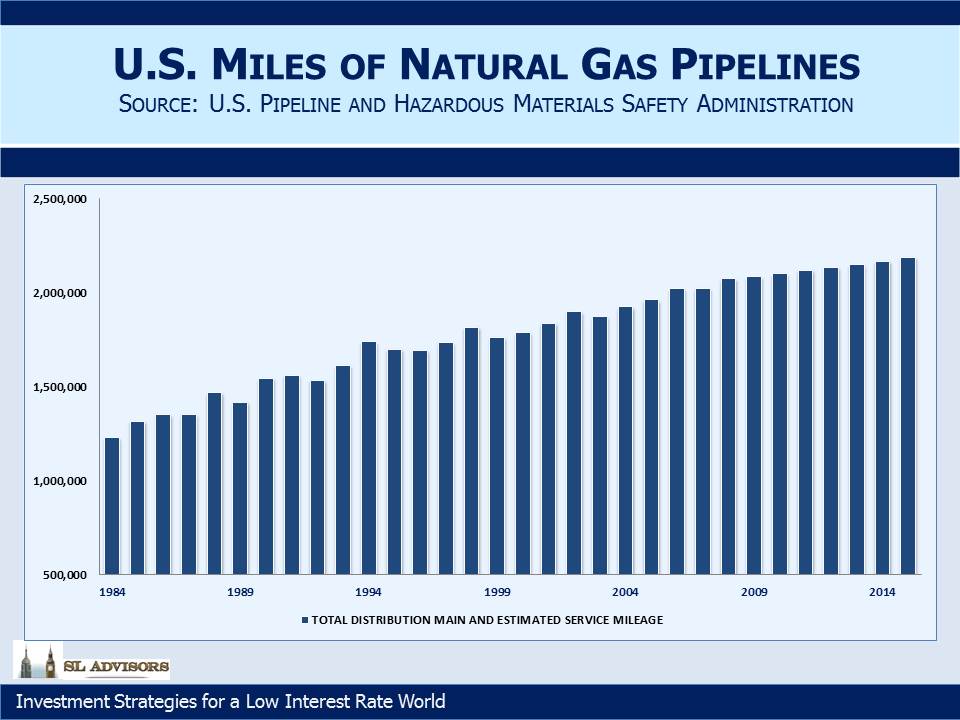

But PAA aside, MLPs are not as closely aligned with crude oil as popularly believed. The charts below show in raw numbers how many miles of U.S. pipelines are dedicated to crude oil, refined products, Natural Gas Liquids (NGLs) and natural gas. We have over 2 million miles of transmission capacity for natural gas. While a good portion of that travels the last few yards to a residence or business, almost 1.3 million miles is classified as “Distribution Main” mileage. On pure miles of pipeline, natural gas swamps anything else. Their owners are diverse and include utilities as well as MLPs. The network of gas pipelines has been growing, to accommodate America’s increasing use of natural gas for heating, electricity generation and other industrial uses.

