The World Wants More American Gas

First Citizens Bancshares has agreed to buy most, but not all, of Silicon Valley Bank’s (SVB) carcass from the FDIC. They’re acquiring $72BN of loans at a discount of $16.5BN. The FDIC estimates SVB’s failure will cost it around $20BN. The Deposit Insurance Fund currently sits at 128BN. It’s funded by banks, which means by customers. Former SVB CEO Greg Becker is hopefully googling “clawback”.

Several former banking colleagues have been dismissive of a recent academic paper (Why do banks invest in MBS?) which estimated bank losses from rising rates of $1.7TN, most of their $2.2TN in capital. The $1.7TN figure has also made it into the WSJ.

The analysis doesn’t consider deposits, which increase in value when the Fed tightens because savings rates lag. Customer funds are often sticky. For asset/liability management banks assume a certain portion of their deposit base has long duration based on prior experience. Revaluing assets based on higher rates without considering liabilities is clearly wrong for the industry, although money market funds and treasury bills are increasingly competing for customer deposits. Many banks will likely have to be more responsive in raising savings rates, although I can report that JPMorgan for one still pays virtually 0%.

Another criticism was the assumed duration of 3.9 years on loans, which underpins the $1.7TN figure. Floating rate loans dominate according to one friend, a former senior banker who would know. He went on to wonder whether some banks even know the interest rate risk of their loan portfolios.

The banking crisis has dominated recent news, but it confirms the upside risk to inflation facing investors. Rates well below inflation are already causing financial stress. Markets expect the Fed to cut within months. Jay Powell is steadily becoming the worst Fed chair any of us can remember. Under his leadership the FOMC embraced temporarily higher inflation in 2020, only to abandon that position when their policies helped generate more than they bargained for. Expect a politically motivated pivot that claims victory is in sight so as to ease the pressure on banks.

This is why energy infrastructure deserves a place in every portfolio. Pipelines often have tariffs that increase with inflation under rules overseen by the Federal Energy Regulatory Commission (FERC). The energy transition is impeding capex in reliable energy while enjoying enormous tax subsides for renewables, hydrogen and carbon capture. This underlies the strong relative performance of the sector in recent years.

Natural gas is especially well situated as a substitute for coal and a source of reliability as power generation adds intermittent, weather-dependent solar and wind.

