The Upside Case for Pipelines

Client interaction has been overwhelmingly constructive – we haven’t had a single call from anyone wanting to “sell everything.” Our fund has seen very modest net outflows, and new money has been coming in every day.

One investor said on the weekend that we need to present the positive case more forcefully. So, here it is:

- Our midstream energy infrastructure investments and the components of the American Energy Independence Index are >75% investment grade companies. The industry has been reducing leverage and strengthening balance sheets since the 2014-16 oil collapse. Growth projects are increasingly funded with cash from operations, with less reliance on debt and no equity issuance. 4X Debt:EBITDA is common, using 2020 guidance which will be revised down in the coming weeks.

- We estimate around 80% of the customers of our portfolio companies are themselves investment grade. Cheniere Energy is 100% in this respect, so although they’re in the 25% of our companies that’s not investment grade, the credit quality of their customer base provides some comfort.

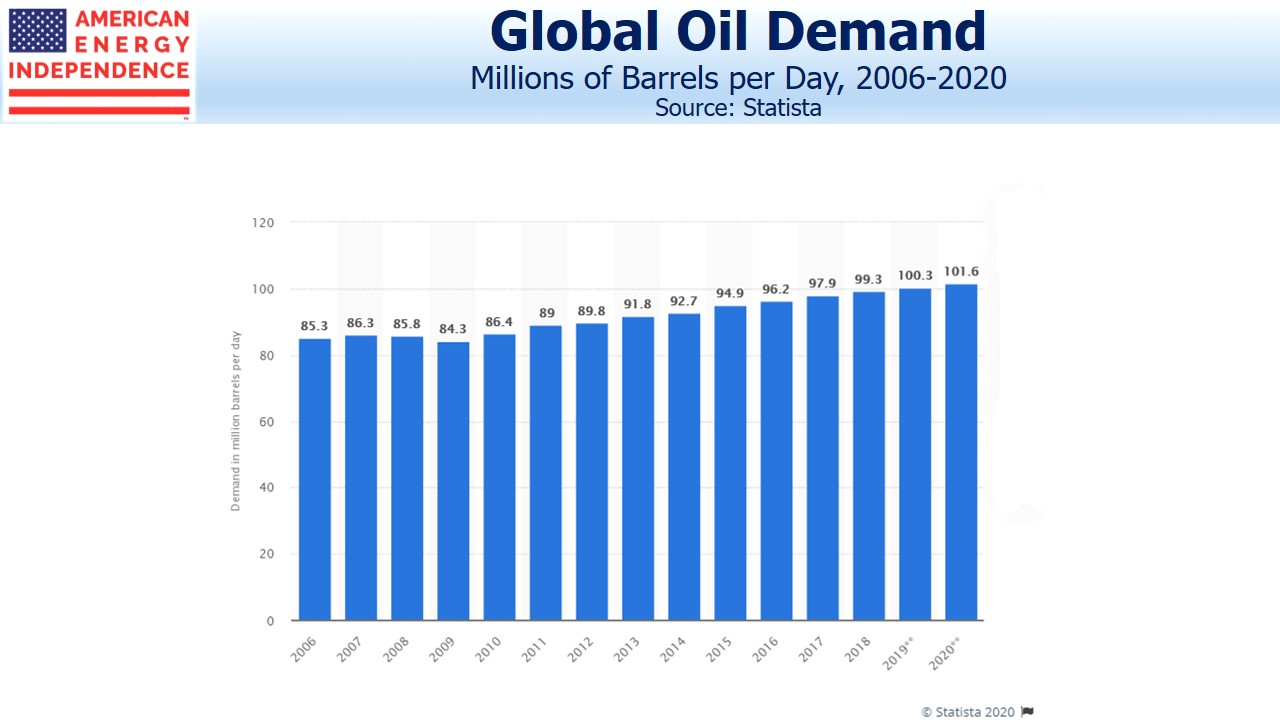

- While energy demand will dip, and economic activity is contracting, there’s plenty of reason to think that in the weeks and months ahead all the efforts at mitigation and control will leave society confronting a new but manageable virus. Getting through the near term is understandably everyone’s focus, but life will eventually return to something we all recognize. Global crude demand fell just 2%% from 2007 to 2009. Natural gas volumes were unaffected. Demand may fall more than then, and supply further still. Although exports are more important than before, the U.S. pipeline business is mostly natural gas and NGLs (primarily petrochemical feedstock), and is mostly about U.S. consumption. We estimate that crude & refined products contribute just 20% of cash flows.

- Companies can improve cash flow by curtailing growth projects. Upstream companies are likely to cut production and growth capex by 20-40%. So far, Oneok (OKE) is the only midstream company to have issued any revised guidance, and they reduced 2020 growth capex by $500MM (20%), while surprisingly reaffirming EBITDA guidance. In Updating the Coming Pipeline Cash Gusher we forecast 2020 Free Cash Flow (FCF) of $22BN (up from $9BN last year). This forecast relies on guidance from companies that is all pre-Coronavirus. However, it also incorporates $37BN of capex spending this year. It’s quite conceivable that pipeline companies’ capex reductions could more than offset any drop in cash flow from operations. We were assuming Distributable Cash Flow (DCF) of $59BN. FCF is derived from DCF minus growth capex. If DCF fell by 20%, which is not in any forecast we’ve seen so far, growth capex would likely drop by more, which would cushion the ultimate impact on FCF.

- Unlike the 2015 downturn, capex is now internally financed. Midstream energy infrastructure companies stopped accessing public markets for equity a couple of years ago, and have no need to do so now. Moreover, debt is long-term and staggered. We don’t see near-term debt financing problems.

- Lastly, assuming an average 20% decline in growth capex similar to Oneok’s announcement, the sector trades at a 2021E 15.6% FCF yield (that’s after capex), fully supporting its 13% dividend yield. Few other sectors have such valuation support today.

The energy sector has taken a triple hit from Coronavirus, OPEC+ collapse and Saudi supply hikes. Investors are most worried about which names will survive. Those with leverage were forced to sell last week, notably including MLP closed end funds. We don’t use leverage and haven’t been forced to sell anything, either for ourselves or for client accounts. Today for example, we have not made a single sale. Sit tight. This will eventually pass. It’s not inconceivable that prices could eventually double from here.

Once America confronts a challenge, history shows that we deploy unmatched resources to take it on and defeat it. The impact on society arrived like a thunderbolt in recent days, and as a country we’ve been knocked on our heels. But our response is coming, and no country is better equipped to come right back and do whatever is required to overwhelm this threat.