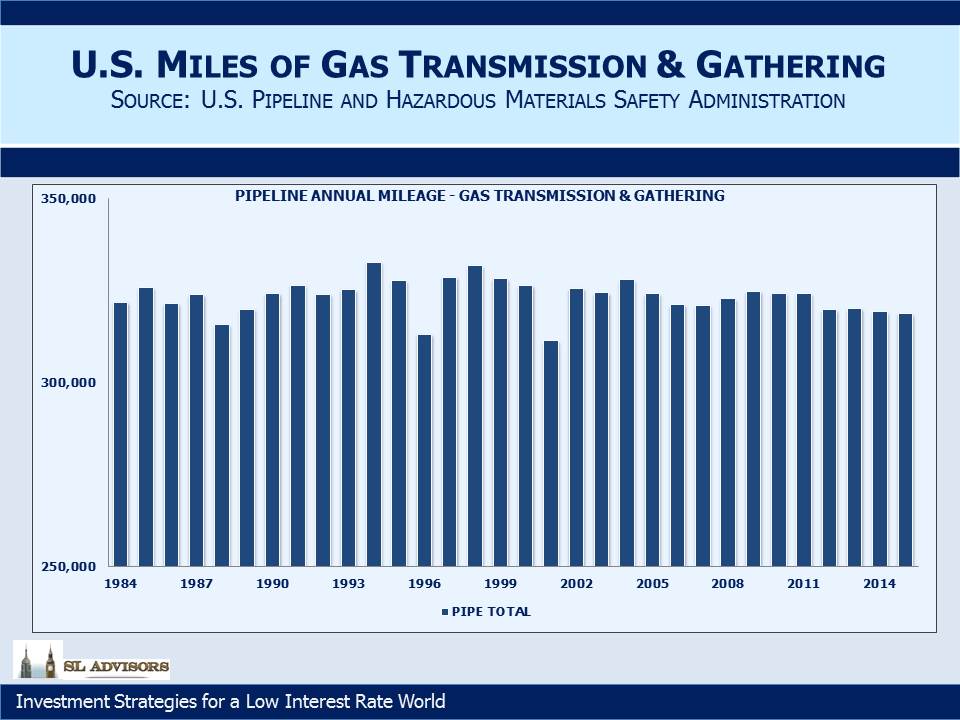

The Energy Information Administration (EIA) counts 300,000 miles of inter-state and intra-state transmission pipelines which are largely controlled by MLPs.

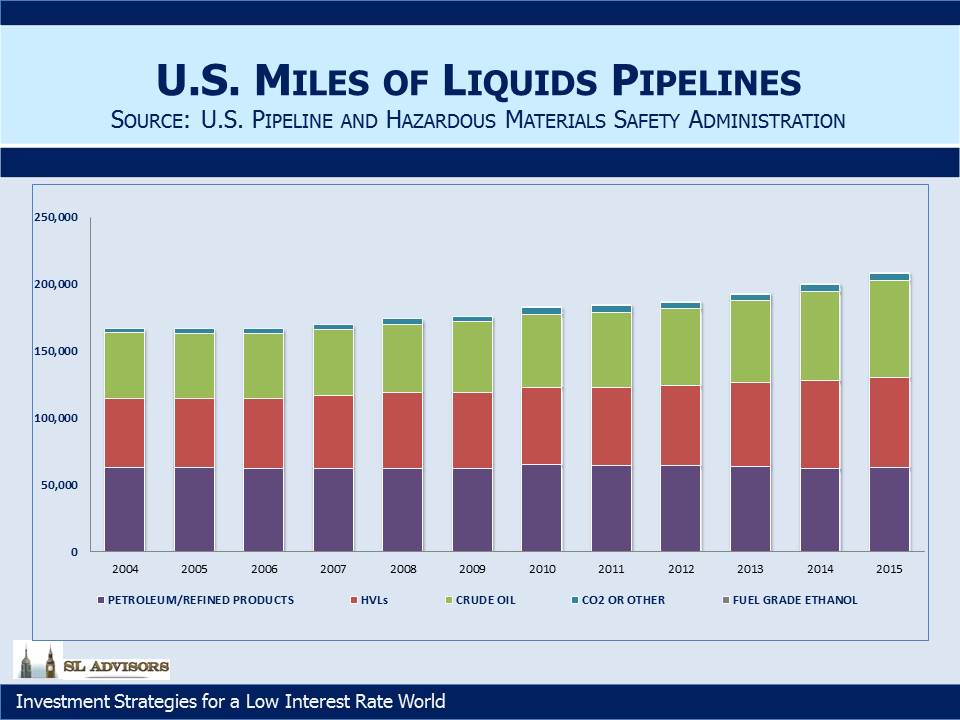

We have over 200,000 miles of pipelines carrying hazardous liquids, which are roughly evenly split amongst petroleum/refined products, NGLs (referred to as HVLs) and crude oil. The last two categories have been responsible for the growth in this sector.

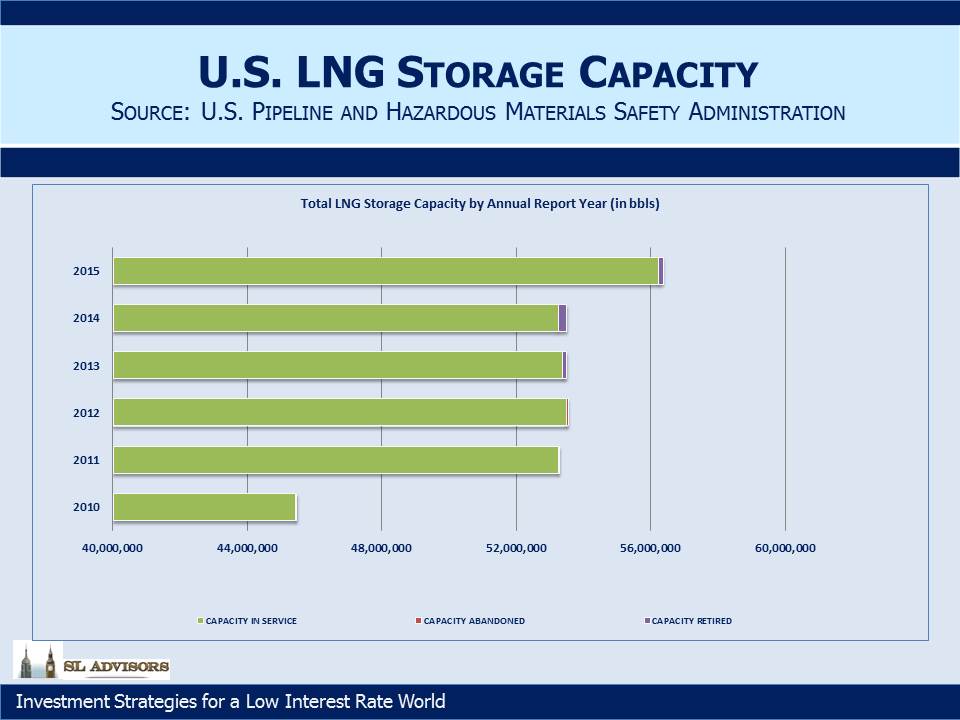

We’re also storing more NGLs too, and the chart below shows a recent jump in storage capacity (measured in Millions of Barrels).

Meanwhile, spending on new infrastructure has continued although the 2015 MLP Crash did lead to the deferral of some projects. There have also been some notable cancellations because of the often complex approval process. Kinder Morgan (KMI) halted their North East Direct project because they were unable to obtain enough capacity commitments. This was in part because in Massachusetts there’s no financial incentive for a utility to secure long term supply, which limited their interest in signing up for pipeline capacity. Access Northeast, another effort to improve distribution and storage for New England under the direction of Spectra Energy (SE), may also be cancelled for similar reasons. A surprising consequence is that Boston now imports Liquified Natural Gas (LNG) by ship for use in winter, even while the U.S. is beginning to export it. LNG has to be liquefied for storage and regassified for use, a not trivial expense borne by the helpless consumers in the region.

It’s not uncommon to hear energy sector executives complaining about the present Administration and their opposition to fossil fuels. The increases in crude oil and natural gas production over the past eight years weaken the case for critics, although the drawn out and eventual cancellation of the Keystone pipeline project did not reflect an enlightened energy policy. More recently, the Dakota Access Pipeline (DAPL) project run by Energy Transfer Partners (ETP) has been the victim of some hostile and possibly illegal moves by the Administration. It is too long a story to recount, but a good description is on Forbes (see Why The DOJ Order To Shut Down Construction On The DAPL Pipeline is Legally Indefensible). While the opposition to new projects such as this hurts many unwitting participants including consumers who’d benefit from cheaper energy, such difficulties can only enhance the value of existing infrastructure. Given the unpredictability of the approval process as shamefully on display in the DAPL case, a new build looks ever more daunting compared with extracting higher returns out of existing assets.

In fact, on this point we recently ran across a very old documentary (sometime in the 1950s) highlighting the Transcontinental Gas Pipe Line Corporation as it traverses from Texas north through the eastern U.S. to New York City. If you have twenty five minutes to spare it’s worth watching. It reminds how energy infrastructure has a useful life of decades and is in many cases impossible to replicate as communities develop around and over it. Today Transco, as it is called, belongs to Williams Companies (WMB).