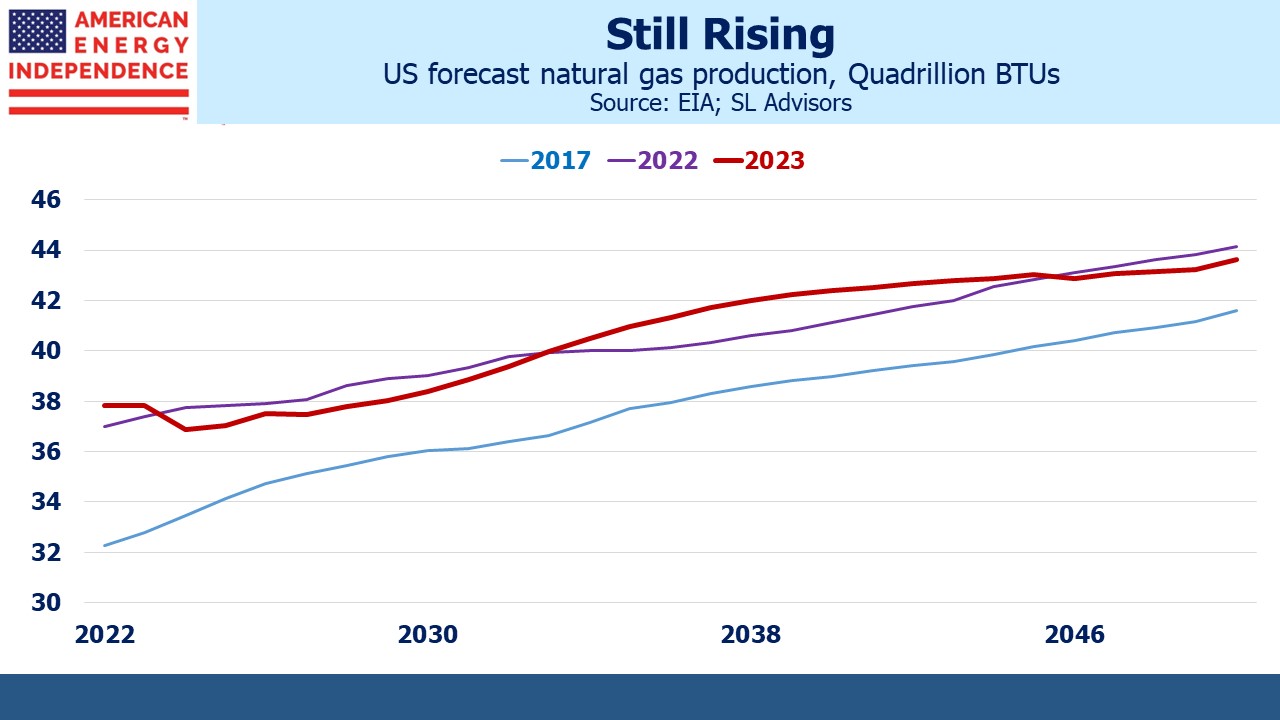

The Energy Information Administration (EIA) just published its 2023 Annual Energy Outlook (AEO). In recent years they have revised up near term production of natural gas. Compared with their 2017 AEO, the government now expects 8% more natgas output through 2050.