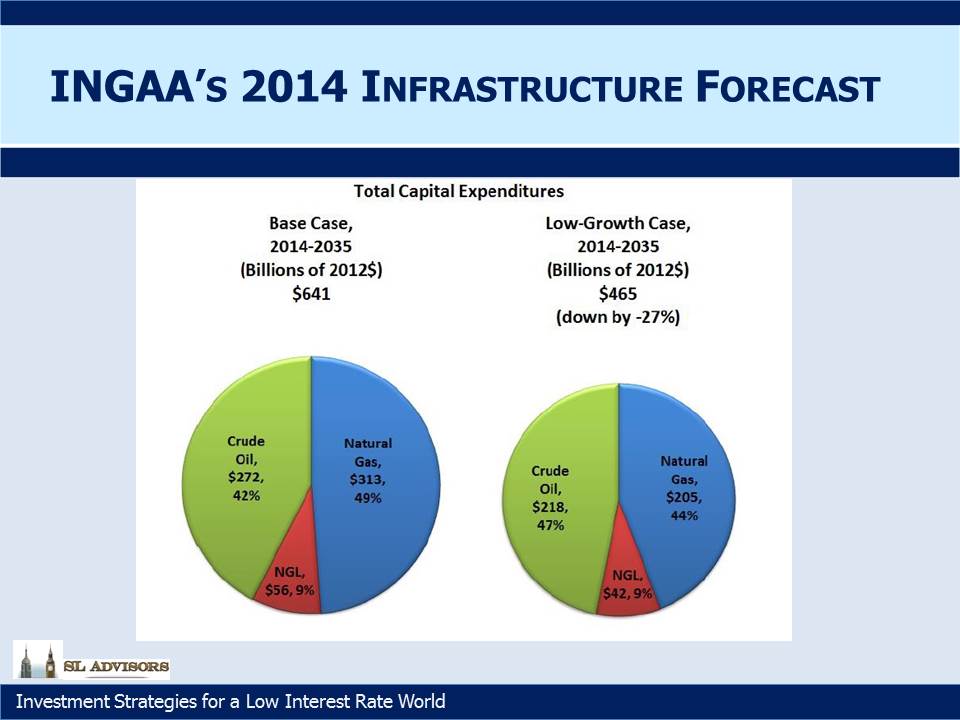

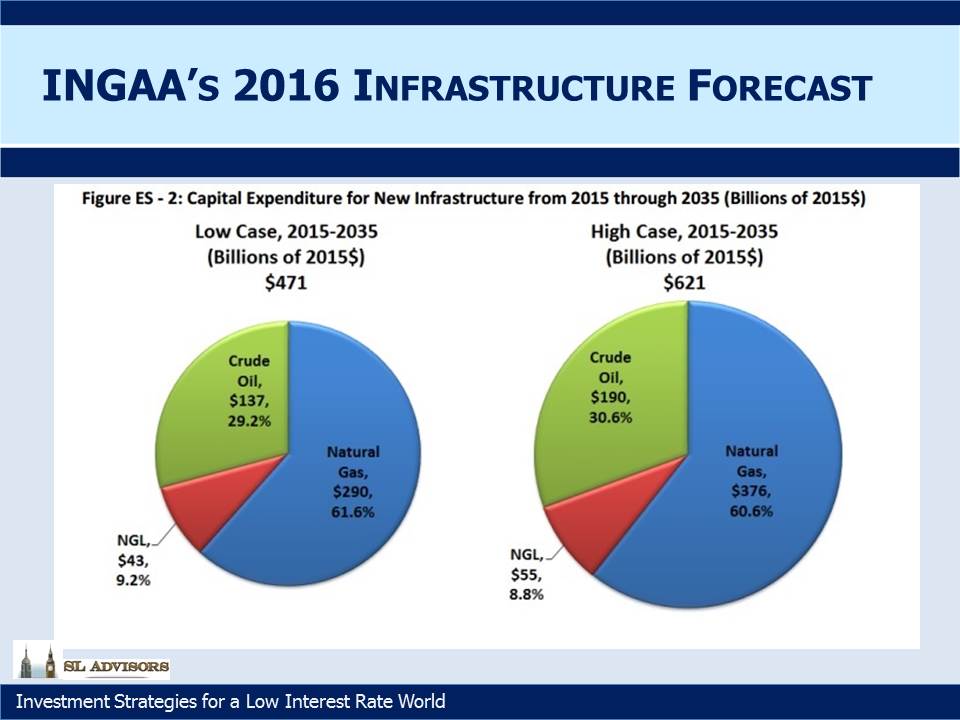

What has changed over the past couple of years is that the planned new infrastructure dedicated to natural gas has grown while crude oil projections have fallen, as forecast by the Interstate Natural Gas Association of America (INGAA). The charts below compare 2014 and 2016. The prospect of MLPs investing approximately two times their current market capital in new projects over the next twenty years hasn’t been much altered. MLPs and crude oil are gradually disengaging (see MLPs and Crude Oil, the Improbable Dance Partners). Just as hedge fund asset growth is good for hedge fund managers, MLP asset growth should be good for MLP General Partners. At a time when the Federal Reserve continues its benign interest rate policy of wealth transfer from savers to borrowers (see The Shrinking Pool of Cheap Assets), MLPs remain one of the few asset classes to offer attractive valuations.

We are invested in KMI, SE and WMB