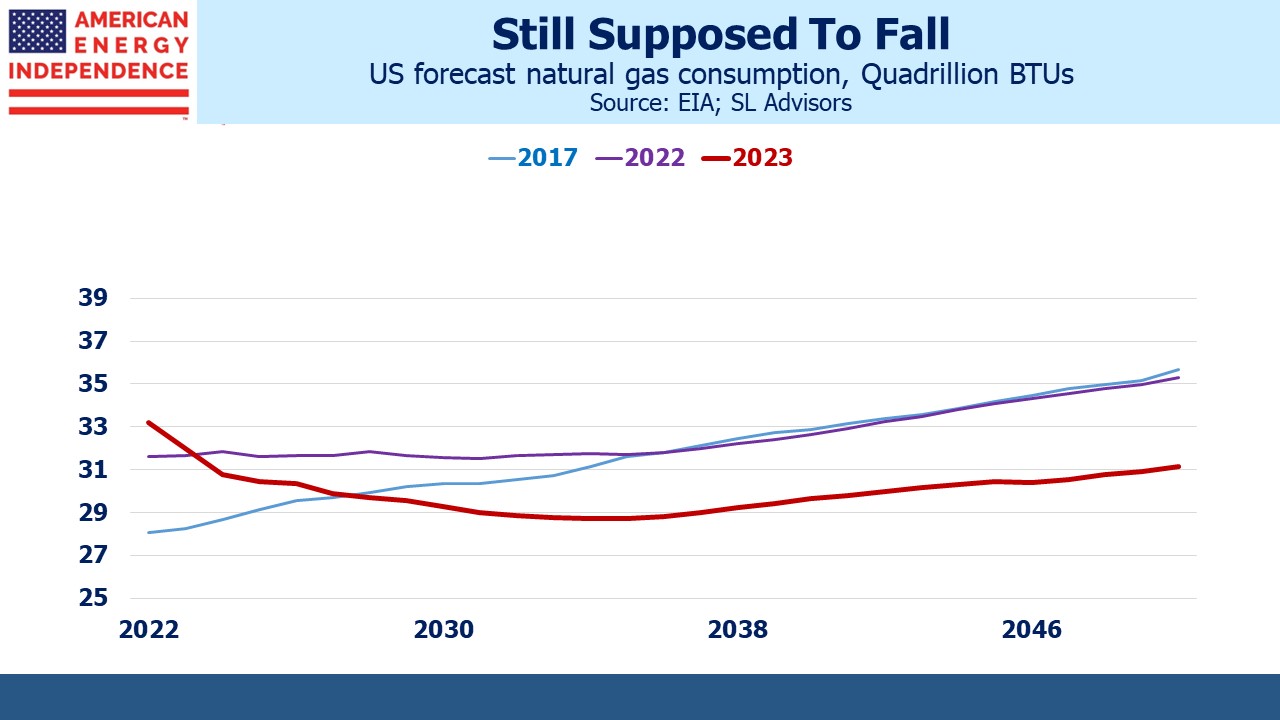

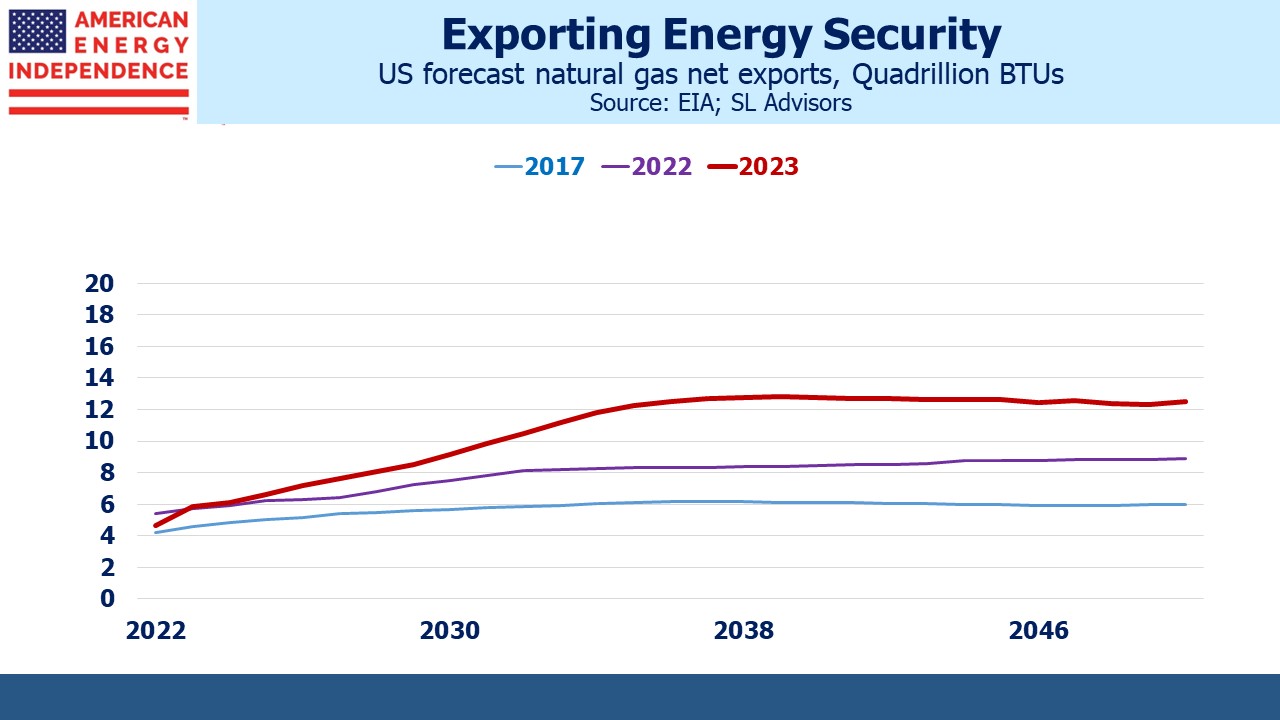

Domestic consumption has been running higher than expected. Last year we used 18% more than the EIA thought we would in their 2017 forecast. They have a pattern of underestimating near-term demand. Nonetheless, over the forecast period to 2050 the EIA expects the domestic need for natural gas to decline modestly until 2035 when it will start drifting higher again. Production growth is fully due to exports, which are now forecast to be a third higher than in last year’s AEO.

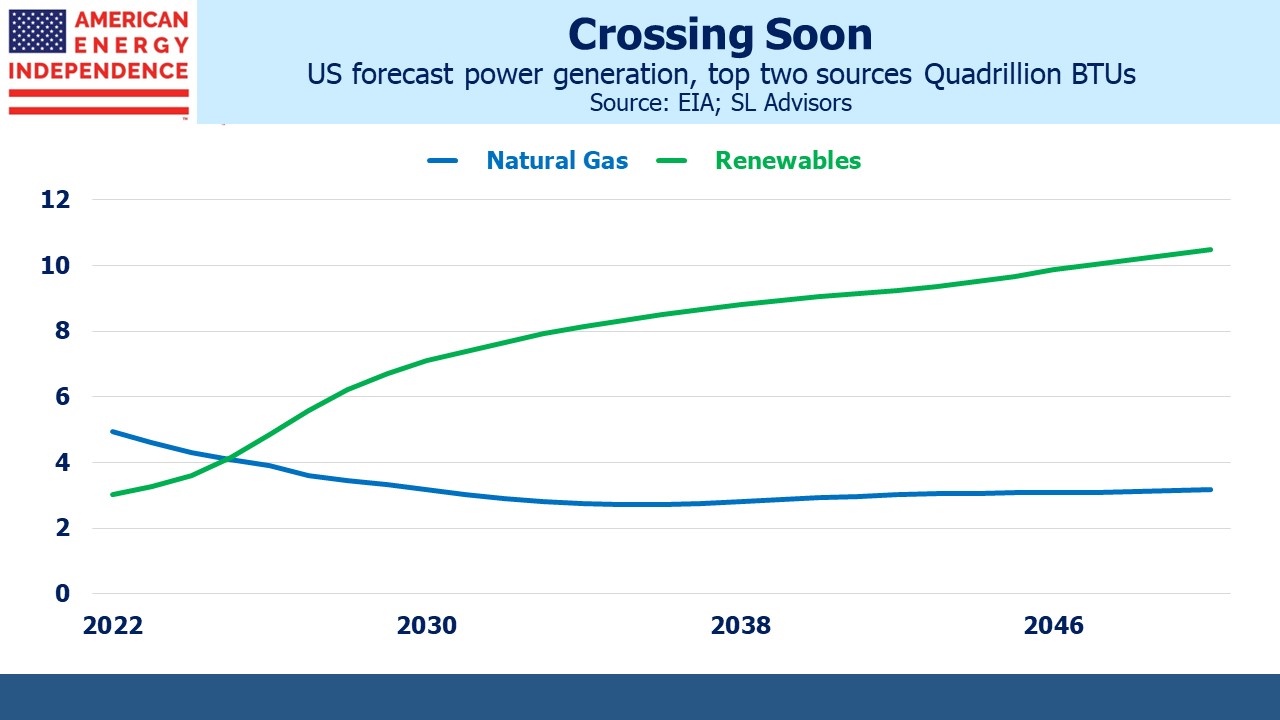

The EIA also expects renewables (mostly solar and wind) to displace natural gas as our biggest source of power generation by 2025. There are many negatives in this for America – electricity will become more expensive, less reliable and will need more room both for generation and transmission. It is the first time in human history that we’ve pursued an energy transition that is less efficient in every dimension.

There’s nothing about California, New England or Germany that appeals in terms of energy policy. We should be using more nuclear, displacing coal with natural gas and maintaining reliable power generation with carbon capture which now enjoys even bigger tax credits under the Inflation Reduction Act.

Nonetheless, this utopian vision for climate extremists won’t dent steady production growth because power generation is only 15% of domestic gas consumption

America has some of the world’s cheapest natural gas, and Russia’s invasion of Ukraine boosted its appeal. Europe’s absence of energy security has resulted in a surge in LNG imports. Regassification terminals have been built in record time by using floating storage and regassification units. The EU now expects to increase its import capacity by almost a third next year by adding 8 additional terminals (27 to 35).

US LNG exports to Europe more than doubled last year to over 7 Billion Cubic Feet per Day (BCF/D). That trend is likely to continue. The EIA continues to forecast a very bright future for reliable energy.

We have three funds that seek to profit from this environment: